This policy brief is based on “A disorderly transition with risks of delay”, included in Capital Market Assumptions 2024, April 2024, Amundi Asset Management. The views expressed are those of the authors and not necessarily Amundi Asset Management S.A.S.

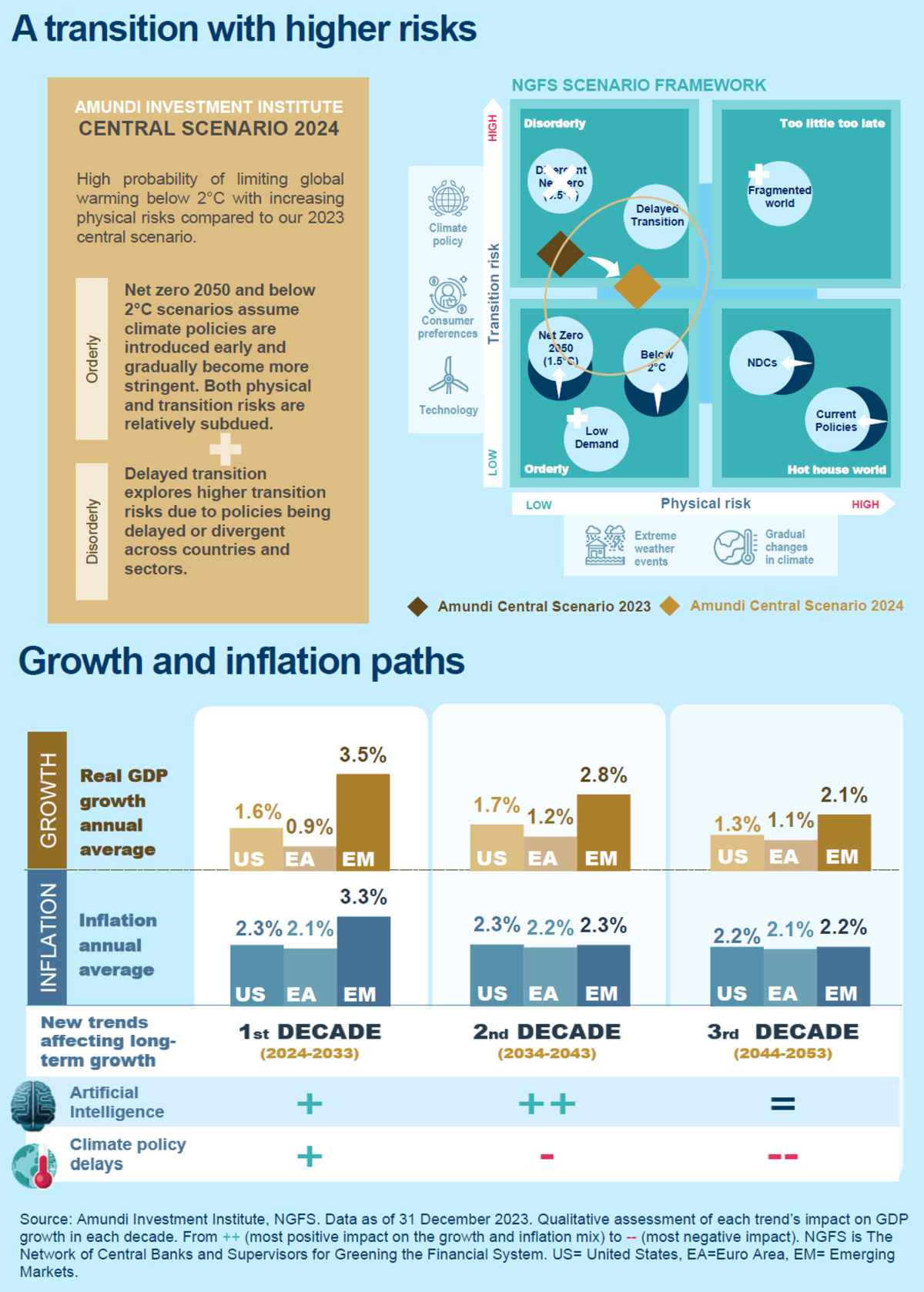

Since 2022, when we started to factor energy transition pathways into our long-term economic assumptions, three major themes have prompted adjustments to our central scenario.

First, climate change has been accelerating at a time when the implementation of climate policies is being delayed. Last year was the hottest on record and January 2024 marked the first 12-month period in history when temperatures exceeded an average 1.5°C of warming (above pre-industrial temperatures)1. Second, the Russia-Ukraine conflict and rising geopolitical tensions in the Middle East have made the trajectory of the transition more disorderly. Resurgent nationalism, concerns regarding competitiveness and security, and regional conflicts are pushing countries to increasingly focus on domestic issues. Third, the adoption of Artificial Intelligence (AI) is becoming a relevant theme with potential long-term impacts on the global economy.

Therefore, we have revised our central scenario to capture these changes. In particular:

‘Our central scenario combines orderly and disorderly transition pathways to account for a world characterised by geopolitical fragmentation and lower commitments from some countries.’

Our central scenario has some important macro implications:

Based on global surface air temperature according to the latest Climate Bulletin of the Copernicus Climate Change Service.

We have also included part of the ‘Rocky Road’ Shared Socioeconomic Pathways (SSPs3), defined in the IPCC Sixth Assessment Report on climate change in 2021.