An overview of the functioning and governance of the Bitcoin network is provided e.g. by Böhme et al. (2015). The underlying technology and the conceptional setup can be summarized as follows: There is no central authority, but a global network of computers controls, monitors, and stores the system information. New Bitcoins are coined by decentralized “mining” by users and their computers. New data packets are added to the blockchain every few minutes. The maximum total number of Bitcoins is technically limited to about 21 million, of which just under 19 million are already in circulation. When this limit is reached – the transaction fees become the only source of income for the miners, on whose existence Bitcoin depends in the long run. To prove the correctness of the entire blockchain and its extensions, computers must solve a mathematical puzzle for each block. The so-called miners validate the transactions by entering them into a public ledger. Currently rewards include transaction fees as well as seignorage from newly created Bitcoins, i.e. the market value of a bitcoin minus the mining costs.

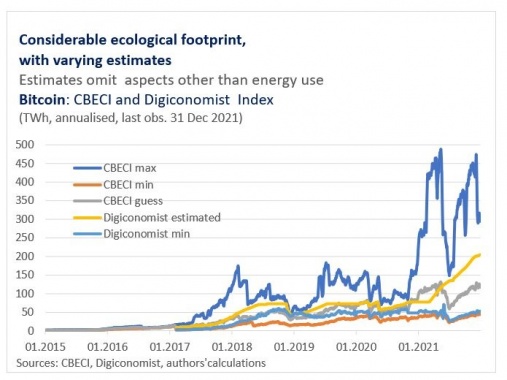

This proof-of-work method has a scalable difficulty level and aims to keep the incentive for miners to keep running the system sufficiently high. The more computing capacity and the faster the validation process takes place, the safer the whole system will be. Such dynamic and decentralized protection leads to an exponential increase in the power demand of the computers, which means a huge energy demand for the system. Bitcoin’s price directly affects the value of the mined coins and therefore the amount of resources miners can afford to spend on mining (see e.g. the simple model of de Vries, 2021). With a higher Bitcoin price, more producers are incentivised to compete for new coins. This in turn requires to make the encryption puzzle more difficult. By consequence, the miners will require more electricity to solve the puzzle and will consume more electricity and increase carbon emissions.

The durability, stability and scalability of the Bitcoin network is noteworthy. Moreover, as stated e.g. by Auer (2021), blockchain and the distributed ledger technology are rapidly becoming an industry standard for digital assets and in other applications. The entire potential of these technologies has still not fully been explored.

Still, several authors have raised serious doubts on Bitcoin’s underlying technology and concept (for example Taleb, 2021; Avoca 2021; Acemoglu, 2021; Kolbert, 2021). The proof-of-work concept, which is a constituting feature of the Bitcoin system, is generally recognised as cumbersome and slow: it can only handle seven to ten transactions per second. This results in long transaction processing time as found by Avoca (2021). For comparison: The Visa network is said to be able to process an estimated 24,000 transactions per second (Avoca, 2021, p.4), i.e. the scalability and efficiency of well-designed conventional centralised payment systems is far less constrained.

It may also be noted that slow and opaque pricing networks have traditionally attracted predatory high-frequency algorithm traders and are vulnerable to related market stress. The flash crash of 6 May 2010 was a point in case (although unrelated to Bitcoin). As Baqer (2016) showed Bitcoin itself has suffered from attacks by high frequency trading firms, too. Avoca (2021) stress that the Bitcoin network is also vulnerable because of its reliance on a single security technology that experts consider to be outdated by advances in computing. Bitcoin uses the secure hash algorithm (SHA) which is more than twenty years old. While the U.S. Department of defence and many leading IT firms like Microsoft found the SHA-1 standard too weak for cyber-protection and decommissioned its use in the early 2010s. Researchers believe that the technology will not be able to keep up in a quantum computing environment. In the absence of a central legitimized management it is hard to see how the fundamental security technology could be replaced to withstand the challenges of future technological advances of others.

The Bitcoin network has also been reported for a long time to have another technical vulnerability of conceptional nature. It is prone to a so-called 51 percent attack, which occurs when miners (potentially malicious) gain control of more than 51 percent of the network’s hash-rate: they could then issue coins twice. While Bitcoin is in principle less exposed to the risk of a 51 percent attack because of its vast network of 1,000 nodes, a problematic concentration would actually have occurred in 2014: In June 2014, the mining pool GHash.IO reached a share of about 55 percent of the Bitcoin hashrate over 24-hours. Although a month later GHash.IO’s share of the network’s hashrate had dropped to just over 38 percent, the risk remained that a single miner or mining pool could again take control. GHash.IO voluntarily committed to stay far below 40 percent (Hern, 2014).

Moreover, the Bitcoin network is already now increasingly run by supercomputers and server farms and the incentive structure of retail miners might take a hit once all Bitcoins are minted and the reward system will rely on fees only. In consequence, the hash-rate is not unlikely to be increasingly concentrated in the hands of a few.

As importantly, the Bitcoin network comes with a large energy hunger due to its reliance on proof-of-work (see figure 2). It wastes power and is therefore an immense environmental polluter. The reason is the power demand of the proof-of-work concept – which is a necessary condition for the security of the system. According to the Cambridge Centre for Alternative Finance Bitcoin computers use around 140 terawatt hours of electricity per year – about a quarter of Germany’s electricity consumption. Digiconomist (2021) estimates that the entire Bitcoin network consumes 201.894 TWh per year. This would be close to the amount of energy all data centres consume globally. The consumed energy further results in 95.9 metric tons of CO2, comparable to the carbon footprint of metropolitan London. The more energy the Bitcoin network uses, the more secure it is. A lower energy demand of the Bitcoin system is therefore neither expected nor desired – rather, Bitcoin is sometimes justified by the fact that it would on balance be beneficial for planet earth and humanity as argued e.g. by Vukolic (2021). And even if alternative sources of energy were used or disused power plants revived, the network would still waste energy that could be used for other purposes, as convincingly argued recently by the Swedish Financial Supervisory Authority and the Swedish Environmental Protection Agency (2021).

Figure 2: estimated energy consumption of the Bitcoin network

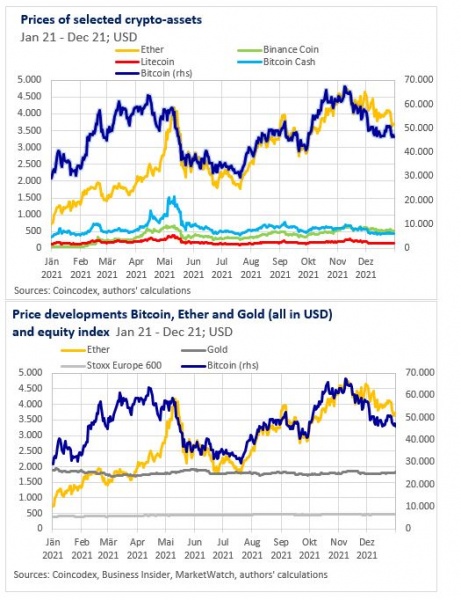

Nakamoto (2008) presented Bitcoin as useful for society through its payment function, but his related arguments were already rather unclear at that time. There is today in any case a broad consensus that Bitcoin fails in its original objective of being a currency. Bitcoin is too volatile to fulfil the classic functions of money: unit of account, means of payment, store of value (see figure 3 illustrating the exceptional volatility of Bitcoin). Moreover, the system is too slow and expensive to compete with established payment systems and currencies. Incentivizing system maintenance without central authority is challenging and expensive. The lack of acceptance by merchants due to long settlement times and high fees (currently between USD 2,5 and 4 per transaction) already shows that Bitcoin cannot be understood as a means of payment outside of niches. Therefore, Bitcoin’s business model as a global means of payment is not plausible.

Figure 3: Prices of selected crypto assets and price developments

The latest attempt to make the vision of Nakamoto (2008) reality on a larger scale was El Salvador trying to introduce Bitcoin as a second legal tender alongside the US Dollar on 7 September 2021. The launch was bumpy largely because there was no popular acceptance of the new means of payment. On the day of introduction, the Bitcoin exchange value plummeted by 15 percent, accompanied by protests targeted against President Nayib Bukele as reported by BBC News (2021).

Nevertheless, the number of Chivo Bitcoin wallets has expanded to more than 4 million. This however might be related to the USD 30 (its equivalency in BTC) given by the government to Salvadoran citizens to download the Chivo wallet as suspected by Fitch (2021). It is also important to note that payments through the Chivo wallet are actually layered and not settled in the Bitcoin network. Instead, they are just internally settled by the wallet provider, who acts as custodian (Merten, 2021). Therefore, at best, the Chivo Wallet is a payment system backed by Bitcoin, but fully betraying the idea of Nakamoto of overcoming the dependence of payments on centralised intermediaries, even if this betrayal has good reasons (the Bitcoin network being too slow, insufficiently scalable, and too costly for payments). Whether Chivo Wallets are fully backed or possibly underfunded is not fully transparent (although there is no indication that they are underfunded).

In the meantime, President Bukele has launched new plans to push Bitcoin’s use and mining in El Salvador with a new city built around a Bitcoin industry. The construction financing and maintenance of the “Bitcoin City” would be based on new Bitcoin bonds; and the required energy taken from a volcano in the proximity.3

One of the most popular arguments among Bitcoin supporters is that the limited supply of Bitcoin would make it a great asset to protect investors against inflation, while fiat money, which can be multiplied at will, would increasingly lose value.

However, even if one were to assume that Bitcoin could become the new global money, its technically fixed “money supply” would turn out to be a weakness on closer inspection: the world would be led into a deflation trap in a growing economy. In a deflation, falling prices of goods and services tempt citizens to postpone less urgent purchases into the future. This is reasonable for individuals, but aggregate demand suffers which slows down the economy.4

The advocates of gold as a weapon against inflation – and those who praise Bitcoin for the same as reason as the new gold – should remember the reasons for the abolition of the gold standard. While the gold peg could indeed offer protection against inflation, the flip side is the above-mentioned increased risk of deflation: In 1931 major currencies gave up the gold peg after years of painful recession, deflation, and financial instability.

Similarly, the indirect gold standard of the Bretton Woods monetary system after the end of World War II failed. During that time currencies were no longer tied directly to gold but to the US Dollar (at a fixed parity of 35 US Dollar per ounce of gold). The reason for the failure was that the U.S. could not keep money tight enough to maintain the gold parity as credible and at the same time provide the dynamically growing world economy with sufficient liquidity.

But the often-used comparison to gold also fails for more basic reasons. As Taleb (2021) argues, gold is both used industrially and has been appreciated as jewellery for centuries before it became a store of value, an investment asset, or a reserve currency. Moreover, it does not degenerate over time and retains its value even in chaotic or degenerative states of the world like natural catastrophes or in the case of a temporary or lasting failure of the electric or digital infrastructure.

Finally, the objection that the fiat money of modern central banks also has no intrinsic value falls short: because in deliberately moving away from the gold standard, sovereigns and central banks have put in place clearly defined mandates, legal guarantees, institutional and operational arrangements (independence as well as loans against collateral) to be able to release the gold brake without losing stability (see e.g. Bindseil and Fotia, 2021, 103-107).

Last but not least, the alternative of Bitcoin as a store of value is not predominantly central bank fiat money, but the financing through equity and/or debt of real economic projects which serve needs of society and generate a cash flow which allows positive yields to be sustained, anchoring the value of the investment assets in its real productivity. Investors’ worries about the stability of certain fiat currencies can be legitimately expressed by allocating their wealth into equity, commodities, real estate, human capital, or other productive assets. As Adam Tooze formulates, fiat money is backed by “‘nothing’ other than the trifling matter of tens of trillions of dollars in private credit, the rule of law and the power of the state, itself inserted into a state system. In other words, the entire structure of global macrofinance” (Tooze, 2021).

Some have also argued that the spike in Bitcoin valuation is due to the low interest rate policies of central banks. These would force investors to seek yield as assumedly offered by Bitcoin, a sort of digital commodity that would be able to escape from financial repression. While the wish for high nominal and real yields and the dissatisfaction about reality in many advanced economies is comprehensible and legitimate, it should not be a reason for shifting savings into highly speculative investments. If central banks were setting excessively low nominal interests rates, i.e. not well justified by monetary policy considerations, then investors should seek to fund real assets with sustainable values because of a proven contribution to the needs of society, and should at the same time support policy makers that commit to take measures supporting real economic growth and thereby real rates of returns of the capital stock of the economy.

Because Bitcoin is neither efficient nor suitable as a means of payment, it is not competitive for legal payments. Moreover, Bitcoin has no intrinsic value and does not generate a cash flow or dividends. Hence, the market valuation of Bitcoin is purely based on speculation. As Diehl (2021) puts it: ”[…] crypto morphed into a pure speculative mania which attracted a fanatic quasi-religious movement fuelled by gambling addiction and the pseudo-intellectual narrative economics of the scheme.” This market rally only works as long as the Bitcoin community’s beliefs about Bitcoin’s alleged advantages as a means of payment or that the market value can rise forever can be maintained. The Bitcoin hype has all the characteristics of a speculative bubble along the so-called greater fool theory (Oxford Business Review, 2020). Accordingly, the value rises if there is still a “greater fool” who assumes he can sell at an even higher price later. But much like the number of Bitcoins is ultimately limited, “eventually, one runs out of greater fools” (Malkiel, 1973).

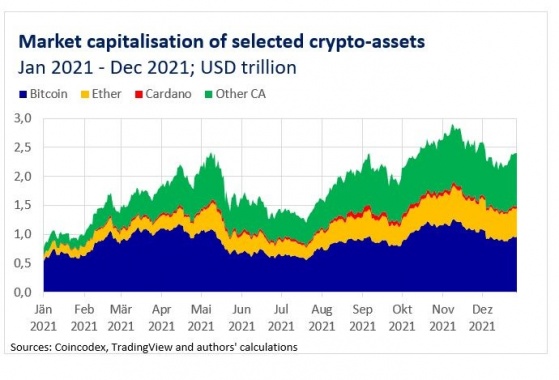

The enthusiasm for Bitcoin alone is not enough in the long run, especially as Bitcoin is in the end only a number chain and technologies are replaced by better technologies; with the newer soon displacing the new. In fact, Bitcoin remains the dominant crypto-asset but its market share has declined sharply in 2021 from more than 70 percent to less than 45 percent. Market interest has grown for newer blockchains that use smart contracts and aim to solve the challenges of earlier blockchains by introducing features to ensure scalability, interoperability, and sustainability. The biggest among the newer crypto-assets is Ether, which surpassed Bitcoin trading volumes earlier in 2021 (IMF, 2021). Finally, Bitcoin’s stellar long-term market performance that continues to attract investors was largely contingent on the timing of the initial investment. According to Wewel (2021) crypto returns do not even deviate markedly from traditional assets on a risk-adjusted basis, which is attributable to their substantially higher volatility.5

For all its economic shortcomings, there remains the vision of Bitcoin to restore freedom from government control and from centralized entities that abuse their power. Bitcoin, with its decentralized organization, promises the emancipation of the individual and the ultimate democratization of the monetary system as stated in Omarova (2021). However, even the case of Bitcoin freedom needs rules, otherwise there is a threat of anarchy and the law of the strongest. The fact that the economy and financial markets in developed market economies are not purely decentralized and spontaneously organized, but rely on central institutions and distributed nodes with internal hierarchies (firms) and within set rules, has long been recognized in economic literature, at least since the work of Nobel laureates Ronald Coase (1937) and Oliver E. Williamson (1975). Firms and incomplete contracts help deal with uncertainty and complexity and reduce transaction costs – and are by no means second-best solutions in the absence of appropriate technologies. Mechanistic rules, as Bitcoin appears to create, are not an appropriate solution for a changing world. Therefore, the recent more ambitious attempt to make Bitcoin a means of payment unavoidably betrayed its libertarian principles, including the core idea of Nakamoto (2008) to overcome the role of central payment intermediaries.

Bitcoin is also by no means as grassroots democratic as its community may have believed, at least in the early days, but is shaped by financial interests and powerful shareholders and, relatedly, the exposure to concentration risks, given its large reliance on a few entities, like custodial wallets and exchanges (for example, Binance handles more than half of trading volumes according to the IMF (2021)). The majority, 75 percent of the addresses, holds just over 0.2 percent of the market share; the hundred largest Bitcoin shareholders hold more value than the smallest 38 million combined (Dunn, 2021; although these numbers may be impacted by exchanges and wallet providers holding “omnibus accounts” for small holders).

Finally, Bitcoin offers a vision of a global means of payment without national jurisdictions to overcome borders – quite unlike conventional cross-border payments. People could send value across borders for free and unhindered to anyone with a Bitcoin wallet. This view ignores that the high cost of conventional cross-border payments is not only due to the inefficiency of payment instruments, but in significant part to costs of market and liquidity risk management and regulatory requirements to combat money laundering and terrorist financing. However, the cost of complying with these requirements, and provisions for legal and exchange rate risks only affect the regulated financial sector. The fact that some bitcoin transactions, e.g. like peer-to-peer, have been able to escape this entirely so far is a regulatory gap, not a technological achievement. It is however not denied that the area of cross-border payments needs improvements in terms of cost, speed, transparency and inclusiveness. The authorities, in the form of the Financial Stability Board (FSB, 2020) published an ambitious roadmap to enhance cross-border payments in October 2020 that is being thoroughly followed up.

Bitcoin has been successful as payment means for criminal usages. A distinction must be made between market manipulation and dubious activities of exchange operators and the use for money laundering and drug trafficking, terrorist financing and extortion and ransom below the radar of law enforcement and regulatory authorities.

Dunn (2021) presents a long list of shady operators and market manipulation that have marked Bitcoin’s history on the supply side. The first bubble in 2013 was fuelled by the Mt Gox exchange which hosted about 70 percent of Bitcoin trading. The exchange lost 650,000 Bitcoins of its users and went bankrupt. Studies by Gandal et al. (2021) suggest that the first boom – a rise from USD 100 to USD 1,000 in just two months – was due to manipulation of a trading software.

Griffin (2019) found that the second and third booms were associated with the launch and rise of Tether. Tether is a so-called stablecoin, i.e. a type of crypto-asset that aims to maintain a stable value by being backed by fiat currency or other assets. Tether is, according to the issuer, nominally pegged one-to-one to the US Dollar and is backed entirely by cash-like assets. Griffin’s investigations during the 2017 boom suggested that 50 percent of the sharp price increase was due to manipulation with Tether.

Bitcoin has also been popular for financing criminal activities. Drug trafficking, money laundering, terrorist financing and extortion are the most popular areas of use. In recent years, exit scams have dominated crypto-assets crimes according to Cybertrace (2021). For instance, in May 2021, a ransomware attack on a US energy pipeline was carried out by a group operating out of Russia who received ransomware payment of approximately USD 5 million in Bitcoin (Reuters, 2021d), in June 2021 the meat company JBS paid USD 11 Million in Bitcoin to avoid further disruptions (WSJ, 2021), in March 2021, another attack made CNA Financials pay USD 40 million in Bitcoin to get data back (Simpson, 2021). Suspicious activity reported on ransomware attacks accounted only in the first half of 2021 for 590 USD million in the U.S. with crypto assets being the vehicle for ransom payments (Fincen, 2021). While this amount of ransom attacks may present a limited share of global money laundering activity, it is certainly strongly growing and of high concern, also due to the high indirect cost an damage, e.g. through operational disruptions or confidential data leakages. In addition, Bitcoin is also one of the main crypto-assets used in the Darknet (65 percent in Q1 2020) (Crystal, 2020).

The share of illicit payments in total Bitcoin transactions are disputed: While Foley (2019) estimates that some 45 percent are for illegal use, the Chainalysis’ 2021 crypto crime report finds less than 1 percent for 2020. As suggested by Green (2021), such small ratio could be because the denominator confuses trade volume (mostly relating to investment flows) with payments matching an economic transaction. FATF (July 2021) reports variations in identified illicit Bitcoin transactions from 2016 – 2020 to range between 0.6 and 9.9 percent (in proportion to the number of transactions) and 0.1 and 5.1 percent (in proportion to the USD value of transactions). Moreover, it was also found that in total, illicit transactions were identified to occur typically without an intermediary (wallet provider or exchange). Bitcoin’s design attracts illicit usages as it allows to hide identities, to transact entirely within the darknet or on-chain without reliance on regulated entities, to use mixing services to obscure the trail of a transaction or to use exchanges that have not yet adopted the AML/CFT standards of FATF (Crystal, 2020).

However, Bitcoin’s set-up can support forensic analysis in tracing illegal activities as transactions never disappear from the blockchain. While this may allow at times to recover some of the paid ransom, it remains a complex, time-consuming and disproportionate exercise, as the US Department of Justice has revealed in recent years.6,7

The longer the boom lasts and the more money flows into the system before the music may stop, the higher are the risks and costs for invested individuals and the society at large. Often, different kinds of social costs of the Bitcoin network are not well-distinguished in the debate. Consider the following issues:

On balance, societies will eventually have to write off the cumulative energy consumption (including unpriced negative externalities), investment costs of hardware, the built-up human capital of the Bitcoin ecosystem, the cumulated work and a good dose of societal consensus. Moreover, in the meantime the Bitcoin network will have facilitated criminal activities by providing a means of illicit payments. All these costs are broadly proportional to the market capitalization that Bitcoin will reach and are moreover driven by the overall duration of the Bitcoin cycle. McCauley, (2021) concludes from similar observations that Bitcoin is a negative-sum game for society even worse than a Ponzi scheme.

The broad use of Bitcoin for illicit activities was recognised early. The shutting down of the darknet illicit marketplace Silkroad in 2013 (Time, 2013) revealed the extensive use of Bitcoin for illicit purposes – just five years after the white paper of Satoshi Nakamato was published. In 2014, the money laundering and terrorist financing related to crypto assets started to be picked up by the FATF (2014) and in 2019, it issued its guidance for a “Risk-Based Approach for Virtual Assets and Virtual Asset Service Providers” demanding national implementation and enforcement (FATF, 2019). If fully and consistently implemented and enforced, it means that providers of services in crypto assets would apply AML/CFT measures, including customer due diligence or the checking and reporting of suspicious transactions. As a result, the illicit usage of Bitcoin would become much more difficult in particular when exchanging it into fiat currency or using it for purchases of goods and services. Despite the advancements in the field of AML/CFT, regulators have been somewhat slow in addressing the above mentioned most obvious societal problems of Bitcoin.

Several explanations may be considered for this. First, the potential development of social risks may have been underestimated because of the relatively small size and unleveraged nature of the crypto assets market, which was assessed to not represent a fundamental threat to global financial stability. Second, regulatory responsibilities for Bitcoin seem somewhat fragmented as it raises multi-facetted threats and involves multiple actors. Moreover, the risks and concerns related to Bitcoin were first mainly related to money laundering and terrorist financing, while ransomware attacks occurred more recently, and with the surge in Bitcoin activities led to consumer and investor protection concerns. Third, many aspects of Bitcoin are fundamentally new and difficult to comprehend. Furthermore, they do not easily fit into existing regulation and raise regulatory challenges: Bitcoin operates borderless, misses a national anchor and was not perceived as a legal entity that could be addressed by regulation and incrimination (ECB, 2019). Also, regulators need to seek the right timing and suitable design of financial regulation to address risks and avoid gaps as well as unintended consequences, like stifling innovation (Warren, 2021). Given the global nature of Bitcoin, global cooperation amongst regulators is of importance to avoid regulatory gaps and arbitrage, as pointed out by IMF (2018), which is a time-intensive process. And it is not atypical that once a need for regulation has been identified, it can take years until regulation is finalised and applied. Fourth, the vested interests of large Bitcoin holders and financial intermediaries seeking for investment and business opportunities might have led to increased lobbying activities. The Economist (2021) warns that crypto lobbying was going ballistic, as companies were hoping to influence where the rules end up while regulators were toughening up their approaches.

In light of the continued reporting on illicit usages and climate implications, growth of the crypto-asset markets and its increased integration with financial markets] the threats are recognised (ECB, 2019, FSB, 2021, Cunliffe, 2021) and more accentuated calls for addressing the risks of crypto-assets are made (ECB, 2019; Lagarde, 2017). In a speech on 10 December 2021, Panetta (2021) has been explicit that “the value of crypto-assets is growing rapidly and currently stands at over 2,500 billion dollars`. That is a significant figure with the potential to generate risks to financial stability that shouldn’t be underestimated.”

Moreover, a number of jurisdictions have taken or are preparing measures to regulate Bitcoin alongside other crypto-assets. The spectrum of regulatory approaches is hereby wide reaching from criminalising crypto-asset business to more inclusive approaches of licensing and supervising intermediaries.

Some jurisdictions have banned Bitcoin (and similar crypto-assets), e.g.: In December 2021, Reuters (2021a) reported that the Indian government is considering prohibiting crypto-asset activities of individuals including a use as store of value, unit of account or means of transfer with violations by individuals being possibly sanctioned by arrests without bail options. Notably, reportedly the bill would also include non-custodial wallets, an area of the Bitcoin network that is largely unregulated. However, the bill has not yet been presented to the Parliament (Business Insider India, 2021). In November, the religious leaders in Indonesia, the National Ulema Council (MUI), have forbidden Muslims (almost 90 percent of the population) to use Bitcoin and other crypto assets. The MUI deemed crypto assets as “haram”, i.e. banned, as it had elements of “uncertainty, wagering and harm”, as reported by (Bloomberg, 2021). In June 2021, the Chinese central bank announced that all transactions of crypto-assets were illegal, effectively banning Bitcoin and other crypto-assets entirely (BBC News, 2021 a). In November 2021, Sweden proposed an EU wide ban of proof-of work crypto-assets like Bitcoin due to their energy consumption. Crypto asset producers were increasing their presence in the Nordic region to search more renewable energy sources, the heads of the Swedish Financial Supervisory Authority and the Swedish Environmental Protection Agency (2021) stated in an open letter. But Sweden would need the renewable energy for the climate transition to meet the Paris Agreement. Energy-intensive mining of crypto-assets should therefore be prohibited.

Other jurisdictions have taken a less rigorous stance and have primarily aimed at bringing crypto-assets “within the regulatory perimeter” to address risks but also support possible benefits of innovation (e.g. Cunliffe, 2021). Besides this call by Cunliffe, the UK’s FCA (2021) prohibited activities of crypto-exchange Binance and issued a warning to consumers and on crypto-assets. Australia, in December 2021, introduced a draft legislation aiming at licensing crypto-exchanges and activities in crypto-assets (Reuters (2021b)). For the U.S., Reuters (2021c) reports that the regulation and enforcement across different authorities is shaping for each’s respective area of responsibility. The approach of regulating crypto assets is accompanied by several enforcement actions (Vox, 2021). The President’s Working Group on Financial Markets (US Treasury, 2021), comprising the Secretary of the Treasury and the Heads of all the key US financial regulators, call to speed up efforts on regulation and guides federal agencies to use their existing powers. The group of legislators call for more federal oversight of custodial wallet providers, i.e. firms that offer products that allow users to hold their crypto tokens. Moreover, the SEC has rejected a bitcoin-based exchange traded fund (ETF) in November 2021 due to concerns of possible price manipulation (FT, 2021a). The OCC (2021) requires from banks to have controls prior to engaging in crypto-assets business and must receive a non-objection. And the U.S. Infrastructure Bill of November 2021 calls crypto-exchanges to notify the tax authority of crypto asset transactions (Time, 2021). In the EU, the European Commission (2020) proposed the regulation for Markets in Crypto-Assets (MiCA). In the absence of a central issuer, MiCA will not regulate Bitcoin and other crypto-assets, but target intermediaries, offering services in crypto-assets (crypto asset service providers). This is in line with other approaches seen for decentralised crypto-assets, e.g. by the FATF, and such approach was also suggested by the ECB’s crypto asset task force (2019). Besides MiCA, the European Commission (2021) presented a draft legislative proposal to enhance the EU’s framework for AML/CFT. Like MiCA, it requires intermediaries to apply AML/CFT measures and forbids the opening of anonymous crypto asset wallet accounts. These regulations, once they apply, will likely address several of the societal issues related to Bitcoin – but not all of them. The rules will not cover Bitcoin transactions that happen without any regulated intermediaries, namely using non-custodial wallets or on-chain peer-to-peer transactions, or if service providers and countries with low compliance levels are used. For professional criminals, using the Bitcoin network through on-chain peer-to-peer payments does not seem to be particularly challenging, even if the regulation of service providers will make the laundering of Bitcoin received through illicit activities more difficult.

These examples indicate that regulators are progressing in addressing the risks posed by Bitcoin and crypto-assets. At the same time, they illustrate that stances differ (because of different assessments of the value of crypto-assets for society) and initiatives are at different levels of maturity. It can also be noted that regulations, apart from those criminalizing Bitcoin, face limits due to Bitcoin’s decentralized and global set-up.

To forestall or limit global regulatory gaps and arbitrage, international cooperation on crypto-assets amongst regulators is important, as the IMF (2018) called for. FSB (2019) demonstrated the manifold initiatives and activities related to crypto-assets at international level. In parallel to initiatives at country level, the international bodies have amplified their efforts in addressing the risks posed by crypto-assets over the last years and some of those international actions have guided national implementations.

An example is FATF, which issued global, binding standards to prevent the use of crypto-assets for money laundering and terrorist financing. As outlined above, FATF focuses on the providers offering crypto-asset services to apply the same safeguards as the financial sector. However, in its progress report of July 2021, FATF (2021) indicates deficits in the implementation in jurisdictions, concluding “that there is not yet a global regime to prevent the misuse of virtual assets and VASPs for money laundering or terrorist financing.” Moreover, the report acknowledges that a significant value for peer-to-peer crypto-asset transactions may be operating outside the FATF standards.

A further example is the G7 (2020). The G7 raised concerns that ransomware payments are regularly made in crypto-assets and demanded the implementation of the FATF standards. Furthermore, G7 Finance Ministers and Governors (2021) stated that volatile unbacked crypto-assets were not suitable for payments.

Another international standard setter, the Basel Committee on Banking Supervision (BCBS), consulted on a preliminary proposal for the prudential treatment of banks’ crypto-asset exposures, distinguishing crypto-assets that may be generally eligible for falling within the current Basel requirements; and other crypto-assets, such as Bitcoin, that would require a more conservative prudential treatment (BCBS, 2021).

All these examples show that the international community aims at harmonised international standards for addressing the risks of crypto assets. Of course, the translation of those into national rules can be a years-long process with fragmented implementation.

While there has been significant progress towards a consistent and effective regulation of crypto assets, Bitcoin prices and market capitalization have still reached new peaks in November 2021. Some measures by public authorities may have contributed to these new peaks by supporting renewed investment flows into Bitcoin. For example, the US SEC (2021) recently gave the green light for a first futures-based Bitcoin ETF (while it has repeatedly rejected Bitcoin spot market ETF)8 or the German legislator has adopted in July 2021 a “Fondstandortgesetz” which allows German investment funds for institutional investors (“Spezialfonds”) to invest up to 20 percent into crypto assets. For hesitant investors, such public measures seem to legitimize Bitcoin without necessary safeguards; they could be interpreted as signals that public authorities do not doubt on the sustainability and rationale of Bitcoin. Moreover, these measures facilitate investment flows and the integration of Bitcoin in the traditional financial systems. Finally, any signal from public authorities through measures about Bitcoin are considered indications of the future policy stance. This reduces investors’ uncertainty vis-à-vis an asset of which the price is not anchored in any real contribution to society. Overall, it may be concluded that the net effect of authorities’ recent measures on Bitcoin were ambiguous. This ambiguous net effect therefore also could apply to Bitcoin’s eventual negative consequences for society, which go beyond its use for illicit payments.

As also argued in detail elsewhere (Taleb, 2021; Dunn 2021; Green, 2021; Roubini, 2021; Bindseil and Schaaf, 2021) the sustainability of Bitcoin is questionable. It is difficult to find good arguments that support its soundness as a medium of exchange or as form of investment. If Bitcoin eventually collapses, the net social cost of the Bitcoin life cycle will be very large. And it will be the larger the longer it lasts, and the higher Bitcoin’s maximum market capitalisation will be. In the absence of a positive contribution of Bitcoin for society, the gross and net social costs will be equal – and they will encompass the energy consumption and hardware usage of the Bitcoin network, the human and technical capital that will have to be written off. What is not quantifiable is the damage to the social fabric that will occur when retail investors find that their savings are lost, while some early investors who got out before the music stopped playing have enriched themselves at their expense.

Public policymakers have not been fast to address all problems related to Bitcoin. Although its usage for illicit payments has been noted early, slow global implementation and enforcement of AML/CFT rules for Bitcoin based payments has undermined the huge efforts made to prevent illicit payments through regulated industries and allowed regulatory arbitrage by criminal actors. Moreover, Bitcoin has become, also somewhat through the benevolence of public authorities, an asset class that everyone can now easily invest into and that “looks like a security, swims like a security, and quacks like a security, but is not regulated as a security” (Diehl, 2012) and even more importantly, that lacks a plausible underlying contribution to society justifying its valuation.

More recently, many public authorities, have taken or plan to take strong measures against Bitcoin, after concluding that its societal value is negative. Also, regulators of advanced western economies have launched significant implementation measures to fight the reliance on Bitcoin for illicit purposes, although the non-intermediated use of the Bitcoin network is still largely out of regulators’ actions. Further regulatory efforts are therefore needed that effectively address all kinds of illicit payments through Bitcoins. The principle of “same function – same risks – same rules” is to apply consistently if global efforts against illicit payments are to be successful, regardless of the unique nature of Bitcoin.

Legislators and authorities need to be careful to not at the same time contribute to renewed momentum of investment flows into Bitcoin that will contribute to increase the market capitalisation of Bitcoin and to the scale of the eventual cumulated social cost of the Bitcoin network. The year 2021 has seen several such developments, and the spike of Bitcoin valuations in November 2021 is likely also attributable to investment inflows that were supported by such measures. For example, the news that the trading of futures-based bitcoin ETFs would (or could) not be prohibited, or the German Fondstandortgesetz effective as of 1 July 2022 allowing institutional investors funds to invest into Crypto-assets are being mentioned as drivers for the Bitcoin price dynamics in autumn 2021.

Last but not least, doubts on the sustainability of Bitcoin and the related social costs does not mean that DLT, blockchain and decentralised finance have no merits as innovative technological approaches. What remains unclear is if crypto coins other than stablecoins (or non-fungible tokens representing ownership of some other assets) can represent a meaningful investment asset. In the case of Bitcoin these doubts are particularly strong because of Bitcoin’s reliance on the inefficient proof-of work concept and its poor performance as means of payment.

Acemoglu, D (2021), “The Bitcoin Fountainhead”, in: Project Syndicate, 5 Oct 2021, available: https://www.project-syndicate.org/commentary/bitcoin-an-appealing-distraction-by-daron-acemoglu-2021-10.

Aggarwal, D et al. (2017), “Quantum attacks on Bitcoin, and how to protect against them”, Submitted on 28 Oct 2017; https://arxiv.org/abs/1710.10377

Avoca Global Advisors (2021), “Bitcoin: a trojan horse”, wcg avoca 14 Oct 2021, available: https://www.linkedin.com/posts/activity-6854411140617818112-NpKx

Auer, R, C Monnet and H S Shin (2021), “Distributed ledgers and the governance of money”, BIS Working Papers No 924, January 2021 (revised November 2021), available at SSRN: https://ssrn.com/abstract=3770075 or http://dx.doi.org/10.2139/ssrn.3770075

Baqer, K, Huang, D Y (2016), “Stressing Out: Bitcoin ‘Stress Testing’”, Published in Financial cryptography, 22 February 2016, http://diyhpl.us/~bryan/papers2/bitcoin/Stressing%20out:%20Bitcoin%20stress%20testing%20-%20analysis%20-%202016.pdf

BBC News (2021), “Bitcoin protests in El Salvador against cryptocurrency as legal tender”, 16 September 2021, https://www.bbc.com/news/world-latin-america-58579415.

BBC News (2021)a, “China declares all crypto-currency transactions illegal”, published 24 Sept 2021, https://www.bbc.com/news/technology-58678907

BCBS (2021), “Prudential treatment of cryptoasset exposures”, published on 10 June 2021, https://www.bis.org/bcbs/publ/d519.htm.

Bindseil, U and A Fotia (2021), “Introduction to Central Banking”, Berlin: Springer, https://link.springer.com/content/pdf/10.1007%2F978-3-030-70884-9.pdf.

Bindseil, U and J Schaaf (2021), „Nicht vom Bitcoin narren lassen“, in: Frankfurter Allgemeine Zeitung, 18 Sept 2021.

Bloomberg (2018), “IMF Calls for Global Talks on Digital FX as Bitcoin Whipsaws”, published on 18 Jnaury 2018, https://www.bloombergquint.com/global-economics/imf-calls-for-global-talks-on-digital-fx-as-bitcoin-whipsaws.

Bloomberg (2021), “Crypto Is Forbidden for Muslims, Indonesia’s National Religious Council Rules”, published 11 Nov 2021, https://www.bloomberg.com/news/articles/2021-11-11/crypto-is-forbidden-for-muslims-says-indonesia-s-ulema-council.

Böhme, R, Christin, N., Edelman, B., and Moore, T. (2015), “Bitcoin: Economics, Technology, and Governance”, in: Journal of Economic Perspectives, 29, 2 (2015), 213–238.

Business Insider India (2021), “India ends Winter Session of Parliament with no crypto bill in sight”, published on 23 December 2021, https://www.businessinsider.in/cryptocurrency/news/no-india-crypto-bill-in-sight-even-after-winter-session-of-parliament-comes-to-a-close/articleshow/88449161.cms.

Coase, R H (1937), “The Nature of the Firm,” Economica 4 (November): 386–405.

Cointelegraph (2021), “Iceland cuts power to new Bitcoin miners”, 8 Dec 2021, https://cointelegraph.com/news/iceland-cuts-power-to-new-bitcoin-miners.

Corporate Compliance Insights (2021), “The Complete Guide to Compliance and Compliance Risk Management”, in Resource Library, Whitepapers, 17 November 2021, https://www.corporatecomplianceinsights.com/banks-15b-in-fines-in-2020/

Cunliffe, J (2021), “Is ‘crypto’ a financial stability risk?”, speech given at Sibos, published on 13 October 2021, https://www.bankofengland.co.uk/speech/2021/october/jon-cunliffe-swifts-sibos-2021.

Cybertrace (2021), “Cryptocurrency Crime and Anti-Money Laundering Report”, February 2021; available: https://ciphertrace.com/2020-year-end-cryptocurrency-crime-and-anti-money-laundering-report/.

Crystal analytic (2020), “Darknet Use and Bitcoin — A Crypto Activity Report by Crystal Blockchain“, blog, 19 May 2020, https://crystalblockchain.com/articles/darknet-use-and-bitcoin-a-crypto-activity-report-by-crystal-blockchain/

Diehl, S (2021), “The Token Disconnect”, blog, https://www.stephendiehl.com/blog/disconnect.html.

Digiconomist (2012), “Bitcoin may consume as much energy as all data centers globally”, blog, March 10, 2021, https://digiconomist.net/bitcoin-may-consume-as-much-energy-as-all-data-centers-globally

Dunn, W (2021), “Bitcoin’s gold rush was always an illusion”, in: The New statesman, 20 July 2021, https://www.newstatesman.com/business/finance/2021/07/bitcoins-gold-rush-was-always-illusion

ECB Crypto-Asset Task Force (2019),” Crypto-Assets: Implications for financial stability, monetary policy, and payments and market infrastructures”, Occasional paper 223, May 2019.

European Commission (2020), “Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on Markets in Crypto-assets, and amending Directive (EU) 2019/1937”, published 24 September 2020, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52020PC0593

European Commission (2021), “Anti-money laundering and countering the financing of terrorism legislative package”, published 20 July 2021, https://ec.europa.eu/info/publications/210720-anti-money-laundering-countering-financing-terrorism_en.

FATF (2014),” Virtual Currencies: Key Definitions and Potential AML/CFT Risks”, June 2014, https://www.fatf-gafi.org/publications/methodsandtrends/documents/virtual-currency-definitions-aml-cft-risk.html.

FATF (2019), “Guidance for a Risk-Based Approach to Virtual Assets and Virtual Asset Service Providers”, June 2019, https://www.fatf-gafi.org/publications/fatfrecommendations/documents/guidance-rba-virtual-assets.html.

FATF (2021), “Second 12-Month Review of the Revised FATF Standards on Virtual Assets and Virtual Assets service providers”, July 2021, https://www.fatf-gafi.org/media/fatf/documents/recommendations/Second-12-Month-Review-Revised-FATF-Standards-Virtual-Assets-VASPS.pdf.

FCA (2021), “Consumer warning on Binance Markets Limited and the Binance Group”, published on 26 June 2021, https://www.fca.org.uk/news/news-stories/consumer-warning-binance-markets-limited-and-binance-group.

Fincen (2021), “Financial Trend Analysis January to June 2021”. See Y. Bizouati-Kennedy “US Government is Seizing so Many Cryptos, It’s Enrolling Private Contractors”, 5 August 2021 in gobankingrates.com.

Fitch (2021), “El Salvador Bank Bitcoin Risk to Depend on Adequacy of Regulation”, in: Fitch Wire, 11 Nov 2021, https://www.fitchratings.com/research/banks/el-salvador-bank-bitcoin-risk-to-depend-on-adequacy-of-regulation-11-11-2021.

Foley, S, JR Karlsen and TJ Putniņš (2019), “Sex, Drugs, and Bitcoin: How Much Illegal Activity Is Financed through Cryptocurrencies?”, in: The Review of Financial Studies, Volume 32, Issue 5, May 2019, Pages 1798–1853, https://doi.org/10.1093/rfs/hhz015.

Fitch (2021), “El Salvador Bank Bitcoin Risk to Depend on Adequacy of Regulation”, in: Fitch Wire, 11 Nov 2021, https://www.fitchratings.com/research/banks/el-salvador-bank-bitcoin-risk-to-depend-on-adequacy-of-regulation-11-11-2021.

Foley, S, JR Karlsen and TJ Putniņš (2019), “Sex, Drugs, and Bitcoin: How Much Illegal Activity Is Financed through Cryptocurrencies?”, in: The Review of Financial Studies, Volume 32, Issue 5, May 2019, Pages 1798–1853, https://doi.org/10.1093/rfs/hhz015.

FSB (2019), Crypto-assets Work underway, regulatory approaches and potential gaps, published on 31 May 2019, https://www.fsb.org/wp-content/uploads/P310519.pdf.

FSB (2021), “Crypto-assets and Global “Stablecoins”, published on 11 October 2021, https://www.fsb.org/work-of-the-fsb/financial-innovation-and-structural-change/crypto-assets-and-global-stablecoins/.

FSB (2020), “Enhancing Cross-border Payments Stage 3 roadmap”, published on 13 October 2020, https://www.fsb.org/wp-content/uploads/P131020-1.pdf.

G7 (2020), “Ransomware Annex to G7 Statement”, publised on October 13, 2020, https://home.treasury.gov/system/files/136/G7-Ransomware-Annex-10132020_Final.pdf.

G7 (2021), “G7 Finance Ministers and Central Bank Governors’ Statement on Central Bank Digital Currencies (CBDCs) and Digital Payments”, published on 13 October 2021, https://www.bundesfinanzministerium.de/Content/EN/Downloads/G7-G20/2021-10-13-g7-central-bank-digital-currencies.pdf?__blob=publicationFile&v=2.

Gandal, N, JT Hamrick, T Moore and T Obermana (2018), “Price manipulation in the Bitcoin ecosystem”, Journal of Monetary Economics, Volume 95, May 2018, Pages 86-96, https://www.sciencedirect.com/science/article/pii/S0304393217301666.

Green, M (2021), “The Case Against Bitcoin”, in “Common sense”, 14 May 2021, https://bariweiss.substack.com/p/the-case-against-bitcoin.

Hern, A (2014), “Bitcoin currency could have been destroyed by ’51%’ attack”, The Guardian, 16 June 2014.

IMF (2021), “The Crypto ecosystem and financial stability risks”, in: Global Financial Stability report, Chapter 2, October 2021.

John M. Griffin, JF and A Shams (2019), “Is Bitcoin Really Un-Tethered?”, (October 28, 2019); https://ssrn.com/abstract=3195066 or http://dx.doi.org/10.2139/ssrn.3195066.

Kolbert, E (2021), “Why Bitcoin Is Bad for the Environment”, in: The New Yorker, published 22 April 2021, https://www.newyorker.com/news/daily-comment/why-bitcoin-is-bad-for-the-environment.

Lagarde, C (2017), “Central Banking and Fintech — A Brave New World?”, Speech, London, 28 September 2017, https://www.imf.org/en/News/Articles/2017/09/28/sp092917-central-banking-and-fintech-a-brave-new-world.

Malkiel, B (1973), “A Random Walk Down Wall Street”, W. W. Norton & Company, 1973.

McCauley, Robert (2021), “Why bitcoin is worse than a Madoff-style Ponzi scheme”, Financial Times, 22 December 2021.

Merten, L (2021): “Chivo wallet: bitcoin Verlust durch Sicherheitsluecke? ” published on 29 December 2021, https://bitcoin-2go.de/chivo-wallet-sicherheitsluecke-bitcoin-verlust/.

Nakamoto, S (2008), “Bitcoin: A Peer-to-Peer Electronic Cash System”, Bitcoin Foundation, November 2008.

OCC (2021), “OCC Clarifies Bank Authority to Engage in Certain Cryptocurrency Activities and Authority of OCC to Charter National Trust Banks” published on 23 November 2021, https://www.occ.gov/news-issuances/news-releases/2021/nr-occ-2021-121.html

Omarova, S T (2021), “The People’s Ledger: How to Democratize Money and Finance the Economy”, Cornell law school research paper No. 20 – 45; 74 Vanderbilt Law Review 1231 (2021); https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3715735.

Oxford Business Review (2020), “The Greater Fool Theory”, Oxford Business Review, 2020-12-30.

Panetta, F (2021), “The present and future of money in the digital age”, Lecture, Rome, 10 December 2021, https://www.ecb.europa.eu/press/key/date/2021/html/ecb.sp211210~09b6887f8b.en.html#footnote.2

Reuters (2021)a, “Proposed India bill banning crypto payments could mean jail for violations”, published on 7 December 2021, https://www.reuters.com/markets/currencies/proposed-india-bill-banning-crypto-payments-could-mean-jail-violations-document-2021-12-07/

Reuters (2021)b, “Australia proposes new laws to regulate crypto, BNPL Proposed India bill banning crypto payments could mean jail for violations”, published on 8 December 2021,

https://www.reuters.com/markets/currencies/australia-plans-update-regulatory-framework-payment-systems-2021-12-07/

Reuters (2021)c, “US crypto framework begins to evolve: A Special Report update”, published on 22 October 2021,

https://www.reuters.com/legal/transactional/us-crypto-framework-begins-evolve-special-report-update-2021-10-22/

Reuters (2021)d, “U.S. seizes $2.3 million in bitcoin paid to Colonial pipeline hackers”, published on 7 June 2021, https://www.reuters.com/article/us-cyber-colonial-justice-idTRNIKCN2DJ2BN

Roubini, N (2021), “Bitcoin is not a hedge against tail risk”, in Financial Times, published on 10 Feb 2021, https://www.ft.com/content/9be5ad05-b17a-4449-807b-5dbcb5ef8170

Schär, F, A Berentsen (2020), “Bitcoin, Blockchain, and Cryptoassets: A Comprehensive Introduction”, MIT press, 2020.

Simpson, A (2021), “Memo cites lessons from ransomware payments by CAN, JBS and Colonial pipeline”, in Insurance Journal (2021), 20 November 2021,

https://www.insurancejournal.com/news/national/2021/11/29/643569.htm

Swedish Financial Supervisory Authority and the Swedish Environmental Protection Agency (2021), “Crypto-assets are a threat to the climate transition – energy-intensive mining should be banned”, published by Finansinspektionen on 5 Nov 2021: https://www.fi.se/en/published/presentations/2021/crypto-assets-are-a-threat-to-the-climate-transition-energy-intensive-mining-should-be-banned/”

Taleb, N (2021), “Bitcoin, currencies, and fragility”, published online: 22 Jul 2021: https://www.tandfonline.com/doi/full/10.1080/14697688.2021.1952702?scroll=top&needAccess=true

Time (2013), “Everything You Need to Know About Silk Road, the Online Black Market Raided by the FBI “, published on 4 Oct 2013, https://nation.time.com/2013/10/04/a-simple-guide-to-silk-road-the-online-black-market-raided-by-the-fbi/.

Time (2021), “Two Things Crypto Investors Should Know About the Infrastructure Bill President Biden Signed” published on 29 November 2021, https://time.com/nextadvisor/investing/cryptocurrency/infrastructure-bill-crypto-taxes/

The Economist (2021), “Crypto lobbying is going ballistic – As regulators toughen up, companies hope to influence where the rules end up”, 12 December 2021; https://www.economist.com/finance-and-economics/crypto-lobbying-is-going-ballistic/21806674

The Guardian (2021), “India to ban private cryptocurrencies and launch official digital currency”, published on 24 Nov 2021, https://www.theguardian.com/world/2021/nov/24/india-to-ban-private-cryptocurrencies-and-launch-official-digital-currency.

Tooze, A (2021), “Chartbook newsletter #15: Talking and reading about Bitcoin”, accessed online on 15 November 2021 : https://adamtooze.substack.com/p/chartbook-newsletter-15.

US Treasury (2021), “President’s Working Group on Financial Markets Releases Report and Recommendations on Stablecoins”, 1 November 2021, https://home.treasury.gov/news/press-releases/jy0454.

Violation Tracker (2021), Violation Tracker Parent Company Summary, BNP Paribas, https://violationtracker.goodjobsfirst.org/parent/bnp-paribas.

Vox (2021), “Biden’s SEC is ready to regulate cryptocurrency”, published on 9 September 2021, https://www.vox.com/recode/22663312/coinbase-sec-cryptocurrency-bitcoin.

Vukolic, M (2021), “On the Future of Decentralized Computing”, accessed online 15 November 2021 on: https://vukolic.com/on-the-future-of-decentralized-computing.pdf.

Wewel, C (2021), “Crypto returns: Some stylised facts”, FX Atlas, J Safra Sarasin, November 10, 2021:

https://publications.jsafrasarasin.com/publ-dl-ch/dl-discl?dl=5DDA631652B5F3C6B91E3CB5DA01A36F3E352BDB2E6853B68DFEDFB963377AF39E9341956D11B781.

Williamson, O E. (1975), “Markets and Hierarchies: Analysis and Antitrust Implications”, New York: Macmillan Publishers.

WSJ (2021), “JBS paid $11 million to resolve ransomware attack”, Wallstreet Journal, published on 9 June 2021, https://www.wsj.com/articles/jbs-paid-11-million-to-resolve-ransomware-attack-11623280781