Achieving high productivity growth is a central goal of policymaking because productivity impacts not only on key macroeconomic variables, but also on a country’s living standards and the resource inputs necessary for production. In particular, central banks have an intrinsic interest in promoting productivity given its interaction with the natural rate of interest r*, which crucially shapes the monetary policy space. A variety of factors help explain weak productivity dynamics in industrial countries in the past decades. They range from low demand, expansionary monetary policy, specific firm characteristics, technological and financial market dynamics as well as demographics to the burden of regulation. In the years ahead, digital transformation and climate change may add to the list of crucial factors. To promote productivity, we will need a multifaceted and country-specific policy mix; “one-size-fits-all” policies are deemed suboptimal.

Achieving high productivity growth is a central goal of policymaking in most industrialized countries. This is attributable to the key role productivity growth plays for variables such as income per capita, supply of goods and services, wage growth and international competitiveness. The lower the productivity is, the more the income level depends on resource use. This makes production processes inefficient and environmentally unsustainable.

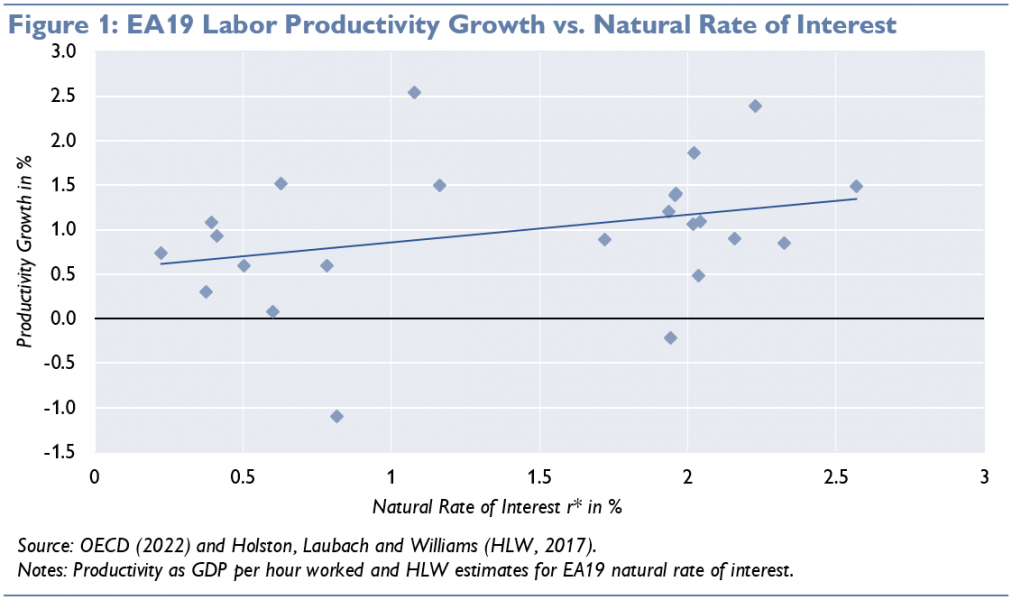

Central banks have an intrinsic interest in promoting productivity growth because of its interaction with the natural rate of interest r*, which crucially shapes the monetary policy space. Changes of long-run productivity growth are conjectured to impact on r* and vice versa. The slow productivity growth which we have been seeing in the current period of very low interest rates may therefore not be a coincidence. In contrast to the negative textbook relationship in the short run, higher interest rates may incentivize savings and induce larger investment returns in the long run, potentially amplifying productivity growth. In figure 1, the correlation between a common proxy of productivity growth and r* appears to be positive. However, this relationship, which strongly depends on the model specification, the employed productivity measure and the time horizon, has given rise to a plethora of studies and hypotheses, which we reviewed in Breitenfellner et al. (2022).

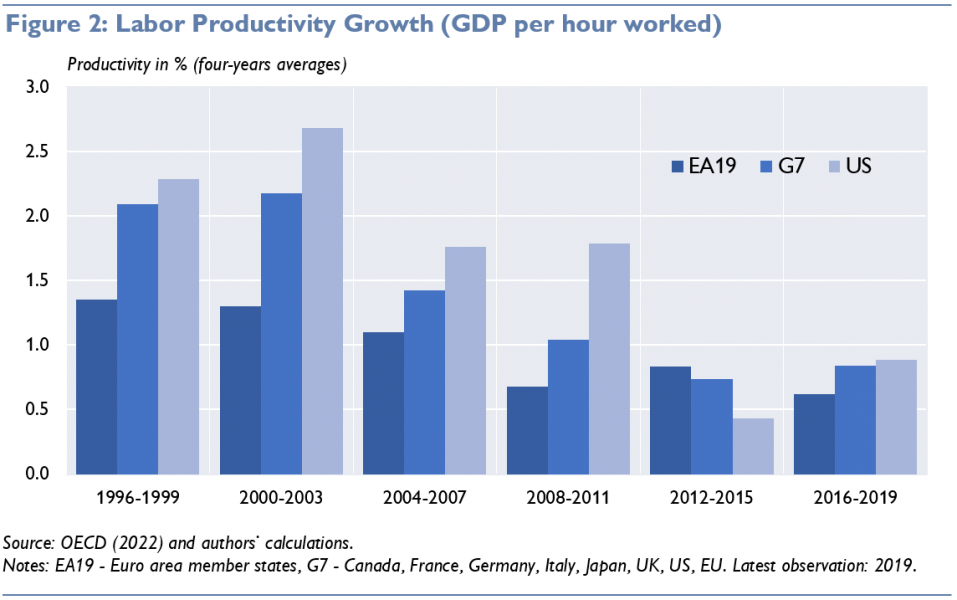

Major advancements in production techniques in the past (e.g. the industrial revolution) had tangible positive effects on productivity growth. This is why we would also expect recent achievements to have a visible impact on productivity measures. Yet, the ongoing digital transformation notwithstanding, labor productivity growth has slowed down in advanced economies since the 1970s and has virtually stagnated since the mid-2000s (figure 2). In the euro area, annual growth in labor productivity declined from 1.1% in 1996 to below 0.6% in 2019.

The US has outperformed European countries over the last decades, which is partly due to its stronger investment and faster implementation of ICT-related technologies. Factors that may have also benefited the US are demographics, higher firm dynamism and different management practices. Moreover, financial market characteristics have a role to play: in the US, especially SMEs and start-ups find it easier to avail themselves of equity-based sources of finance. Within Europe, we observe a North-South gap when it comes to productivity growth. This gap is related to differences in ICT capital intensity, the quality of public governance, the regulatory burden, the importance of SMEs and their financial constraints, and also to the efficiency of the labor market and the educational system.

We have surveyed the theoretical and empirical literature to learn more about the key drivers of the recent productivity slowdown. In Breitenfellner et al. (2022), we define nine hypotheses. Each tackles the productivity puzzle from a different angle. Here, we briefly summarize the main points and policy measures we suggest with a view to counteracting the negative effects on productivity:

While all these factors may have contributed to the past productivity puzzle, some of them may gain importance (e.g. demographics as a result of population aging), and other factors may fade (e.g. the lagged effects of the 2008/09 financial crisis). At the same time, new factors may come into play and shape future productivity trends:

Given the manifold and time-varying reasons of subdued productivity growth, finding the right policy mix is challenging. “One-size-fits-all” policies are deemed suboptimal to combat weak productivity growth. The relative weight of appropriate measures depends on the current stage of a country’s development as well as its history and the prevailing business environment. Hence, policies may differ widely across regions.

Given central banks’ intrinsic interest in the level and trend of productivity, they may play an active role in promoting productivity and its measurement and thus supporting policymakers to find the right policy mix. They can do so (1) by giving well-founded advice to policymakers and by promoting rigorous monitoring and evaluation of productivity-enhancing measures; (2) by helping advance research in areas of importance for future productivity growth; and (3) by initiating and funding projects to better exploit existing data sources and collect new data, while specifically using the increasing availability and accessibility of firm-level data.

Breitenfellner, A., Holzmann, R., Sellner, R., Silgoner, M. and Zörner, T. (2022): “Quo vadis, productivity?”, OeNB Occasional Paper No.1, March.

Holzmann, R. (2013): “An Optimistic Perspective on Population Aging and Old-Age Financial Protection”, In: Malaysian Journal of Economic Studies 50(2): 107–137.

Holzmann, R., Robalino, D. and Winkler, H. (2020): “NDC Schemes and the Labor Market: Issues and Options”, in: Holzmann, R., Palmer, E., Palacios, R. and Sacchi, S. (eds.): “Progress and Challenges of Nonfinancial Defined Contribution Pension (NDC) Schemes, Volume 1: Addressing Marginalization, Polarization, and the Labor Market”, Chapter 15. Washington, D.C.: The World Bank.

Silgoner, M. (2022): “Conference on European Economic Integration 2021: Recalibrating tomorrow’s global value chains – prospects for CESEE”, In: OeNB Focus on European Economic Integration Q1/22.

The authors would like to thank Christian Alexander Belabed (OeNB), Klaus Friesenbichler (WIFO), Michael Peneder (WIFO), Christian Reiner (Lauder Business School), Andreas Reinstaller (WIFO), Jakob Schriefl (Vienna University of Economics and Business), Helene Schuberth (formerly OeNB), Thomas Url (WIFO) and Klaus Weyerstraß (IHS) for valuable contributions and comments as well as Ingrid Haussteiner (OeNB) for language support. The views expressed in this paper are those of the authors and do not necessarily reflect those of the Eurosystem or the OeNB.

Solow, R. (1987): “We’d better watch out,” New York Times Book Review, July 12.

Liu, E., Mian, A. and Sufi, A. (2022): “Low Interest Rates, Market Power, and Productivity Growth,” Econometrica 90(1): 193-221.

Aghion, P., Antonin, C. and Bunel, S. (2021): “The Power of Creative Destruction: Economic Upheaval and the Wealth of Nations”, Harvard University Press.