The views expressed are those of the authors and do not necessarily reflect those of the Federal Reserve Bank of San Francisco or those of the Banque de France or the Eurosystem.

The natural rate of interest, commonly known as r-star, is a key variable used to judge the stance of monetary policy. In this Brief, we present a novel euro-area estimate based on a dynamic term structure model estimated directly on the prices of bonds with cash flows indexed to the euro-area harmonized index of consumer prices with adjustments for bond-specific risk and real term premia. Despite a recent increase, our estimate indicates that the natural rate in the euro area has fallen about 2 percentage points on net since 2002 and remains negative at the end of our sample. We also devise a related measure of the stance of monetary policy, which suggests that monetary policy in the euro area remains restrictive as of July 2024, and significantly so by historical standards.

The natural rate of interest, widely known as r-star, is a key variable in finance and macroeconomic theory. For investors, the equilibrium level of the real short rate serves as a benchmark for projections of the future discount rates used in valuing assets. For policymakers and researchers, the natural rate of interest is a valuable neutral benchmark to calibrate the stance of monetary policy: monetary policy is expansionary if the short-term real interest rate lies below the r-star and contractionary if it lies above. A good estimate of the equilibrium real rate is also essential to operationalize popular monetary policy rules such as the Taylor rule. For fiscal policy, the equilibrium real rate of interest is instrumental to assessing the future sustainability of public finance.

Before the pandemic, interest rates around the world had fallen significantly for several decades, sparking policy debates about bond market conundrums, global saving gluts and secular stagnation. This persistent decrease led to a consensus about a lower new normal for interest rates. More recently, the post-pandemic spike in interest rates globally has given rise to intense policy debates about whether interest rates will hold steady at the new higher levels or revert towards their pre-pandemic lows. Unfortunately, despite its importance, r-star is not directly observable; instead, it has to be inferred from economic data, leading to much uncertainty about its level.

We revisit this issue and offer a euro-area perspective using a finance-based model estimated directly on the universe of prices of French OAT€ bonds since 2002. Specifically, we propose to estimate the natural rate of interest in the presence of market risk and real term premia by using an arbitrage-free dynamic term structure model of real yields that accounts for bond-specific risk premia. In our setup, r-star is the 5y5y forward average expected real short rate. At this horizon, we expect all transitory shocks to have dissipated; hence, this measure ought to be well positioned to capture persistent trends in the natural real rate. Focusing on French governments bonds indexed to euro-area HICP comes with several advantages. First, France has deep and liquid markets for government debt. Second, with maturities of up to 33 years, the OAT€ market contains the farthest forward-looking information among all the inflation-indexed bond markets in the euro area and hence is likely to provide the clearest evidence for the question at hand. Third, by relying on inflation-indexed bonds, we avoid any issues related to the effective lower bound that applies to the ECB’s policy rate and other nominal interest rates.

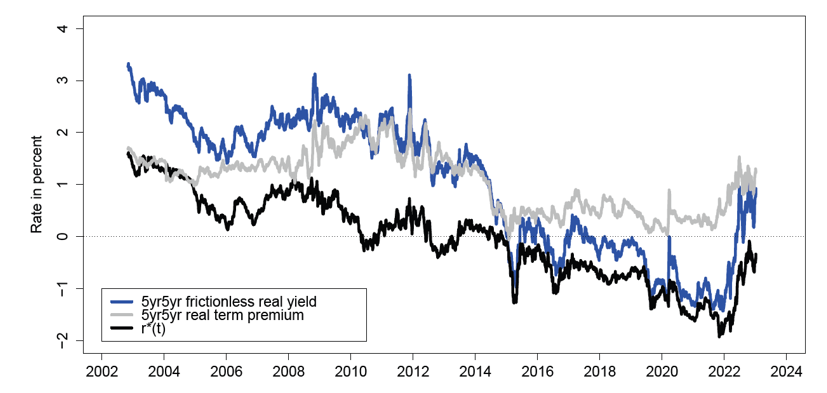

Our preferred estimate of the natural rate of interest is depicted in Figure 1 along with the 5y5y forward frictionless real yield (i.e., the real yield purged for bond-specific risk) and the real term premium. Forward real yields in the euro area trended down during the 2002-2021 period, and the fact that so did nominal yields suggests little net change in inflation expectations or the inflation risk premium during that 20-year period. The estimated equilibrium real rate fell from above 1.5 percent to below -1.5 percent by the end of 2021, before retracing some of that decline during 2022, while the real term premium has pronounced countercyclical variation but no long-term trend. Our results show that more than 75 percent of the 4-percentage-point decline in longer-term yields by the end of 2021 represents a reduction in the natural rate of interest. Our model estimates also indicate that about 75 percent of the interest rate increases the past year reflect increases in the natural rate of interest. However, model projections suggest that the natural rate of interest is likely to revert only very gradually towards its old mean in the years ahead. Thus, policy rates in the euro area may return to levels close to the effective lower bound once the economy moves past the current spell of high inflation.

Figure 1. 5y5y real yield decomposition into our estimate of r-star and a real risk premium

Note: Our model provides us with a 5y5y forward frictionless real yield, which we further decompose into an estimate of r-star and a 5y5y real term premium; see Christensen and Mouabbi (2024) for details.

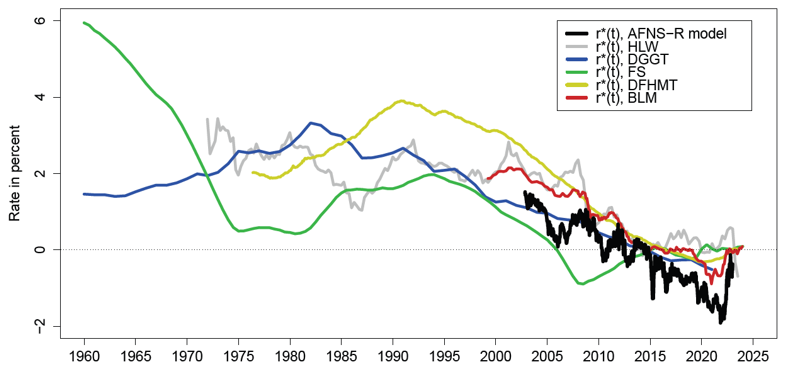

In Figure 2, we compare our r-star estimate to other macro-based and finance-based estimates from the literature. All considered measures suggest that r-star in the euro area has declined notably the past 20-30 years and remain close to zero at the end of our sample, despite the recent sharp increases in long-term interest rates in the euro area and other major advanced economies. Interestingly, we also compare our euro-area measure to the U.S. market-based estimate reported by Christensen and Rudebusch (2019), which uses solely the prices of U.S. TIPS. These two market-based estimates of the natural rate have a high positive correlation and similar downward trend. Moreover, they share the common feature that their most pronounced declines over the past two decades occurred before and after, but not during the GFC. These findings suggest that the factors depressing U.S. and euro-area interest rates are likely to be global in nature and are not particularly tied to developments surrounding the GFC.

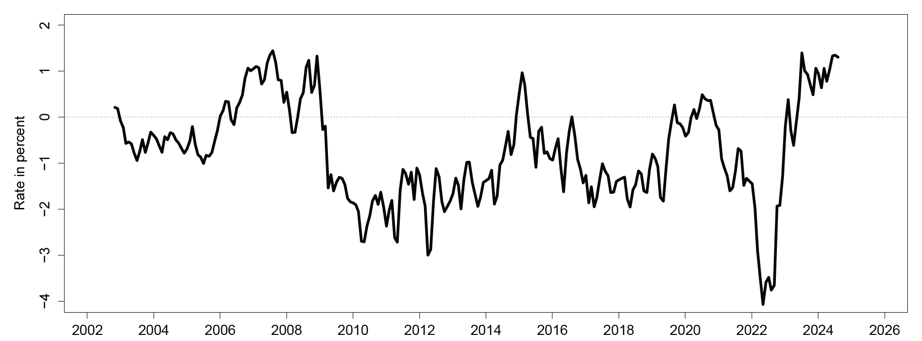

As a separate contribution, we use our model to devise finance-based measures of the stance of monetary policy by deducting our r-star estimate from observed measures of one-year real yields in the euro area. We consider this measure to be a reasonable proxy for the theoretically ideal, but unobserved, instantaneous real short rate appearing in textbook formulas of the stance of monetary policy measured as the gap between the current short-term real rate and its long-term equilibrium level. As shown in Figure 3, our results indicate that monetary policy remains restrictive as of July 2024, and significantly so by historical standards. The updated results also underscore the usefulness of our approach for real-time policy analysis.

Figure 2. Comparison with macro-based estimates of r-star in the literature

Note: We compare our r-star measure (in black) to several extant measures of r-star in the literature (for more details, refer to Christensen and Mouabbi, 2024). HLW, DGGT, FS, DFHMT and BLM respectively refer to the r-star measures reported in Holston et al. (2017), Del Negro et al. (2019), Ferreira and Shousha (2023), Davis et al. (2024) and Brand et al. (2024).

Figure 3. Stance of monetary policy

Note: Our model allows us to compute a finance-based measure of the stance of monetary policy by deducting our r-star estimate from the one-year fitted real yield in the euro area. Our model can be updated in real time, thus this estimate reflects our measure of the monetary policy stance up to July 2024.

Brand, Claus, Noemie Lisack, and Falk Mazelis, 2024, “Estimates of the Natural Interest Rate for the Euro Area: An Update,” European Central Bank, Economic Bulletin Issue 1.

Christensen, Jens H. E. and Sarah Mouabbi, 2024, “The Natural Rate of Interest in the Euro Area: Evidence from Inflation-Indexed Bonds,” Working Paper Series 2024-08, Federal Reserve Bank of San Francisco.

Christensen, Jens H. E. and Glenn D. Rudebusch, 2019, “A New Normal for Interest Rates? Evidence from Inflation-Indexed Debt,” Review of Economics and Statistics, Vol. 101, No. 5, 933-949.

Davis, Josh, Cristian Feunzalida, Leon Huetsch, Benjamin Mills, and Alan M. Taylor, 2024, “Global Natural Rates in the Long Run: Postwar Macro Trends and the Market-Implied r* in 10 Advanced Economies,” Journal of International Economics, Vol. 149, 103919.

Del Negro, Marco, Domenico Giannone, Marc P. Giannoni, and Andrea Tambalotti, 2019, “Global Trends in Interest Rates,” Journal of International Economics, Vol. 118, 248-262.

Ferreira, Thiago R. T. and Samer Shousha, 2023, “Determinants of Global Neutral Interest Rates,” Journal of International Economics, Vol. 145, 103833

Holston, Kathryn, Thomas Laubach, and John C. Williams, 2017, “Measuring the Natural Rate of Interest: International Trends and Determinants,” Journal of International Economics, Vol. 108, 559-575.