This paper examines changes between 2008 and 2018 to the sovereign investor base of 27 countries across six institutional sectors: domestic central banks, domestic banks, domestic non-banks, the foreign official sector, foreign banks and foreign non-banks. We find that QE programmes have led to central banks becoming increasingly dominant in sovereign debt markets, accompanied by heterogeneous shifts in investor bases. Central banks have mostly displaced traditional domestic (not foreign) investors such as banks or institutional investors. The implications are threefold: Issuers benefit from lower re-financing risks but have a more concentrated investor base; investors face a trade-off between safe-haven assets and the search for yield; and central banks are increasingly exposed to their respective sovereigns, with implications for monetary policy independence and effectiveness.

A major challenge faced by many central banks to achieve their price stability objectives has been the zero lower-bound on interest rates. Several jurisdictions have responded to this challenge by implementing quantitative easing (QE) and consequently central bank holdings of sovereign debt have increased considerably in recent years. Numerous studies have looked into the effects of QE, but little attention has been paid to the resulting changes in the investor bases which are relevant for fiscal sustainability, the sovereign banking-nexus and international financial spill-over risks. This paper aims to provide some answers to these issues.

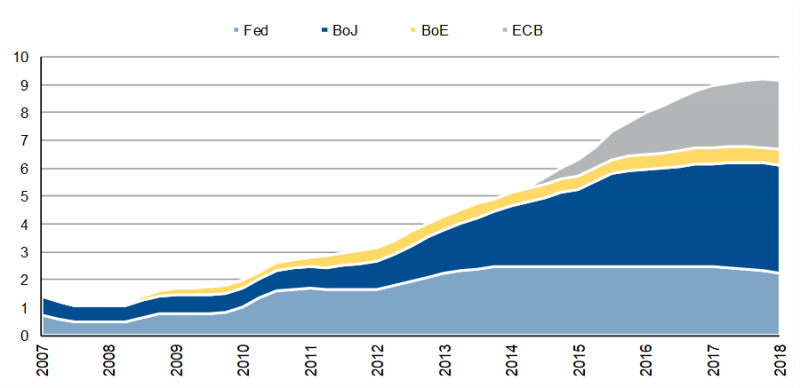

In 2001, the Bank of Japan was the first to introduce QE in response to falling growth rates and deflationary pressures. Following the financial crisis of 2007-08, several other central banks followed suit, including: The Federal Reserve (November 2008); the Bank of England (March 2009); the ECB (January 2015); and the Swedish Riksbank (February 2015). These unconventional monetary policies have led to a significant expansion of central banks’ holdings of sovereign debt. From year-end 2008 to year-end 2018, cumulative government debt holdings of the Fed, the Bank of Japan, the Bank of England and the ECB increased more than eightfold, exceeding USD 9trn (Figure 1).

Figure 1: Government debt holdings of major central banks

USD trn

N.B. The figures have been aggregated by using fixed exchange rates as of 31st of December 2018

Source: ECB, IMF, Scope Ratings GmbH

Examining sovereign debt holdings by central banks versus other institutional sectors is relevant for public finance risk as investment strategies typically differ between the two. Private and public investors typically hold government debt as collateral, either for liquidity management or to realise profits. Central banks, on the other hand, are required by their mandate to support economic activity and/or price and financial stability. Central banks therefore tend to i) adopt a hold-to-maturity approach, ii) are typically ‘sticky’ holders of debt instruments, and iii) are less likely to divest when faced with heightened yield volatility, acting instead as stabilising investors. Thereby, the increasing presence of central banks as sovereign debt holders is likely to have a long-lasting impact on the rest of the investor base.

Using IMF data1 on holders of sovereign debt for advanced economies and emerging markets, we analyse how the shares of central bank holdings have increased in the sovereign investor base from December 2008 to December 2018.

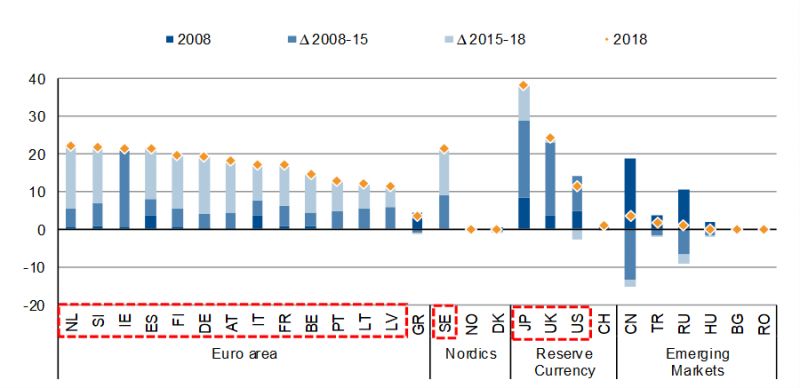

Figure 2. Domestic central bank holdings of sovereign debt, selected countries

% of total debt

N.B. The red boxes highlight countries that have adopted QE

Source: IMF, Scope Ratings GmbH

Figure 2. shows that countries that adopted QE have seen a substantial increase in their central banks’ holdings as a share of the investor base, by 17.4pps on average during the 2008-18 period. In detail:

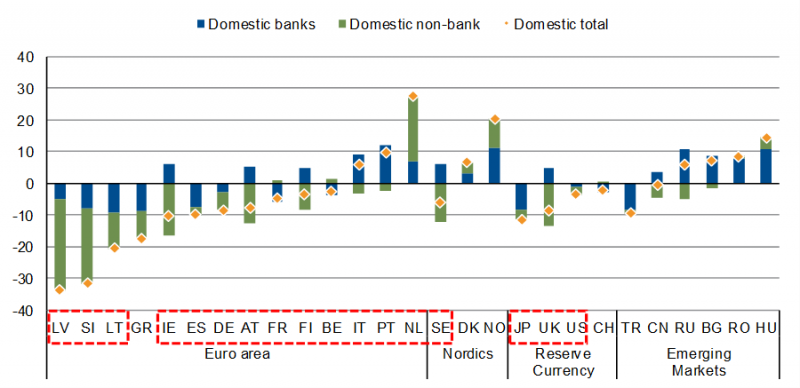

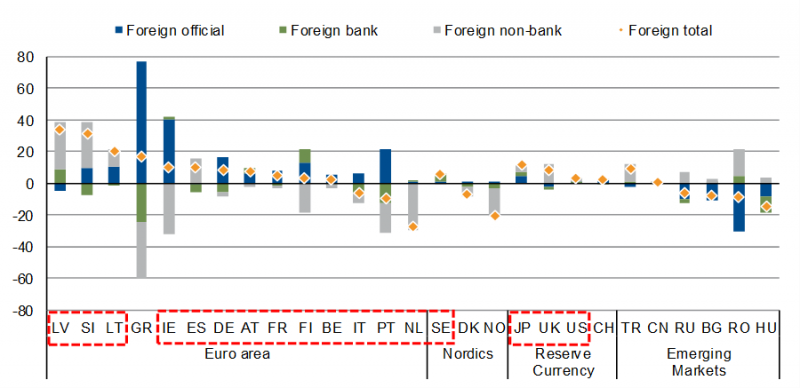

Large-scale asset programmes have led to domestic central banks becoming dominant investors in sovereign debt markets. While this has reduced refinancing risk2, it has also led to the entry of a large and relatively new player in the market with potentially distortionary effects (Boermans & Keshkov, 2018). This may have displaced traditional sovereign bond holders – the key question being which ones? The IMF databases allow us to examine how the rising central bank share in sovereign debt holdings has impacted other institutional sectors. To analyse the shift over time in the sovereign investor base – excluding that held by the central bank – we focused on the change in composition of the ‘residual share’ of sovereign debt holdings.3 The results per institutional sector are shown in Figures 3 and 4.

Figure 3. Shifts in domestic residual holdings, 2008-18

pps

N.B. The red boxes highlight countries that have adopted QE

Source: IMF, Scope Ratings GmbH

Figure 4. Shifts in foreign residual holdings, 2008-18 pps

N.B. The red boxes highlight countries that have adopted QE

Source: IMF, Scope Ratings GmbH

These charts point to one general conclusion: domestic banks and non-banks have seen their relative shares of sovereign debt drop as a result of central bank purchases. This is the case in Japan, the UK, the US and all euro area countries except for Italy and Portugal, where residual holdings by domestic banks have increased slightly since year-end 2014, as well as in Germany, Ireland and the Netherlands, where domestic non-banks have seen an increase during the same period.

The crowding-out of domestic investors becomes even more striking against the simultaneous increase in the domestic shares of government debt holdings in Nordic countries that did not adopt QE (Norway and Denmark). We have provided details on the change in investor bases per region in the Annexes. In the case study below, we explore how developments in Italy and Portugal have contrasted with those in Spain.

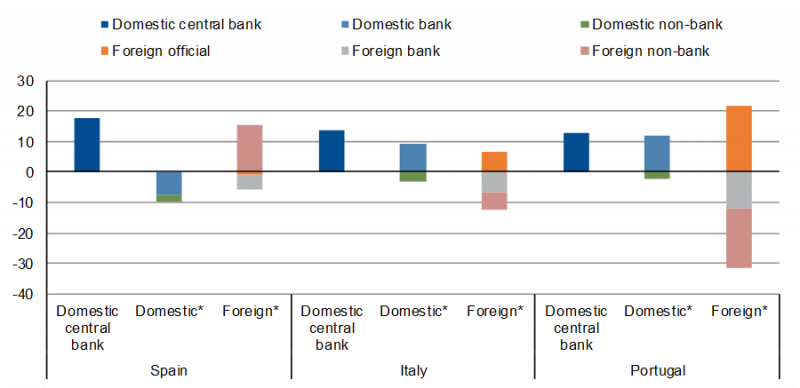

Rising central bank holdings have been accompanied by significant, heterogeneous shifts in sovereign debt ownership structures. A comparison of Italy and Portugal versus Spain illustrates this heterogeneity in the former crisis countries. While the share of central bank holdings has increased in all three countries, the effect on private debt holders has differed, with domestic holders displaced in Spain, and foreign ones in Italy and Portugal (see Figure 5).

Figure 5. Shifts in investor bases for Italy, Portugal and Spain, 2008-18

pps

*Calculations based on residual shares

Source: IMF, Scope Ratings GmbH

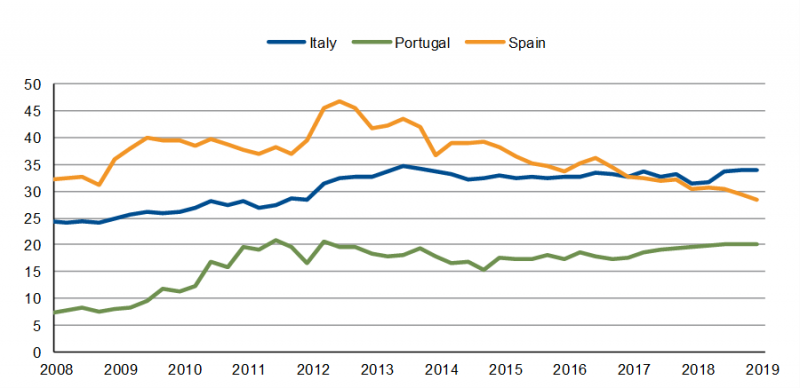

Across the three countries, a striking divergence in investor behaviour was observed for domestic banks. Between 2008 and 2012, a period marked by the financial crisis and subsequent sovereign debt crisis, all three countries saw residual holdings by domestic banks rise significantly, a result of foreign investors having fled from the peripheral euro area economies during that period (Figure 6).

Figure 6. Domestic banks’ residual holdings, 2008-18

% of total debt

*Calculations based on residual shares

Source: IMF, Scope Ratings GmbH

From 2013 onwards, however, Spanish banks began to divest from domestic government debt, reaping large trading gains in the process and placing the residual share of domestic banks on a firm downward trajectory, whereas residual holdings of Italian and Portuguese banks remained broadly stable. The persistence of domestic bank holdings in the latter two has implications for the sovereign-bank nexus in the euro area (Dell”Ariccia, et al., 2018).

These heterogenous developments possibly reflect i) the different economic and public finance fundamentals (Cornand, et al., 2016), ii) yields, iii) varying degrees of domestic capital market depth, iv) investor preferences and constraints, v) rating levels and their regulatory implications4, vi) issuance levels, and/or vii) the scope and degree of banking sector consolidation.

The recent significant increase in central bank holdings of sovereign debt has important implications for issuers, investors and the central banks themselves:

Issuers: multiple trade-offs

The increase in central bank holdings has reduced borrowing costs and refinancing risks. However, QE has also resulted in a more concentrated investor base. As such, sovereign debt management offices could benefit from re-engaging with traditional investors such as investment and pension funds, as recently suggested by the OECD (2019). For sovereigns with limited fiscal space, the gains from a (re)financing perspective need to be contrasted with possible incentives for governments to postpone fiscal consolidation measures and much-needed structural reforms.

Conversely, for sovereigns with low indebtedness, increased holdings by their central banks may lead to scarcity effects, given the long maturity of purchases and holding strategies of these institutions (IMF, 2018). According to the IMF, this may impair market functioning through the diminished availability of public debt securities, a safe-haven asset (IMF, 2015). The increased scarcity of these assets and the related risks to financial stability have been discussed at length, resulting in various proposals for central banks to create safe assets directly (Greenwood, et al., 2016).

Investors: search for yield

Despite the observed heterogeneity (which we will explore in follow-up research), QE programmes in Japan, the UK, the US and the euro area have mostly displaced the traditional domestic (not foreign) investor base of banks and institutional investors.

This may reflect the resulting low-for-long yield environment, incentivising private investors to search for yield elsewhere. As a result, the asset-class and geographical diversification of institutional portfolios – away from fixed-income towards more equity-like products and from advanced economies into Emerging Markets – could be an important consequence.

Central banks: dealing with uncertainty

Central banks have become increasingly vulnerable to sovereign debt crises. This could result in a loss in their credibility due to growing concerns: i) about central banks preserving their balance sheets instead of achieving inflation targets, and/or ii) among investors regarding monetary policy independence, given the high central bank share of sovereign debt.

In addition, central banks face increased uncertainty given the limited predictability of monetary policy effectiveness. With interest rates already at or below zero and substantial QE measures in place, central banks’ investment opportunities are limited, especially among safe assets. Furthermore, the use of additional instruments is likely to be accompanied with unforeseen consequences.

Arslanalp, S. & Tsuda, T., 2012. Sovereign investor base estimates for advanced economies. Washington, D.C.: IMF.

Arslanalp, S. & Tsuda, T., 2014. Sovereign investor base estimates for emerging markets. Washington, D.C.: IMF.

Boermans, M. & Keshkov, V., 2018. The impact of ECB asset purchases on the European bond market structure: Granular evidence on ownership concentration. DNB Working Paper, Volume No. 590.

Cornand, C., Gandre, P. & Gimet, C., 2016. Increase in home bias in the Eurozone debt crisis: The role of domestic shocks. Economic Modelling, Volume 53, pp. 445-469.

Dell”Ariccia, G. et al., 2018. Managing the sovereign-bank nexus. ECB Working Paper Series, Volume No 2177.

ECB, 2019. Taking stock of the Eurosystem”s asset purchase programme after the end of net asset purchases. Economic Bulletin, Issue Issue 2.

Greenwood, R., Hanson, S. & Stein, J., 2016. The Federal Reserve”s Balance Sheet as a Financial Stability Tool. Jackson Hole conference working paper.

IMF, 2015. Selected Issues: Euro Area Policies, Washington, D.C.: IMF.

IMF, 2018. Scarcity Effects of Quantitative Easing on Market Liquidity: Evidence from the Japanese Government Bond Market. IMF Working Paper.

OECD, 2019. Sovereign borrowing outlook 2019, Paris: OECD Publishing.

The datasets used are the Sovereign investor base estimates by Arslanalp and Tsuda (2014; 2012).

See previous Scope research: Sovereign debt refinancing risk

Hereafter residual shares exclude central bank holdings and are equal to:![]()

A potentially important factor is the “cliff-effect” at the A- rating level. Below this level, the Eurosystem requires higher haircuts applied to assets used as collateral in market operations while institutional investors often exclude securities rated below this same level from their portfolios.