The views expressed in this brief are those of the authors and should not be attributed to the IMF, its Executive Board, IMF management, the Bank of Spain, or the Eurosystem.

The note investigates the impact of monetary policy on capital allocation and productivity among Spanish firms from 1999 to 2019. It finds that expansionary monetary shocks reduce capital misallocation, indicated by decreased within-industry dispersion of firms’ marginal revenue product of capital (MRPK). To analyze the underlying mechanism, it first focuses on incumbent firms and finds that, following a monetary policy easing surprise, high-MRPK firms exhibit a greater increase in investment and debt financing relative to low-MRPK firms. MRPK emerges as a crucial determinant of investment response over other standard metrics of financial frictions like age, leverage, or cash holdings. Second, looking at the extensive margin, it finds a muted response to monetary easing in terms of firms’ entry and exit, challenging the idea that such policies foster zombie firms. The overall effect underscores the significance of the capital reallocation channel among incumbent firms in shaping monetary policy’s effects.

The relationship between monetary policy and productivity has recently attracted renewed attention. In particular, the discussion has focused on how monetary policy affects the allocation of capital across firms, and ultimately productivity. So far, there is no consensus on the direction and magnitude of this effect. On the one hand, monetary policy easing may foster the entry and growth of productive firms by increasing access to finance, thereby improving capital allocation. On the other hand, low interest rates and lax credit standards may channel funding to less productive enterprises, inefficiently keeping them afloat.

In this study, we assess how monetary policy affects the allocation of capital across incumbent firms, as well as their entry and exit decisions. To do so, we analyze how firms in Spain respond to unexpected shifts in monetary policy during 1999-2019 and how these responses affect the aggregate misallocation of capital.

We start with the theoretical observation of Hsieh and Klenow (2009) that, absent any distortions, competitive firms employing similar technology equalize their marginal revenue product of capital (MRPK). It follows that the industry dispersion of MRPK can be used as a good proxy of distortions, and as such, it is directly linked to productivity. We show empirically that, at the industry level, expansionary monetary policy decreases the dispersion of MRPK, which implies an improvement in the allocation of capital and an increase in productivity.

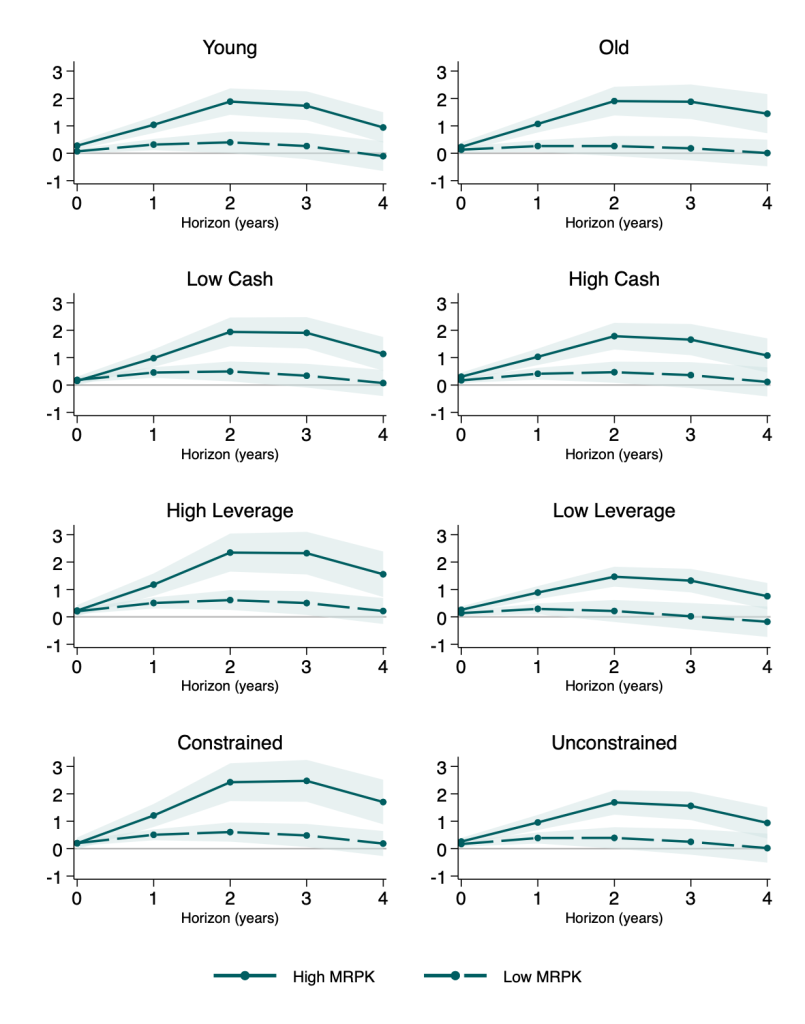

To understand the observed effect of monetary policy on the allocation of capital, we first analyze its impact on incumbent firms. Monetary policy easing can affect their investment decisions by lowering their cost of capital and relaxing financial constraints. In this case, the ex-ante constrained firms, i.e., relatively small firms that are more productive on the margin, are likely to react more strongly to a monetary policy shock. Indeed, we find that, following a monetary policy easing, the investment of high-MRPK firms almost doubles compared to that of low-MRPK firms two years after the monetary policy unexpected easing. Importantly, we find that high-MRPK firms not only increase their debt financing relatively more, but they are also more likely to enter the credit market and keep borrowing after monetary easing, which suggests the presence of the bank lending channel. Furthermore, we show that traditional measures of financial constraints – such as firm leverage, age, and cash holdings – are largely irrelevant or matter only for the investment sensitivity to a monetary policy shock if the firm has high levels of MRPK (Figure 1). This evidence supports that MRPK is a good proxy for financial frictions.

Secondly, we turn to analyze how monetary policy affects the entry and exit decisions of firms, as well as their composition. We find that monetary policy easing increases entry and decreases exit rates, but both effects are small quantitatively and do not appear to last long. Neither do we find stark differences in entry or exit rates between high-MRPK and low-MRPK firms. We conclude that monetary policy does not significantly affect the entry and exit choices, nor the allocation of resources through the extensive margin. These findings are inconsistent with the hypothesis that monetary policy easing alone creates “zombie firms” by helping less productive firms stay afloat.

Summing up, we provide new empirical evidence on the relationship between monetary policy and capital misallocation. We show there is a decrease in capital misallocation following an expansionary monetary policy shock, which in turn improves TFP. This is mainly driven by a relatively larger increase in investment by high-MRPK firms due to the relaxation of financial frictions, and a muted response of the entry and exit margin. These findings provide empirical support for the capital misallocation channel of monetary policy, which can have important normative implications (González et al. forthcoming).

Figure 1. Dynamic Heterogeneous Effects of Monetary Policy Easing on Firm Investment

Notes: The figure illustrates the effects of monetary policy easing (one standard deviation of high-frequency monetary policy shocks) on firm investment across different firm groups. Firm investment is measured as growth rate of tangible capital (in percentage points). These groups are defined by the interaction of high-MRPK (Marginal Revenue Product of Capital) and financial constraints indicators. In the bottom chart, “financial constraints” refers to firms that are highly leveraged and cash-poor. Specifically, a firm is considered “constrained” if its leverage exceeds the industry median and its cash ratio is below the industry median; otherwise, it is deemed “unconstrained.” The analysis controls for lagged firm characteristics (employment, leverage, age, liquidity), sector-level sales growth, aggregate unemployment rate, inflation rate, and industry fixed effects. Errors are two-way clustered by firm and industry-year. The shaded areas represent 90% confidence intervals.

Albrizio, S., B. Gonza lez and D. Khametshin, A Tale of Two Margins: Monetary Policy and Capital Misallocation (2024), IMF Working Paper No. 2024/121.

Gonza lez, B., G. Nun o and D. Thaler, Firm Heterogeneity, Capital Misallocation and Optimal Monetary Policy (forthcoming).

Hsieh, C. and P.J. Klenow, Misallocation and Manufacturing TFP in China and India (2009), The Quarterly Journal of Economics, Volume 124, Issue 4, November 2009, Pages 1403–1448.