Disclaimer1

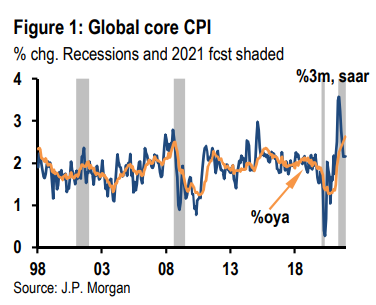

May CPI reports continued a string of upside surprises and highlighted the sharp and broad-based acceleration in global inflation. After falling to 1.1% last year, global CPI inflation roared back to 2.7% in the year ending in May, on par with the 2018-19 pace. The year-ago comparison is biased upward by last year’s collapse as prices fell 0.7% from March through May 2020. More relevant for the trajectory ahead, the global CPI has surged to a 4.5%ar since the start of the year. Behind this year’s acceleration are both the usual and the unprecedented. The doubling in crude oil prices over the past year matches the similar gain over the first two years of the last expansion. By contrast, core inflation usually moderates early in an expansion. Its rapid ascent this year has instead pushed its year-to-date pace to its fastest in over a quarter century (Figure 1).

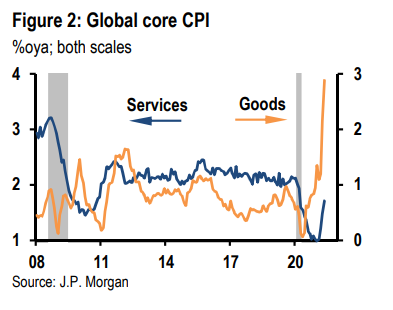

The unprecedented acceleration in core inflation can be tied to two pandemic-related developments short-circuiting the role elevated slack plays in the early stages of an expansion. First, the pandemic has upended the normal elasticity of global supply in manufacturing. When combined with the rotation in global demand over the past year toward goods, this has extended delivery times, creating shortages that are producing a spike in goods input and output prices (Figure 2). Second, the pandemic generated a rare and extreme downturn in global service sector activity, which depressed prices in sectors sensitive to mobility last year. Led by countries in which mobility is recovering earliest – the US and China – a move toward service sector price level normalization is pushing core inflation higher in normally sticky components of the price basket.

We have gradually incorporated these global pandemic dynamics into our outlook, which now sees global core inflation jumping to 2.6%oya this year. However, the power and breadth of global forces may still be underappreciated in a forecast that projects a sharp and quick deceleration of core inflation. Indeed, we expect inflation to settle back to a 2.2%ar during 2H21, consistent with its pre-crisis norm. The risk is that the pressures boosting inflation do not abate as quickly as assumed. Goods price pressures are likely to moderate, but only gradually from their recent record pace, as consumer demand is now accelerating and inventories look to have been drawn down further last quarter. More importantly, the rebound in services prices (which account for the lion’s share of the core basket) is in its early stages as mobility is expected to rise, rotating growth momentum toward services through the rest of this year. Against this backdrop, a normalization in the level of services prices could propel global core inflation to 3% or higher this year.

|

|

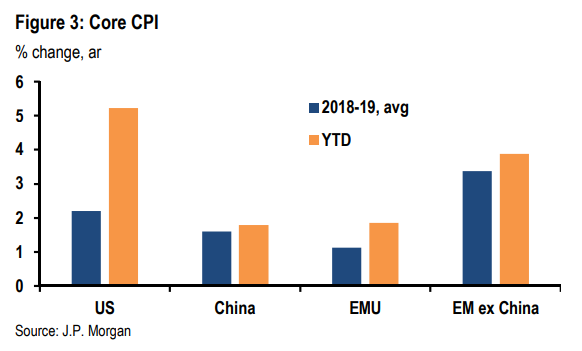

Given the US’s lead in the global recovery, it may provide a useful guide for developments elsewhere. Extrapolating the US signal on inflation would be very dramatic as year-to-date annualized core inflation has spiked to 5.2% (Figure 3). Although core inflation is tracking above the pre-pandemic pace elsewhere, the US has been exceptional for a number of reasons. First, US services prices have proven far more sensitive to the pandemic with the deceleration to a 1%oya pace in January, representing a full 2%-pt drop from pre-pandemic levels. Second, the US consumer has received an enormous boost from fiscal supports that enabled real consumer spending to retrace all of its slide from 4Q19 last quarter. By contrast, spending remained depressed elsewhere with Western European consumption down by roughly 10%. Finally, the unique features of the US labor markets and policy response have seen supply constraints extend to its labor markets, where supply-demand mismatches are boosting labor costs and household purchasing power. Nevertheless, while the magnitude of the US upswing should be tempered as a guide, the direction of upside surprises should not be ignored.

Although upward pressure on inflation is broad-based, there are wide variations in business cycle conditions. US GDP is rebounding smartly now, but employment remains depressed as the pandemic has generated a significant productivity boost. Western Europe appears to be joining the US growth boom this quarter, but the second-wave recession leaves activity well below pre-crisis norms. Outside North Asia, output gaps are even wider in EM with many economies in Asia and Latam poised to contract this quarter.

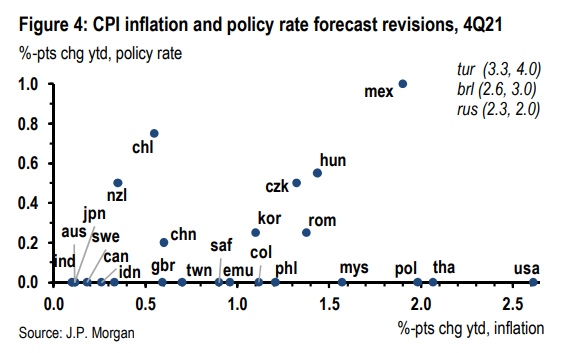

Although the cyclical backdrop is varied, central banks all need to address the challenge this year’s inflation spike poses. In the DM, there is little risk that higher inflation will prompt a near-term policy response, but it is likely to reinforce the move toward tapering balance sheets and shift the discussion on medium-term risk bias. In the EM, rate adjustments are underway and are likely to broaden beyond the high-yielders if our forecast for a strong 2H21 growth rebound is realized. However, we expect policy adjustments over the next year – both globally and in EM – to be remarkably modest given our inflation and growth forecasts (Figure 4).

With both headline and core inflation running well ahead of expectations this year, we now see 13 EM central banks hiking between now and 1Q22 – up from six at the start of the year. While an anticipated improving growth backdrop will be a welcome motivation for all, others will also react to rising inflation and credibility concerns. For now, robust global growth prospects across the region are sustaining capital inflows, allowing for an incremental path to normalization.

In Latin America, Brazil and Mexico both printed higher-than-expected May inflation readings this week. The outturns led us to revise our end-2021 inflation forecast for Brazil to 5.8% and reinforce upside risks to the 5.2% we see in Mexico. Brazil’s COPOM has already been hiking, and we and the market expect another 75bp next week. However, we look for a more hawkish shift in tone, with the COPOM probably removing the language around a “partial” normalization of monetary policy and playing up recent comments on its commitment to do whatever it takes to achieve the inflation target.

In Mexico, clear upside risks to growth and inflation likely concern the current board, and would reinforce our out-of-consensus call for 50bp tightening by year-end. However, this may be challenged by a shifting reaction function on a board whose composition is set to take a more dovish tilt, with the current finance minister already flagged as the eventual successor to the more hawkish current governor (whose term ends in December). In Chile, the recent 2Q Monetary Policy Report delivered clear guidance toward hikes amid upward revisions to 2021 GDP growth and inflation, while trend growth and neutral rates were revised lower. Thus we now expect 100bp of hikes by December, up from 50bp.

The impulse of rising inflation pressures on central bank policy calls is similarly pronounced across EMEA EM, including this week’s upside surprises for Hungary, Romania, Russia, Serbia, Ukraine, and Egypt. For now, central banks are attributing much of the higher inflation to transitory factors, but signs of rising inflation expectations are shifting the policy path. We look for policy rate hikes through end-2022 of 100bp in Russia, Czechia, Romania, and Egypt and 200bp in Ukraine. This week we brought forward rate hikes in Romania to 1Q22 and also pulled forward the start of tightening in Hungary to June. For Russia, we raised our estimate of the terminal rate to 6.5% (from 5.75%). Our forecast for rate hikes in EMEA EM as a whole remains below market pricing, reflecting our view that much of the inflation jump is transitory. In South Africa, where we see the SARB only hiking 75bp through end-2022, we see a lingering negative output gap outweighing any near-term concerns about rising core inflation.