The nexus between monetary and fiscal policies runs deep. Both are intrinsically entwined as instruments of the state with privileged access to resources. Achieving overall economic stability requires that policymakers wield these powers responsibly. Breaching the limits in one policy domain jeopardises sustainability in the other. The two policies must operate consistently and with sufficient safety margins, within a “corridor of stability”. This calls for institutional arrangements that encourage a balanced reliance on each and an appropriate degree of coordination. Those arrangements have worked very well during the pandemic, but challenges loom ahead, as tensions between the two policies are likely to re-emerge. The “joint normalisation” task from unprecedented historical conditions will play a key role.

The Covid-19 crisis has brought to the fore the nexus between monetary and fiscal policies. Faced with an unprecedented economic collapse, monetary and fiscal authorities acted in unison to stabilise markets and shore up activity. The two policies have worked smoothly together so far. But there are questions about whether they will continue to do so as the crisis fades and about the implications of any tensions that may arise.

This note examines these issues by standing back and exploring the deeper nexus between the two policies. This perspective emphasises that monetary and fiscal policies are intrinsically entwined as carried out by organs of the state – the government and the central bank – with privileged access to resources.2 Privileged powers come with commensurate responsibilities. The powers have limits that, if breached, can seriously damage the economy. And breaching them in one policy domain would jeopardise sustainability in the other. Thus, achieving overall economic stability requires that policymakers wield the powers responsibly. Both policies need to work consistently with a common focus on long-term sustainability. In turn, this calls for institutional arrangements that encourage a balanced reliance on each and an appropriate degree of coordination, which varies with the economic context. Those arrangements have worked very well during the pandemic, when monetary and fiscal policies worked in close concert to limit the pandemic’s fall out. But more challenging tests lie ahead, as tensions between the two policies are likely to re-emerge.

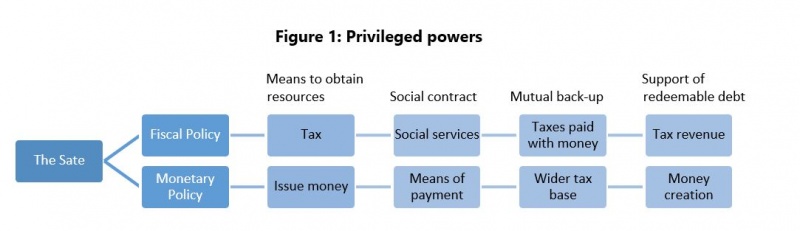

Privileged powers

Fiscal and monetary policies are intimately linked and share common roots (Figure 1). Both are key policy functions of two organs of the state: the government and the central bank. And both are tools through which the state gains privileged access to resources, through, respectively, the power to tax and the power to issue “money” – irredeemable debt that acts as means of payment. Money, in turn, is the cornerstone of the central bank’s ability to set interest rates, through which it exerts a pervasive influence on the economy.3

These powers are exercised as part of an implicit social contract. Taxation is accepted on the premise that it allows the provision of valuable services to society. The issuance of money is predicated on its acceptance as a means of payment and unit of account, for which a stable value is key.

The powers to tax and issue money, in turn, back each other up. Most directly, the requirement to pay taxes with money helps establish a demand for money, thereby helping to underpin its value. A stable monetary system, in turn, helps shore up the tax base. The privileged access to resources that these power grant also ultimately support the government and central bank’s ability to issue redeemable debt. Tax provides the resources to repay debt; the central bank’s ability to issue money generates income (seigniorage) and allows the government to avoid technical default, given that debt is redeemable in money.4

These privileged powers are subject to limits, again reflecting their assignment as part of the implicit social contract. Taxes generate incentives for avoidance, especially if the proceeds are not seen as well-spent: the higher the tax rate, the stronger the pressure. Money will not be accepted if it loses its store-of-value property: the laxer the management of monetary powers, the higher the risk.

Ultimately, approaching or reaching the limits of those powers causes economic activity to collapse, as trust in the state dwindles and the social contract is broken.

Consider taxes first. If agents are unable to avoid taxes, excessively high rates will reduce labour effort and diminish incentives to invest. The end-result is a reduction in the economy’s productive capacity, and hence in the tax base, as output and wealth generation contract.5 If agents are able to avoid taxes, the state has three options: i) reduce its own activity commensurately with the lower tax revenue; ii) borrow future resources by issuing debt; and iii) either renege on previous resource commitments (strategic default) or increase its reliance on money issuance to acquire resources. There are limits to how far it is possible to pursue each of these avenues without damaging the economy.

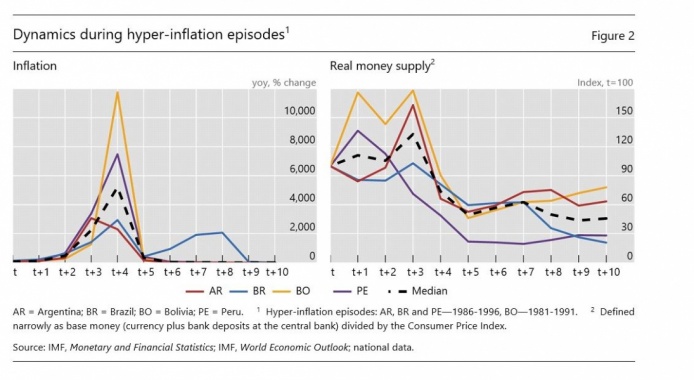

Consider money next. A lack of discipline in exercising the power to set interest rates can generate runaway inflation and/or financial crises with widespread defaults. Such episodes would go hand-in-hand with a collapse in output and large wealth dislocations. In open economies, exchange rate depreciation is a key amplification mechanism, as agents’ attempts to avoid inflation and/or default-induced losses on domestic obligations spur large-scale capital flight. In the extreme, a loss of trust in the institution of money would undermine the viability of the payment system, causing demonetisation. This would effectively cripple the central bank’s privileged access to resources. Figure 2 illustrates the experience of hyperinflation in a number of Latin American countries. In these episodes, the demand for money – narrowly defined as cash and bank reserves and measured in inflation-adjusted terms – which represents the “tax base” for money, initially rises but then falls appreciably as the rate of inflation ratchets up.6This fall reflects agents’ attempts to economise on their money holdings.

Entwined responsibilities

Despite the common root of their powers, monetary and fiscal policies exert their impact on the economy through very different channels.

Fiscal policy impinges directly on economic activity through the compulsory transfer of resources via taxes, which in turn provides the basis for government expenditures and transfers – another major influence on activity. Indeed, the government wears a double hat: it spends on private-sector goods and services and it produces non-marketable services – it is a major employer in the economy.7 Importantly, fiscal policy also affects the incentives that drive decisions about resource allocation. It can thus work to shape economic growth, encouraging certain types of activity or sectors over others.

Monetary policy works more indirectly, primarily through the interest rate, which influences financial conditions and hence expenditures. Even so, its effect on the economy is pervasive and potentially long-lasting, particularly through its impact on debt accumulation and the evolution of private sector balance sheets more generally.8

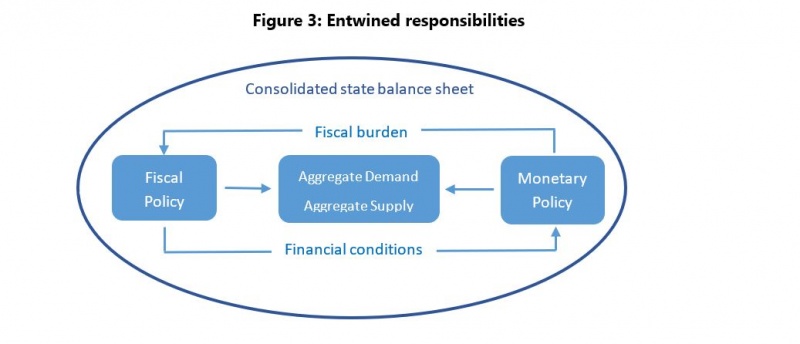

Despite these differences, both policies interact closely through two, overlapping, mechanisms: their respective impact on the economy; and interlocking balance sheets and the associated income transfers (Figure 3).

The impact on the economy is the more prominent mechanism and is well recognised. Both policies influence aggregate demand and thus inflation, hence the long tradition of analysing the appropriate “policy mix”.9 And both have a bearing on the economy’s aggregate supply, and hence longer-term growth, through their impact on resource allocation. For monetary policy, this occurs primarily through its impact on investment in different sectors, including on expenditures for research and development.10

Apart from their joint influence on aggregate demand and supply, the two policies also infringe on each other’s territory. Fiscal policy impinges on financial conditions: debt issuance has an impact on the yield curve (term premia); perceptions of fiscal sustainability on risk premia – also for private sector borrowing – and exchange rates; and the state of public finances on banks’ soundness – a key channel for monetary impulses – given banks’ typically large holdings of government securities. Monetary policy, in turn, influences the state of public finances: by setting interest rates, it helps determine the government’s borrowing costs; through its effect on the exchange rate, it affects the fiscal burden of foreign currency debt; and through its impact on economic activity and inflation more generally, it can materially alter government expenditures and taxes. In the extreme, undisciplined monetary policy can fuel runaway inflation and financial instability, the latter resulting in huge fiscal costs.

More mechanically, though no less significantly, monetary policy exerts an influence on public finances through income transfers to and from the government as well as through interlocking balance sheets. The government owns the central bank: profits and losses (net remittances) ultimately flow into the government’s accounts. And because a large portion of the government’s and the central bank’s liabilities are very close substitutes and the central bank typically invests in government securities, many economic issues are best examined through the lens of the consolidated balance sheet of the two entities.

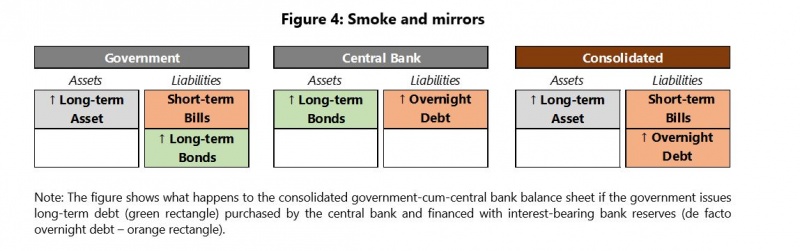

Consider an operation that has become increasingly common – central bank large-scale purchases of government debt financed with interest-bearing reserves, or so-called “quantitative easing”. Because of the close substitutability of (overnight or very short-term) government securities and those reserves, the operation is essentially equivalent to a debt swap. 11 The main difference is that banks are “captive lenders”, as they are obliged to hold any bank reserves that the central bank issues. This softens the government budget constraint and can overcome debt “digestion” problems in the market due to large debt issuance, which would otherwise lead to market tensions.

The tight link through interlocking balance sheets can be like a game of smoke and mirrors (Figure 4). Imagine that the government lengthens the average maturity of its fixed-rate debt, by issuing a large amount at the very long end to finance the acquisition of some long-term asset, such as public infrastructure (left-hand panel). Imagine next that the central bank buys this debt and finances it with interest-bearing overnight bank reserves or its own very short-term debt (middle panel). If one looks at the government accounts on a stand-alone basis, one would think that the government has reduced the sensitivity of its funding costs to higher interest rates. But, in fact, the sensitivity is now higher. This is because higher rates will translate into lower central bank remittances. From a consolidated balance sheet perspective, the combination of the two transactions amounts to a large debt management operation, through which the state has actually financed itself at very short maturities (right-hand panel). As this example indicates, there can be major overlaps between central bank operations and public debt management.12

Tighter interactions

Monetary and fiscal interactions have evolved over time.

A longer-term factor has been the changing nature of the business cycle. Since the 1980s, with the conquest of inflation, recessions associated with financial disruptions have become more of the norm.13 As a result, the impact of monetary policy on financial stability has gained significance relative to that on inflation as a factor affecting public finances. First, financial busts and crises can generate a huge fiscal burden.14 Second, they have had a profound imprint on the operation of monetary policy, in a way that has tightened the interaction with fiscal policy.

The Asian financial crisis in the late 1990s bore these hallmarks. The financial losses were immense, with the fiscal burden shifted to the central bank in some cases. Central banks in the region have also steadily built up large foreign exchange reserves even as they have adopted more flexible exchange rate regimes. The resulting expansion of their balance sheets has become a key touchpoint, and sometimes a source of tension, with the government, because of the gains and losses linked to exchange rate movements and their impact on net remittances to the government.

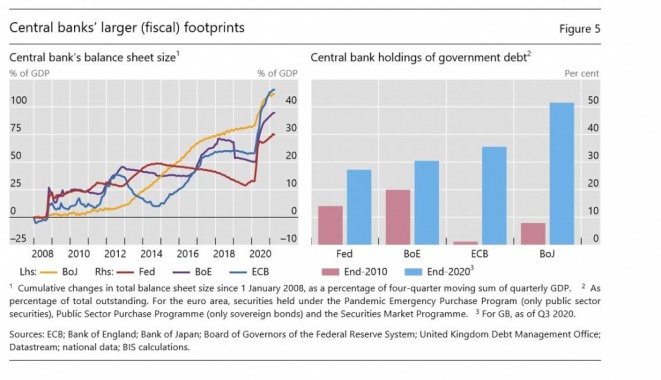

Among advanced economies, the GFC has also intensified monetary-fiscal interactions. For one, having kept interest rates at very low levels for many years, monetary policy has helped ease fiscal burdens and expand the government’s policy headroom. In addition, as central banks have increasingly relied on adjustments to the size and composition of their balance sheets to set the policy stance (“balance sheet policies”), each policy’s footprint on the other has increased through interlocking balance sheets and remittances. Central bank balance sheets have soared (Figure 5, left-hand panel), reflecting large-scale purchases of government securities funded predominantly with interest-bearing reserves. In many advanced economies, central banks now hold roughly a third of all outstanding government bonds – in the case of Japan, over half (right-hand panel). And with much larger balance sheets, central bank profits and losses, and the associated income transfers, have also grown. Moreover, during the Covid crisis, also many EMEs have intervened in their government bond markets to calm tensions.

1 Cumulative changes in total balance sheet size since 1 January 2008, as a percentage of four-quarter moving sum of quarterly GDP. 2 As percentage of total outstanding. For the euro area, securities held under the Pandemic Emergency Purchase Program (only public sector securities), Public Sector Purchase Programme (only sovereign bonds) and the Securities Market Programme. 3 For GB, as of Q3 2020.

Sources: ECB; Bank of England; Bank of Japan; Board of Governors of the Federal Reserve System; United Kingdom Debt Management Office; Datastream; national data; BIS calculations.

On the flip-side, the monetary implications of fiscal decisions have also increased. As monetary policy has sought to control a larger segment of the yield curve, the overlap with public debt management has grown: by influencing the curve, debt management operations now have a direct impact on the effective monetary policy stance. This is in marked contrast with pre-GFC arrangements. To be sure, in those days, most central banks did routinely purchase government bonds as part of their monetary operations to implement interest rate policy. But those operations were substantially smaller and the central bank operated so as to minimise the impact on bond yields in order not to interfere with the signal of the stance conveyed through the policy rate – the exclusive measure of the stance.

More generally, the GFC and the Covid episodes illustrate how crises typically have the effect of further tightening the interaction between monetary and fiscal policies. In these situations, the two policies become highly complementary, as they leverage each other’s comparative advantage in resource mobilisation. The central bank can quickly mobilise and channel resources in a targeted way, through its close interface with financial markets, leveraging its lending and market-making capacity. For its part, the government can instil stability by providing essential fiscal backstops to key economic sectors, especially banks, and by transferring resources to particular economic segments. In fact, the government may grant these backstops also to the central bank itself. In this case, the objective is exclusively of a political economy nature: by insulating the central bank from losses, the indemnities can also help shield it from political interference that may hinder its ability to pursue its stated objectives, ie protect its independence (see below).

Managing the interaction: sustainably leveraging on complementarities

Managing the entwined powers and responsibilities is critical to ensure that monetary and fiscal policies together support a thriving economy. The key is to exploit their respective comparative advantages.

Arguably, fiscal policy is best suited to enable robust long-term growth, by drawing on its ability to direct resources to specific segments of the economy. Examples include promoting an environment conducive to investment and innovation as well as carrying out investment directly in areas with high productive potential. Here, there are overlaps and synergies with structural policies.

Monetary policy is better suited to help stabilise growth. This means seeking to keep the economy on an even-keel along a feasible growth path, by mitigating the forces that may derail it – be these inflation or, since the 1980s in particular, financial instability.

Why such a comparative advantage?

Fiscal policy, the outcome of a fundamentally political decision-making process, has the necessary legitimacy to carry out the required, inevitably highly redistributive, policies. But for much the same reasons, it cannot respond nimbly to cyclical economic fluctuations. By contrast, being one-step removed from political decisions, monetary policy can act quickly and flexibly. And through its pervasive impact on financial conditions, can exert a powerful influence on economic activity.

To be clear, this by no means imply that each policy domain cannot complement the other. Far from it. Fiscal policy, in particular, can contribute importantly to mitigating economic fluctuations, not least through automatic stabilisers. It is simply that in relative terms, considering also governance arrangements, each policy is better suited for certain goals. Indeed, in exceptional times, such as crises or deep and protracted slumps, this relative comparative advantage becomes more nuanced. In such cases, the stabilisation powers of monetary policy alone are generally insufficient and fiscal policy must share the burden of promoting recovery.

Operating against this comparative advantage can give rise to tensions and conflicts. Ill-timed and ill-calibrated fiscal policy in the pursuit of stabilisation goals can overburden monetary policy’s stabilisation function. The tendency for fiscal policy to be pro-cyclical, especially in emerging market economies, gives rise to particular challenges. At the same time, reliance on monetary policy to take charge of long-term growth can raise unrealistic expectations, drag the central bank into the political arena and undermine its legitimacy.

Fundamentally, a prerequisite for successful economic management is that both fiscal and monetary policies be sustainable. Neither can perform its function effectively if the other is out of kilter.

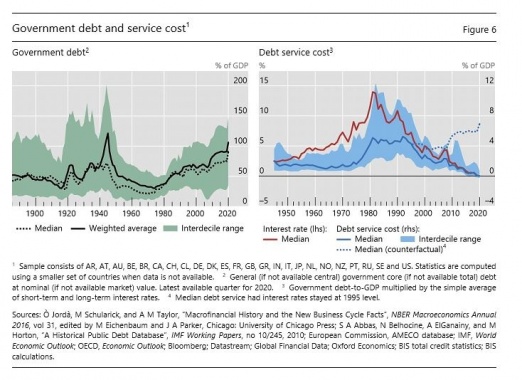

Unsustainable fiscal policy can undermine the sustainability of monetary policy, by forcing it into an “accommodation trap” in the face of rising public debt burdens. Over time, this could generate financial instability and/or inflation. The issue has gained prominence owing to the relentless rise in public debt to post-war peaks – in line or above World War II levels – even as debt service costs have fallen to post-war troughs, reflecting the decline in interest rates to historical lows (Figure 6). The dashed blue line in right-hand panel shows the counteracting forces at work: had interest rates remained at their 1995 levels, rising debt levels would have actually boosted debt service costs to post-war peaks by the end of 2020. This shows that public finances are now quite sensitive to any normalisation of policy interest rates.

Conversely, unsustainable monetary policy can threaten fiscal sustainability. Overly tight monetary policy that drives economies into deep recessions can erode the tax base. Excessively easy monetary policy can generate large fiscal burdens if it contributes to financial instability. Moreover, to the extent that sustained monetary accommodation encourages further government borrowing, it becomes harder for monetary policy to raise interest rates without increasing the government’s refinancing burden.

Similarly, corrections from positions that risk becoming unsustainable by one type of policy can generate persistent headwinds for the other. Required protracted fiscal consolidation can increase the stabilisation burden on monetary policy. And a protracted normalisation of monetary policy can reduce the headroom for fiscal policy.

All this points to two key considerations.

First, it is important that both monetary and fiscal policies operate with sufficient safety margins – within a kind of “corridor of stability”.15 This would allow them to deal with unexpected shocks that could derail the economy and, as a result, the policies themselves. Failing to do so could trigger a vicious cycle, whereby both policies end up further narrowing their respective rooms for manoeuvre. If so, shocks become increasingly damaging over time.

Second, it is equally important that the two policies operate “consistently”. Apart from minimising the likelihood of outright conflicts, a balanced reliance on the two is essential in order not to push one policy too close to its limit. Even if the short-term outcomes of an unbalanced reliance may be perceived as desirable, the long-term damage to the institutional credibility of policy is likely to be very costly and hard to reverse.16

The ease with which consistency can be achieved depends on circumstances and institutions. During crises, the interests of monetary and fiscal policies are generally aligned; moreover, markets may exert discipline on them to induce alignment. At other times, this is less likely to be the case. Hence clear institutional arrangements are important, primarily to avoid monetary policy being derailed by short-term political considerations. For monetary policy, a key institutional pillar is central bank independence, which allows monetary policy to focus on longer-term objectives. For fiscal policy, semi-independent fiscal councils can help provide an important cross-check on fiscal largesse. For both, constitutional provisions can strengthen these safeguards further, as has been done in some countries.

More importantly, a critical requirement for a constructive interaction is clear mandates. It is for monetary policy to focus on seeking to deliver – through price and financial stability – an environment conducive to sustainable growth. It is for fiscal policy to focus on the appropriate shape of growth and an economic structure consistent with society’s preferences. This serves to ensure clarity in the delegation of duties and to provide a solid basis for policy legitimacy. Ultimately, such legitimacy will hinge on the ability to deliver satisfactory outcomes, ie to exercise the privileged powers responsibly.

At the current juncture, two challenges loom large.

First, both policies are running out of headroom and need to rebuild it in order to operate with sufficient safety margins. This longer-term “joint normalisation” predicament partly reflects some of the problems outlined above. As interest rates have trended down to historical lows, the constraint on monetary policy has considerably tightened, resulting in greater reliance on fiscal policy in economic stabilisation. Monetary policy must therefore be able to re-normalise when the time comes in order to keep financial conditions and the economy on an even keel. Concurrently, fiscal policy cannot take accommodative financing conditions for granted. Fiscal sustainability is essential and should be consistent with more normal interest rate levels, taking into account also future contingencies. Objectives, which have coincided during the Covid-crisis, may well diverge again at some point.

Second, and as a result, institutional arrangements ensuring that each of the two policies focuses on its respective mandate will be especially important to support sustainable growth. Along the normalisation path, as both policies seek to regain greater room for manoeuvre, they will tend to work at cross-purposes. This is likely to bring underlying tensions to a head. Communication can play a key complementary role, by shaping public expectations and supporting the policy priorities in each domain.

Bartsch, E, A Bénassy-Quéré, G Corsetti and X Debrun (2020): “It’s all in the mix: how monetary and fiscal policies can work or fail together”, Geneva Report no 23, CEPR Press, December.

Benigno, G. and L. Fornaro (2018): “Stagnation traps,” Review of Economic Studies vol 85(3), pp 1425-1470.

Bruno, M and W Easterly (1998): “Inflation crises and long-run growth”, Journal of Monetary Economics 41(1), pp 3-26.

Borio, C, M Drehmann and D Xia (2018): “The financial cycle and recession risk,” BIS Quarterly Review, December.

Borio, C J Contreras and F Zampolli (2020): “Assessing the fiscal implications of banking crises”, BIS Working Papers, no 893, October.

Borio, C, E Kharroubi, C Upper and F Zampolli (2015): “Labour reallocation and productivity dynamics: financial causes, real consequences”, BIS Working Papers, no 534, December.

Borio, C and P Disyatat (2010): “Unconventional monetary policies: an appraisal”, The Manchester School, vol 78(s1), pp 53–89.

Cagan, P (1956): “The monetary dynamics of hyperinflation,” Studies in the Quantity Theory of Money, Chicago: University of Chicago Press, pp 25–117.

Eggertsson, G (2006): “The deflation bias and committing to being irresponsible”, Journal of Money, Credit and Banking 38(2), pp 283-321, March.

Garga, V. and S. R. Singh (2021): “Output hysteresis and optimal monetary policy,” Journal of Monetary Economics, vol 117, pp 871-886.

Gopinath, G, S Kalemli-Ozcan, L Karabarbounis, and C Villegas-Sanchez (2017): “Capital allocation and productivity in South Europe”, Quarterly Journal of Economics, vol 132(4), pp 1915-1967.

Greenwood, R, S Hanson, J Rudolph and L Summers (2014): “Government Debt Management at the Zero Lower Bound”, Hutchins Center on Fiscal and Monetary Policy at Brookings Working Paper, no 5.

Jaimovich, N and S Rebelo (2017): “Nonlinear effects of taxation on growth”, Journal of Political Economy 125(1), pp 265-291.

Leeper, E (1991): “Equilibria under ‘active’ and ‘passive’ monetary and fiscal policies”, Journal of Monetary Economics vol 27, pp 129–147.

Leijonhufvud, A (2009): “Stabilities and instabilities in the macroeconomy”, VoxEU, 21 November.

Mian, A, L Straub and A Sufi (2020): “Indebted demand,” NBER Working Paper, no. 26940.

Rungcharoenkitkul, P, C Borio and P Disyatat (2019): “Monetary policy hysteresis and the financial cycle,” BIS Working Papers, no 817, Bank for International Settlements.

Sargent, T and N Wallace (1981): “Some unpleasant monetarist arithmetic.” Federal Reserve Bank of Minneapolis Quarterly Review, vol 5, pp 1–17.

Schmitt-Grohé, S and M Uribe (2008): “Policy Implications of the New Keynesian Phillips Curve”, Federal Reserve Bank Richmond Economic Quarterly 94(4), pp 435-465.

Sims, C (1994): “A simple model for study of the determination of the price level and the interaction of monetary and fiscal policy”, Economic Theory vol 4(3), pp 381–399.

Wray, R (1998): Understanding modern money: the key to full employment and price stability, Northampton, MA, Edward Elgar.

The flexibility in the fiscal space which money creation accords is set out in Wray (1998).

See, eg Borio et al (2020).