Abstract

We introduce a new method to identify output growth accelerations based on the weighted average of both the long-term trend and volatility of a country’s output growth, instead of one-size-fits-all filters for output growth. Based on a sample of 181 countries between 1951 and 2023, we identify 134 growth accelerations across 110 countries. During these periods, real GDP per capita growth averages 5.9 percent per annum, more than six times higher than in other years. The average duration of growth accelerations is 13.4 years, significantly longer than the commonly assumed eight-year duration in the literature. Initial conditions, contemporaneous domestic and external economic conditions all matter for the continuation of an acceleration, while changes in any single policy condition have less of an impact.

Traditionally, scholars have analyzed long-term output trends to understand the factors behind differing growth patterns across countries. Focusing on long-term growth averages, however, assumes a stable linear relationship between growth and its fundamentals suitable for all countries in all economic conditions. This assumption is flawed because countries rarely maintain constant growth rates over long periods. Instead, growth patterns are typically volatile, with countries experiencing phases of progress, stagnation, and setbacks (Pritchett, 2000).

Recognizing the inadequacy of traditional long-term trend analysis owing to the volatile nature of growth rates, researchers have shifted towards investigating specific episodes of rapid and sustained growth, also known as growth accelerations (Hausmann et al., 2005; Jong-A-Pin and de Haan, 2011). The significance of studying growth accelerations can be motivated from various economic perspectives. For instance, countries may undergo a rapid upsurge in output growth only to revert to their prior growth trajectories, often due to transient shocks that temporarily bolster growth performance (as per neoclassical growth theory). Conversely, some countries may transition to a permanently higher growth path, driven by enhanced economic policies, for example (as viewed from an endogenous growth model perspective). Regardless of the theoretical framework used, episodes of accelerated growth reflect the most interesting variation in growth data, which would be obscured when considering long-term averages. By linking the timing of these episodes to driving forces, scholars can gain deeper insights into the causal mechanisms behind variations in growth performance.

Hausmann et al. (2005) laid the groundwork for the empirical examination of growth accelerations. To identify such accelerations, they propose a set of fixed growth thresholds and criteria that identify periods with a high level of growth sustained for a relatively long period. These criteria have garnered widespread adoption in empirical studies as a useful benchmark for identifying growth accelerations.

However, the approach of Hausmann et al. (2005) has several drawbacks. For instance, as their criteria are based on periodic averages, the filter risks identifying periods with sporadic high growth interspersed with low or negative growth, contradicting the aim of identifying periods with sustained high output growth. Moreover, the use of ad hoc criteria may lead to errors in assessing growth performance due to variations in output growth volatility, potentially resulting in under-identification of growth accelerations in less volatile economies and over-identification in more volatile ones.

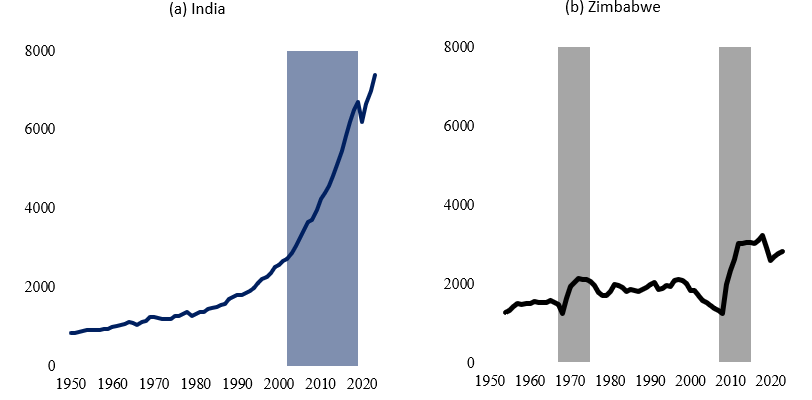

To examine the issues with the use of uniform economic criteria to identify growth accelerations in more detail, Figure 1 shows real GDP per capita for India and Zimbabwe since the 1950s. India is one of the world’s fastest-growing economies in recent decades. In stark contrast, Zimbabwe’s economy has been fraught with challenges, including hyperinflation, currency crises, debt distress, and political turmoil. By 2023, India’s real GDP per capita was over two and a half times that of Zimbabwe ($7,379 versus $2,811), even though both countries had comparable per capita incomes in the early 1990s. Clearly, India’s growth experience has significantly outperformed that of Zimbabwe over the period under consideration.

To understand growth performance, it is crucial to explore what factors significantly contributed to India’s success compared to what hindered Zimbabwe’s progress. However, the criteria commonly used in the literature to identify growth accelerations fall short in this context. Despite India’s impressive growth performance since the early 1990s, the filter proposed by Hausmann et al. (2005) does not identify any acceleration during this period. Specifically, India never experienced a two-percentage point uptick in growth sustained over eight years. This highlights the difficulty of the filter in detecting sustained, steady growth episodes in countries with generally stable growth patterns.

Figure 1. Real GDP per capita (in 2017 USD) in India and Zimbabwe and the identified growth accelerations using the Hausmann et al. (2005) criteria (grey) and our criteria (blue)

Notes: The dark gray area represents the periods identified as growth accelerations according to the criteria outlined by Hausmann et al. (2005). The approach of Hausmann et al. (2005) does not identify growth accelerations for India. Our method identifies a growth acceleration for India from 2003 to 2019 (in blue), disrupted by the onset of the COVID-19 pandemic. For Zimbabwe, we do not identify growth acceleration episodes.

In contrast, their filter identifies two growth accelerations for Zimbabwe, starting in 1968 and 2008. Although these periods saw sharp increases in GDP per capita, these surges turned out to be short-lived, driven by one or two years of strong growth, and preceded by significant economic downturns. As a result, real GDP per capita did not show substantial increases relative to earlier periods. More so, these findings reflect the economic volatility experienced by Zimbabwe rather than genuine growth accelerations.

The filter we propose is based on the weighted average of both the long-term trend and volatility of a country’s output growth, capturing unique growth patterns to identify growth accelerations. Furthermore, our criteria do not impose a fixed time frame, allowing for analyses of the duration of growth accelerations. When applying our filter to the data, a growth acceleration is identified for India from 2003 to 2019, disrupted by the onset of the COVID-19 pandemic. For Zimbabwe, we do not identify growth acceleration episodes.

The filtering technique starts with calculating country-specific metrics based on the mean and the standard deviation of a country’s real GDP per capita growth over the full sample period. The mean controls for the country’s long-term trend in real GDP per capita growth, while the standard deviation captures its volatility. In our baseline, we assign equal weights to the mean and the standard deviation. After having calculated this metric for each country, we identify acceleration episodes using the following criteria:

These criteria are necessary to ensure that the identified episodes are sustained and that they capture accelerated real per capita output growth. While the first criterion allows the episode length to vary, the second one makes sure that the identified episodes are sustained and less influenced by cyclical movements. The third criterion is crucial to avoid the premature ending of a growth acceleration when real GDP per capita growth temporarily dips while the trend is still strong. For example, in nearly half of the cases with a temporary dip, real GDP per capita growth does not deviate more than 25 percent from the calculated threshold in the year it falls below the threshold. Finally, the last criterion is needed to minimize the inclusion of pure cyclical rebounds.

Based on a sample of 181 countries between 1951 and 2023, we identify 134 growth accelerations across 110 countries. During these periods, real GDP per capita growth averages 5.9 percent per annum, more than six times higher than in other years. The average duration of growth accelerations is 13.4 years, significantly longer than the commonly assumed eight-year duration in the literature. Out of the 134 accelerations, 98 lasted ten years or longer. A considerable number even spanned fifteen years or more, such as those in the Republic of Korea and Taiwan between the 1960s and the 1990s, in several Western European countries and Japan between the 1950s and the 1970s, and more recently in Bangladesh and Vietnam.

While our proposed filter yields a smaller number of growth accelerations compared to prevalent methods, the share of country-year observations in an acceleration is substantially higher. Although global trends in growth accelerations are similar under all filtering methods, notable differences emerge across different regions and country groups. Specifically, we identify a larger number of sustained growth accelerations among advanced economies and among emerging market and developing economies in specific regions such as South Asia and East Asia and the Pacific, whereas fewer accelerations are observed in volatile economies.

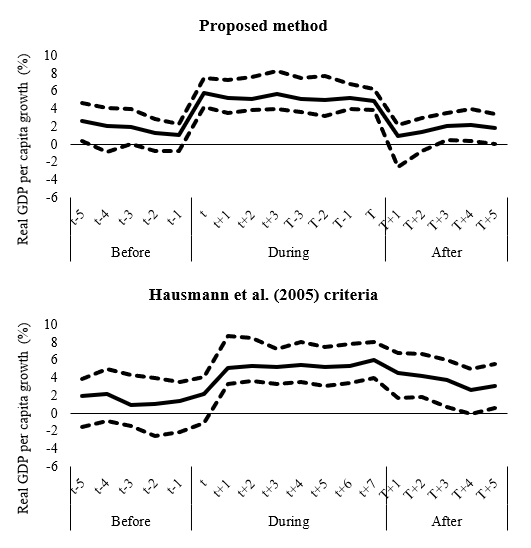

A range of statistics demonstrates the benefits of our method to identify growth accelerations. As shown in Figure 2, the episodes identified by our proposed filter are characterized by a significant upswing in median real GDP per capita growth at the beginning (i.e., year t) of the identified growth spells and a clear dip at the end (i.e., year T). This pattern, however, is not clear in the growth accelerations identified using other methods. For instance, under the Hausmann et al. (2005) criteria, growth only rises moderately in the first year of the identified acceleration episodes and remains elevated in the years after the episodes. This result raises concerns about the accuracy of the endpoints of the growth accelerations identified using those methods that fixed the duration of growth accelerations.

Figure 2. Median real GDP per capita growth before, during, and after output acceleration episodes

Notes: The solid line shows the median of real GDP per capita growth in the years before, during, and after output accelerations. The dashed lines show the 25-percentile and the 75-percentile of real GDP per capita growth. Year t is the first year of the growth acceleration, while year T refers to the final year (which is the same as year t+7 for the conventional approaches). Hence, year t-1 captures the final year before the start of a growth acceleration, whereas year T+1 reflects the first year after the termination of a growth acceleration.

Furthermore, through a series of country case studies, we find that the method we propose aligns closely with anecdotal evidence in acceleration patterns. For instance, in the case of India, we identify a prolonged spell from 2003 to 2019. We show that the method is robust to the use of alternative weights, various minimum-length requirements, rolling windows, and reduced sampling to calculate the thresholds.

To illustrate the advantages of our proposed filter, we run a series of survival analyses to understand what factors can help sustain an output acceleration. We find that initial conditions, contemporaneous domestic, and external economic conditions matter for the sustaining of an acceleration, while changes in policy conditions have less of an impact. The findings seem to suggest that having a stable macroeconomic environment matters more than one single policy reform for prolonging growth accelerations. The results are robust to the use of alternative policy measures, different distributional assumptions, and the use of alternative samples.

Our filter opens up several avenues for future studies. Currently, our understanding of what sustains growth accelerations remains limited. The factors triggering the start of a growth acceleration may differ from those vital for its continuity (Berg et al., 2012). Further research is urgently needed, especially considering that lower-income countries not only require growth accelerations but also need to maintain them over extended periods to stop falling behind other developing and advanced economies and resume convergence in per capita incomes.

Moreover, future research may leverage our approach to revisit the drivers of growth accelerations. Although previous papers have dealt with this issue, there is clearly no consensus about the factors that stimulate the initiation of growth accelerations. For instance, whereas Hausmann et al. (2005) claim that political reforms precede growth accelerations in contrast to economic reforms, de Haan and Jong-A-Pin (2011) report the opposite. Our filter not only identifies growth accelerations more strongly associated with rapid and sustained growth but also provides more reliable starting points for growth acceleration episodes than previous methods. Consequently, future research may shed new light on what initiates growth.

Last but not least, the filter enables further exploration of country differences in growth patterns. For instance, as we do not impose a fixed length, we also identify the end of growth accelerations more accurately. Future studies may focus on how growth performances differ across countries after accelerations.

Berg, Andrew, Jonathan Ostry, and Jeromin Zettelmeyer (2012). What Makes Growth Sustained? Journal of Development Economics 98, 149–166.

Gootjes, Bram, Jakob de Haan, Kersten Stamm, and Shu Yu (2024). Identifying Growth Accelerations. World Bank Policy Research Working Paper 10945.

Hausmann, Ricardo, Lant Pritchett, and Dani Rodrik (2005). Growth Accelerations. Journal of Economic Growth 10, 303–29.

Jong-A-Pin, Richard, and Jakob de Haan (2011). Political Regime Change, Economic Liberalization and Growth Accelerations. Public Choice 146, 93–115.

Pritchett, Lant (2000). Understanding Patterns of Economic Growth: Searching for Hills among Plateaus, Mountains, and Plains. World Bank Economic Review 14(2), 221–250