Drawing from the first two waves of the Household Finance and Consumption Survey, we investigate the potentially non-linear relation between households’ indebtedness and their consumption between 2010 and 2014 in Belgium. We find a negative effect of households’ indebtedness on their consumption, even in the absence of any negative shock on their assets, that appears to be related to the day-to-day sustainability of the debt, rather than its overall sustainability. To explore potential non-linearities in this effect, we perform a threshold analysis, whose results suggest that households should not have a debt-service-to-income ratio greater than 30% as this leads to a substantial reduction of their consumption. The effect appears to be robust to various specifications, to result from a trade-off between housing and consumption, and to be more prevalent among more fragile households.

The sovereign debt crisis that occurred in Europe following the financial crisis of 2007 put public as well as banks’ indebtedness behaviour under the spotlight. Nonetheless, not much focus was put at the time on the individual debts. This was particularly the case for Belgium which saw three of its largest banks – Fortis, Dexia and KBC – bailed out, sold off and/or nationalised to avoid bankruptcy while the effects of the crisis were less clear-cut at the micro level. This was also true concerning the economic research. While most studies have been analysing the impact of household indebtedness at the macro level (Bunn and Rostom, 2015; Cecchetti et al., 2011; Jordà et al., 2013; Mian et al., 2013), only recently have some researchers started to focus on the effect at the micro level, claiming that the overhang of households’ debt has been holding their consumption back in the aftermath of the crisis, therefore slowing the economic recovery (Andersen et al., 2014; Dynan, 2012; Kukk, 2016). Performing an analysis at the household level is of particular interest as it can help shed light on the mechanisms at play and allow to look at the impact of debt for different types of households, which could help to formulate better, more framed policies.

In a recent study (Du Caju et al, 2021), we try to contribute to this literature by analysing the effect of household indebtedness on their consumption in Belgium between 2010 and 2014 and by: 1) Considering two different aspects of debt, stock and flow, and the impact they can have on household consumption in the absence of a negative shock on household assets.2 We measure these aspects by using the debt-to-asset (DTA) ratio and the debt-service-to-income (DSTI) ratio respectively. 2) Investigating the possibility of non-linearities in the effect of debt on consumption, as put forward by previous studies, and trying to quantify the critical level of debt leading household to reduce their consumption. 3) Investigating the potential heterogeneity of the effects found by looking at how they differ depending on the households’ income, working status, and/or level of education.

We look at whether the results found appear to be robust to changes in the specifications as well as to the inclusion of other European countries, to not suffer from an endogeneity bias,3 and to be related to housing decision by the households.

We finally try to relate the results to the theoretical literature and, more specifically, to the predictions of the life-cycle/permanent income (LC-PI) model (Modigliani and Brumberg, 1954; Friedman, 1957), extensions of this model such as the one developed by Eggertsson and Krugman (2012), or the later model by Kaplan et al. (2014), in which households can hold two types of assets: liquid and illiquid assets.

We first look at the effect of household indebtedness on their consumption in a linear way, controlling for potential confounding factors that are usually controlled for in the literature. In particular, we look at how the households’ indebtedness level in 2010 (characterised by the DSTI and the DTA ratios) can impact the growth of their food consumption at home. Although food consumption might seem to be a very restrictive part of consumption, we argue that it is a good measurement for at least two reasons. First, food consumption represents an important share of a household’s total consumption, among its three largest items. Second, food consumption is supposed to be quite inelastic, as it represents an essential part of households’ consumption. It can therefore be viewed as a conservative measurement. If high indebtedness is found to have a negative impact on food consumption, we strongly expect total consumption to be declining as well.

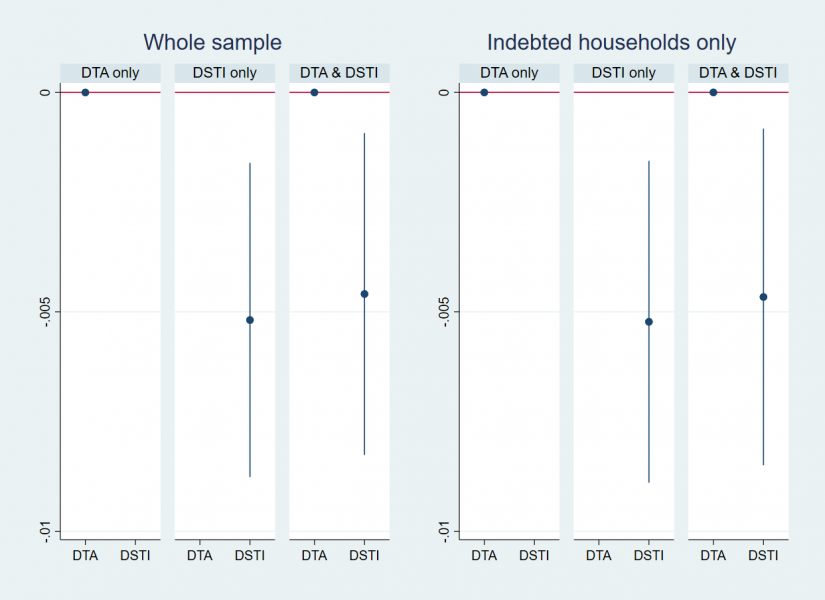

Figure 1: Results of the linear regressions for the coefficients of interest

We find that it is the DSTI of the households that appears to have an impact on households’ consumption rather than the DTA. This result can be seen in Figure 1, which displays the results when we considered the whole sample or only indebted households, and when we included the debt indicators separately as well as together. We argue that this result shows that, even in the absence of a strong negative shock on the households’ assets, households’ debt can have an impact on their consumption and that this impact occurs through the day-to-day sustainability of the debt as measured by the DSTI ratio.4

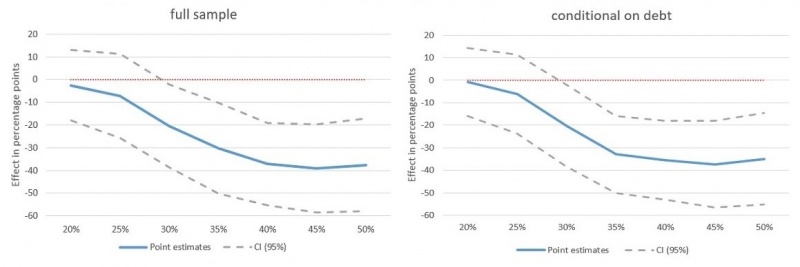

We then explore the possibility that the effect of indebtedness on consumption occurs in a non-linear way. This further allows us to quantify the critical level of debt. Finding this critical level of indebtedness can also be interesting from a policy perspective as only a few euro area countries impose legal limits on macroprudential instruments such as the DTA or the DSTI (Lang et al., 2020). To try and find this critical level, we create an overindebtedness indicator that classifies a household as overindebted when its DSTI ratio exceeds a certain threshold.5 We then vary this threshold to see at what level indebtedness becomes critical. Figure 2 shows the effect found for the overindebtedness indicator when we vary the thresholds form 20% to 50% by steps of 5%.

Figure 2: Effect of the overindebtedness indicator for varying thresholds

Note: The two graphs plot the coefficients (solid blue line) and confidence intervals at 95% (grey dashed line) obtained for the different thresholds on both the full sample and conditional on debt; The confidence intervals were computed using a set of 1000 replicated weights constructed by bootstrap replication.

It appears, from Figure 2, that the negative effect found is significant at the 95% level as soon as the threshold becomes greater or equal to 30%. For a threshold set at 30%, highly indebted households have a consumption growth 20.5 percentage points lower than households without debt. In monetary value, this means that highly indebted households ended up with a consumption of food at home per person reduced by almost 70€. This reduction is larger when considering 35% as the threshold and amounts to 104€ less per month (or a growth 30.6 percentage points lower). The results are similar when we consider only indebted households (right part of Figure 2). Note that this magnitude of the effect in absolute value is confirmed when we take the simple difference of consumption levels as a dependent variable rather than consumption growth.

The effects found above are substantial, even more so as we are only considering the consumption of food at home, a type of consumption, as explained above, that should be quite inelastic. Therefore, we expect the effect to be in the same direction and potentially greater for total consumption.

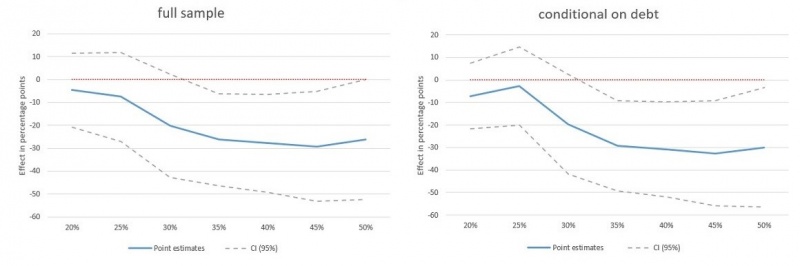

Household debt in Belgium is mainly composed of mortgages and this share has been increasing over the years (Du Caju et al., 2014). However, we do not know whether our results can truly be attributed to mortgages. We therefore investigate whether the effect found also holds when considering only mortgage debts.

Figure 3 shows the results of the estimation when considering only mortgage debts. We directly see that the results, although they are significant at lower levels of confidence, are similar to those found when considering all debts. The critical level of indebtedness appears to be 30%, even when considering only mortgage debts. The broader size of the confidence intervals could simply be due to the reduction of the sample size when considering only mortgage debts. This result seems to indicate that households end up facing some trade-off between housing and consumption.

Figure 3: Effect of mortgage debt for varying thresholds

Note: For those graphs, only mortgage debts were considered; The confidence intervals were computed using a set of 1000 replicated weights constructed by bootstrap replication.

Having found a negative effect of indebtedness on consumption, we verify whether this effect holds for specific types of households. For this purpose, we define categories of households depending on three dimensions: income, work status, and level of education. For income, we divide our sample into three terciles that we will call ‘poor’, ‘middle’, and ‘rich’. For the work status, 3 categories are created, based on the work status of the reference person: the employed and self-employed, the retired, and the unemployed and others. Finally, for the level of education, our sample is divided into three groups according to the educational attainment of the reference person: primary or no education, secondary, and tertiary. We then perform the non-linear analysis exposed above interacting the overindebtedness indicator with each category of the three dimensions.

Poor households, households whose reference person is unemployed and households in which the reference person has a lower level of education are found to suffer larger impacts of indebtedness on their consumption and for lower levels (thresholds) of DSTI ratio. This seems to indicate that the trade-off faced by households between housing and consumption might be more prevalent for more fragile households.

When confronting the results with the theoretical literature, we find that the life-cycle/permanent income (LP-CI) model is backed up by our data for indebtedness levels that are reasonable, but not for high levels. These results are in line with models that explicitly include a debt limit such as the one developed by Eggertsson and Krugman (2012). They also seem to point towards an effect linked to the liquidity of the households, which thus supports models such as the one developed by Kaplan et al. (2014).

Policy implications would include monitoring households’ indebtedness more closely, even in the absence of negative shocks on their assets. Such monitoring is not present in most of the euro area countries as only a few countries impose limits on the DSTI ratio. Setting up a limit at 30% on the DSTI ratio may appear as the most natural implication, given our initial finding. However, the results obtained for the different types of households put some nuance to this: as homeownership can be seen as a stepping stone out of poverty, limiting the poor’s access to credit could further trap them in poverty. A solution could therefore be an enforced limit to the DSTI ratio, combined with a housing policy targeted at fragile households. Such a policy should aim to help poor households to become homeowners without having to reduce their food consumption.

Andersen, A., Duus, C., & Jensen, T. (2014). Household debt and consumption during the financial crisis. Danmarks Nationalbank Working Papers No. 89.

Bunn, P., & Rostom, M. (2015). Household debt and spending in the United Kingdom. Bank of England Staff Working Paper No. 554.

Cecchetti, S., Mohanty, M., & Zampolli, F. (2011). The real effects of debt. BIS Working Paper No. 352.

Du Caju, P., Roelandt, T., Van Nieuwenhuyze, C., & Zachary, M. D. (2014). household debt: evolution and distribution. National Bank of Belgium Working Papers No. 397.

Du Caju, P., Périlleux, G., Rycx, F., & Tojerow, I. (2021). A bigger house at the cost of an empty fridge? The effect of households’ indebtedness on their consumption: Micro-evidence using Belgian HFCS data. NBB Economic Review, 61–80.

Dynan, K. (2012). Is a household debt overhang holding back consumption? Brookings Papers on Economic Activity, 2012(1), 299-362.

Eggertsson, G. B., & Krugman, P. (2012). Debt, deleveraging, and the liquidity trap: A Fisher-Minsky-Koo approach. The Quarterly Journal of Economics, 127(3), 1469-1513.

Friedman, M. (1957). The permanent income hypothesis. In A theory of the consumption function (pp. 20-37). Princeton University Press.

Jordà, Ò., Schularick, M., & Taylor, A. (2013). When credit bites back. Journal of Money, Credit and Banking, 45(s2), 3-28.

Kaplan, G., Violante, G. L., & Weidner, J. (2014). The Wealthy Hand-to-Mouth. Brookings Papers on Economic Activity, 2014(1), 77-138.

Kukk, M. (2016). How did household indebtedness hamper consumption during the recession? Evidence from micro data. Journal of Comparative Economics, 44(3), 764-786.

Lang, J. H., Pirovano, M., Rusnàk, M., & Schwarz, C. (2020). Trends in residential real estate lending standards and implications for financial stability. Financial Stability Review, 1.

Mian, A., Rao, K., & Sufi, A. (2013). Household balance sheets, consumption, and the economic slump. The Quarterly Journal of Economics, 128(4), 1687-1726.

Modigliani, F., & Brumberg, R. (1954). Utility analysis and the consumption function: An interpretation of cross-section data. Post Keynesian Economics, 388-436.

Most of the previous studies focus on countries in which households suffered from a strong negative shock on their assets, such as a sharp decline in the housing prices.

We perform an instrumental variable analysis, to ensure that our results do not suffer from an endogeneity bias. We propose, for this analysis, an instrument that is new in the literature.

We further claim that finding an effect that is more prevalent for the DSTI ratio could point towards an effect linked to the liquidity of the households.

We focus on the DSTI given our results in the linear case exposed in Figure 1. Results that showed that only the DSTI ratio had a significant impact on households’ consumption in our case.