A few currencies make up the lion’s share of invoicing in international trade, with the US-dollar playing a particularly important role. For countries that have different currencies and set trade prices in a dominant one, the textbook link between exchange rates and exports is weakened. In this policy note, I show that a depreciation against a dominant currency indeed has little impact on average exports per firm. However, the currency depreciation also raises profits in the exporting sector (in the exporter’s currency) and the higher export profits induces firm entry. This “export supply channel” of exchange rates is both statistically significant and economically meaningful and account for the bulk of export adjustment. It is an effect rarely emphasized by policymakers, although it can be the most prominent one for small open economies with export prices set in dominant currencies.

Prices set in “dominant currencies” and their effects on global trade has recently been a topic of discussion among policymakers and academics. In an influential paper, Gopinath et al. (2020) outlined a Dominant Currency Paradigm (DCP) and showed that non-US countries tend to increase their imports more when their currency appreciates against the US-dollar than when it appreciates against the exporters’ currency, and that this effect is greater the higher the country-level US-dollar invoicing share in trade.

From the exporter’s perspective, sticky export prices set in a dominant currency would negate the textbooks effects of an exchange rate change on export volumes, as the dominant currency price does not change with the exchange rate, leaving demand for the exporter’s goods or services unchanged. This reasoning largely holds for the intensive margin of exports (average exports per firm). But although established exporters might not change their dominant currency export price following an exchange rate change, new firms are not necessarily bound by the (sticky) prices set by incumbent firms and might find it profitable to enter the export market when profits in the export sectors increases in the exporter’s currency. Existing exporters might also opt to expand the number of products they sell as it becomes more profitable. These extensive margin channels of exchange rates have been highlighted recently by Tenreyro (2019) and Obstfeld (2020), as they tend to be important in both theoretical models of trade (Melitz, 2003 and Bernard et al, 2011) as well as empirically (Hummels and Klenow, 2005 and Fernandes et al. 2018).

In a recent study (Frohm, 2021), I show that export volumes increase following a currency depreciation against dominant currencies. Differently from much of the literature, I outline the export adjustment to exchange rates along both the intensive and extensive margin. This decomposition of exports turns out to be important, as primarily the extensive margin is affected by a currency depreciation against dominant currencies and account for the bulk of the impact on total exports.

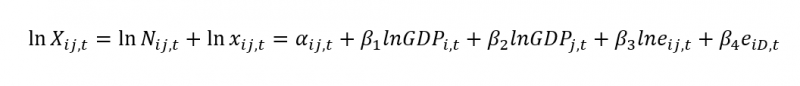

To be able to trace the exchange rate response of total exports (X) between two countries, I first decompose exports into the extensive (N) and intensive margin (x), following Mayer and Ottaviano (2008):

Total exports, the extensive margin and intensive margin are then mapped into a simple gravity framework. This can be shown by taking logs and adding conventional determinants of trade, like a standard gravity variables αij, e.g. distance, language and initial levels of trade, GDP of the exporter and the importer (capturing supply and demand conditions) as well as the bilateral exchange rate between the exporter and the importer (eij) and the exchange rate with the dominant currency (eiD).

The data used for total exports, the extensive and intensive margin comes from the World Bank’s Exporter Dynamics Database (Fernandes et al. 2016). This unique database contains information on the number of exporters, average exports per firm, average export unit values and the number of products sold per exporter, for each exporter-product-importer-year combination. It covers a large sample of exporting economies and destinations and is available at the HS2-product level. This data is merged with bilateral exchange rates and GDP data from the World Bank, as well as a country’s total imports of HS2-products from the World Integrated Trade Solution (WITS), to better control for import demand at the sector-level. The final panel data set is unbalanced, stretches from 1997−2014, includes 47 exporters (mostly emerging market economies) and 171 destinations. Like Gopinath et al. (2020), I exclude HS2-product codes below 28, as well as the HS2-codes 71-83 as these are largely internationally traded commodities following world market prices.

I use the US-dollar as the dominant currency (as Gopinath et al. 2020), because of its strong dominance among the sample of countries included. However, other currencies than the US-dollar could potentially be dominant within certain regions, like the euro for trade within Europe or the renminbi in Asia (Tille et al. 2021).2

Armed with the export decomposition and data, the impact of bilateral and US-dollar exchange rates on total export volumes and export margins are estimated with panel data techniques. Exporter-product-importer and product-year fixed effects are included to control for time-invariant heterogeneity in each market and global product-level shocks. Bilateral HS2-product trade data are used to obviate the risk of reverse causality, i.e. that exports at the aggregate level cause exchange rates to move and both the bilateral and US-dollar exchange rates are lagged one year to diminish concerns of endogeneity. The United States is also excluded from the sample.

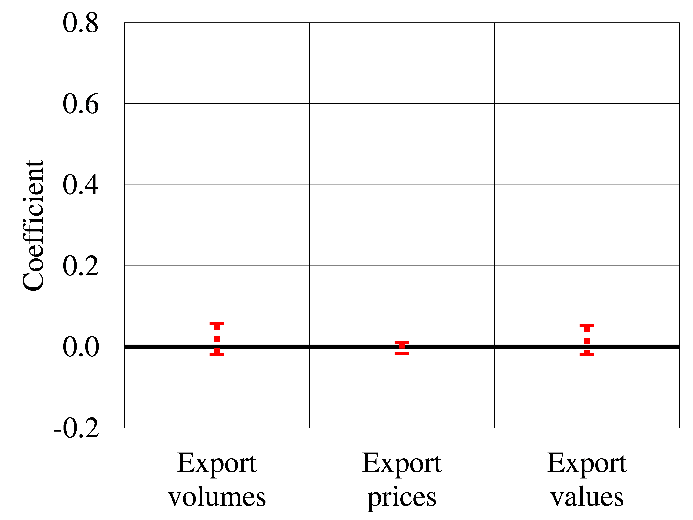

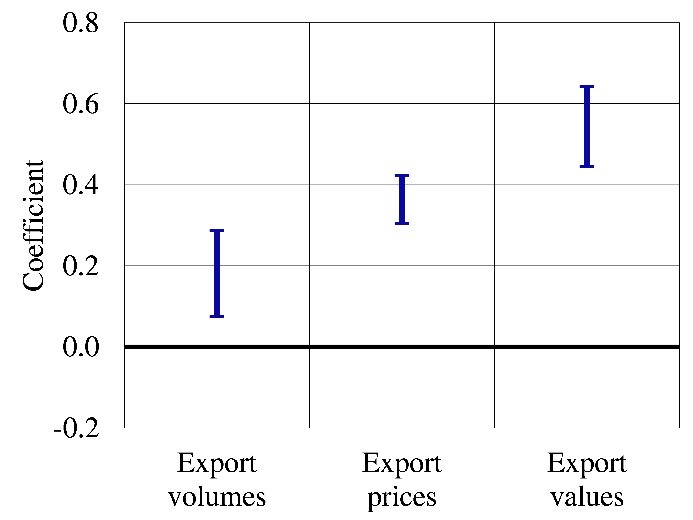

The first finding supports the DCP-paradigm, see Figure 1, which presents estimates of the exchange rate impact on nominal exports. In the exporter’s currency, nominal exports are not affected by the bilateral exchange rate (left panel) but are strongly affected by the US-dollar exchange rate (right panel). Following a one percent depreciation of the US-dollar exchange rate, nominal exports increase by about 0.5 percent in the exporters currency. The impact is mostly (2/3 of the impact) due to a price effect, whereas export volumes only contribute to about 1/3 of the increase.

Figure 1. Exchange rate impact on export volumes, unit export values and nominal exports

| (a) Bilateral exchange rate, t-1 | (b) US-dollar exchange rate, t-1 |

|

|

Notes: The dashed (solid) high-low bars are 95 percent confidence intervals for the bilateral exchange (US-dollar exchange rate). Robust standard errors are clustered at the exporter-importer level (3,572). All regressions include 362,165 observations and exporter-importer-product and HS2-product×year fixed-effects, as well as controls for (natural log of) the exporting and importing country GDP as well as total imports of HS2-products in the importing country.

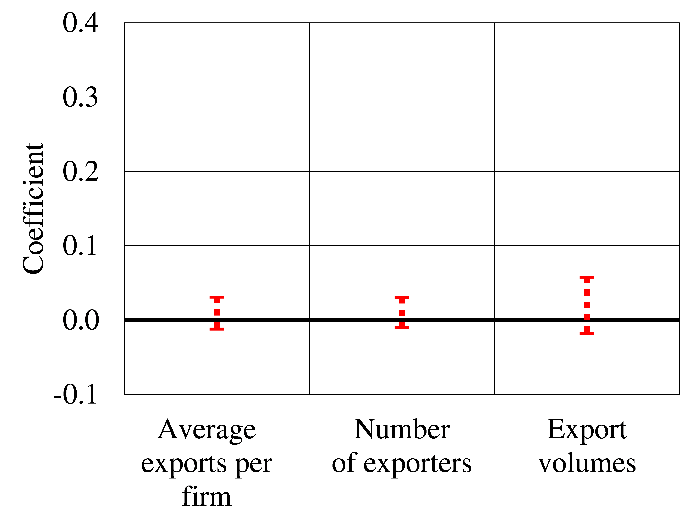

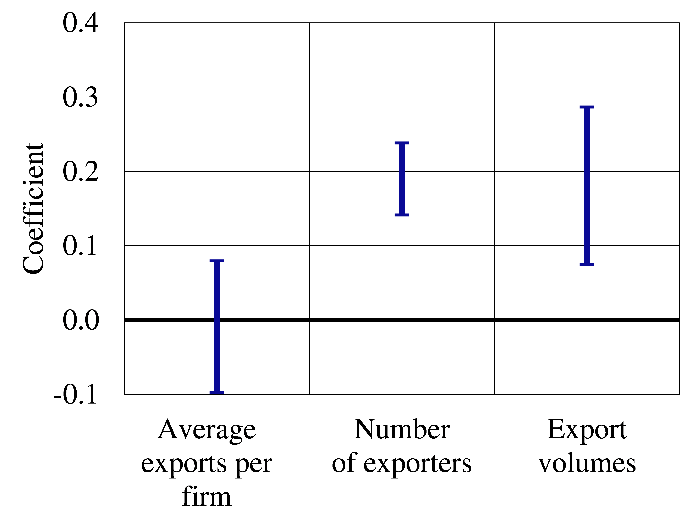

There is still significant export volume adjustment to the US-dollar exchange rate, which we would not expect if prices were fully set in dominant currencies. The decomposition of total export volumes into the two margins thus comes in handy. The main finding is illustrated in Figure 2. The results show again that export volumes do not react to a depreciation of the bilateral exchange rate (left panel), whereas export volumes increase by roughly 0.2 percent following a one percent depreciation of the US-dollar exchange rate (right panel). The new finding is that the export response is not a function of the intensive margin. Instead, total exports are driven by the extensive margin and highlights the “export supply channel” of exchange rates against dominant currencies. That entry increases after a US-dollar exchange rate depreciation is robust to various additional controls and fixed effects, definitions of exporter entry, econometric specifications, and US-monetary policy shocks as an instrument for the US-dollar exchange rate.

Although a depreciation of the US-dollar exchange rate prompts entry into a given HS2-product-destination market, other extensive margins, like the introduction of new products by existing exporters, are found to be statistically insignificant. Moreover, market power, approximated by the Herfindahl-Hirschman Index (HHI) moderates the exchange rate response of total exports, the extensive margin and the intensive margin and outlines the heterogeneous US-dollar exchange rate impact across countries and product groups (similar to Berman et al. 2012).

Figure 2. Exchange rate impact on average exports per firm, number of exporters and export volumes

| (a) Bilateral exchange rate, t-1 | (b) US-dollar exchange rate, t-1 |

|

|

Notes: The dashed (solid) high-low bars are 95 percent confidence intervals for the bilateral exchange (US-dollar exchange rate). Robust standard errors are clustered at the exporter-importer level (3,572). All regressions include 362,165 observations and exporter-importer-product and HS2-product×year fixed-effects, as well as controls for (natural log of) the exporting and importing country GDP as well as total imports of HS2-products in the importing country.

Policymakers in small open economies usually highlight the exchange rate effect on exports as an important channel of policy transmission to the real economy and inflation. The narrative usually goes something like this:

A weaker exchange rate − a depreciation − increases exports as domestic goods and services become cheaper compared with foreign ones in export markets. The surge in export production contributes to economic activity and thus inflationary pressures.

In a world where the Dominant Currency Paradigm holds, this demand-side effect of exchange rate changes on exports can indeed be negligible. Exchange rates do not alter the prices in dominant currencies and exchange rate changes do not stimulate demand for the exporter’s goods and services. Instead, changes in exchange rates directly affect exporting profits in the domestic currency, which can have supply-side effects on trade by incentivising entry into exporting that can drive total exports, as shown in this policy brief.

Entry into the export sector might in turn lead to productivity gains through “learning by exporting” (De Loecker, 2013), even though the existence or relevance of this channel is uncertain (Singh, 2010). A learning by exporting effect would increase the exporting economy’s growth potential and is an effect of exchange rate movements that could be studied further at the firm-level.

What are then the trade related demand-side effects of exchange rates? It depends. If entrants into exporting are previously domestic producers, an exchange rate change can simply divert domestic production to the production of exports, keeping economic activity constant. On the other hand, entry into the exporting sector of previously domestic firms might increase production by expanding their new potential (international) market. Previous exporting firms might also opt to enter new geographical markets as conditions improve and thus increase production. Alternatively, new firms might enter the export sector directly without ever having any domestic production, which would lead to increasing overall production.

The analysis in this policy brief is silent on whether entry is driven by existing firms, new firms or whether the entry is associated with increasing domestic production overall or not. What is clear is that the policy narrative on the exchange rate effect on exports in small open economies needs amending, to accommodate the findings in the literature on dominant currencies in trade.

There are several avenues for future research. One would be to fully examine the consequences for activity and productivity of intensive and extensive export margin adjustment to exchange rate changes. Another is to examine the effects outlined in this policy brief for other countries and other dominant currencies in different regions of the world.

Bernard, Andrew B, Stephen J Redding, and Peter K Schott, “Multiproduct firms and trade liberalization,” The Quarterly Journal of Economics, 2011, 126 (3), 1271–1318.

Berman, Nicolas, Philippe Martin, and Thierry Mayer, “How do different exporters react to exchange rate changes?,” The Quarterly Journal of Economics, 2012, 127 (1), 437–492.

Fernandes, Ana M, Caroline Freund, and Martha Denisse Pierola, “Exporter behavior, country size and stage of development: Evidence from the Exporter Dynamics Database,” Journal of Development Economics, 2016, 100 (119), 121–137.

Frohm, Erik, “Dominant currencies and the export supply channel,” European central bank working paper series, 2021, No 2580.

Gopinath, Gita, Emine Boz, Camila Casas, Federico J Diez, Pierre-Olivier Gourinchas, and Mikkel Plagborg-Møller, “Dominant currency paradigm,” American Economic Review, 2020, 110 (3), 677–719.

Hummels, David and Peter J Klenow, “The variety and quality of a nation’s exports,” American Economic Review, 2005, 95 (3), 704–723.

Loecker, Jan De, “Detecting learning by exporting,” American Economic Journal: Microeconomics, 2013, 5 (3), 1–21.

Mayer, Thierry and Gianmarco IP Ottaviano, “The happy few: The internationalisation of European firms,” Intereconomics, 2008, 43 (3), 135–148.

Melitz, Marc J, “The impact of trade on intra-industry reallocations and aggregate industry productivity,” Econometrica, 2003, 71 (6), 1695–1725.

Obstfeld, Maurice, “Harry Johnson’s “Case for Flexible Exchange Rates”–50 Years Later,” National Bureau of Economic Research Working Paper Series, 2020, (26874).

Singh, Tarlok. “Does international trade cause economic growth? A survey.” The World Economy 33.11, 2010, 1517-1564.

Tille, Cedric, Arnaud Mehl, Georgios Georgiadis, and Helena Le Mezo. “Fundamentals vs. policies: can the US dollar’s dominance in global trade be dented?,” European central bank working paper series, 2021, No 2574.

Tenreyro, Silvana, “Monetary policy and open questions in international macroeconomics,” 2019. Speech, John Flemming Memorial Lecture, London 28 October.

The opinions expressed in this policy brief are the sole responsibility of the author and should not necessarily be interpreted as reflecting the views of the European Central Bank (ECB).

Available data on countries trade invoicing shares have improved greatly recently (due to the efforts of Boz et al. 2020). However, it is still largely based on country-aggregates and not bilateral information.