Disclaimer1

Sustainable finance taxonomies can play an important role in scaling up sustainable finance and, in turn, in supporting the achievement of high-level goals such as the Paris Accord and the UN sustainable development goals. This paper develops a framework to classify and compare existing taxonomies. Several weaknesses emerge from this classification and comparison, including the lack of usage of relevant and measurable sustainability performance indicators, a lack of granularity and lack of verification of achieved sustainability benefits. On this basis, the paper proposes key principles for the design of effective taxonomies. The principles are then employed to develop a simple framework for transition taxonomies. The key policy messages of the analysis are: (i) Endeavor that taxonomies correspond to specific sustainability objectives; (ii) Encourage the development of transition taxonomies and focus alignment with the objectives of the Paris Agreement; (iii) Monitor and supervise the evolution of certification and verification processes; and (iv) Shift to mandatory impact reporting for green bonds.

Scaling up sustainable finance is a key element in raising private financing to support the transition to a sustainable economy. How should taxonomies be designed to encourage financial flows to sustainable investments and support this transition in the most effective way?

Before delineating the crucial design features of taxonomies, it is important to establish what taxonomies are and what they are for:

A taxonomy for sustainable finance is a set of criteria which can form the basis for an evaluation of whether and to what extent a financial asset can support given sustainability goals. Its purpose is to provide a strong signal to investors, and other stakeholders, and assist their decision making – by identifying the type of information investors need to assess the sustainability benefits of an asset and to classify an asset based on its support for given sustainability goals.

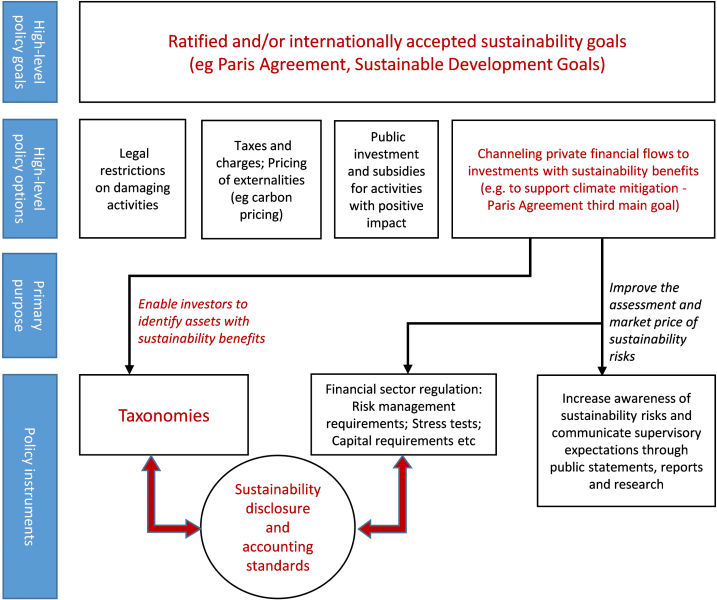

Our definition implies that the starting point of a taxonomy are sustainability goals (Graph 1). By aligning the sustainability goals with high-level policy objectives (eg carbon emission reduction in line with the Paris agreement), sustainable finance taxonomies can be important instruments for achieving these objectives. A well-designed taxonomy provides a strong signal to investors and other stakeholders and assists their decision making by identifying the non-financial benefits of a given asset. It safeguards market integrity by ensuring that those assets that cannot achieve the sustainability benefits required for the label are clearly identifiable by investors. Market integrity, in turn, helps to sustain longer-term investor interest in sustainable finance markets, as well as prod firms that are not so sustainable to improve their performance.

By contrast, taxonomies are not designed for risk management purposes. For instance, to provide a comprehensive assessment of exposures to climate-related risks, would require taking into account interdependencies with investors’ and entities’ other portfolio holdings, as well as a deeper analysis of the financial impact of possible future shocks. Taxonomies are also not necessarily an instrument to implement disclosure requirements, though ideally taxonomies should be based on disclosed data. Disclosure of non-financial data is a prerequisite for an efficient assessment of how an asset complies with the criteria set out in a taxonomy.3 Taxonomies then use and potentially process this information to classify an asset according to its sustainability benefits.

Graph 1. Taxonomies as one policy instrument to achieve high-level sustainability goals

Source: Authors’ illustration.

We delineate four main characteristics of sustainable finance taxonomies by which they may be classified:

Objective. Which sustainability goals are supported?

Scope. Which activities/industries/entities are included?

Target. How is the purpose translated into a measurable target?

Output. What types of information are provided?

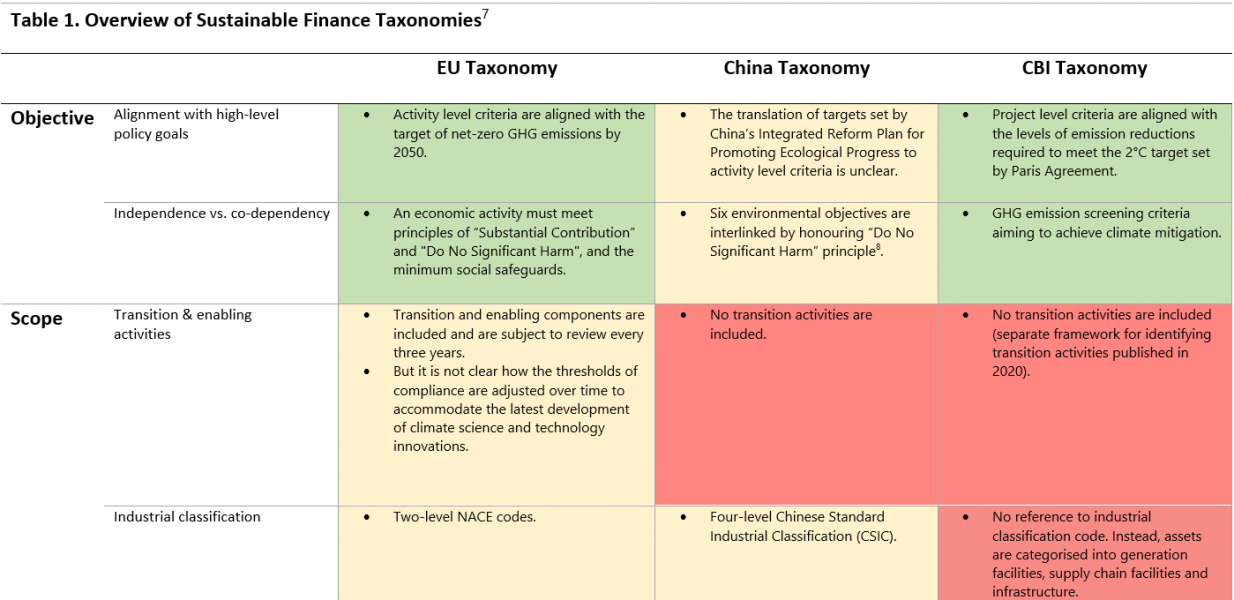

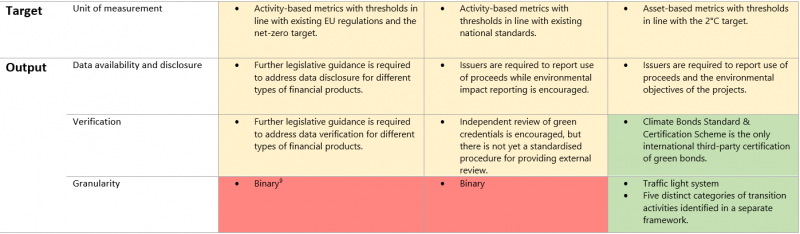

These four dimensions allow for a streamlined comparison of sustainable finance taxonomies. In Table 1, we discuss the official taxonomies in the EU4 and China5, together with the market-based taxonomy of the Climate Bond Initiative (CBI)6 to shed light on gaps amongst existing frameworks as well as the degree of comparability between them. We find that existing taxonomies often mix several sustainability goals and provide output that could be more transparent and decision-useful for investors. Key issues are the need for more use of relevant and measurable sustainability performance indicators, a lack of granularity and lack of verification of achieved sustainability benefits.

[Editor’s note: For a better view of Table 1 please refer to the article’s pdf version, page 4.]

7 Green indicates taxonomy is fully aligned with the core principles we set out in Section 3; yellow indicates taxonomy is partially aligned with our core principles; and red indicates taxonomy is not compatible with our core principles.

8 http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/4236381/index.html

9 It should be noted that the EU Platform on Sustainable Finance, a permanent expert group of the European Commission, is of the view that the EU taxonomy is not binary, because activities not classified as “green” can include a range of environmental performance levels. The EU taxonomy is work in progress where more activities including transition activities will be added to its scope. Fully aware of the intention to develop other categories, we choose to label the EU taxonomy as binary based on the established signals provided by the taxonomy as of November 2021.

Motivated by the above findings, we propose five core principles for designing effective taxonomies and employs those principles to develop a basic design for transition taxonomies – taxonomies that are in line with a transition to reduced carbon emissions consistent with the Paris accord.

3.1 The five principles for designing effective taxonomies

The principles anticipate a rapidly increasing amount of available sustainability-related data going forward – enabled by increasing sustainability disclosures, collection of data from third parties, and technological innovation in collecting these data.

1. Alignment with high-level policy objectives and measurable interim targets

High-level policy goals determine the direction of policy development. Without such alignment, any labelled asset will face ongoing market or regulatory scrutiny. The interest in assets that do not contribute to policy relevant objectives will eventually wane when investors look under the hood of the green label. Alignment with high-level policy objectives should therefore be the guiding principle of designing effective sustainable finance taxonomies.

2. Focus on one single objective (“One taxonomy, one objective”)

The primary purpose of taxonomies is to provide a clear signal to investors. To provide a clear signal there needs to be a direct link with the underlying objective. Mixing objectives naturally reduces clarity and hence blurs the signal intended for investors. It also opens doors for “green washing” – poor performance in one area can be underweighted or offset by better performance in other areas, even if sustainability performance is perfectly measured.

Several current taxonomies are based on the “do-no-significant-harm” principle (DNSH), stating that if a taxonomy supports one objective, it should at the same time not be harmful in terms of other objectives. It is important to note that the full implementation of the DNSH principle requires both the definition and measurement of a full and complete set of high-level sustainability policy objectives.

3. Outcome-based using simple and disclosed key performance indicators (KPIs)

Measuring outcomes through simple and disclosed key performance indicators allows investors to verify the sustainability performance of an asset, allows granular assessments and can be directly linked to the underlying sustainability objective. An outcome-based taxonomy can be relatively easily adapted to country or firm circumstances. Thresholds can be lowered, for instance, in case firms do not have access to the technology required to achieve better sustainability performance. Further, outcome-based taxonomies allow for straight-forward certification schemes and potentially low-cost verification. Verification of the certification should be an integral part of a taxonomy’s design, which can be cost efficient If taxonomies are based on simple and already disclosed KPIs.

4. Incorporation of entity-based information whenever possible

If a firm is able to label certain activities as green without changing its overall carbon footprint, the extent to which green finance is financing transition comes under question. Analogous to emission-exporting, issuers could shift emission-intensive parts of a project to other projects, creating the appearance of emission reduction for any project that is certified by a transition taxonomy without thorough oversight on the entity level. While much of the infrastructure to date of the green bond market has been focused on certifying and verifying green activities, for the sake of providing incentives to decision-makers to contribute to high-level policy goals, taxonomies should incorporate entity-based information whenever possible.

5. Sufficient granularity, covering both high and low sustainability performance

For a taxonomy to provide a decision-useful signal, investors require a certain level of granularity to determine whether an asset fits into their investment strategy. Binary taxonomy outputs (eg “green” vs not green) greatly limit the range of possible investment strategies based on such a taxonomies.

An important feature of the sustainability performance of issuers is its highly often skewed distribution – the 1% of firms with the highest carbon intensity produce close to 40% of global carbon emissions. As a result, the improvement of firms with low environmental performance is essential to achieve sustainability goals on a global level.

3.2 Employing the principles for a basic design of climate transition taxonomies

As for alignment with high-level policy objectives (Principle 1), the longer-term science-based target for the transition for many national jurisdictions is to achieve net zero emissions by 2050. Since this is beyond the horizon of many investors, realistic and measurable interim targets should be specified as well to provide clarity on what exactly the target is and how it can be measured.

As for the recommended focus on a single objective (Principle 2), different objectives may in theory be complementary or mutually exclusive. In the case of transition taxonomies, if the taxonomy were to include both a climate mitigation and water security objective—and meeting one or the other would qualify for the label—without drilling down beyond the label, an investor would face considerable uncertainty over what the precise non-financial benefits of the certified asset were to convey. Water security may or may not contribute to the climate transition objective, even if clear and measurable targets were given.

When aiming to be outcome-based (Principle 3), the choice of the right KPI is crucial for outcome-based transition taxonomies. As most policy objectives are forward-looking, but disclosed data are more often than not backward-looking, measurable objectives need to be translated into thresholds for KPIs that may vary over time. To prevent loopholes and leakages, GHG emissions should be i) measured at the highest available scope (eg scope 3); and ii) cover all relevant greenhouse gases emitted. In absence of measures for other greenhouse gases, a good first start is CO2 emissions. A transition taxonomy could easily be updated, once data availability for other greenhouse gas emissions is sufficient.

Future sustainability disclosures may include expected future emissions, which would be a highly useful KPI for transition taxonomies. In this case, certifying labels and verifying outcomes takes on an extra degree of importance (and difficulty). The key role of the certification providers would be to assess whether such forward-looking targets and commitments are plausible and make adjustments to the disclosed forward-looking estimates when necessary.

In incorporating entity-based information (Principle 4), transition taxonomies must by definition not examine activities in isolation but recognize progress relative to a legacy of previous activities that fall under a given actor or entity’s remit. For this reason, even more than more traditional taxonomies, they must convey entity-specific information to document what the entity is transitioning away from in terms of its activities.

When applying the principle of sufficient granularity (Principle 5), to incentivise issuers with lower performance to improve, the output of the transition taxonomy should be granular among performance metrics that don’t meet thresholds. For instance, there could be one category for firms with carbon intensity increases, another for slight decreases (ie 0%-1%) and several additional categories.

In addition to providing clarity to investors and other stakeholders about the sustainability benefits of a given asset, taxonomies following these principles can greatly facilitate their comparability and interoperability across different firms and markets – including emerging markets. While some of these principles, both in traditional taxonomies and in the case of climate transition finance, are intended for application over medium to longer term horizons, there are some concrete near-term policy actions that can be recommended. First, policymakers should endeavor that specific taxonomies (or certification processes) correspond to specific sustainability objectives. Second, they should encourage the rapid development and implementation of transition taxonomies to facilitate the channeling of funds to transition activities and increase the focus on Paris alignment. Third, they should monitor and supervise the evolution of certification and verification processes. Fourth, they should transition from the current system of voluntary guidelines for post-issuance reporting to mandatory annual impact and use of proceeds reports.

Disclaimer: This is an abridged version of a paper provided as an input paper to the G20 Sustainable Finance Working Group and published as BIS Paper No. 118 , October 2021. The views expressed in this paper are those of the authors and do not necessarily reflect the views of the BIS. We are grateful to CDP, in particular Laurent Babikian, Nico Fettes and Eoin White, for sharing their impressive study with us. We also greatly benefitted from input by the BIS Banking department on green bond impact reports – in particular from Evertjan Veenendaal, Ulrike Elsenhuber, Pierre Cardon and Nertila Xhelili. We also thank Claudio Borio, Stijn Claessens, Corrinne Ho, Benoit Mojon and Hyun Song Shin for their helpful comments.

While we refer to sustainable finance taxonomies more generally, most of the examples we describe are related to green finance, and in particular to finance aimed at climate change mitigation. We view this focus as consistent with the near-term objectives of the SFWG in 2021.

The Task Force on Climate-related Financial Disclosures (TCFD) established by the Financial Stability Board (FSB) endeavors to develop recommendations for more effective climate-related disclosures.

Sustainable Finance Taxonomy – Regulation (EU) 2020/852.

Green Bond Endorsed Projects Catalogue (2021 Edition).

Climate Bonds Taxonomy (January 2021).