This Policy Brief provides a summary of Akkaya, Bitter, Brand, and Fonseca (2024). The views are the personal views of the authors and should not be reported as representing the views of Sveriges Riksbank, the European Central Bank (ECB) or the Eurosystem.

Abstract

Using a new statistical approach based on high-frequency asset price reactions to ECB policy announcements, we highlight the importance of risk-shifting factors alongside established dimensions of monetary policy. By using Varimax rotation of principal components, which exploits the statistical properties of financial data such as their tendency to be “fat-tailed”, we avoid reliance on economic assumptions as is common in the literature. When working with a sufficiently broad set of risky assets, the path dimension i.e. forward guidance is no longer easily separable from the target and the QE dimensions. Instead, monetary policy operates primarily through the established target and quantitative easing (QE) channels, with risk factors playing an important additional role. We find insufficient statistical importance of macroeconomic information shocks from ECB policy announcements, possibly because these are dominated by risk factors.

Over recent decades, economic research has recognised that monetary policy operates not only through interest rate decisions but also through communication, such as guidance on policy interest rates. Additionally, the use of unconventional monetary policy tools gained prominence during the global financial crisis, when central banks introduced novel measures to influence asset prices beyond traditional short-term interest rates. The increasing complexity of the monetary policy toolkit necessitates a multi-dimensional approach to its measurement. For example, the European Central Bank (ECB) has employed various strategies such as forward guidance on interest rates and asset purchases to lower long-term interest rates and reduce fragmentation in the sovereign debt market. These measures have effectively reduced risk aversion and improved financing conditions. As inflation surged in the post-pandemic period, central banks began unwinding asset purchase programs and tightened monetary policy, while continuing to guide market expectations about future policy action. This approach has also strongly affected asset prices across different maturities and financial market segments.

So far, the focus has been on assessing the impact of unexpected changes in policy rates (target), the effects of forward guidance (path) and quantitative easing (QE). However, increasing attention is being directed towards dimensions beyond direct monetary policy tools, in particular to a more nuanced understanding of the impact of monetary policy through risk channels and the role of macroeconomic information conveyed through policy announcements.

Contrary to imposing the existence of specific policy dimensions ex ante, by using structural assumptions, we propose a data-driven approach called “Varimax” to identify different policy dimensions. Varimax is particularly useful when exploring additional monetary policy dimensions, as it avoids imposing potentially unreliable assumptions and adopts a statistically-driven, exploratory approach to identify and rank relevant dimensions. Extending this approach to a broader set of risky assets provides several new insights. First, the inclusion of risky assets blurs the distinction between forward guidance and quantitative easing, shifting emphasis towards a general risk dimension. Second, this general risk dimension can be further decomposed into sovereign risk, policy uncertainty, and corporate risk factors. Finally, using this theory-agnostic framework, we find no evidence supporting the presence of a central bank information channel in ECB monetary policy news.

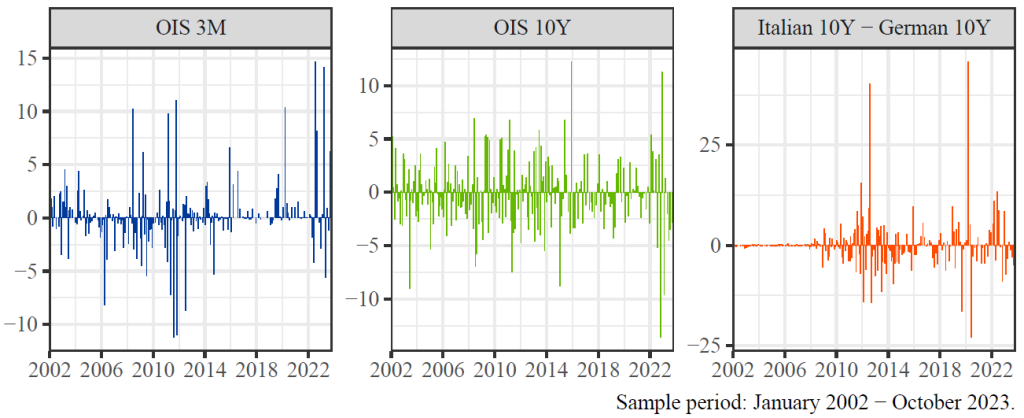

Figure 1. Value of the high frequency change in basis points in selected assets around ECB Governing Council meetings, based on data from Altavilla et al. (2019)

The Varimax approach aims to attribute each factor to as small a subset of assets as possible. This method leads to large (absolute) loadings on some assets and small (absolute) loadings on the remaining, rather than affecting many assets similarly.1 Rohe and Zeng (2023) have shown that if the true loadings are sparse and the principal components are leptokurtic (i.e. they have large tails), then Varimax allows for identification and inference of the underlying structural factors.

When applying Varimax rotation to OIS rates and sovereign bond yields, we identify policy factors (target, path, QE i.e. quantitative easing, and sovereign risk) similar to those found with a conventional approach and in previous studies. Target is a downward sloping factor, capturing movements in the short-term rate. Path is a hump-shaped factor, capturing movements peaking between 6 months and 2 years. QE is an upward sloping factor, capturing movements peaking in the 10-year and moving all sovereign yields in the same direction. Sovereign risk is a spread widening factor: it drives Spanish and Italian yields higher, keeping risk-free long rates and German yields stable, but creates only a mild impact on the French yield. The effect of this factor is in line with the ‘market-stabilization QE’ factor of Motto and ¨Ozen (2022) and Ricco et al. (2024).

Including the Eurostoxx stock price index enables us to explore whether the previously identified factors re-emerge in a broader setting, while also checking incidences of so called “macroinformation effects” and assessing the importance of risk factors in measuring monetary policy. The information effects channel posits that central banks, through their communications, reveal not only their policy decisions, but also their assessment of the economy, providing new information to market participants. This is often identified when risk-free rates and stock prices move in the same direction, opposite to the usual co-movement in reaction to a monetary policy shock. On the other hand, the risk channel, as identified by Kroencke et al. (2021), Cieslak and Schrimpf (2019), and Cieslak and Pang (2021), focuses on how monetary policy influences investor behaviour and market risk perceptions. The Varimax approach finds no evidence of a central-bank information channel in the euro area but rather highlights a risk channel. We identify a risk-shift factor in monetary policy, beyond direct effects on interest rate swaps and sovereign bond yields. This risk dimension predominantly drives stock price responses, with significant movements in stock indices and correlating with changes in sovereign spreads as depicted in the middle panel of Figure 2.

We further investigate the risk dimensions operating around monetary policy decisions in the euro area by extending the dataset to include movements in the Eurostoxx Bank index, Eurostoxx VSTOXX, EUR/USD exchange rate, option-implied standard deviation of the 3-month Euribor 1-year ahead, and corporate bond spreads for investment grade and high-yield issuers. Our analysis documents that all these variables are more volatile on Thursdays of the ECB Governing Council meeting than on other Thursdays, suggesting their relevance in monetary policy transmission. Applying Varimax rotation to this further extended dataset, the target and QE factors remain stable, whereas a separate path factor, capturing forward-guidance, no longer emerges naturally. Instead, the broad risk-shift factor is further disaggregated into three distinct subcomponents representing the sovereign risk, policy uncertainty, and corporate risk dimensions around monetary policy decisions. The sequential emergence of the different monetary policy factors on this risk extended dataset and their respective asset price response profiles are shown in Figure 2. The policy uncertainty factor highlights the influence of monetary policy on interest rate uncertainty, while the corporate risk factor captures the impact on corporate bond spreads and stock market volatility. These findings underscore the significance of risk dimensions in understanding the comprehensive impact of monetary policy.

Finally, we confirm the importance of these distinct channels in shaping asset price dynamics over time using a Bayesian Proxy-VAR analysis. Our findings reveal that the transmission of target, path and QE consistently impacts financial variables, aligning with baseline decomposition results. The financial propagation of the monetary policy along sovereign risk, policy uncertainty and corporate risk aligns with the general transmission channel documented in the literature that higher risk aversion and uncertainty negatively impacts economic activity and leads to a decline in inflation. To further explore the risk-taking channel, we construct a risk appetite index for the euro area (in line with the work of Bauer et al., 2023, for the US), finding that monetary policy tightening, particularly in sovereign risk and policy uncertainty, significantly dampens risk appetite. This comprehensive analysis underscores the importance of considering risk as an additional important dimension of monetary policy.

Figure 2. Varimax rotation applied to an increasing number of principal components for a risk extended set of asset

We propose a novel approach to deriving multi-dimensional monetary policy indicators using Varimax rotation on principal components extracted from high-frequency asset price changes. Unlike traditional methods, this approach leverages excess kurtosis, i.e. the fat tails in the data, to identify policy factors without relying on economic assumptions. When applying Varimax to euro area interest rate swaps and government bond yields, we confirm previously identified factors such as interest rate target, forward guidance, and quantitative easing. When including risky assets, we find evidence in favour of risk-shift factors, which can be decomposed into sovereign risk, policy uncertainty, and corporate risk dimensions. However, our approach does not find statistical support for central bank macro-information shocks in the euro area. Investigating the financial transmission of policy indicators, our findings rather indicate significant evidence of monetary policy transmitting through risk-taking when considering the extended set of asset price responses to policy announcements.

Akkaya, Y., L. Bitter, C. Brand, and L. Fonseca (2024). A statistical approach to identifying ecb monetary policy. ECB Working Paper Series (2994).

Altavilla, C., L. Brugnolini, R. S. Gürkaynak, R. Motto, and G. Ragusa (2019). Measuring euro area monetary policy. Journal of Monetary Economics 108, 162–179.

Bauer, M. D., B. S. Bernanke, and E. Milstein (2023). Risk appetite and the risk-taking channel of monetary policy. Journal of Economic Perspectives 37 (1), 77–100.

Cieslak, A. and H. Pang (2021). Common shocks in stocks and bonds. Journal of Financial Economics 142, 880–904.

Cieslak, A. and A. Schrimpf (2019). Non-monetary news in central bank communication. Journal of International Economics 118, 293–315.

Jarociński, M. (2024). Estimating the Fed’s unconventional policy shocks. Journal of Monetary Economics.

Kaiser, H. F. (1958). The varimax criterion for analytic rotation in factor analysis. Psychometrika 23 (3), 187–200.

Kroencke, T. A., M. Schmeling, and A. Schrimpf (2021). The FOMC risk shift. Journal of Monetary Economics 120, 21–39.

Motto, R. and K. Özen (2022). Market-stabilization qe. ECB Working Paper Series (2640).

Ricco, G., E. Savini, and A. Tuteja (2024). Monetary policy, information and country risk shocks in the euro area. CEPR Discussion Paper No. 19679.

Rohe, K. and M. Zeng (2023, 07). Vintage factor analysis with Varimax performs statistical inference. Journal of the Royal Statistical Society Series B: Statistical Methodology 85 (4), 1037–1060.

More formally, Varimax maximises the variance of the squared loadings of each factor subject to some technical restrictions.