Gillman expresses appreciation for funding from the UMSL Hayek endowment fund, a grant and Senior Research Fellowship CIAS Budapest, and a Visiting Scholar Fellowship from the Bank of Finland; forthcoming Summer 2024 in The Journal of Human Capital.

We contribute an alternative explanation of business cycles using human capital investment as a second sector tied down with accounting methods. Inputs of education expenditure and tertiary student time in this sector enable explanation of a broad set of business cycle moments. A challenge difficult to meet in the one-sector models, the labor time share, labor productivity, and consumption are jointly well-explained. With the goods sector less human capital-intensive, human capital deepening occurs during contractions, while expansions see physical capital deepening in the goods sector. The external margin from human capital investment clarifies conflicting estimates of the labor elasticity. We explain policy implications of solving these RBC riddles.

An enduring problem in the real business cycle (RBC) literature has been to explain simultaneously the procyclical comovement of consumption with output along with the procyclical comovement of labor with output. The one-sector RBC model has been extended gradually to address this problem. In particular, an extensive labor margin was added in a long variety of ways that enabled a switch of labor to and from the market sector. Hansen (1985) was one of the earliest such papers allowing an all or nothing choice of being in the labor market (“indivisibility”). As Hansen put it: “Equilibrium theories of the business cycle, such as Kydland and Prescott (1982) or Lucas (1977), have been criticized for failing to account for some important labor market phenomena.” After the one-sector models, two-sector models began to address this by adding a second non-market “household” sector that engaged in some activity that was produced and then consumed; they showed that this to and fro from the household sector improved RBC model ability to match correlations of labor with output.

We approach the problem in this paper by saying that what is produced in the household sector is human capital investment, as indeed one might envision all such family life as endeavoring towards. Many other two-sector models have emerged with human capital investment as the second sector, including extensions using the prominent Lucas (1988) generalization of the Solow model of technological advance through the added human capital investment sector. Rather than assuming a fixed exogenous trend up in productivity in the market sector as in the Solow model, Lucas explains technological advance through the stationary household choice of the growth rate of human capital (with the productivity parameter in goods production held constant). Progress occurs because goods sector productivity as factored by the human capital stock grows at the rate of human capital, which grows at the same rate as output, consumption and physical capital investment along the balanced growth path.

The problem with using this as a model for RBC work is that the inputs into the human capital investment sector seem difficult to tie down with a production technology based in national account data sources, as has been pioneered in the alternative intangible capital RBC approach, for example McGrattan (2020). Typically much related work simply leaves these second sector inputs to a residual from their calibration. The challenge using human capital is whether a well-defined human capital sector model would work to explain RBC facts comprehensively, and what would be the research and policy implications of such success.

McGrattan (2020) views human capital as “intangible capital” owned partly by the household. However, instead we take human capital investment production from an aggregate point of view and consider the two main elements in education: Education expenditure by an economy and the amount of time that tertiary students put into studying. Albeit these inputs do not include time spent by households in childcare and raising children, but they are quantifiable using data. This means that we are able to “tie down” the specification of the human capital investment sector using well-respected NIPA and Current Population Survey data. For the former, we use the NIPA education expenditure which starts in 1997; for the latter we use the student time allocation starting in 1970.

With the first hurdle met of a well-defined human capital investment sector, we then investigate whether this model is able to explain the key RBC facts. The intangible capital approach explains procyclical labor but does not present the typical RBC “second moments” that show the correlation and volatilities of the variables with output in the simulated model as compared to the actual business cycle filtered data. We do include all of these moments and we show that the model performs exceedingly well in explaining the puzzles of labor comovement while capturing the traditional comovement of consumption and physical capital investment that the one-sector model achieves. This is the main contribution of the paper. We jointly explain the RBC second moments for both labor and other variables for the first time in a comprehensive approach.

The other key ingredient is that we allow include a productivity shock to the human capital investment sector along with the traditional RBC productivity shock to the goods sector. These shocks are similar to how a productivity shock is added to the household production second sector of that literature. However, since it is a shock to human capital investment, which in turn determines the endogenous growth rate of the economy, this added productivity shock causes an increase in the level of human capital and in the permanent income of the consumer. This causes consumption to move up by more through the increase in permanent income, in an extension of the permanent income hypothesis of consumption that is built into the dynamic stochastic general equilibrium model, ever since Ramsey (1928) revolutionized micro-founded macroeconomics and its rational expectations extensions. As productivity rises in the goods sector first, the household reallocates time shares from human capital investment into market goods sector production. This makes labor procyclical with consumption and output, and dynamically shifts resources between the two sectors. Education expenditure and student time are countercyclical in both data and model due to the extensive labor margin of the human capital investment sector.

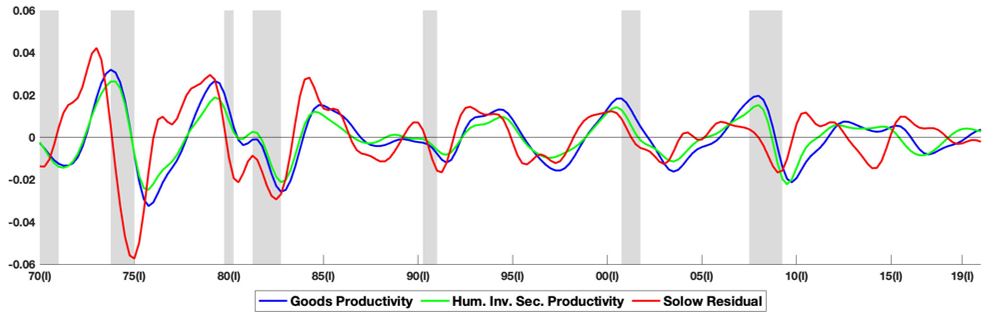

When the human capital investment productivity is shocked upwards, given a lesser variance than the goods sector shock while positively correlated with the goods sector shock, it eventually causes resources to shift back towards the human capital investment sector. During recessions the education expenditure and student time rise, while both fall during expansions. Figure 1 shows the two productivity shocks (goods sector in blue, human capital investment sector in green) that we back out historically, as compared to the alternate, standard, Solow residual shock (red). As in the intangible capital approach, our productivity shock more closely matches the turning point in the dated NBER business cycle recessions for key episodes. After 2008, our two shocks better explain the slow rebound, and how it only somewhat exceeds the long term trend, as compared to the Solow shock estimate that we do not otherwise use.

Figure 1: Goods Sector TFP and Human Capital Investment Productivity Shock versus Solow Residual, 1970Q1-2019Q4.

A corollary contribution is that we find both a stationary wage elasticity of labor supply consistent with microeconomic estimates, and a large dynamic wage elasticity in response to the productivity shock. This resolves a long-standing differential in the one-sector macro model wage elasticities and the micro estimates, while showing a strong shock response of the extensive labor margin in shifting resources between sectors. We find a steady state wage elasticity at one-half as in micro estimates and a dynamic shock wage elasticity of five, a high magnitude that has been emphasized for RBC models to work well.

Altogether, we tie down our human capital sector with data, explain the main RBC facts including labor ones, and offer a resolution of differences reported between macro and micro estimates of the labor supply wage elasticity. We also show by extension, and for the first time, that the model explains the RBC second moments of the main component shares of both the GDP and the GDI sides of the NIPA data.

The policy implications arise from the original research agenda of the RBC literature: to explain cycles with productivity and without government policy. Furthering this agenda by nailing down several outstanding issues, we can readdress policy in the RBC light. Rather than stabilization policy by which the government can eliminate recessions as in the older literature, productivity explains cycles regardless of government policy that actually existed. Government policy enters the conversation in such a paper as ours through several channels. First, it can efficiently raise human and physical capital investment in ways that the private economy cannot accomplish due to “incomplete markets” that do not span all the risk possibilities. Broad social insurance policy by the government includes insuring against aggregate risk to employment, health, banking insurance and a host of other possible policy options that can be and have been set in the RBC framework. Efficiently financing and designing these social insurance programs creates more net wealth, permanent income and consumption for the aggregate economy, while by their nature promising less inequality of outcome.

Given a comprehensive RBC explanation of business cycles, research and policy can continue to focus on each social insurance program to design those that “span” markets best with the least amount of “moral hazard.” Moral hazard results if the policy itself increases the risk of the bad state of affairs, such as more unemployment through permanent unemployment benefits. A perfect social insurance program leaves incentives undistorted, without an increase in the probability of the bad state and without moral hazard. Striving towards this requires risk-based “premiums” to be built into social insurance policy, such as the risk-based deposit insurance premium of the FDIC since its 2006 reform law.

The goal, once we can explain cycles in broad outline through productivity shocks, is to improve on welfare through well-designed social insurance policy in every realm in which the government engages. All government policy could be viewed as part of a social insurance policy platform. Defense, police, health, unemployment, banking and also monetary policy. Extension of our RBC model to include money is one area on which we are working. A high-yield, low-risk monetary policy is one with a low, stable inflation tax that minimizes the inflation risk premium, lowers real interest rates, and minimizes the moral hazard of government induced financial fragility. This allows more long-term investment and growth.

In contrast, an inefficient monetary regime with low-yield and high-risk might be viewed as one engaging in ad hoc ex-post banking insurance policy after a crash that causes higher, more variable money supply growth and inflation, higher inflation tax premiums, lower investment and growth, and greater financial fragility with increased moral hazard of greater banking risk. For example, to improve we need to design a better system-wide financial intermediation ex-ante insurance scheme for the entire financial sector so that monetary policy need not ad hoc try to compensate for its lacking. In particular, allowing expansion of FDIC risk-based premium insurance to any financial intermediary, on an open invitation basis, for any amount of insured deposits (with a rising rate as the amount of coverage increases), and extending that system ultimately to an international platform may best minimize systemic financial insolvency, illiquidity, and global financial fragility.

Hansen, Gary D., 1985. “Indivisible labor and the business cycle,” Journal of Monetary Economics, vol. 16(3, Nov.), pp. 309-327.

Lucas, R. E., Jr., 1988. “On the Mechanisms of Economic Development,” Journal of Monetary Economics, vol. 22(1), 3-42.

McGrattan, E. R., 2020. “Intangible capital and measure productivity,” Review of Economic Dynamics, vol. 37, 5147-5166.

Ramsey, F. P., 1928, “A Mathematical Theory of Saving,” The Economic Journal, Vol. 38, No. 152 (Dec.), pp. 543-559.