The views expressed in this paper are those of the authors only and do not necessarily reflect the views of the Eurosystem or the Central Bank of Ireland. Any errors are our own.

The 2020 Household Finance and Consumption Survey (HFCS) marked the first time that Irish survey data on debt was supplemented with administrative records. Using the panel component of the survey, we develop a simple approach for estimating measurement error and find at least one third of Irish households hold debt previously not reported in the HFCS, but which the administrative data has now “revealed”. We estimate the value of this debt to be almost 13 per cent of the total debt outstanding in 2020. Controlling for demographic and income characteristics, we show that households with more complex balance sheets are more likely to hold revealed debt. Together, these novel results suggest that incorporating administrative data into surveys can improve overall data quality and help alleviate issues surrounding recall bias and other human errors that may generate initial misreporting in surveys.

Surveys, such as the Household Finance and Consumption Survey (HFCS), are a crucial source of microdata on household finances.1 Providing granular information on the composition of household balance sheets and the distribution of income and wealth, they enable microsimulations, stress testing and other scenario analysis. These exercises are essential in helping central banks and other policymakers consider the impact of policies and shocks, as well as better understand transmission mechanisms. However, as surveys are reliant on respondents self-reporting accurately, they can suffer from misreporting, whether intentional or not.

There are many reasons why households may misreport. These include a lack of knowledge or awareness, diminished memory of retrospective events or simple inconsistencies from rounding. Response quality may also be impacted by fatigue or a lack of trust in the interviewer due to fear of being defrauded or facing legal or tax implications. Some debts may be more salient than others, while respondents may perhaps feel pressure to understate their debts in order to conform to social expectations or impress the interviewer (Neri et al., 2012).

The rational inattention literature (revolving around the idea that economic agents cannot absorb all information available to them but can choose what to select, summarise and internalise) suggests that misreporting in surveys is driven by the costs associated with a household updating their information set exceeding the benefits (Maćkowiak et al., 2021; Reis, 2006; Sims, 2003 and Bucks & Pence, 2008).

One solution to overcome this misreporting problem is to incorporate more administrative data into surveys. This data reflects detailed information that is collected by government departments, agencies or other organisations for their own purposes. The Central Bank of Ireland’s Central Credit Register (CCR) is one example. It contains personal and credit information on all types of consumer loans of €500 or more, collected under the Credit Reporting Act 2013 to improve the understanding of lending patterns by both the Central Bank of Ireland and lending institutions in Ireland.

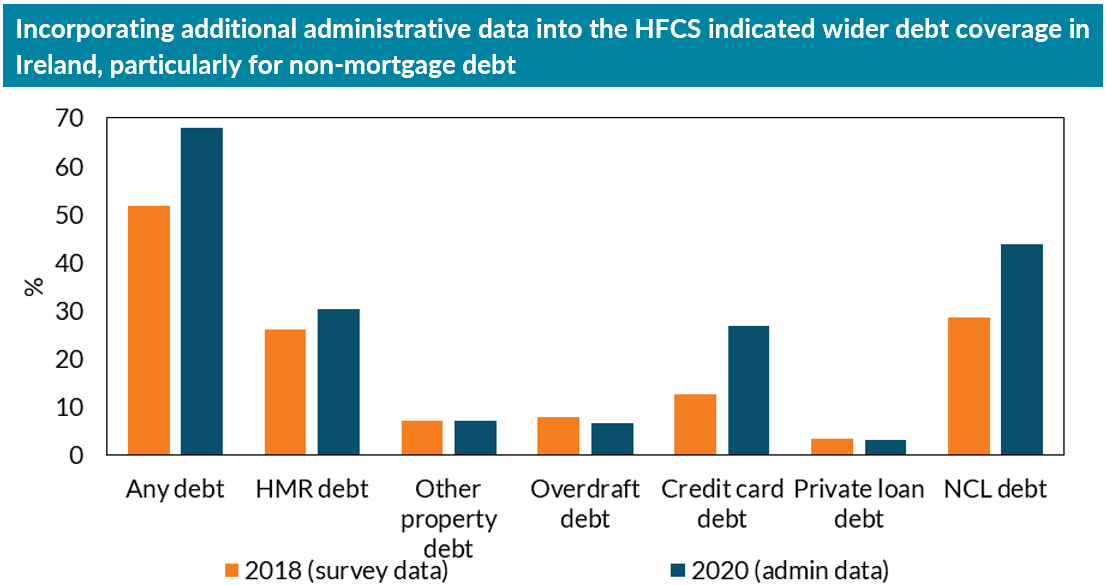

Data from the CCR was incorporated into Ireland’s HFCS for the first time in 2020 by Ireland’s Central Statistics Office who led on the collection and compilation of the survey. As a result, the 2020 HFCS showed a large increase in debt participation (Figure 1). The overall debt participation rate rose 16.3 percentage points, while the total outstanding balance was up by almost a tenth. The starkest changes occurred for credit card debt, where a double digit increase in participation was observed alongside a doubling in the outstanding balance.

Figure 1: Debt participation rate in Ireland – by debt type (2018 vs 2020, %)

Source: HFCS (weighted to 2018 and 2020 population using respective cross-sectional weights) and authors’ own calculations.

Source: HFCS (weighted to 2018 and 2020 population using respective cross-sectional weights) and authors’ own calculations.

Note: Debt information in the 2018 HFCS is based on self-reported responses; whereas 2020 is based on administrative data from the Central Bank’s Central Credit Register matched to the survey households by Ireland’s Central Statistics Office.

While this series break in the HFCS has since been corrected for (by also revising the 2018 HFCS with the CCR data), the purpose of our paper is to estimate the extent to which these initial increases were due to the CCR “revealing” debt which households previously omitted or under-reported.

The ideal approach for identifying “revealed” debt would be to directly compare survey responses against administrative data. While close, this is not quite possible in our case due to the challenge of having a time dimension in our data. To overcome this deficit, we exploit the information collected from panel households who completed the survey in both 2018 and 2020.

Specifically, we look at the household main residence (HMR) mortgage, non-collateralised loan (NCL) and credit card (CC) debt of panel households, and estimate the extent to which these debts constitute “new” borrowing; an “existing” balance carried forward from 2018, or debt which was previously not reported in the HFCS but has now been “revealed” by the inclusion of the CCR. Our methodology is distinctive as the previous literature largely rests on distribution or aggregate comparisons. Instead, we compare at the household level and in doing so, make an important contribution to the economic measurement literature by showing how a simple approach applied to panel data can be used to estimate measurement error.

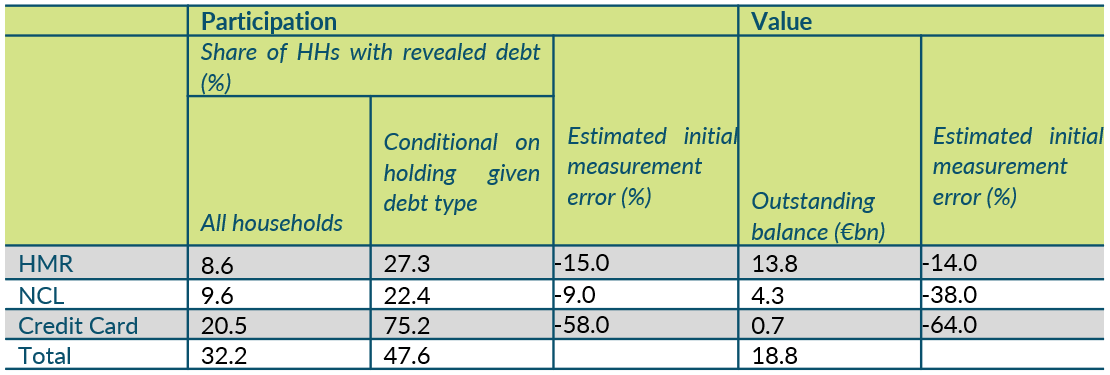

We provide evidence that the CCR has corrected initial under-reporting. At a minimum, almost one in three Irish households hold some revealed debt (Table 1). Conditional on being a debt participant, the ownership rate rises to 47.6 per cent. We estimate that the identification of “revealed” debt contributed to around half of the net change in debt participation observed since the last HFCS in 2018, with this likely representing a lower threshold of the true change.

Table 1: Revealed debt participation and outstanding balance – across debt types (2020)

Source: HFCS panel (weighted to the 2018 population) and authors’ own calculations.

Source: HFCS panel (weighted to the 2018 population) and authors’ own calculations.

Our results echo earlier studies that found unsecured debts have lower correspondence than mortgages and secured loans. One of our key results is that the increase in overall debt participation is driven principally by credit card debt, which has the highest share of revealed debt holders and the largest initial downward bias corrected for. Similarly large measurement errors for this debt type were found by Zinman (2009) and Brown et al., (2015). In terms of the value of “revealed” debt, we estimate the outstanding balance sums to around €18.8bn; equivalent to around an eighth of the total debt held by households in 2020.

In our paper, we also consider whether the CCR has improved the accuracy of debt information. We show that its inclusion enables the composition of household debt to be more accurately captured. What is more, considering households who hold only existing debt and experienced no compositional effects (i.e. no change in the number of loans), approximately 78 per cent of HMR debt holders and 85 per cent of NCL debt holders experienced a change in how the initial terms of their loan were characterised. This result suggests current terms – such as the interest rate used in simulation analysis – may have experienced similar improvements.

Finally, we show that households with more complex balance sheets are more likely to benefit from the incorporation of further administrative data. Interestingly, diversity is seemingly more important here than quantity. Controlling for demographic and income characteristics, each additional type of debt on a household’s balance sheet increases the probability of holding revealed debt by 1.7 times that of a simple increase in number of debts. This result is robust to several checks including alternative measures of balance sheet complexity and different thresholds for what constitutes “complex”.

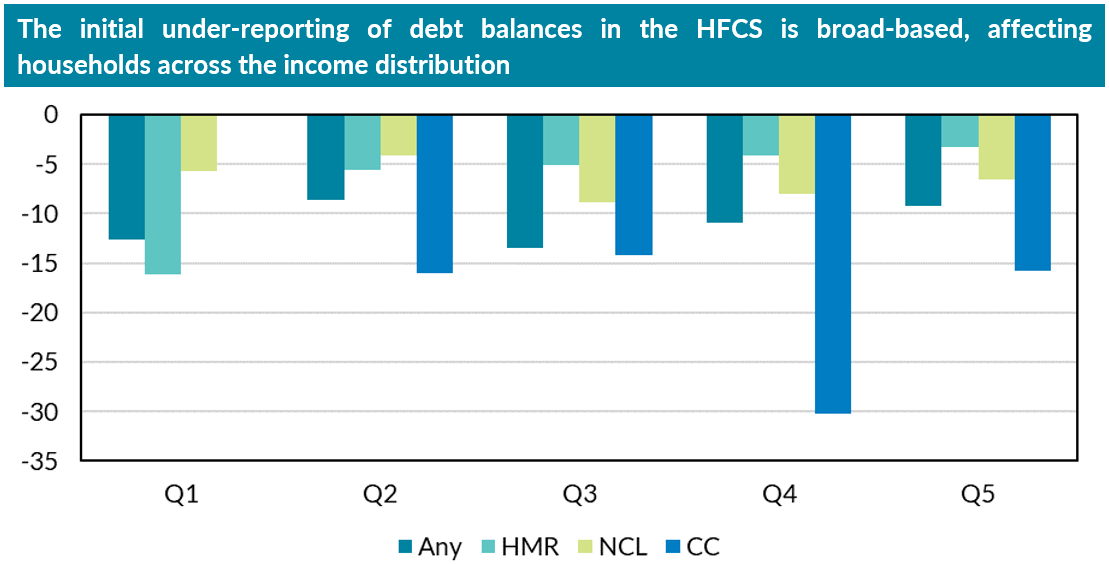

Had the revealed debt remained unknown, the HFCS would show a debt participation rate in Ireland of around half of households (as opposed to its true figure of over two thirds) and financial fragility measures would have recorded weaker improvements between waves. Given the scale of initial measurement error corrected for, we explored whether the prevalence of misreporting varied across the distribution. We find misreporting was greater for balance than participation, but the phenomena was generally broad based, affecting all parts of the distribution (Figure 2). This provides reassurance that while survey data can be improved in level terms, it remains a useful source for distributional analysis.

Figure 2: Average percent difference in balance once uncovered debt is accounted for, across the income distribution (Ireland, 2020, %)

Source: HFCS panel (weighted to the 2018 population) and authors’ own calculations.

Source: HFCS panel (weighted to the 2018 population) and authors’ own calculations.

Note: Charts are conditional on a household holding specific debt type. Average difference in credit card balance for first quintile suppressed for statistical disclosure purposes. Distribution reflects gross household income. Any = Any debt type; HMR = Household main residence debt; NCL = Non-collateralised loan debt; CC = Credit card debt.

Our findings have a number of policy implications. While our results do not indicate that the “revealed” debt substantially changed our assessment of median financial fragility measures, the prevalence of more debt in the household sector indicates a more leveraged sector than first thought. This is particularly relevant for Ireland in light of the elevated debt levels observed following the Global Financial Crisis. It also suggests a wider reach for monetary policy and interest rate decisions. Finally, from a consumer protection perspective, households with less accurate knowledge of their debt holdings may have lower debt literacy levels and make poorer financial decisions. For example, if a household cannot recall the details of their loan, they may fail to consider switching to a better mortgage deal (McGowan et al., 2023).

Ultimately, our results illustrate the value of incorporating administrative data into household finance surveys and will be of interest to survey designers thinking about questionnaire set-up, researchers working with survey data and policymakers who rely on survey results.

The full paper is available on the Central Bank of Ireland’s Research Exchange, accessible here.

Brown M., Haughwout, A., Lee, D., and van der Klaauw, W. (2015). Do we know what we owe? Consumer debt as reported by borrowers and lenders. Economic Policy Review, (21-1), 19-44

Bucks, B., and Pence, K. (2008). Do borrowers know their mortgage terms?. Journal of Urban Economics, 64(2), 218-233.

Maćkowiak B., Matějka F. and M. Wiederholt (2021). Rational inattention: A review. European Central Bank (ECB) working paper series. No. 2570 / June.

McGowan, F., Papadopoulos, A., and Lunn, P. (2023). Who Switches and Why? A Diagnostic Survey of Retail Financial Services in Ireland. ESRI Working Paper No. 748.

Neri, A., and Ranalli, M. G. (2012). To misreport or not to report? The measurement of household financial wealth. The Measurement of Household Financial Wealth (July 26, 2012). Bank of Italy Temi di Discussione (Working Paper) No, 870.

Reis R. (2006). “Inattentive consumers”, Journal of Monetary Economics, Vol. 53 (8) pp.1761 – 1800.

Sims C. (2003). “Implications of rational inattention”, Journal of Monetary Economics, Vol. 50(3) pp.665 – 690.

Zinman, J. (2009). Where is the missing credit card debt? Clues and implications. Review of Income and Wealth, 55(2), 249-265.

The HFCS is the most comprehensive survey source of household balance sheet information in Ireland. As part of a Eurosystem project coordinated by the ECB, the HFCS gathers granular and comparable information on households’ assets, liabilities, income, transfers/gifts, consumption and use of credit. Three waves of data, collected in 2013, 2018 and 2020 are available for Ireland. With thanks to the ICW team in Ireland’s Central Statistics Office for granular HFCS data access.