This policy note outlines a possible approach for a modern regulatory reporting regime and challenges given structures in the regulatory landscape. Based on incumbent regulatory processes, we have developed a concept for a Blockchain/DLT-based reporting regime that could improve micro and macro-prudential banking supervision. We argue that the transformation towards distributed ledger-based reporting might enable financial market regulators to meet their objectives more efficiently and effectively. We further show how our concept embeds regulatory content in smart contracts. These smart contracts may automatically send timely, granular, high-quality, and inter-entity matched information on all financial market transactions to the required parties.

While it can be recognized that current regulatory regimes strongly improved upon the pre-2008 crisis status, they may simultaneously cause economic costs and still do not seem to provide sufficient stability and transparency according to many stakeholders in society. Three major reasons that could, in our opinion, force policy makers and financial authorities to act:

(1) Risks caused by the technological authorities not using the latest available supervisory tools

(2) The massive financial burden due to current non-automated regulatory standards

(3) Outdated data handling hinders innovation & application of new technologies

1.1. Risks associated with the suboptimal ruleset and tools of financial market supervision

We argue that both, regulators and regulated entities, are still not fully able to forecast financial crises when using the current regulatory regime. And the reason behind this could be a lack of quality data.

Weather forecasts are a good example to highlight the importance and influence of increased and improved data availability for the society. Weather forecasts have strongly improved over the last 30 years. With the availability of local, good-quality and live data, the understanding of many small climate subsystems could be enhanced, which strongly improved systemic weather forecasting.

While the same research effort has been devoted to economic systems, we argue that the lack of adequate data availability poses one of the major challenges for improving financial market theory and stability. We further argue that reliable data and tools for regulators, central banks, and academia, for the purpose of supervision and research, are necessary to improve the current regime. An improved regime could be highly beneficial for the society. However, we claim that reliable data and tools might only be provided by using modern technology. Concluding, “better” data would need to have the following characteristics:

| – High quality | – Live availability | |

| – Full granularity | – Matched across entities and ready for |

1.2 Reduce overall costs for the regulatory regime

Currently, financial market participants must meet numerous regulations on regional, national, and supranational levels causing high costs. Resulting costs are twofold: (1) direct costs (meeting regulation to keep a bank’s business active), and (2) indirect costs (stopping or reducing business due to regulation).1 It is generally known that, since the introduction of reporting obligations, banks have been forced to pass costs from such non-value generating activities onto their customers, and thus the overall economy.

New regulatory requirements may further impose costs, although many cost-drivers for regulatory reporting already exist:

| – Data requirements are often overlapping, contradicting | – Data lineage is not safeguarded | |

| – Data models are not standardized | – High efforts of semi-automated reporting due to manual data handling |

|

| – Data is only available siloed |

1.3 Promote new technologies and market entrants

New financial market entrants may face major hurdles when trying to comply with the existing, non-automated regulation which is difficult to implement. While established market participants had time to slowly build their regulatory compliance departments and IT infrastructure, new entrants must build those from scratch at the very beginning. This is also likely to be one of the reasons for FinTechs to specialize in small niches instead of offering full-service banking.

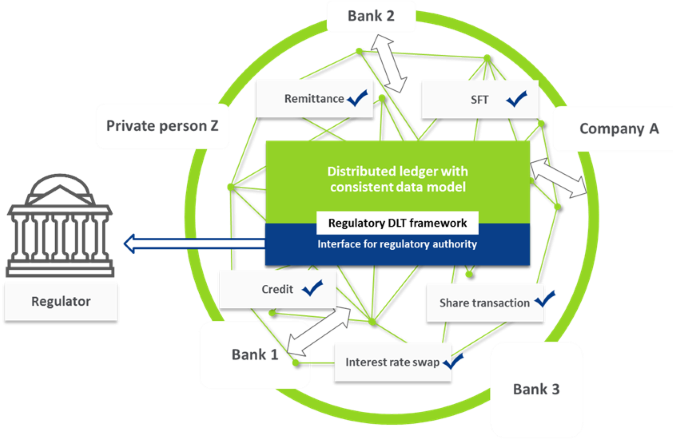

We further argue that the current regulatory reporting regime is not entirely capable of leveraging new technologies to their full potential. In our opinion, a reason for that is low-quality, fragmented, outdated, siloed, and unmatched data. The application of new technologies like our implemented blockchain system approach (see figure 1), artificial intelligence or even quantum computing to this data may have a strong potential for improvement of regulatory reporting processes.

Based on aforementioned challenges and issues, we conclude that the current regulatory and reporting frameworks seem not to be as effective, cost-efficient or economically and technologically integrating as they could potentially be; and whose marginal utility is continuously decreasing. We claim that more effective, cost-reducing, and technologically as well as economically reasonable concepts and approaches are needed. Thus, a new and efficient regime that fulfills regulatory objectives could strongly improve micro- and macro-prudential supervision while simultaneously lowering implementation and maintenance costs. It could furthermore facilitate the entry of new companies and shall be technologically inclusive.

2.1 The concept

Following the emergence of blockchain and DLT, the financial market was one of the first industries that has officially begun to rethink industry standards. Particularly mid- and back-office processes, namely all operations that follow the completion of a financial contract, were subject to considerations of being simplified, streamlined or even replaced by blockchain-based systems. These systems might have triggered, even though much slower than originally expected, a technological transformation of existing banking systems and have brought changes for financial market intermediaries. While observing a growing number of such DLT-based applications, we expect their breakthrough as a solution for a variety of financial products in the mid-term future.

To demonstrate what our DLT-based RegTech solution could offer, we construct a hypothetical scenario in which financial markets run fully interconnected. In this scenario DLT-based solutions are available for all financial market activities, financial market instruments and financial market participants; and transactions are executed via programmable smart contracts. Our approach focusses on the regulatory content that banks must report to authorities after having concluded a financial transaction via smart contracts.

We envision in this scenario that these smart contracts include all content that is required to conclude and report a regulatory compliant transaction. It therefore does not seem reasonable to push data through current reporting and aggregation systems that are based on multiple, bank-individual Extract-Transform-Load (ETL) processes, allocating transactions’ data onto templates and sending these templates infrequently to a regulator. Since our regime uses regulatory content in smart contracts, it would be more effective in granting the regulator direct access to the underlying transaction network. Hence, the network could cover all data and would be ready to carry out analyses at any point in time. Figure 1 shows such a theoretical distributed ledger system, which covers all regulatory data requirements for financial products.

Figure 1: Target state of a regulatory DLT framework

The main advantages of this DLT-based regulatory reporting solution may be:

2.2 Use case: transaction reporting

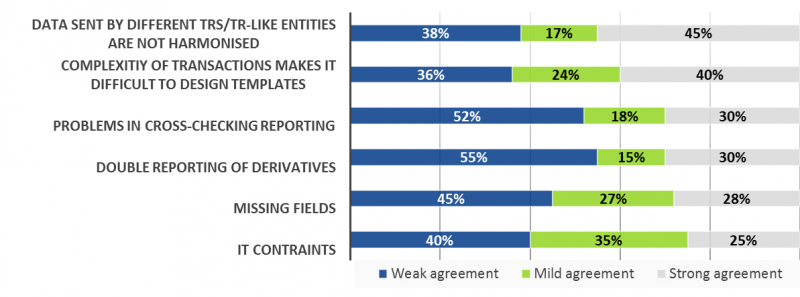

Policy makers have introduced privately-owned trade repositories (TRs) as data-collectors for risky OTC-transactions e.g., derivates.2 However, while only reflecting a small proportion of transaction-based reports that are available to authorities, the process is subject to major inefficiencies, especially with regard to collecting high quality data.3 Analyzing the issues mentioned in a survey released by the Bank of International Settlements (BIS) (see Figure 2), data processing for regulators could not be improved by adding another intermediary.

Figure 2: Major inefficiencies in reporting to trade repositories4 – As answer to the question: Does your central bank face problems in the aggregation process of data collected by TRs/TR-like entities?

Figure 2 indicates that transaction reporting has major deficiencies. It can cause high costs, but it does not seem to fulfill the regulators’ needs. Regulatory authorities are currently starting to fine financial institutions for reporting errors, but existing technologies in the financial industry do not seem to be sufficient to solve the issues mentioned above.5

We will use transaction-based reporting for derivatives as an example to demonstrate how our system could enable an enhanced regulatory reporting regime. Reflecting a starting point for triple accounting, our application may enable financial institutions to include inter-entity matched granularly reported data in their balance sheets.6

2.3 DLT-based transaction reporting

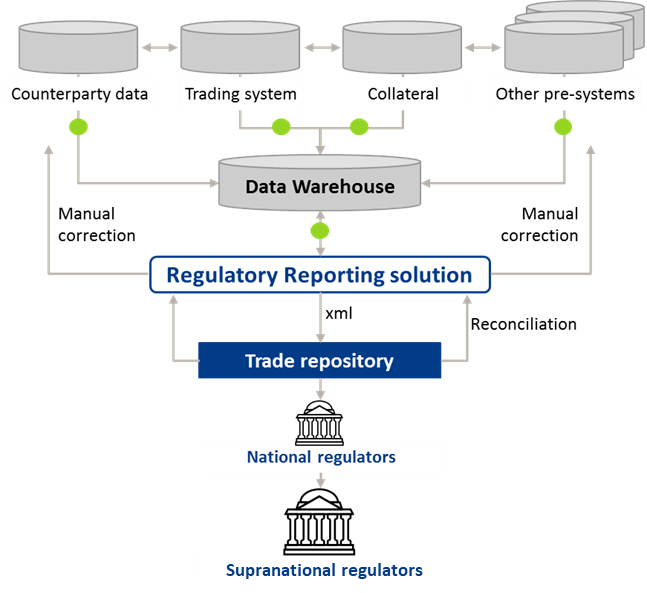

Figure 3 roughly outlines how transaction-based reporting for derivatives is conducted nowadays, which we use as an example to demonstrate how our distributed ledger concept revolutionizes financial market data provision.

Transaction reporting of derivatives and other obligatory disclosure contracts has been a downstream process in the banks” back offices due to extensive documentation requirements. Contracts, often concluded via simple terminals and text boxes, include content that is relevant for regulatory reporting. Transferring all information to IT systems takes place via a mixed process involving manual and automatic data entry which might be prone to errors and inconsistencies.

The current process of transaction reporting looks as follows: Transactions subject to margin requirements are forwarded to a central clearing institution, which handles collateral management. With the transformation of all required data into the format requested by the trade repositories or the transaction registers, reports on the concluded transaction are forwarded to the central reporting unit.

Each trade repository aggregates the provided data into data sets in accordance with the requirements of the supervisory authority and transmits them afterwards. Regulators then use statistical measures for micro- and macro-prudential supervision.

Figure 3: Trading Environment e.g. for SFT & OTC-Derivatives

We claim that one of the major difficulties in the current reporting process is that corrections must be made daily, causing problems in the reporting process. A large percentage of reports does not match between the respective reporting counterparties. By using a blockchain network, the reporting process may be streamlined with all aforementioned benefits.

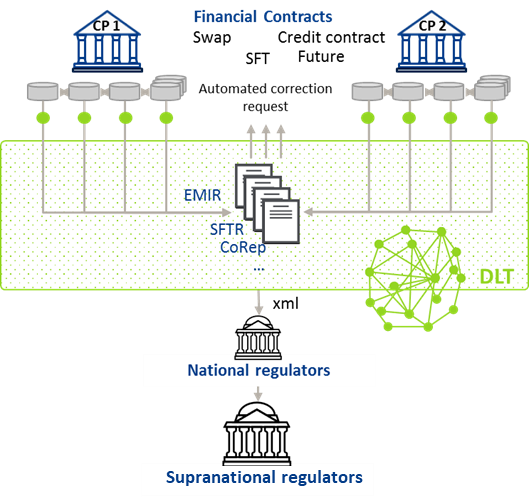

Our concept envisions transactions subject to regulatory requirements to be first harmonized and then to be reported error-free from the distributed ledger.

In our envisioned concept, the trade is then finalized and will be published in the network to the databases of both counterparties. The transaction is also visible for the regulator. Thus, the network may ensure that all counterparties and the regulator have access to an identical dataset that has passed all validations in real-time. The transaction remains private since no other counterparties can view the entered trade.

Such a system, as described above, could potentially facilitate reporting directly via smart contracts between financial institutions. Trade repositories may then become obsolete. Figure 4, sketching a basic scenario, indicates how regulators would retrieve regulatory content from (in)direct access to the distributed ledger platforms.

Figure 4: Basic Scenario: Emerging DLT Contracting-Platforms for Financial Products

All parties involved in any kind of interaction within the financial market may significantly benefit from a distributed ledger supported reporting framework. We further show what our concept and a standalone reporting ledger could mean for some key stakeholders.

3.1 Financial institutions & intermediaries

It is possible that the financial sector will gain substantial rewards from a regulatory regime that strongly increases market transparency. If an enhanced regulatory system could be operated at lower costs, banks and other financial intermediaries would consequently see rising profits. Moreover, a DLT-based reporting ledger may support banks in fostering self-disruptive innovation and applying new technologies.

3.2 Regulators & central banks

A DLT-based regulatory reporting system with a completely standardized data model, a flexible reporting logic, and the possibility of completely new direct intervention in markets could possibly enable regulatory authorities to revolutionize the way they work. Our envisioned concept may provide central banks and academia with enriched data to improve economic forecasts and also to develop new theoretical approaches for financial market stability.

3.3 FinTechs

We argue that FinTechs could greatly benefit from an effective and efficient regulatory regime. In case a regulatory regime is technologically easy to implement for new market entrants while being standardized and transparent, market entry may then be facilitated and there may be more competition. Our DLT-based regime allows for a rapid implementation of innovative ideas and new technology.

The introduction of DLT-based regulatory reporting could promote improvements of regulatory reporting processes and outcomes. The opportunities for regulators to directly intervene in financial market transactions and contracts could affect the way micro- and macro-prudential supervision is performed. Global supervisory authorities have also recognized the beneficiary characteristics of a DLT-based reporting regime in a recent BIS report.7

We argue that there are two main reasons that have prevented further development so far:

Regardless of who will be leading initiatives, the stakeholders should become more active in the area of DLT-based regulatory reporting. Further research is needed, and we claim that discussions of the issues technology & governance including all stakeholders of the financial markets will help to validate the approach. From our point of view, it will be necessary to have in-depth impact assessments for costs and benefits in the individual context.

A next logical step would be to form initial groups of interested parties to test functionality, technology and governance in the context of prototyping solutions, and implement limited market-ready solutions. Such initiatives could ultimately lead to a first iteration of the DLT-based regulatory reporting regime, a possible future of regulatory reporting.

BaFin (2019): Mission Statements. https://www.bafin.de/EN/DieBaFin/Ziele/ziele_node_en.html, retrieved: 25.10.2019

Berger, Allen, Philip Molyneux and John O.S. Wilson (2015): Banking in a post-crisis world. In: Oxford Handbook of Banking. 2nd Edition. Oxford.

BIS (2018): IFC Report – Central banks and trade repositories derivatives data.

https://www.bis.org/ifc/publ/ifc_report_cb_trade_rep_deriv_data.pdf, retrieved: 27.08.2019

BIS (2019): Embedded supervision: how to build regulation into blockchain finance. https://www.bis.org/publ/work811.pdf, retrieved: 20.09.2019

BearingPoint (2019a): A proof of concept for regulatory reporting with distributed ledger technology.

https://www.reg.tech/files/BearingPoint_Whitepaper_DLT_PoC_Preview.pdf?download=0&itemId=11005, retrieved: 02.09.2019

BearingPoint (2019b): Financial supervisors and central banks as a part of Blockchains?. https://www.reg.tech/en/download/?item=398&module=9493, retrieved: 02.09.2019

Blundell-Wignall, Adrian and Paul Atkinson (2011): Global SIFIs, Derivatives and Financial Stability. In: OECD Journal: Financial Market Trends Vol. 2011/1. https://www.oecd-ilibrary.org/finance-and-investment/global-sifis-derivatives-and-financial-stability_fmt-2011-5kg55qw0qsbv

Board of Governors of the Federal Reserve system (2016): The Federal Reserve System: Purpose & Functions.

https://www.federalreserve.gov/aboutthefed/files/pf_complete.pdf

European Parliament and the council of the European Union (2012): Official Journal of the European Union (2012). Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories.

ESMA (2019): ESMA 2019 annual programme (2019).

https://www.esma.europa.eu/sites/default/files/library/esma20-95-933_2019_annual_work_programme.pdf

FCA (2017): Our Mission 2017 – How we regulate financial services.

https://www.fca.org.uk/publication/corporate/our-mission-2017.pdf

FCA (2019): FCA fines Goldman Sachs International £34.3 million for transaction reporting failures.

https://www.fca.org.uk/news/press-releases/fca-fines-goldman-sachs-international-transaction-reporting-failures, retrieved: 20.09.2019

Kern, Alexander (2019): Principles of Banking Regulation. Cambridge.

OECD (2014): OECD Regulatory Compliance Cost Assessment Guidance. OECD Publishing.

https://read.oecd-ilibrary.org/governance/oecd-regulatory-compliance-cost-assessment-guidance_9789264209657-en#page10

OECD (2014), OECD Regulatory Compliance Cost Assessment Guidance.

Official Journal of the European Union (2012): Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories.

BIS (2018), IFC survey on TR data.

BIS (2018), IFC survey on TR data, Graph 14.

E.g. FCA (2019), FCA fines Goldman Sachs for transaction reporting failures.

Access to details of the prototype: see BearingPoint (2019a).

See BIS (2019), Embedded supervision: how to build regulation into blockchain finance.