This is a summary of a longer paper entitled ‘SEC-OCRA: a simple capital requirements approach for synthetic securitisations (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5112233). The views expressed in this article are our own and do not necessarily reflect those of the ECB or Granular Investments.

Abstract

Recent political statements have highlighted the urgent need to expand the European securitisation market. In response, banking supervisors in the EU and beyond have initiated new consultations to reassess whether the current prudential treatment of securitisation is still appropriate.1 This reassessment presents an opportunity to address structural issues in the existing capital requirement approaches and propose a streamlined solution. This paper focuses on the adequacy of the current prudential treatment of synthetic transactions, which have become the dominant segment of securitisation in Europe, but it can be extended to traditional cash securitisations as well. It introduces the SEC-Overall Capital Requirement Approach (SEC-OCRA). By replacing the commonly used SEC-Internal Rating Based Approach (SEC-IRBA) and SEC-Standardised Approach (SEC-SA), SEC-OCRA aims to mitigate the inefficiencies of current approaches, enhance risk sensitivity, and better align with macroprudential objectives, ensuring a simpler and more balanced trade-off between risk aversion and the economic benefits of securitisation.

The existing prudential frameworks for securitisation, SEC-IRBA and SEC-SA, determine the risk-weighted asset (RWA) density for securitisation tranches, differing only in how the “p-factor” is calculated. The core concepts and terminology to operationalise these frameworks include:

The effect of SEC-IRBA and SEC-SA is to reallocate the original portfolio RWA, plus a margin of “p”, to the various tranches. If the pool RWA is €100 million and “p” is 30%, the sum of the RWAs of all the tranches will be €130 million before the RWA density floor is applied. A key feature of securitisation is the possibility to replace the RWA density of a tranche with the RWA density of its guarantor if the tranche is guaranteed by unfunded protection (i.e., not collateralised), or 0% in the case of a funded (cash-collateralised) guarantee.

There are several concerns with these approaches:

The current SEC-IRBA and SEC-SA have so many flaws that it is impossible for anyone to judge whether a securitisation will end up with more or less loss-absorbing capacity than the portfolio had before, after junior tranches have been transferred or guaranteed, let alone by how much. In this context, discussions to fine-tune parameters such as the p-factor are meaningless because there is never a clear target that we are solving for.2

We advocate for the SEC-Overall Capital Requirement Approach (SEC-OCRA) as a risk-sensitive framework that aligns with macroprudential policy needs. This approach seeks to replace current methods with a more flexible and comprehensible system, better reflecting the realities of capital requirements in the context of securitisation. By calculating capital requirements based on the Overall Capital Requirement (OCR) instead of the static 8% benchmark, SEC-OCRA aims to rectify distortions present in the current framework.

The Overall Capital Requirement (OCR) is a key bank solvency parameter, representing the sum of the total Supervisory Review and Evaluation Process (SREP) capital requirement, capital buffer requirements, and macroprudential requirements, expressed as own funds requirements. The OCR encompasses the bank-specific capital requirements under Pillar I, Pillar II, and various buffers, including Capital Conservation (CCoB), Globally Systemically Important Institution (G-SIB), Counter-cyclical (CCyB), and Systemic Risk (SyRB) buffers. It reflects the amount of capital supervisors deem necessary for a bank to hold against each unit of RWA. As of Q1 2024, the average OCR across EU reporting institutions was 14.3% of RWA, according to the ECB’s “Aggregated results of SREP 2023,” excluding Pillar 2 guidance CET1, which is not part of the OCR.

However, the capital prudential framework requires banks to hold a base capital of 8% against RWAs, not the OCR (currently around 14%). This 8% base capital charge has remained fixed since the Basel I Accord.3 The difference between the base capital charge and the OCR introduces distortions, as banks now must hold more than 8% capital, causing a tranche with a RWA density of 1,250% to absorb more capital than its size.4

By assigning an unrealistic amount of capital to the junior tranche, less capital than required is allocated to the mezzanine and senior tranches, assuming we disregard the p-factor for a moment. Crucially, under CRR Article 249, a junior tranche of €10 million, which had been allocated €14 million of capital, could be protected by an investor, and be cash-collateralized with €10 million, reducing the capital allocation back to €10 million. However, the €4 million difference is not redistributed to the mezzanine and senior tranches, resulting in a lower total capital in the transaction. This capital buffer reduction is counterbalanced by a large “p” factor (typically 70-100%, halved for STS), but the combined effect is highly uncertain. The supposed non-neutrality could sometimes be positive but may also be negative.

We propose moving towards simplicity, increased risk sensitivity, and better alignment with macroprudential policy by replacing the flawed supervisory formulas for securitisations under SEC-SA and SEC-IRBA with a simpler approach. This involves deducting from capital (or assigning an RWA of 1/OCR) for all retained tranches attaching up to a Benchmark and assigning 0% RWA to all retained tranches attaching above that level.5 The Benchmark level could be the RWA density of the original pool, multiplied by the bank’s OCR, and further increased by an extra 5-10% to account for non-neutrality, depending on whether the transaction is STS-eligible. We would call this new Benchmark “Kocra” and the new capital requirements approach “SEC-OCRA” or Overall Capital Requirements Approach for securitisations.

For example, consider a pool with an RWA density of 70% and a bank OCR of 14%. The original capital requirement would be 70% x 14% = 9.8% (compared to 5.6% if using an 8% base capital charge, i.e., 70%x8%). Kocra would be 70% x 14% x (1+10%) or 10.8% with a 10% non-neutrality factor, and 10.3% in the case of STS with a 5% non-neutrality factor. Any retained tranche with a detachment point below 10.8% would have an RWA density of 1/OCR = 714%. Any retained tranche above 10.8% would have a 0% RWA density, eliminating the need for buying protection.6

In line with CRR Article 249, tranches would continue to benefit from credit risk mitigation. Protected tranches would be assigned a 0% RWA density if backed by a funded guarantee or by an unfunded guarantee from a list of approved counterparties. While this paper suggests OCR as the benchmark, other options could be discussed and may be better suited depending on regulators’ preferences. The key message is the need to connect capital relief directly with risk-sensitive measures of solvency.7

Under SEC-OCRA, the p-factor becomes an easily understandable and adjustable 5-10%. These assumed numbers reflect the level of non-neutrality typically observed in transactions where the junior tranche is protected, but regulators can decide any other level. Importantly, the p-factor level can be adjusted up or down based on changes in preference or aversion to non-neutrality. This proposed approach does not require an RWA floor or related calibrations. There would be no further penalties for banks’ portfolios under the Standardised approach compared to the divergent SEC-SA and SEC-IRBA.

Since the RWA on tranches above Kocra would be zero, they will all be retained, and no other bank will invest in those tranches, removing the risk of a cliff effect on synthetic securitisation. Rated mezzanine or senior tranches may be available to third-party banks in traditional securitisations outside of SEC-OCRA, but these are typically externally rated, so the cliff effect is already addressed by the RWAs in SEC-ERBA. Furthermore, under SEC-OCRA, with no RWA floors, any asset class could potentially be available for risk and capital sharing without distortions. This is a straightforward message that any MEP or layperson can understand: when a bank engages in a synthetic securitisation under SEC-OCRA, a slightly larger “loss-absorbing buffer” than previously required by existing approaches is made available against that portfolio, and it is clear by how much.

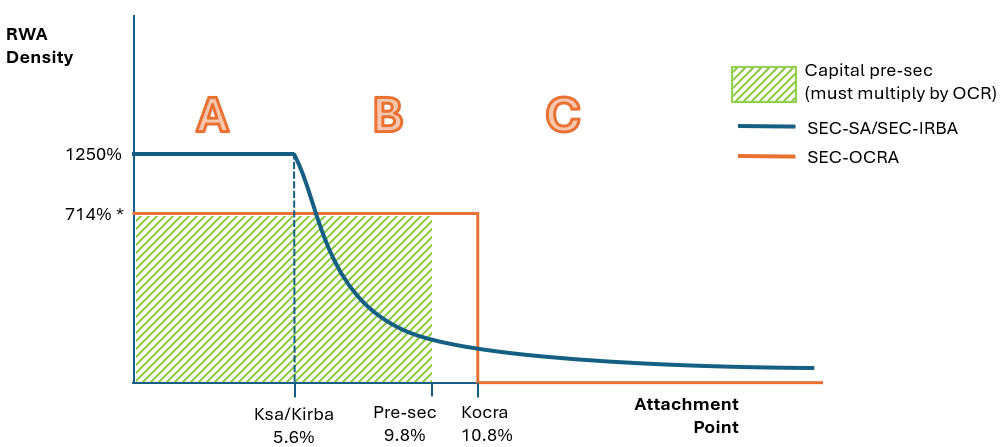

Chart 1 below illustrates the RWA density of infinitesimally small tranches attaching at various points under the existing SEC-SA/SEC-IRBA frameworks and the proposed SEC-OCRA framework. This is for a pool of loans with an initial RWA density of 70% and a bank with an OCR of 14%, resulting in a pre-securitisation capital requirement of 14% x 70% = 9.8%. First, the maximum RWA density for a tranche under SEC-OCRA is 1/OCR, which in this case is 714%. It is important to note that a tranche with an RWA density of 714% equates to a 1:1 capital charge. The green area represents a fully capital-deducted tranche that corresponds to the pre-securitisation capital charge (capital neutrality). Kocra is set a further 10% beyond that point.

In the “A” section of the chart, between 0 and Ksa/Kirba, there is a constant RWA density. Since full capital deduction is achieved with an RWA density of 714%, there is an overweight of risk density under SEC-SA/SEC-IRBA. In the “B” section of the chart, between Ksa/Kirba and Kocra, there is an initial part where SEC-IRBA/SEC-SA again charges more than a 1:1 capital to the thin tranche, but this RWA density decreases rapidly (usually faster for SEC-IRBA than for SEC-SA) while SEC-OCRA continues to require full capital deduction. Finally, in the “C” section of the chart, a retained senior tranche still has an RWA density above zero (floored at 10-15% for SEC-SA/SEC-IRBA) and therefore absorbs capital, whereas it would be zero under SEC-OCRA.

Chart 1. The RWA density of a very thin tranche (*)

Note: (*) RWA density for capital deduction when OCR=14%

Underlying loan pool with RWA density=70% requiring OCRx70%=9.8% capital

Ksa/Kirba=8%x70%, Kocra=14%x1.1×70%=10.8%

Lines indicate RWA density. Areas multiplied by OCR indicate capital since capital=OCR x RWA density x tranche size. Chart not drawn to scale.

Market impact of SEC-OCRA

A new approach would be ineffective if it were incompatible with the market structure and led to no viable synthetic securitisations. Instead, SEC-OCRA is likely to support the market as it will not drastically alter bank capital release efficiency compared to today’s transactions. It is expected to bring innovation for wider investor participation and lower costs of released capital. While SEC-OCRA may initially appear more stringent for banks than SEC-IRBA, observations from a large sample of transactions across several years and asset classes show that the average SEC-IRBA transaction has a p-factor of 70-80%. At that level, and with bank OCR in line with the EU average, SEC-IRBA and SEC-OCRA produce similar requirements for loss-absorbing capacity. However, SEC-OCRA achieves this transparently, whereas SEC-IRBA reaches it through a double distortion: overallocation of capital to junior tranches and unrealistic oversizing of the p-factor, with no clarity on the combined outcome.8

Additionally, SEC-OCRA offers benefits to banks compared to SEC-SA, though there may be a slight reduction in capital efficiency compared to current STS transactions. Under the current approaches, a significant portion of a synthetic securitisation’s capital is absorbed by the retained senior tranche. To compensate, banks are strongly incentivized to place all tranches below Ksa/Kirba due to the 1/8% vs 1/OCR (1250% vs 714%) RWA density differential. This results in all deals being similarly structured, with an optimal attachment point for the retained senior tranche and possibly a very thin junior tranche to cover expected losses, while the intermediate portion is covered by protection sellers.

Under today’s rules, where a severe p factor is applied, banks are forced to protect all tranches below Kirb to create deals that release capital at a reasonable cost and benefit from the 1250% versus 714% advantage. However, under SEC-OCRA, a bank could afford to retain very junior risk and only place a junior mezzanine tranche that attaches at a relatively higher level compared to today’s standards (e.g., at 3-4% instead of 1%) and detaches at Kocra. This approach allows banks to manage risk differently and potentially reduce costs. This could appeal to a class of protection sellers (funded or unfunded) targeting lower risks and coupons compared to the majority of today’s players.

The current capital requirement frameworks for securitisation, particularly SEC-SA and SEC-IRBA, are deemed inadequate due to their rigid structures and opaque calculations. The introduction of SEC-OCRA is proposed as a necessary evolution in capital treatment, providing a more effective and transparent method that reflects actual risks and supports the growth of the European securitisation market while maintaining regulatory oversight. The analysis suggests a need for regulatory adjustments to improve clarity and flexibility, ultimately fostering a healthier financial ecosystem.

Eurogroup (2024), Statement of the Eurogroup in inclusive format on the future of Capital Markets Union.

European Commission (2024), Targeted consultation on the functioning of the EU securitisation framework.

Bank of England (2024), CP13/24 – Remainder of CRR: Restatement of assimilated law consultation paper, Chapter 3 Securitisation requirements.

Duponcheele, G., Fayémi, M., González Miranda, F., Perraudin, W., and Tappi, A. (2024a) European competitiveness and securitisation regulations.

Duponcheele, G., Fayémi, M., Hermant, J., Perraudin, W., and Zana, F. (2024b) Rethinking the securitisation risk weight floor.

Gonzalez, F. and Triandafil, C. (2023) The European significant risk transfer securitisation market, European Systemic Risk Board OPS No. 23.

European Union regulation No 575/2013 of the European Parliament and of the Council of 26th June 2013 (CRR) on prudential requirements for credit institutions and amending Regulation (EU) No 648/2012.

See for example, the Eurogroup (2024) “Statement of the Eurogroup in inclusive format on the future of Capital Markets Union”, followed by the recent European Commission (2024) “Targeted consultation on the functioning of the EU securitisation framework”, section 9, as well as the Bank of England (2024) “CP13/24 – Remainder of CRR: Restatement of assimilated law”, Chapter 3 and the Duponcheele et al (2024a) paper “European Competitiveness and Securitisation Regulations”.

For more detailed explanations see the original underlying paper Giovannetti, G. and Gonzalez Miranda, F. (2025).

If banks were required to hold 8% capital against a tranche, and it was desired that a €10m tranche to be equivalent to a €10m capital deduction, one would assign a RWA density of 1,250% to the tranche, and the capital charge would be 8% x 1,250% x €10m = €10m.

For example, for a bank with an OCR of 14%, that is 14% x 1,250% x €10m = €14m. If the OCR is 14%, the RWA density for a tranche to be equivalently deducted from capital should be 1/14% or 714%, not 1,250%.

A capital charge may still be reasonable for the senior tranche a bank purchases from another issuer which is outside its consolidation perimeter.

This follows the logic that the OCR would cover the unexpected losses of the transaction after accounting for non-neutrality add-ons. However, it would be also conceivable to incorporate a risk weight floor for the retained senior tranche.

Tranches would be assigned the RWA density of the eligible, rated guarantor as per CRR Chapter 4 in the case of other unfunded protection.

For a more detailed analysis of the effect of SEC-OCRA compared to the current approaches, please refer to the longer version of this paper.