Acknowledgements: I would like to acknowledge the privilege and honor it was to be Franco Modigliani’s student, mentee and friend. His fingerprints are all over this document. Thanks also to Sanjay Muralidhar and Prof. Sunghwan Shin for helpful comments. These are personal views of the author and do not reflect the views of any organization he is associated with, and all errors are his own.

Disclosure Statement: I have no conflicts or funding issues to disclose.

1. I received no financial support from any entities.

2. While I serve as co-founder of AlphaEngine Global Investment Solutions LLC and Mcube Investment Technologies LLC, this paper is entirely theoretical and has no apparent value in the performance of my investment functions in this capacity or to the investment and technology firms in the conduct of its business activities.

3. There was no third-party review required or conducted of this paper.

4. There were no non-disclosure arrangements that have any relevance to this paper.

Abstract

The stable price goal of central banks (CBs) is the most watched globally. However, the benchmark for the price index for personal consumption expenditures (PCEPI) is “under specified”, causing a mismatch between what a CBs believes their mandate to be and the impact on citizens they serve. The Fed and other CBs could incorporate the effective benchmarking practices of institutional investors, with a simpler and transparent benchmark, that allows for the achievement of longer-term goals and better governance at multiple levels. We propose an alternative benchmark, which incorporates the fact that these variables are stochastic and that allows for better tracking of not only current inflation but also inflation over the “longer run”, an unspecified period in current CB announcements. More importantly, this transparent benchmark will remove the need for investors and analysts to guess the future CB moves, currently a cottage industry of analysts parsing speeches and “dot plots”. We recommend CBs specify “ski-slopes” instead as to how they will converge to their policy goals, especially after periods of “transitionary inflation”.

“Inflation is always and everywhere a monetary phenomenon.”

Milton Friedman, 1963

“I complain that the Federal Reserve does not tell us its target. Why do I complain? Because I have no way of telling if it is doing a good job or not. That’s why I want them to tell us what their targets are – and not necessarily money targets. I don’t care about money targets. They can do anything with money, as long as they tell us what their real targets are – and as long as they take the blame when they do not hit the real targets.”

Franco Modigliani (San Francisco Fed, 1977)

The late Nobel Laureate Milton Friedman spent his career focusing on inflation and how monetary policy could solve and control rampant inflation. “What is monetary policy? It is the Federal Reserve’s actions, as a central bank, to achieve three goals specified by Congress: maximum employment, stable prices, and moderate long-term interest rates in the United States” (Fed Undated). This is the first sentence of a publication by the US Federal Reserve on Monetary Policy. A more formal statement follows: “The Federal Reserve Act states that the Board of Governors and the FOMC should conduct monetary policy ‘to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates’….the FOMC also established a numerical longer-run goal for inflation: In the Committee’s judgment, an annual rate of increase of 2 percent in the price index for personal consumption expenditures—an important price measure for consumer spending on goods and services—is most consistent, over the longer run, with meeting the Federal Reserve’s statutory mandate to promote both maximum employment and price stability.” (emphasis added). While the Fed’s mandate is multi-pronged (e.g., employment and moderate long-term interest rates), the primary focus of this brief will be on the “stable prices” goal. However, the principles applied to price stability can be applied easily to the other goals individually and potentially on a weighted basis (to reflect the priorities of the Fed). Also, while we focus on the US, the ideas apply to all central banks globally that have copied or have a variant of the US approach.

We try to address the question that Franco Modigliani raised 50 years ago that is currently unaddressed in Fed monetary policy. An inordinate amount of media time is devoted to analysing and parsing the statements of the central banks, the speeches of individual governors, the “dot plots” etc. We argue that this inefficiency could be reduced and productivity, transparency and governance improved with two simple enhancements to this underspecified price index for personal consumption expenditures (PCEPI) benchmark. Instead, the Fed could take a page from the benchmarking practices of effective institutional investors, to set a simpler and more transparent benchmark that allows for the achievement of longer-term goals. These institutional investors are a good benchmark as they too have multiple levels of governance and delegation, with resulting accountability.

We propose an alternative and more realistic benchmark, that allows for better tracking of not only current inflation experience, but also inflation over the “longer run”, which currently is an unspecified time period in Fed announcements, publications and minutes. For example, PCEPI as of March 2024 was 2.4% (2.63% on Core), clearly above the target “2%” level, but no mention has been made about the past experience of PCE over the “longer term”. The primary issue with the current statement is that the current “2% goal” is missing a volatility component, and for another, “longer term” is not specified allowing it to be vague. The longer run impact of hot inflation probably requires the current inflation target to be much lower than 2% to achieve the “longer term” goal and account for periods of above 2% inflation experience. After all, if a dinner cost $100 in 2019, and now costs $120, then bringing inflation back to 2% leaves citizens worse off, even though it may appear that the Fed has met its goals.

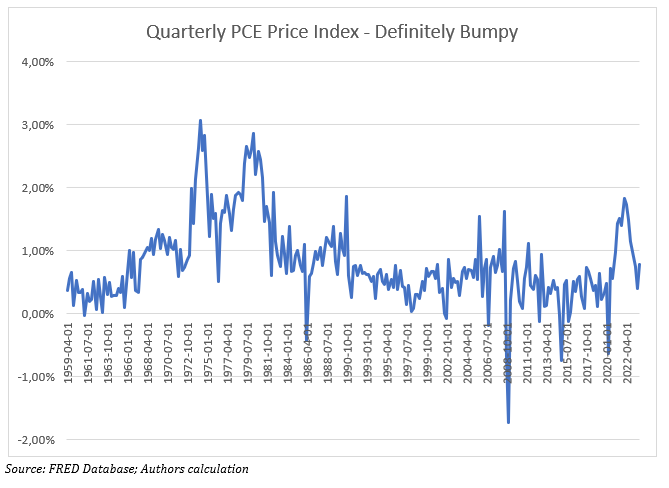

PCEPI Volatility – Stable, but Non-Zero. Definitely Bumpy

Stated differently, the PCEPI is volatile as shown in Figure 1 (with an annualized volatility of the quarterly data of 1.32%, since inception of the series in 1959). Hence, to state a level without also stating a volatility target, makes little sense and would fail a basic Economics/Finance 101 homework assignment. The word “stable” precedes the word “price level”, so what qualifies as “stable”? One simple guide would be the historical volatility of the annualized PCE price index (e.g., 1.25% to round off 1.32%), or another might be a target volatility that the Fed seeks to achieve as volatility is also dynamic.

Figure 1. Quarterly PCE Price Index values

For example, Table 1 shows the volatility of the annualized volatility of GDP, PCEPI, and the Unemployment Rate (using quarterly data releases) for different time horizons, so the volatility and correlation of PCEPI and GDP is also dynamic.

Table 1. Detailed Annualized Statistics on GDP, PCEPI and Unemployment Rate

(GDP data from January 1947 – October 2023; PCEPI data from January 1959 – October 2023; Unemployment from January 1948 – October 2023)

Institutional Benchmarks – Better Specificity

The corollary to this statement is the experience public pension plans have had in specifying their return targets. Pension funds and endowments have similar governance structures in that principals (Boards or Congress) hire individuals (Investment Teams or the Governors) to oversee a delegated portfolio of decisions.

The Investment Policy Statements (IPS) of, say, the New Mexico Employees’ Retirement Association (NMPERA) has much greater specificity and could be a model for the Fed. NMPERA’s IPS explicitly states that the Board established a 10.5% annualized target volatility for the Strategic Asset Allocation, and a 1.5% annualized tracking error for all delegated decisions. The 10.5% annualized target volatility value is lacking for the Fed 2% target. The European Organization for Nuclear Research (CERN) pension fund’s specificity is hard to match and includes a cone of outcomes within which the performance is expected to lie and is used in our proposed benchmark.

Effective risk management and benchmarking require an explicit statement of the goal, the risk target and the time horizon over which these goals will be measured and reviewed.

Modigliani, back in 1997, remarked: “I think that what is really costly about inflation is unexpected deviations of inflation from the anticipated steady state path. This is the problem that I have tried to address.” (San Francisco Fed 1977).

Example of a Simple Statement of Price Stability

Much like NMPERA or CERN, the Fed could easily state that at “over a 10-year rolling period, updated quarterly, the Fed would like to achieve a 2% target rate of PCEPI with a 1.25% volatility”. Here we specify the long-run is 10 years, updated quarterly, and we have added a volatility target at 1.25%, where somewhat higher volatility would be “bumpy”. The proposed approach invokes a choice between Inflation vs Price Level targeting. One potential drawback of such an approach is that it might entail higher output/GDP/employment volatility. One alternative to cushion output volatility would be to widen the bands (i.e., tolerate more inflation volatility), so the economy can take shocks to the Price Level.

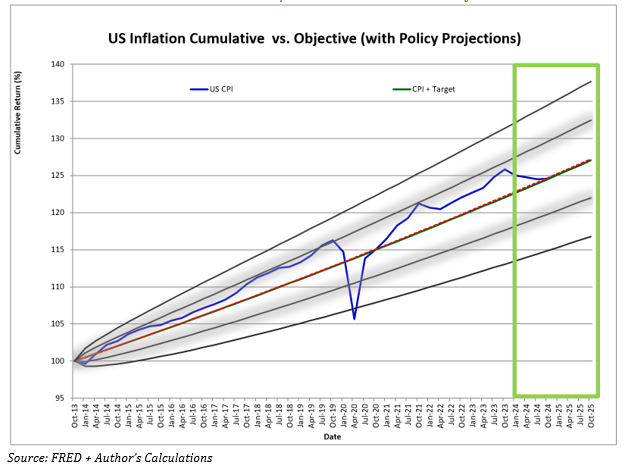

How would this map out graphically to allow market participants to track where the economy is relative to the Fed target and individuals are not penalized for previous periods of “hot” inflation even if the rate of PCEPI returns to 2% p.a? In the case of the rolling 10-year period from October 2013 – 2023, as Figure 2 demonstrates, the Fed should probably be raising rates – not lowering them in 2024. Figure 2 plots the 2% target growing at a quarterly rate of 0.5%, with zero volatility, and then the curves around that line plot the 1 and 2 standard deviation cones around that target based on the 1.25% volatility target. The wiggly line is actual inflation over the 10-year period. For simplicity, we anchor the 1st date on this 10-year rolling period to 100.

Figure 2. Projected Path of PCEPI to Better Benchmark Specifications

(2% annual target; 1.25% volatility; 10 year rolling window with 1 and 2 standard deviation cones)

Data from December 10/2013 – 2023 + Forecast of 2 years

To improve the transparency of policy, the Fed could state that if the blue line approaches the first cone, rates will be adjusted by 25 bps immediately (if above, then raise rate and vice versa), and if it approaches the second cone then the adjustment would be in 50 bps increments/decrements, unless there are exceptional circumstances like the covid drop we see in the chart. However, the current conditions seem to presage more interest rate increases or at least holding the line for a while, rather than 2 to 3 cuts in 2024. While 10 years rolling may seem to adequately capture the “long term”, others may define it as 15 years (because policy was altered dramatically in 2008) but the idea is the same. Table 1 highlights the annualized inflation experience over various time periods and this could be updated in various Fed statements/minutes. Hence the importance of specificity in the details of policy are important for not only the market participants but for Congress to know how the Fed is performing relative to objective measures. According to the proposed measure, for the last 5 years, the Fed would be seen to be way off target and should not have been cutting rates.

Ski Slopes Instead of Dot Plots

With these goal charts, adapted from the CERN Board reporting package, the Fed could also show the public how, and over which period, it plans to bring inflation back to the target. We demonstrate this in the green-squared part of Figure 2, where the Fed gets to project how they plan to bring inflation down to the target path over, say, a 2-year window (so in this case from January 2024 to October 2025). This degree of specificity will hold governors accountable as they will not be able to claim that inflation was “transitory” and bear no consequence, while the population suffers from an overhang of compounded past “hot” inflation.

Federal Reserve. Undated. The Federal Reserve System Purposes & Functions.

Friedman, Milton (1963). Inflation, Causes and Consequences, Asian Publishing House.

San Francisco Federal Reserve Bank. 1977. The Monetarist Controversy Or, Should We Forsake Stabilization Policies? American Economic Association Presidential Address by Franco Modigliani