Money in general and central bank money in particular have undergone changes in form and usage throughout history. New forms of technology enable and require other changes. Central bank digital currency (CBDC) is among the hottest topics in the current monetary debate. Given the opportunities presented by distributed ledger technology (DLT), we consider digital money the next logical step in the evolution of money. Central bank money is crucial for payment and settlement systems. It should remain so. We can distinguish between two manifestations of CBDC: retail CBDC provided to the public for general purposes and wholesale CBDC restricted to a group of predefined users for a narrower set of purposes. Even though retail CBDC seems to be more prominent in current discussions, this paper focuses on wholesale CBDC as there is a clear interest and need by financial market players and which tackles the core tasks of a central bank – the settlement of large-value payments. The term “wholesale CBDC” is used in different ways and sometimes misleadingly defined. Our paper makes two contributions. First, we provide a distinct definition of wholesale CBDC and outline its key characteristics based on three features: claim on a central bank, restricted user group and serving programmable payments. Second, we introduce a solution that realises wholesale CBDC without the need to create a new form of (tokenised) money: the trigger solution. Our solution is derived from a solution-oriented approach: first the problem, then the solution. A trigger solution connects the DLT world with conventional settlement systems and enables the settlement of tokenised assets in central bank money. We encourage central bankers and policymakers to start with trigger solutions when considering wholesale CBDC. It is easy to implement and a low-risk solution.

Money is a social construct and has undergone many adjustments in its form, value base and means of exchange. Central bank money is nowadays the safest and most liquid settlement asset and the value basis for all other relevant forms of money. New technological developments require the form of money to change. When talking about new digital forms of money, in particular central bank digital currency (CBDC), “form follows function” should serve as a guiding principle.

There are different motivations for pursuing CBDC depending on the features policymakers aim to use. However, the current discussion about CBDC remains closely related to the introduction of distributed ledger technology (DLT). Non-cash central bank money in electronic form has already existed for decades as so-called reserves, if however, only for a restricted user group. It is undisputed that CBDC gained momentum only after the emergence of Bitcoin and other privately issued digital tokens. When central banks entered the field and started to compete with these new forms of money, at first a plurality of motivations based on a number of alleged distinctive features were published. A convincing purpose for any CBDC should, in our view, be based on a comprehensive definition that allows for a clear differentiation from electronic central bank reserves. Instead of aspiring for an all-in-one solution, we want to encourage, first careful assessment of what exactly is needed and if this really requires new forms of money and, second, reflection on whether this could instead be achieved by enhancing already existing infrastructures.1

This paper focuses on CBDC for wholesale purposes as we consider making central bank money settlement fit for a digital future to be a key challenge for central bankers and policy makers. Section 2 describes the crucial role of central bank money in payment systems and how it has changed under which conditions. Section 3 derives the future form of wholesale CBDC based on potential new functional requirements facilitated through new technological developments such as DLT. In Section 4, we introduce the trigger solution as a low-risk alternative for wholesale CBDC, which could still enable the settlement of DLT-based transactions in safe and secure central bank money. Section 5 concludes by showing that the associated benefits of wholesale CBDC can effectively be realised by connecting existing payment infrastructures with DLT.

Digitalisation may change the form and detailed functional requirements of money in general and of central bank money in particular. In analysing the useful future design of central bank money, a good starting point is the features which will remain stable. In fact, most features of central bank money should remain. What has never changed is that money is what money does. Money needs to fulfil three basic functions: serve as a medium of exchange, as a store of value and as a unit of account. And central bank money is and always will be a claim on a central bank.

Central bank money plays a crucial role in today’s payment systems.2 In the form of central bank reserves it serves for the settlement of large-value payments and thereby reduces risk in the financial system, fosters financial stability, facilitates monetary policy and ensures trust. Thus, principle 9 of the Principles for financial market infrastructures (PFMI) requires settlement in central bank money by all systemically important financial market infrastructures (FMI) where practical and available. It is because of this stabilising function of central bank money that central banks are on alert when other forms of money which are not anchored by central bank money are used on a significant scale for payments.

The Bitcoin whitepaper introduced DLT3 and the notion of tokenised electronic money. The Ethereum network introduced the ability to use smart contracts for the automated settlement of complex contracts and for conditioned payments. These are the decisive new features for digital payments. They create two main benefits. First, they allow for the settlement of transactions between independent parties on a joint data base. This eliminates the need for reconciliation. And, second, they enable the automatic settlement of commercial transactions according to predefined conditions through what are known as smart contracts.4 With smart contracts, complex contracts that previously required a wide range of manual interventions can be processed automatically. This saves time and transaction costs and increases security.

To reap the benefits of DLT for the settlement of tokenised assets, a fitting solution for the cash leg is needed. This is where central banks take the stage. For the sake of financial stability and monetary sovereignty, central banks must ensure that large-value payments will continue to be settled in central bank money. Therefore, central bank money needs to be fit for these new kinds of settlement. That does not exclude other forms of money or privately issued digital money, such as tokenised commercial bank money and stablecoins, which may be used predominantly for retail payments. Even stablecoins backed by central bank money should not be considered for the settlement of large-value payments. Concentration, fragmentation, cumbersome convertibility and closed loop systems could bear risks for financial stability and monetary sovereignty.5 In addition, stablecoins arrangements require information procurement by the user regarding issuer, feasible use cases and collateralisation. An additional permanently necessary effort which could hamper the usage and acceptance of privately issued money.6 Hence, large-value payments including those based on DLT-based settlement should always be settled in central bank money. This is the very essence of the digitalisation of money in market-oriented economies. We have in the past also adjusted and amended our RTGS system to provide new functions, e.g. for liquidity-saving mechanisms or tri-party arrangements. It is in this vein that we argue for empowering central bank money to serve potential new functions. In doing so, we stick to the principles of stability, universality, efficiency and, as far as possible, neutrality (with respect to participants and technology).

Redundancy of reconciliation processes and automation enabled by smart contracts reveal the vision of what is sometimes referred to as the smart economy or industry 4.0. In this future scenario, digital transformation shapes deeply integrated and highly automated business processes along the supply chain for both the financial and the industrial sector. However, to reap the potential benefits of DLT to their fullest extent, the payment method should be part of the overall settlement process, too. In a smart economy, a synchronised flow of goods, information, and money should be facilitated to the greatest extent possible without foregoing stability. Therefore, market participants have the reasonable expectation that central banks as well as commercial banks adapt to these new requirements and provide a settlement instrument in digital processes for tokenised assets.

Although Principle 9 of the PFMI clearly implies a policy reaction, it is quite surprising that more central banks worldwide seem to be actively involved in exploring retail CBDC (rCBDC) than wholesale CBDC (wCBDC).7 However, some central banks in major economies have already moved on from pure research activities to an exploratory phase. The vast majority of ongoing or completed wCBDC projects are devoted to DLT-based securities settlement, the improvement of domestic wholesale payment systems or cross-border payments.8 In recent years, the BIS Innovation Hub has also increased its efforts to coordinate exploration and experimentation in the field of wCBDC. However, motives for the consideration of wCBDC might differ among central banks, which raises the question of what nature wCBDC exactly is.

Retail CBDC literally describes the provision of central bank money in digital form for retail purposes, i.e. regular customer payments available for the general public (sometimes also referred to as “general purpose” CBDC). In the existing monetary system, central bank reserves are mainly available for financial institutions which have an account at the central bank. Central bank money for the public is only available in the form of banknotes and coins. Therefore, rCBDC would be a distinct complement to the existing forms of central bank money. In this sense, the oft-quoted taxonomy of new forms of currency outlined by Ole Bjerg9 in 2017 characterises CBDC simply as universally accessible, electronic and central bank-issued money.

In contrast, the purpose of wCBDC is literally the settlement of wholesale transactions. Some also refer to wCBDC as “narrow purpose CBDC”, mainly to distinguish wCBDC from rCBDC. However, simply defining wCBDC as non-cash central bank money for wholesale transactions does not differentiate it from the electronic central bank reserves that have already existed for decades. Hence, wCBDC lacks a unique characterisation in order to prevent misconception. So far, the Committee on Payments and Market Infrastructures (CPMI) has offered a relatively broad definition of wholesale CBDC as “a digital form of central bank money that is different from balances in traditional reserve or settlement accounts”.10 The BIS “money flower” derived from Bjerg’s taxonomy already delivers some preliminary evidence, stating that a “wholesale central bank cryptocurrency” [sic] would be central bank-issued, peer-to-peer, not universally accessible, and electronic.11 An update of this illustration refers to central bank digital tokens for wholesale purposes as being digital, central bank-issued and token-based, but not widely accessible. Following this definition, the CPMI’s only unique characterisation of wholesale CBDC is a CBDC which “would limit access to a predefined group of users”.12 This somehow only vague distinction from traditional central bank reserves as well as the limited access as sole criteria for wCBDC has caused some justified criticism so far. In that sense, some argue that wCBDC has existed for decades in the shape of central bank reserves.13 Others point out that the debate around wCBDC is superfluous as RTGS systems already settle in electronic central bank money.14

We acknowledge the pre-existence of electronic central bank reserves. However, we find that all these different perceptions neglect a key feature that arrived with the emergence of digital money: programmability, i.e. the ability to utilise money in programmable applications. The term programmability goes beyond the pure execution of regular payments that already exists in the shape of standing orders. The concept of programmability is closely linked to the vision of the smart economy, in which automated, autonomous and conditioned payments allow for equally programmable flows of service, information and cash. Following a definition laid out by a German cross-sector working group, programmable payments define a transfer of money for which the time, payment amount and/or type of transfer is predetermined by conditions specified in advance rather than being set ad hoc during the payment process.15 That does not mean that the exact time and amount of the payment is determined in advance. It means that the conditions are defined and, subject to those conditions, the payment will occur as predetermined. It could, for example, be that the exact amount of the payment is subject to the weight of delivered goods (e.g. for natural products). In that case, the weighing of the products will lead to another amount, but still be specified in advance. There is a difference between a fixed determination, as in the case of a predefined standing order, and programmability where the degree to which conditions are met determines the specific payment.

Hence, programmability is a mandatory requirement for money being able to settle the cash leg of transactions in tokenised assets within DLT networks. The above definition of programmability refers to the payment process itself, whereas the term “programmable money” denotes an inherent logic of conditional usage stored in the digital money itself. As the latter would result in a fundamental change to money as a social construct, speaking of “programmable payments” or just “programmability” seems to be sufficient when talking about CBDC or DLT.

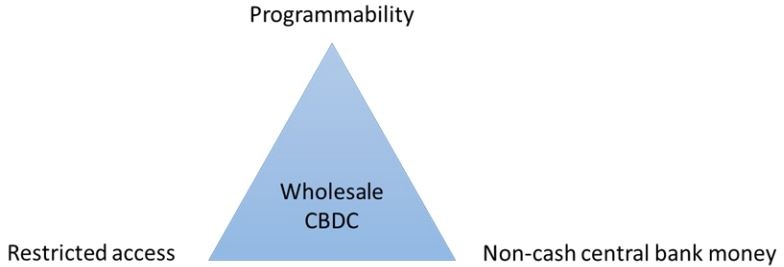

We introduce three characteristics (Figure 1) to unambiguously distinguish wCBDC:

The term CBDC, central bank digital currency, literally implies the non-cash nature of central bank money as an electronic medium of transfer. The prefix wholesale restricts the group of users to banks and the current counterparties of central bank operations. The distinctive feature denotes the utilisation in programmable applications. Only this qualifies money as a settlement instrument in digital processes for tokenised assets. We make this a necessary condition for wCBDC, because we recognise the emergence of DLT and tokenised assets as the reason why wCBDC has become a topic of discussion in the first place. At this stage, a distinction between account-based and token-based CBDC is not necessary as this technical feature does not change the nature of wCBDC itself.16 These characteristics enable a triad of safety, efficiency and innovation in settlement using central bank money. The distinctive feature distinguishes wCBDC from existing large-value payment systems. Introducing a new form of money, as wCBDC would be, makes sense only if it covers new use cases that cannot yet be settled.

Figure 1: Wholesale CBDC uniquely shaped by three core characteristics

Source: Own illustration.

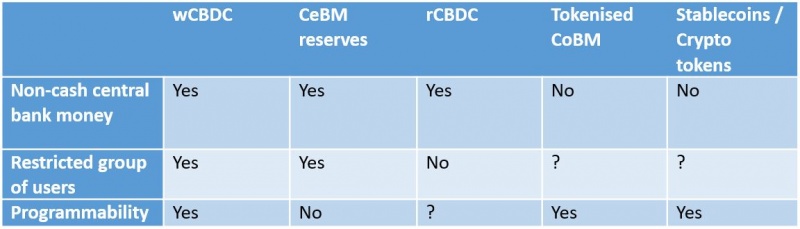

The binary check (Yes/No) against the three postulated characteristics allows for the identification of different forms of money (Table 1). Wholesale CBDC is constituted if all three characteristics are fulfilled. Partially met conditions inevitably imply a different form of money. The existing central bank money (CeBM) reserves are quite similar, but lack the distinctive feature. Retail CBDC is by definition non-cash central bank money, but has a general purpose attribute. In this regard, programmability is an optional feature that some central banks pursue while others do not. Some private forms of money are intended for the use in DLT networks by design. The group of users then depends on the specific design and the governance implemented by the issuer. Those tokens are non-cash, but definitely not a liability of the central bank. Tokenised commercial bank money (CoBM) is a liability of the issuing commercial bank and hence regulated, whereas stablecoins and crypto tokens might be treated differently from a regulatory perspective – depending on the jurisdiction. The regulatory character of private money becomes important when considering interoperability between programmable central bank money and programmable private forms of money, for example as proposed within the Regulated Liability Network.17

Table 1: Identification of wCBDC and similar, but different, forms of money

Source: Own illustration.

Of course, there are many other functionalities associated with wCBDC such as 24/7 settlement or wider access criteria. However, those are ancillary features subject to the discretion of the respective policymakers, who could already implement these at any time by adapting the existing policy framework. Each of these elements taken in isolation would not characterise a new form of money.

We identified programmability as the decisive feature of wCBDC. The next step is to consider how to realise wCBDC without weakening the security and efficiency level of settlement in central bank money. There are essentially two options. First, to make money available in programmable applications in the form of tokens. However, the potential implications of such a solution are not yet fully assessed, as many technical, legal and operational questions remain open.18 Besides, central bank infrastructures have proven sound, resilient and efficient over the last few decades. This leads, second, to the interconnection of the DLT space with existing settlement infrastructures for central bank money.

Creating new tokens as CBDC may cause some problems that will have to be dealt with. For retail CBDC, the most important problems – potential disintermediation and potential impacts on monetary policy – are often discussed. Wholesale CBDC may not cause these problems, but it is not free of risks. First, liquidity would be fragmented. That risk is negligible in times of abundant liquidity, but of serious impact in times of crisis. Second, there is the question of how to oversee the networks where tokens are transferred. The classic fallback solution to preserve stability and reputation is that central bank money remains in systems run, managed or closely monitored and controlled by the central bank. Third, as a consequence of a token circulating in non-central bank networks, the central bank loses its ability to intervene as fast as it can today. Fourth, access to transaction data may be hampered. Fifth, the differentiation between central bank money and commercial bank money may weaken, which could cause reputational repercussions.

We introduce a solution that realises all requisite characteristics of wCBDC without actually creating wCBDC in tokenised form. The trigger solution denotes a technological bridge or interface between a conventional payment system and a DLT-based application. A transaction on a DLT platform, such as the trade of a tokenised asset, automatically triggers the corresponding payment in conventional central bank money. Although trigger solution-induced settlement is account-based and does not require a new form of central bank money, the trigger solution fulfils the three above-mentioned characteristics and can therefore be identified as a wCBDC-like solution. The development of a trigger solution follows a solution-oriented approach. The missing link between a tokenised asset leg and an account-based cash leg is the foundation of the trigger solution.

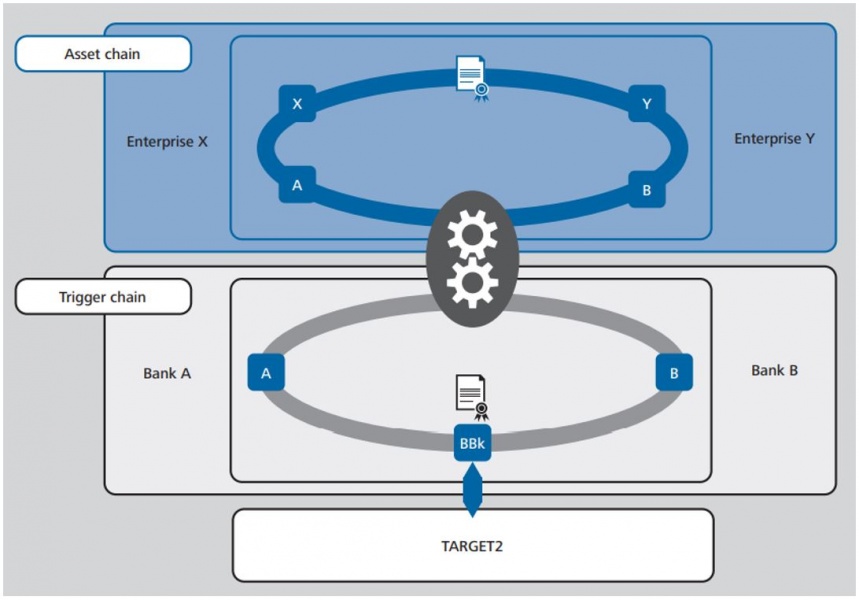

The solution is based on a simple idea. It simply builds a technical bridge between a DLT network and a conventional payment system so that DLT-based asset chains can interact with RTGS systems via an intermediary infrastructure. The solution comprises several parts (Figure 2). The conventional payment system could be any central bank money settlement system such as TARGET Services or formerly TARGET2. An asset chain on which tokenised assets are issued, traded and settled represents the DLT world. The actual bridge consists of two components: a DLT-based trigger chain and some sort of interoperability adapter connecting the asset chain and trigger chain.

Figure 2: Architecture of the Bundesbank’s trigger solution

Source: Deutsche Bundesbank (2021b).

It is in keeping with the two-tier banking system that central banks only provide the central bank money payment system and the trigger chain as an access point. The private sector provides the interoperability adapter as well as the asset chain. However, the operative implementation of the trigger solution must be based on principles ensuring the high degree of trust, safety and reliability of central bank money settlement. Therefore, the asset chain provider can only be a trustworthy party, ideally an FMI, which manages access, policy and trade modalities. Nodes on the trigger chain are exclusively reserved for the central bank and commercial banks, as the management of the payment process takes places upon it. This ensures unchanged access to central bank money and leaves the customer interface to the private sector. The architectural design enables frictionless communication between the DLT network and the conventional payment system. The key for the interaction between the two formerly mutually incompatible systems is to establish a message channel with the use of smart contract functionalities.

Deutsche Bundesbank has already successfully tested such a trigger solution.19 We believe that there are many different ways of attaining the benefits of trigger solutions. However, the basic mechanism remains the same. A technological bridge connects DLT networks with conventional payment systems and enables frictionless communication across the different systems. In practice, multiple asset chains could potentially be connected to one trigger chain. Programmable conditions could be implemented by private sector entities to allow for innovative business models. Smart contract functionality enables participants to set up transactions involving multiple connected external systems, fostering innovation and setting a standard.

Several trigger solutions have already been developed and tested in practice. The above, albeit generalised description is mainly based on the experience gained with Bundesbank’s trigger solution.20 Other similar projects were undertaken by the Banca d’Italia,21 the Swiss Interbank Clearing System for BX Swiss,22 the Bank of England in the project Meridian,23 and some private companies such as LBBW, DZ Bank and Iberpay, that were connecting to commercial bank money systems.

The trigger solution does not require a tokenised form of money or any other new form of money to settle DLT-based transactions. It simply uses existing payment infrastructures and sets up integration with DLT networks via a message channel. This is a key achievement as it brings innovation into settlement in central bank money, while simultaneously preserving the well-proven and established settlement infrastructure. Hence, the only implementation effort is to develop and deploy the asset chain and the trigger chain as well as the interface to the payment settlement system. Experience gained from practical work has provided evidence that, from a technical perspective, it would be feasible to set up a trigger solution in a relatively short time span at manageable costs.

From a monetary policy and financial stability perspective, the trigger solution proves to be minimally invasive. Any potential implication that accompanies the creation of a new form of money is not a relevant factor. The narrow use for wholesale transactions keeps access to central bank money unchanged and maintains the character of the two-tier banking system. From an operational perspective, the trigger chain merely constitutes a new interface with the payment settlement system. Payment processing and interaction within the actual settlement systems stay the same.

DLT is a relatively new development and has yet to prove its full potential. Therefore, it appears strategically advantageous to keep money within established systems instead of prematurely putting cash on the ledger. This approach would restrict the role of the central bank to the current system and, at the same time, empower central bank money to serve modern needs of the economy. Hence, the trigger solution allows central bank money to keep pace with technological advancements, while simultaneously being flexible for future developments.

It is to be expected that the universe of DLT networks might evolve further before it sees consolidation. Therefore, a whole host of market asset chains might be developed.24 A token representing central bank money can only be committed to one DLT platform at a time and requires prefunding. This would limit the universality of money, hamper the usability of money and intensify liquidity fragmentation. A universal and technology-agnostic trigger solution might prevent market fragmentation and require only a single liquidity pool on the books of the central bank without the need for prefunding. The principle of being interoperable by design will be one of the most important characteristics of DLT business and hence CBDC if both want to create a mutual benefit. Indeed, the trigger solution is technology-agnostic across three dimensions, which makes it a fairly flexible tool for further advancements. On the asset side, any types of asset chain could be connected. The trigger chain is use case agnostic and only depends on the incoming payment instruction being signed by the payer bank. On the cash side, the connection of various payment systems is conceivable as well.

The trigger solution also strengthens the private-public partnership in the financial sector and perfectly allocates the core competences of the parties involved. The separation of innovative networks and payment systems provides opportunities for a balanced triad of safety, efficiency and innovation in the payments and settlements sphere. While central bank money always stays in central bank systems, the central bank plays a gatekeeper role on the asset chain and safeguards the trustworthiness and quality of central bank money. With the DLT platform and the smart contract administration being outsourced to the asset chain, the market provides the front-end and enables innovation accelerated by the private sector.

Wholesale CBDC in token form issued on a DLT raises not only considerable policy and governance issues; what is more, it bears hitherto unknown risks. Would the issuance of central bank money on an external DLT be outsourcing? How to ensure control and access options for the central bank? What does this mean for its role as lender of last resort? Does the issuance of wCBDC tokens require extra funding? How to prevent liquidity fragmentation for banks in an ecosystem with several DLT networks? Only few experiments have really assessed the risk-benefit balance of tokenised wCBDC against existing settlement in central bank money. Thus, some of the current CBDC considerations are based on a misunderstanding. It seems quite popular among policymakers first to collate all potential requirements of CBDC and then to aim to create a one-size-fits-all solution. On the other hand, the foundation of money as a social construct reveals its unambiguous link to the utilisation purpose. An intensely digitalised world with multi-faceted economic activities and complex business transactions is likely to bring forth several adequate payment solutions.

With our proposed wCBDC definition, we would like to encourage identification of the core value of new technologies. With regard to DLT, we acknowledge the main benefit on the asset side, with smart contracts enabling the automation of business processes and a joint database making reconciliation processes redundant. On the cash side, this implies the differentiation between core characteristics such as DLT-based settlement and facultative functionalities such as 24/7 availability. From this angle, we regard a “make do and mend” solution building on existing payment rails as a reasonable first step.

The trigger solution offers such an off-chain payment solution for on-chain asset transactions. It realises the proposed three core characteristics of wCBDC: the settlement of DLT-based transactions in non-cash central bank money for a restricted group of users. The connection of DLT networks with conventional payment systems combines the advantages of decentralised infrastructures with the reliability of the central bank. No new form of (tokenised) money needs to be introduced.

The agnostic design enables a high degree of flexibility and allows for future systems to be connected as well. The trigger solution plays a neutral role and is agnostic across three dimensions: use case-agnostic, payment system-agnostic and asset system-agnostic. Furthermore, trigger solutions are characterised by a comparatively low technical and operational complexity. As central bank money stays within the well-established infrastructures, even policy considerations seem manageable with potentially low effort.

Programmable payments have the potential to accelerate digitalisation throughout the economy. However, the further evolution of DLT is hampered by a chicken and egg problem. Private market actors refrain from investing in and committing funds to exploring DLT, while central banks seem to be waiting for more productive use cases. Trigger solutions provide an opportunity to probe the potential of DLT in the financial sector with relatively low costs and minor risks. Therefore, we suggest that central banks and policymakers start with trigger solutions when considering wCBDC. They are a convenient way to test the case for wCBDC and observe market adaptation. Being prepared for potential DLT uptake is a handy side effect. With regard to the PFMI, we consider the following principle appropriate: “better to have, and not need, than to need, and not have”.

Buckley, R. P., D. W. Arner, D. A. Zetzsche, A. N. Didenko and L. van Romburg (2021). Sovereign Digital Currencies: Reshaping the Design of Money and Payments Systems. Journal of Payments Strategy & Systems, Volume 15(1), Pages 21-61.

Banca d’Italia (2022). Integrating DLTs with market infrastructures: analysis and proof-of-concept for secure DvP between TIPS and DLT platforms. Mercati, infrastrutture, sistemi di pagamento, No 26.

Bank for International Settlements (2003). The role of central bank money in payment systems. Committee on Payment and Settlement Systems.

Bank for International Settlements (2018). Central bank digital currencies. CPMI Papers, No 174.

Bank of England and HM Treasury (2023). The digital pound: A new form of money for households and businesses? Consultation paper.

Bech, M. and R. Garratt (2017). Central bank cryptocurrencies. BIS Quarterly Review.

BIS Innovation Hub and Bank of England (2023). Project Meridian: Simplifying transactions through innovation, April, Available at: https://www.bis.org/publ/othp63.pdf.

Bjerg, O. (2017). Designing New Money – The Policy Trilemma of Central Bank Digital Currency. CBS Working Paper.

BX Swiss (2022). BX Swiss lays the technical foundation for the future of regulated trading of tokenized securities. Press release, 13 December, Available at https://www.bxswiss.com/news/20221213-BX-Swiss-legt-das-technische-Fundament-fuer-die-Zukunft-des-regulierten-Handels-mit-tokenisierten-Wertpapieren.

Deutsche Bundesbank (2020). Money in programmable applications – Cross-sector perspectives from the German economy, 21 December.

Deutsche Bundesbank (2021a). DLT-based securities settlement in central bank money successfully tested. Press release, 24 March, Available at https://www.bundesbank.de/en/press/press-releases/dlt-based-securities-settlement-in-central-bank-money-successfully-tested-861444.

Deutsche Bundesbank (2021b). Digital money: options for payments. Monthly Report, April 2021, pp. 57-76.

Deutsche Kreditwirtschaft (2021). Europe needs new money – an ecosystem of CBDC, tokenised commercial bank money and trigger solutions.

Gorton, G. B., Ross, C. P., & Ross, S. Y. (2022). Making money. Working paper No 29710. National Bureau of Economic Research.

Goodell, G. (2022). Tokens and Distributed Ledgers in Digital Payment Systems. ArXiv, abs/2207.07530.

House of Lords (2021). Corrected oral evidence: Central bank digital currencies. Economic Affairs Committee, 23 November.

Kosse, A. and I. Mattei (2022). Gaining momentum – Results of the 2021 BIS survey on central bank digital currencies. BIS Papers. Bank for International Settlements, Number 125.

Kulk, E. and P. Plompen (2021). Demystifying programmable money: How the next generation of payment solutions can be built with existing infrastructure. Journal of Payments Strategy & Systems, Volume 15(4), Pages 445-454.

McLaughlin, T. (2021). Two paths to tomorrow’s money. Journal of Payments Strategy & Systems, Volume 15(1), Pages 23-36.

Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System, Available at https://bitcoin.org/bitcoin.pdf.

Panetta, F. (2022). Demystifying wholesale central bank digital currency. Speech at the Symposium on “Payments and Securities Settlement in Europe – today and tomorrow” hosted by the Deutsche Bundesbank, 26 September.

Shabsigh, G., T. Khiaonarong and H. Leinonen (2020). Distributed Ledger Technology Experiments in Payments and Settlements. International Monetary Fund. FinTech Notes, 20.

The Regulated Liability Network (2022). Digital Sovereign Currency. Whitepaper.

Ugolini, S. (2017). The Evolution of Central Banking: Theory and History. Palgrave Studies in Economic History. London, Palgrave-Macmillan.

Kulk, E. and P. Plompen (2021), Buckley et al. (2021).

Bank for International Settlements (2003), Ugolini, S. (2017).

Nakamoto, S. (2008).

Smart contracts are software codes that execute contracts automatically based on the occurrence of pre-defined events or actions. They could significantly reduce the transaction costs for the settlement of complex recurrent contracts.

Bank of England and HM Treasury (2023).

Gorton, G. B., Ross, C. P., & Ross, S. Y. (2022).

Kosse, A. and I. Mattei (2022), Auer, A., G. Cornelli and J. Frost (2020).

For example, Project Stella (European Central Bank, Bank of Japan), Project Ubin (Monetary Authority of Singapore), Project Jasper (Bank of Canada), Project Helvetia (Schweizerische Nationalbank), Project Jura (Schweizerische Nationalbank, Banque de France).

Bjerg, O. (2017).

Bank for International Settlements (2018).

Bech, M. and R. Garratt (2017).

Bank for International Settlements (2018).

Panetta, F. (2022).

House of Lords (2021).

Deutsche Bundesbank (2020).

McLaughlin, T. (2021), Goodell, G. (2022).

The Regulated Liability Network (2022).

Shabsigh (2020), Bank for International Settlements (2018).

Deutsche Bundesbank (2021a).

Deutsche Bundesbank (2021a).

Banca d’Italia (2022).

BX Swiss (2022).

BIS Innovation Hub and Bank of England (2023).

Deutsche Kreditwirtschaft (2021).