Market forces can become a powerful driver to a greener economy, when asset managers rebalance their financial positions toward firms with low carbon emissions. Investors are increasingly expressing preferences for portfolios that meet some minimum environmental, social, and governance (ESG) standards. Anticipating both the rebalancing strategy of asset managers and the risk of stranded assets caused by climate policies, investors may initiate a race to green the assets they hold and get rid of brown assets before their price drop. Acting in unison, investors can trigger a sell-off of the bonds and stocks of firms they think can be affected, or in other words, a run on brown assets. We argue that the risk of a run on brown firms and the risk of stranded assets are increasingly likely. Offering a backstop liquidity facility to firms that are subject to such risks but also to other firms would address the current market inefficiencies. The backstop facility could be managed by the central bank, or by any other government agency.

Finance is waking up to global warming. While governments have, so far, failed to coordinate on taxing carbon emissions, investors are increasingly expressing preferences for portfolios that meet some minimum environmental, social, and governance (ESG) standards.1 Finance is naturally accommodating this evolution of the buy side. At the same time, many observers and a majority of central banks communicate on the need to adapt the financial system to mitigate climate change.

Market forces can become a powerful driver to a greener economy, when asset managers rebalance their financial positions toward firms with low carbon emissions. Some may argue that this is hardly possible, but an important argument speaking in favour of this rebalancing strategy is that carbon emissions are extremely skewed across firms. The 1% most polluting firms account for 40% of total Scopes 1 to 3 carbon emissions in 2018 (Ehlers, Mojon, and Packer, 2020). Therefore, asset managers can effectively reduce the carbon footprint of their portfolios by excluding (or reducing its exposure to) a small number of firms with limited impact on the financial performance and tracking error of their portfolio (Andersson, Bolton, and Samama, 2016, Jondeau, Mojon, and Pereira, 2021).

However, such a rebalancing of large investors’ portfolios toward green assets may severely impact the firms that are excluded from said portfolios. In addition, future climate policies may try to mitigate the consequences of climate change by forcing highly polluting firms to let a substantial fraction of their assets (fossil fuel reserves, for instance) be stranded, thus imposing possibly large costs to these firms and affecting their value.

Anticipating both the rebalancing strategy of asset managers and the risk of stranded assets caused by climate policies, investors could decide to reduce their exposures to these assets before all other investors do. Acting in unison, investors can trigger a sell-off of the bonds and stocks of firms they think can be affected, or in other words, a run on brown assets.

In view of the market capitalization of brown firms, this risk is a major threat to financial stability, one that central banks and agencies that guard financial stability cannot ignore (Bolton et al., 2020), as estimates of the potential loss in stranded assets vary from USD 1 trillion (Mercure et al., 2018) to USD 18 trillion (IRENA, 2017).

One can see the Damocles sword hanging over brown firms as an opportunity to entice these firms to switch to greener production processes. Yet the increase in transition risk due to the stigma on stranded assets, should be managed.

The mere possibility of a run on brown assets can discipline brown firms to become greener. However, a run is a very coarse market mechanism to discipline firms. As such, and on top of the collateral damage it can cause, it does not consider the two facets of carbon emissions: a firm can produce a lot of carbon because it produces on a large scale, or because its production process is inherently carbon-intensive. While they both look brown, these firms should be treated differently when transitioning towards meeting environmental standards.

In Jondeau, Mojon, and Monnet (2021), we analyse a production economy where firms have different intensity of carbon emission when they produce. For example, for every watt of electricity it produces, a water-based electricity company has a lower carbon intensity than a coal-based electricity company. In addition, firms can all undertake some costly investment to reduce their effective emissions from their natural levels. While efficiency requires that no firm is entirely excluded from the market, they should not all operate at the same scale and they should all take measures to reduce emissions from their natural levels.

We consider the existence and implications of a run on brown assets. When investors run on what they believe are brown firms, the production of these firms has to stop, leaving some assets stranded. This is inefficient given the firms may have already made some initial investments. Also, investors may coordinate on running on firms that are relatively greener and that should optimally keep operating (for instance, nuclear plants versus coal plants). This is also inefficient. Finally, firms that believe they may be subject to a run may protect against such runs by holding more cash for precautionary reasons. This can also be inefficient relative to taping the market for funds. Finally, even in the presence of runs, the market equilibrium allocation is inefficient because investors do not or cannot price the carbon emission externality when lending to firms, but only the run risk. Therefore, firms that are still thought to be relatively green can carry on polluting, while optimally they should take actions to reduce emissions.

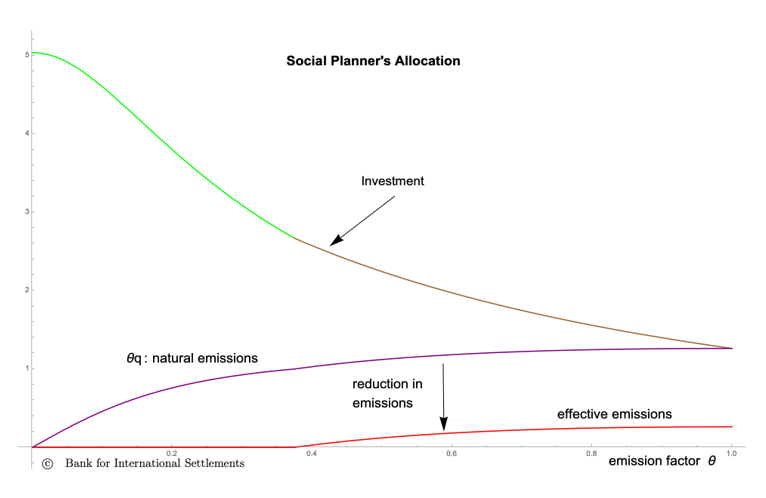

Figure 1 shows, for an economy where people dislike pollution, the socially optimal investment in each firm with increasing levels of emission intensity θ, as well as the level of emission reduction for each firm. Importantly, the planner invests in each firm so that the marginal product of capital net of the cost to reduce emissions is the same across all firms.

We show that a well-designed liquidity backstop facility can address the inefficiencies we outlined above. It will help firms that are subject to a run and prevent that assets become stranded.

A liquidity backstop can sustain the optimal allocation provided it uses a fee structure similar to a two-part tariff that consists of an access fee and a lending rate. Paying the access fee gives a firm the right to borrow from the liquidity backstop facility. The access fee is a lump-sum fee that is contingent on effective emissions, but not on the borrowed amount. Once a firm pays this access fee, the lending rate on the amount it borrows from the facility is independent of effective emissions. We show that the policy can be designed in such a way that in equilibrium all firms with access to a dedicated liquidity backstop will produce and clean their act according to the socially optimal allocation.

Figure 1

Firms borrowing from the liquidity backstop facility choose an investment level such as to equate the marginal product of investment net of the cost to reduce emissions to the lending rate of the backstop. If this rate were to depend the firms’ emission levels, the marginal product net of the cost to reduce emissions could not be the same for all firms and this would be inefficient. Now if the lending rate and the access fee were not dependent on emissions, then firms would have no incentives to reduce their emissions. So, the access fee must depend on emissions.

The access fee could in principle be negative to incentivize all firms to access the liquidity backstop facility. In a dynamic setting, the operator of the facility could impose a positive access fee that would be reimbursed to firms that have managed to reduce their carbon emissions.

The reasoning applies either to non-financial corporates or to the portfolio of financial firms. The carbon footprint of the portfolio will depend on its proportion of brown firms. The stigma and risk of runs may very well apply to these financial intermediaries. Given the vast cross-exposure of financial intermediaries, notably on money markets, brown stigma or fear of brown stigma can induce in turn a systemic market freeze similar to the one the relatively small sub-prime market led to in 2008.

In this respect, our prescribed policy is a theoretical foundation for the need to the design collateral frameworks to can contain the risks that brown stigma undermines financial stability.

It is worth mentioning that the European Central Bank has recently decided that bonds with coupon structures linked to the satisfaction of some sustainability performance targets will be eligible as collateral for Eurosystem credit operations and also for Eurosystem outright purchases for monetary policy purposes (provided they comply with all other eligibility criteria). For sustainability-linked bonds, the performance target refers to some environmental objectives, such as those defined by the United Nations Sustainable Development Goals. Ousry et al. (2020) also explore an approach to factoring climate-related transition risks into a central bank’s collateral framework. The approach consists of aligning the collateral pools pledged by the counterparty with a given climate target.

Also, it is worth noticing the analogy between the two-level pricing mechanism of the liquidity backstop and the logic underlying the level of regulatory capital that financial institutions need to hold to preserve financial stability. In most jurisdictions, holding a bank holding company charter allows a bank to access the central bank emergency liquidity facility. Such charter comes at the cost of meeting capital requirements, as determined by the risk-weighted assets the bank holds. This is equivalent to an entry fee that depends on the risk taken by the bank. However, the cost of emergency liquidity does not usually depend on bank risk. So, as the lending rate of the backstop does not depend on carbon emissions, the interest rate of emergency borrowing does not depend on bank risk.

To push the analogy further, capital requirements could be determined according to the exposure of banks to climate risk. For instance, Thomä and Hilke (2018) and Berenguer, Cardona, and Evain (2020) propose a mechanism by which a higher exposure to green assets and a lower exposure to brown assets would reduce banks’ capital reserve requirements.

Similarly, deposits insurance, as implemented by the Federal Deposit Insurance Corporation (FDIC) in the United States, relies on a mechanism which pricing bears resemblance to the pricing of the liquidity backstop facility we propose: banks have to satisfy some liquidity and reserve requirements to benefit from the insurance mechanism. Once the bank is insured, the FDIC deposit insurance covers all deposit accounts (up to a certain limit) irrespective of the deposit base of banks and bank risk.

We have argued that the risk of a run on brown firms and the risk of stranded assets are increasingly likely. Offering a backstop liquidity facility to firms that are subject to such risks but also to other firms would address the current market inefficiencies. The backstop facility could be managed by the central bank, or by any other government agency.

Andersson, M., Bolton, P., Samama, F., 2016. Hedging climate risk. Financial Analysts Journal 72(3).

Berenguer, M., Cardona, M., Evain, J., 2020. Integrating climate-related risks into banks’ capital requirements. Institute for Climate Economics Report.

BlackRock, 2020. Blackrock survey shows acceleration of sustainable investing. Available at https://www.blackrock.com/corporate/newsroom/press-releases/article/corporate-one/press-releases/blackrock-survey-shows-acceleration-of-sustainable-investing.

Bolton, P., Despres, M., Pereira Da Silva, L.A., Samama, F., Svartzman, R., 2020. The green swan: Central banking and financial stability in the age of climate change. Bank for International Settlements Working Paper.

Ehlers, T., Mojon, B., Packer, F., 2020. Green bonds and carbon emissions: Exploring the case for a rating system at the firm level. BIS Quarterly Review, September 2020.

IRENA, 2017. Stranded assets and renewables: How the energy transition affects the value of energy reserves, buildings and capital stock. International Renewable Energy Agency Working Paper.

Jondeau, E., Mojon, B., Monnet, C. (2021), Greening (runnable) brown assets with a liquidity backstop. Bank for International Settlements Working Paper No. 929.

Jondeau, E., Mojon, B., Pereira Da Silva, L.A., 2021. Excluding firms with large carbon emission for portfolio investment. Bank for International Settlements Working Paper.

Mercure, J.F., Pollitt, H., Viñuales, J.E., Edwards, N.R., Holden, P.B., Chewpreecha, U., Salas, P., Sognnaes, I., Lam, A., Knobloch, F., 2018. Macroeconomic impact of stranded fossil fuel assets. Nature Climate Change 8(7).

Oustry, A., Erkan, B., Svartzman, R., Weber, P.F., 2020. Climate-related risks and central banks’ collateral policy: A methodological experiment. Banque de France Working Paper No. 790.

Thomä, J., Hilk, A., 2018. The green supporting factor: Quantifying the impact on European banks and green finance. 2 Degrees Investing Initiative Report.

BlackRock (2020) reports that 88% of its investors are expressing a preference for Environmental, Social, and Governance (ESG) portfolios with the Environmental pillar being a much bigger concern than either Social or Governance pillars.