The ECB discontinued its net asset purchase programmes at the end of June, paving the way to increase interest rates in July to combat the high and persistent inflation. This necessary discontinuation of net purchases is however potentially at odds with financing needs from newly emerged crises, such as the energy crisis due to Russia’s war on Ukraine. Meanwhile already highly indebted EU countries face additional risks from increasing bond spreads. Within this context it is important to ask whether the ECB is equipped to juggle these opposing factors, while credibly committing to its main duty. We examined how the ECBs public sector bond purchases have been allocated across the various euro countries in the past, to substantiate this debate on fiscal dominance, and the ECBs willingness to sway from its core goal of price stability.

The Eurosystem until recently bought government bonds under two different programmes. In the Public Sector Purchase Programme, the ECB capital key is considered a binding benchmark. This key is calculated according to a country’s population and economic output, and determines the national central banks’ shares in the ECB. For the new crisis programme Pandemic Emergency Purchase Programme the ECB Governing Council decided to allow greater flexibility, to handle asymmetric shocks in the Covid-19 crisis. Some key details are summarized in the box below:

|

PSPP: The Public Sector Purchase Programme (PSPP) started in March 2015 as the most important component of the Asset Purchase Programme (APP) and continued until June 2022, with the exception of a pause in net purchases between January and October 2019. By the end of March 2022, the cumulated PSPP net purchases of the Eurosystem reached €2,674 billion (of which €2,394 billion are national debt and €281 billion supranational). The PSPP purchased bonds from all euro members with the exception of Greece. APP net purchases were on a downward path after March 2022, with €40 billion in April, €30 billion in May, and €20 billion in June.1 PEPP: With the Pandemic Emergency Purchase Programme (PEPP), the Governing Council had added a second purchase program that complemented the ongoing APP with additional net purchases between March 2020 and March 2022. PEPP is an asset purchase program of private and public sector securities. Initially, it was set up with a target of €750 billion until the end of 2020, but the ECB Council increased the envelope in two steps: First in June 2020 to €1,350 billion and second in December 2020 to €1,850 billion. In December 2021 the decision to discontinue net purchases at the end of March 2022 was reached, with the distinct option to reinvest maturing principal payments from securities purchased under the PEPP. The PEPP has bought bonds from all euro members including Greece. By the end of March 2022, the Eurosystem PEPP holdings of public sector securities amounted to €1,666 billion, which is 97% of all PEPP purchases. For the PEPP, allocation rules are more flexible than for the PSPP. The issue and issuer limits for the PSPP that define maximum thresholds for the purchases do not apply for the PEPP. Moreover, the allocation of purchases across euro countries has to follow the ECB capital key more stringently for the PSPP, whereas the PEPP rules claim a larger margin of flexibility to match the asymmetry of the pandemic shock.2 |

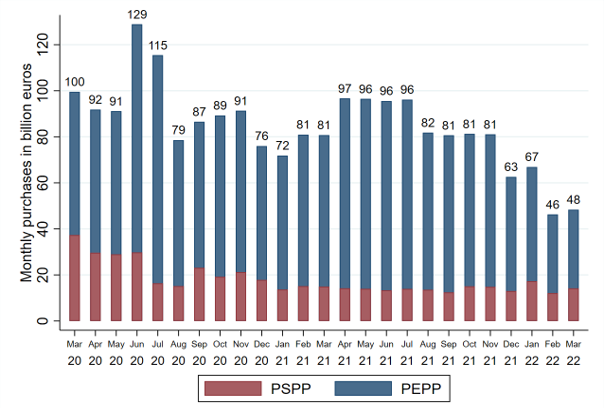

By the end of March 2022, the Eurosystem’s cumulated net purchases of public sector securities through both programmes reached €4,340 billion. Figure 1 below plots the monthly flows of purchases under PSPP and PEPP. The data show a peak of interventions in June and July 2020 with a subsequent decline that was again slightly reversed in summer 2021. Since then, a more steady decrease of net purchases took place, with a combined purchases reaching a minimum of €46 billion in February 2022. Average monthly PEPP purchases were roughly equal in 2020 (€71 billion) and 2021 (€70 billion), but almost halved in 2022 (average January to March: €39 billion). PSPP purchases declined from a monthly average of €24 billion (March to December 2020) to €14 billion in 2021, remaining stable at €14.5 billion in the first quarter of 2022.

The slowdown of net purchases towards the end of the programmes, and the final undershooting of the PEPP of its envelope by €132 billion can be understood as decreased financial distress in the Euro Area from a relaxation of the Covid restrictions and reopening of markets, but also the onset of the inflationary pressure.

Figure 1: Monthly net purchases of PSPP and PEPP in billion euros

Notes: All data on PEPP and PSPP purchases and the capital keys are taken from the ECB website.

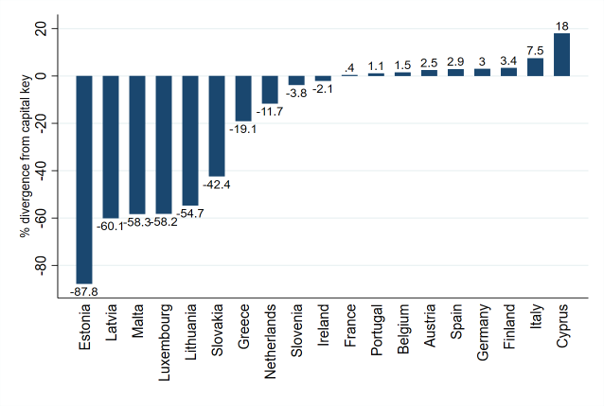

While there are some valid reasons for asymmetric purchases of public bonds, for example to cushion temporary unforeseen shocks, systematic asymmetries along other dimensions such as government debt levels or bond spreads would give a clear indication of fiscal dominance over these monetary instruments. To give a comprehensive picture of the divergence of country allocations from the capital key, Figure 2 examines combined purchases under PSPP and PEPP.

The figure shows that divergence from the capital key reached a maximum of +18% for Cyprus and +7.5% for Italy. Other countries with smaller overweighting of less than 3.5% are Finland, Germany, Spain, Austria, Belgium, and Portugal. France was bought almost to proportion with an overweight of only 0.4%. The result for France is striking as it points to a very significant overweight under the PSPP, since this country was temporarily very strongly underweighted in the PEPP.3

Countries losing out relative to their capital key are the Baltic States, likely due to a scarcity of purchasable bonds, Malta, Luxemburg, Slovakia, and the Netherlands. Since Greek bonds are not purchased in the PSPP, the strong underweight of 19.1% in combined purchases makes intuitive sense, even given a positive divergence of Greece in the PEPP.

In total the figure shows that there are large divergences from the capital key when considering purchases from the PEPP and the PSPP jointly. Defensive arguments along the line of over- or underweighting in one programme being compensated by the other are therefore not credible.

Figure 2: Divergence of PSPP and PEPP combined net purchases from capital key March 2020 to March 2022 in percent

Notes: All data on PEPP and PSPP purchases and the capital keys are taken from the ECB website.

Another informative margin is to analyse the divergence of PSPP and PEPP purchases from the capital key at more granular time periods. For example after Italy and Spain were initially strongly overweighed in spring 2020, their shares had fallen back to a normal level by autumn 2021. Since then, however, the overweighting of these two countries has increased significantly again. This stop of normalization in the autumn of 2021 coincides with the onset of rising Southern European spreads.

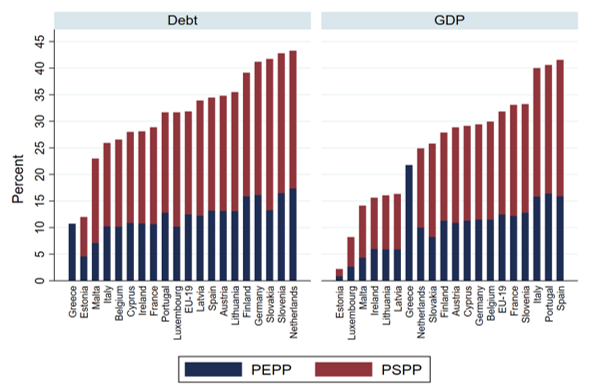

There are also large national differences in the total magnitude of PSPP and PEPP purchases relative to macroeconomic indicators. Figure 3 below shows the ratios of PSPP and PEPP stocks at the end of March 2022 over government debt and GDP for 2021. In Spain, Portugal, and Italy, total cumulated PSPP and PEPP purchases until March 2022 have surpassed 40% of GDP. By contrast, for the Baltic States, Luxemburg, Malta, and Ireland, combined PSPP and PEPP stocks are close to or below 15% of GDP. Relative to total government debt, we observe the highest share of total PSPP/PEPP holdings to public debt for Slovenia, the Netherlands, Slovakia, Germany, and Finland. For the latter four this reflects their lower public debt levels. The results show that the Eurosystem’s involvement is substantial, even relative to the exceptionally high borrowing requirements in the years of crisis.

The average euro area magnitude of the stocks relative to national debt at 31.8% is important also with respect to the PSPP’s issuer share limit of 33%. This limit correspond to the Collective Action Clauses (CACs) for euro area issues and their majority rules for a collectively agreed debt restructuring. These CACS define a blocking minority of 33%. Hence, the upper limit under the PSPP – according to the explanation given explicitly by the ECB Council itself – wanted to avoid that the Eurosystem becomes a veto player in debt negotiations as this would further increase the concerns of an infringement against the ban on monetary financing of Art. 123 TFEU.4 The fact that the average holdings of the combined PEPP and PSPP stocks now have reached this limit signals a crucial red line with respect to the monetary financing debate.

Figure 3: PEPP and PSPP stocks (March 2022) as a share of government debt and GDP 2021

Notes: Data on debt and GDP are taken from the AMECO database by the European Commission. The underlying GDP variable is defined as GDP at current prices. The variable debt is defined as general government gross debt. All data on PSPP and PEPP purchases are taken from the ECB website.

Based on these results following are some considerations for the period post net purchases:

Birkholz, Carlo Moana and Friedrich Heinemann (2021), Magnitudes and Capital Key Divergence of the Eurosystem’s PSPP/PEPP Purchases – Update December 2021, ZEW expert brief No. 21-13, Mannheim.

Birkholz, Carlo Moana and Friedrich Heinemann (2022), Magnitudes and Capital Key Divergence of the Eurosystem’s PSPP/PEPP Purchases – Update June 2022, Study supported by the Brigitte Strube Foundation, ZEW expert brief No. 22-05, Mannheim.

Havlik, Annika and Heinemann, Friedrich (2021), Sliding Down the Slippery Slope? Trends in the Rules and Country Allocations of the Eurosystem’s PSPP and PEPP, Credit and Capital Markets, 54(2): 173-197.

ECB Monetary Policy Decisions, 14 April 2022, Press Release.

See Havlik, Annika and Heinemann, Friedrich (2021), footnote 2, for details.