Findings from a survey of African banks, combined with data covering microfinance, private equity and venture capital, provide insights into how Africa’s financial sector is dealing with the impacts of the COVID-19 crisis. Almost two years after the pandemic hit Africa, the continent’s financial sectors remain resilient. Strong pre-crisis capital buffers and swift responses by financial institutions and policymakers have helped to avoid a liquidity crisis. But, the deterioration in asset quality threatens finance for the recovery, and constraints on finance could bite hardest exactly where investment is most needed for a sustainable and inclusive recovery. For example, smaller firms, micro-entrepreneurs and women-led enterprises were already underserved, and may be the most affected if banks and microfinance institutions take a cautious approach to lending. African financial institutions see strong potential for future investment, supporting the recovery, including in green finance and digitalization. Many are starting to pivot their strategic approaches towards these opportunities. However, a number of risks and barriers will need to be addressed if the full potential is to be realized.

Almost two years into the COVID-19 pandemic, African financial institutions remain resilient. The majority of banks and microfinance institutions were well capitalised before the crisis. Data from an EIB survey of banks across sub-Saharan Africa, as the pandemic unfolded, most quickly adjusted lending process and behaviours to avert a liquidity crisis and to continue serving customers. Of the banks surveyed in early 2021, 31% said that they had tightened credit standards to deal with crisis impacts. Microfinance institutions stopped lending or switched focus towards less affected sectors to reduce risk, as a joint chapter with the Consultative Group on Assisting the Poor (CGAP) revealed. The proactive support of policymakers also helped to maintain financial sector stability. 56% of banks mentioned public guarantees as a source of support during the crisis, and 84% increased use of moratoriums or restructuring, facilitated in many countries by prudential forbearance measures.

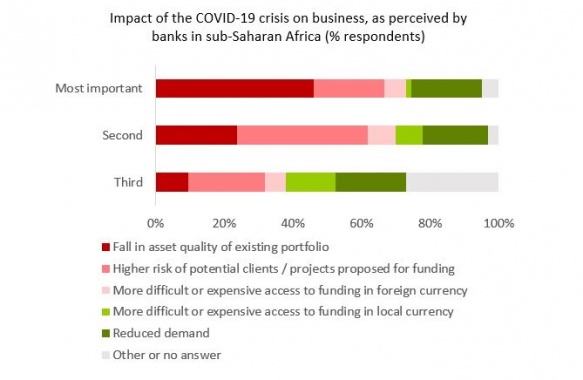

However, the deterioration in asset quality threatens finance for the recovery. Almost half of the banks reported in early 2021 that their biggest worry was the deterioration of their loan portfolios, while another 21% were most worried about the increased risk of new lending. Recent IMF updates confirm that these concerns were well grounded – many banks are now facing increasing levels of non-performing loans (NPLs), despite prudential forbearance still being in place in some countries. Other world regions are experiencing the same challenges, but the situation is more severe for Africa because NPL levels were relatively high in many markets before the crisis, despite progress over recent years. Microfinance institutions tend to support riskier clients and have shorter credit cycles, meaning that problems tend to crystalize faster in this sub-sector than among banks. Recent data confirm that Africa’s microfinance institutions have been more severely affected by increasing NPLs than peers in other regions There is now an elevated risk of solvency issues emerging in some of the smaller institutions. Larger banks and microfinance institutions that remain stable will need to deal with defaults and late payments, as support measures are removed, without compromising capital buffers. This is likely to drive a cautious approach to lending. The increased yields on government debt will exacerbate the situation by “crowding out” credit to private firms. Even in early 2021, although the vast majority of banks surveyed by the EIB expected a recovery in lending in both local and foreign currency, only 70% planned to accommodate increased demand by relaxing credit standards. Capital for the private equity and venture capital sector is also becoming scarce. As analysis of GPCA data showed, even though private equity investment volumes held up relatively well during 2020, fundraising fell by 34%, mainly because of the difficulty of carrying out due diligence, which led many institutional investors to focus on larger, developed markets.

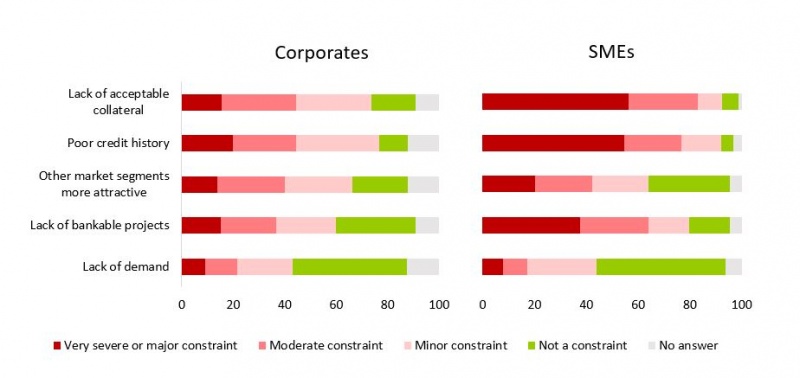

Financing constraints are expected to bite in exactly the places where investment is most needed. For example, banks generally assess small firms and micro-entrepreneurs as high risk. Joint work with MFW4A shows that this reflects the presence of underlying structural barriers, which were flagged by the banks the EIB surveyed. The barriers include inability to provide collateral (55% of banks saw this as at least a major constraint to SME finance), lack of credit history (56%) and lack of bankable projects (38%). Far fewer banks mentioned these factors as significant barriers to financing larger firms. The COVID crisis may have exacerbated structural barriers. For instance, entrepreneurs that defaulted or liquidated potential collateral to keep themselves afloat during the crisis will face major challenges in accessing finance to restart operations. In uncertain times, banks are likely to prefer larger, established firms. Microfinance institutions, too, had to rebalance their portfolios towards their stronger clients, to the detriment of riskier micro-borrowers. If smaller microfinance institutions begin to face solvency problems, gaps in provision could arise in the most remote areas and among the most excluded groups, which tend to rely on these lenders. Finally, private equity and venture capital have been important sources of patient capital risk capital and technical expertise to support innovation, particularly important for tech and tech-enabled firms. As the contraction in capital availability begins to hit investment volumes, finance for these important future-facing sectors may become scarce.

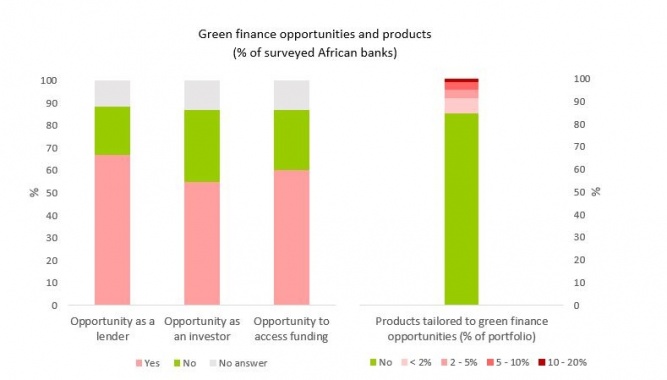

Financial institutions are beginning to seek opportunities in green finance and to consider addressing the impact of the climate crisis on their assets. More frequent droughts could hit the repayment capacity of farmers, infrastructure will need to be upgraded to cope with higher temperatures, coastal nations may lose ground to rising sea levels and investments in oil, gas and emissions-heavy industries are exposed to “transition risk” as the world moves towards net zero.1 At the same time, banks see climate finance as an opportunity. Close to 70% of the banks who completed the EIB survey see green finance as an attractive lending opportunity, 54% actively assess climate change among other key strategic issues,2 and 42% have staff focusing on renewable energy. However, only around 10% have tailored their products to serve green finance needs. Typically, those products accounted for less than 2% of their portfolios, but this is clearly a growing area, already attracting capital to Africa. A joint chapter with the ODI argues that the adoption of recognised green finance principles and strong transparency standards could help to further boost investor demand. That would enable African financial institutions to benefit from favourable financing rates, mitigating the risk that a cautious approach to finance during the recovery slows progress towards the climate transition.

As they look ahead, African financial institutions can draw on the factors that supported resilience during the crisis, including increasing digitalization. The digitalization of Africa’s financial sectors over the last decade, driven by new market entrants, has helped significantly expand financial inclusion. The EIB survey revealed that banks have accelerated their move into digital services in response to the pandemic, meaning that a wider range of services is becoming available on the market. There are opportunities for further expansion, although banks report being held back by the need to address cybersecurity risks and enhance IT infrastructure. Cybersecurity challenges were indicated by 74% of banks as being at least a moderate constraint to moving ahead with digital transformation, while inappropriate IT infrastructure was seen as a constraint by 53% of surveyed banks. Non-bank digital financial service solutions and providers will also require continued investment. These have received strong support from venture capital and private equity investors in the past. These investors may be able to work with development-focused investors to ensure that the reduced availability of capital does not slow the speed of development. At the same time, gaps remain in digital infrastructure and skills, including digital literacy for consumers. Finally, analysis by the OECD Development Centre in a joint chapter on digital financial services highlights the need for African regulatory frameworks to address the macro-financial risks associated with digitalisation.

To learn more about how Africa’s financial sectors could navigate the difficult path ahead, read the EIB Finance in Africa Report. ∎

Insert ref to ECON climate risk analysis.

Ranging from the inclusion of climate within an existing ESG strategy to the formalisation of a standalone climate change strategy.