In recent decades, we have witnessed the expansion of complex institutions, which are organised in different legal entities and conduct different business in different locations. The diversification benefits that may arise because of the different sources of income and of the lack of synchronization have to be balanced against the agency frictions. We study the relationship between risk and complexity in banking groups in three dimensions: organizational, geographic and business and investigate the role of the effective control of parent banks over their affiliates. We document that greater complexity in the organizational and business domain gives rise to higher risk, while greater geographic complexity generates lower risk. We also find that when there is no effective control – no matter type – gives rise to higher risk. Additionally, when there is no transfer of control in a merger, the resulting increased complexity does not generate a change in risk.

In the last decades, there has been a generalised increase in the number of complex banking groups. There are many potential factors behind this trend such as the transformation in the technology of intermediation (Cetorelli et al., 2012), the impact of mergers and acquisitions (Cetorelli et al., 2014, and Carmassi and Herring, 2016) or the impact of regulatory restrictions (Correa and Goldberg, 2020). This process has affected the management of banking groups at its operational level (Liang and Rhoades (1988)).

Our paper (Argimón and Rodríguez-Moreno, 2022) studies the complexity of the Spanish banking system, based on quarterly confidential supervisory data from 2005Q1 to 2016Q4. The reason why the Spanish case is particularly suited for the analysis of complexity is twofold. First, the heterogeneity of bank’s organizational complexity is large in Spain, with standalone entities coexisting with G-SIB, which are considered to be the most internationalised among the largest world banks. Second, the dramatic changes in the complexity of some institutions as a result of the consolidation process, which started at the end of the nineties and culminated between 2009 and 2011 with a high number of mergers among savings banks.

Complexity measures are based on the bank’s affiliate structure, which is garnered from the confidential report on the equity instruments portfolio. For every firm participated directly or indirectly by a banking group through equity instruments, the report contains the information of the firms directly participated by the parent bank or indirectly participated through other firms of the group. In line with previous literature of bank complexity, we restrict our sample of affiliates to: i) all the participations in the entities of the economic group, multi-group and associates; ii) those entities in which the parent has 50% or more of the voting rights.

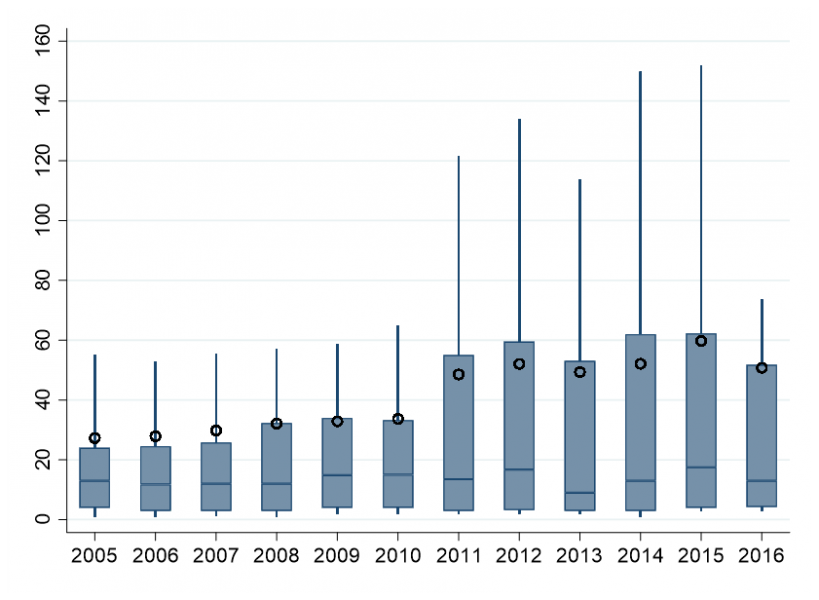

Figure 1 depicts the distribution of the number of affiliates of banking groups on an annual basis. It contains the median (in circle) as well as the percentiles 10, 25, 50, 75 and 90 of the annual distribution. The evolution of the number of affiliates in the Spanish banking groups follows a similar pattern to the one documented in large economies as in the US. We observe a stable pattern of the affiliate structure up to 2010. In 2011, there is a remarkable change where percentiles 75 and 90 almost double. Interestingly, in 2016 the dispersion of the number of affiliates decreases, observing a generalized reduction of all percentiles and the mean, in line with the regulatory efforts to improve the resolvability of banking groups.

Figure 1: Number of affiliates

Following Cetorelli and Goldberg (2014), we study three dimensions of complexity:

For each complexity dimension we compute two alternative measures: i) counts and ii) Herfindahl-Hirschman Index (HHI) based on net worth. In particular, the first proxy of complexity is defined as the number of affiliates, the number of countries or the number of business activities controlled by the parent bank. The second proxy is a normalized HHI where the size of each affiliate is given by its net worth. The use of the HHI broadens the concept of complexity to be able to include in the analysis the contribution of the affiliate’s net worth in the overall group and not just its mere existence. It can thus provide a more accurate description of the bank group activity and complexity, as it captures how the affiliates contribute to the group. However, as in the case of counts measures, this metric is not free from limitations since bank-related affiliates are commonly larger than non-bank-related affiliates, thus, this approach could underestimate the complexity of banking groups.

The median banking group in our sample has 16 affiliates, all of them domiciled in 1 country and operating in the five considered business categories (i.e., bank, other financial, real estate, insurance, and non-financial activities). However, there exist a large dispersion among banking groups, mainly on the geographical domain. We observe that the number of countries in which banks have affiliates, significantly increases overtime for the right tail of the distribution from 2009 to 2014, when we observe that banks in the 90th percentile have domiciled affiliates in 9 different countries. Complexity in geographic terms is much lower than in business terms. This can be explained as many banks have little or no activity abroad for most part of the period under analysis (46 out of 97 banking groups). It is only when restructuring has taken place when complexity in the geographic dimension grows (Berges et al., 2012). The dynamics in the affiliates’ activity is similar using number of affiliates or the HHI.

In complex organizations, there is a trade-off between the benefits of diversification and the costs associated with agency problems. Bank holding companies can be a source of strength to their affiliates (Ashcraft, 2008) as banks that engage in a variety of activities could enjoy economies of scope that boost performance. However, complexity may lead banks to assume higher risk due to an intensification of agency problems, associated to a loss of effective control over all organizational units as less expertise in monitoring can be linked to lending in a new sector or location (Acharya et al., 2006).

The empirical literature is not conclusive on whether diversification benefits of expanding abroad outweigh costs. In the context of the financial sector, Berger et al. (2017) and Krause et al. (2017) gather evidence that geographic diversification increases risk, with data for the US and for the euro area, respectively. One explanation may be that banks may engage in regulatory arbitrage, circumventing strict domestic regulations by taking more risk abroad or because of market- specific factors in the foreign market. On the contrary, Goetz et al. (2016) provide evidence that geographic diversification contributes to reducing risk. The most cited argument for the observed lower risk of generating cash flows in different countries is that geographic expansion lowers risk by reducing exposure to idiosyncratic local risks. The less than perfect correlation between the home and the host business cycle may be the source of the positive effect of diversification on risk reduction (Argimón, 2017).

As for business diversification within financial groups, the empirical literature seems to point at its irrelevance (Krause et al., 2017) or at its positive relationship with risk (Laeven and Levine, 2007, Chernobai et al., 2021). Laeven and Levine (2007), analysing market valuations find that there is a diversification discount. They argue that financial firms engaging in both lending and non-lending activities experience intensified agency problems so that economies of scope are not sufficiently large to produce a diversification premium. Focusing on operational risk events, Chernobai et al., (2021) show that banks’ business complexity as captured by the extent of their nonbanking activity increases their operational risk.

Finally, for organizational complexity, there is empirical evidence that the existence of different units within a financial group affects performance and that the organizational structure of banks is relevant for balance sheet management (Cetorelli and Goldberg, 2016). The results in Correa and Goldberg (2020) point at a negative relationship between this type of complexity and risk.

In our work, we find evidence that higher organizational and business complexity results in higher risk, which is proxied by the negative value of the natural logarithm of the z-score. The higher the number of affiliates within a banking organization and the higher the lines of business it deals with, the more complex it becomes and the more difficult its managing and monitoring. Thus, it seems that the agency problems that arise from having a larger number of affiliates or business lines which entitle different expertise outweigh the potential diversification benefits. On the other hand, higher complexity in the geographical domain results in lower risk as such diversification is able to capture the benefits of being active in different locations and markets. This result is explained by the geographical expansion of the Spanish banking groups, mainly concentrated in areas with low business synchronization with the Spanish economy.

In our work we postulate that the effective control that parent banks have over their affiliates, which is understood as the real capacity to influence the behaviour and output of another entity through formal or informal mechanisms, can channel the relationship between complexity and risk. In this vein, we expect that the weaker the control that the parent bank has over the affiliates, the higher the risk, as agency problems that emerge from weaker control outweigh the potential diversification benefits.

In order to provide evidence on whether the strength of control is a potential channel for the transmission of complexity to risk, we follow two different identification strategies that enable us to clearly differentiate those situations where the parent bank has the effective capacity to influence on another entity and which take advantage of some specific characteristics and changes in the Spanish regulatory framework.

The first approach uses the distinction made by the Spanish Prudential Regulation between effectively controlled affiliates, on the one hand, and multi-groups and assimilated affiliates, on the other, which are included within the Spanish consolidation scope. We define non-effective control when affiliates need to unanimously agree with other entities outside the group the decisions they take (i.e., they take the legal form of multi-group or associated affiliates).

Under the second approach, we focus on the alternative forms of bank consolidation that the Spanish regulation allowed banks to follow during our period of analysis and which gave rise to different control structures: strengthened Institutional Protection Schemes (IPS) and standard mergers and acquisitions (M&A). The main difference between the two processes is that under an IPS each member remains a separate legal entity which will be run independently of one another, so that control is not fully transferred to the new entity created or to one of the participating entities, as it would happen in a standard M&A.

Our results indicate that control of the parent bank over its affiliates is an element to include in the policy discussion. According to our results, it seems that the increase of complexity through multi-groups or associated affiliates, also increases the agency problems in such a way that the potential diversification benefits deriving from the expansion of the group in different dimensions cannot outweigh such cost. On the contrary, expansion through controlled affiliates does not generate such a negative outcome and can even deliver the opposite result. Moreover, if banking groups have weaker control as they become more organizationally complex, it implies that it is more difficult for the parent bank to monitor the desired policy and to ensure that all the affiliates hold to it. Under this situation, the idiosyncratic behaviour of the affiliates hampers the resilience of the whole group, increasing agency costs. However, if banking groups increase their complexity through affiliates over which the parent bank can exert effective control, agency problems are alleviated, improving the resilience of the group.

Our results are aligned with the call for increasing return diversification in European banks and the concerns regarding their low profitability in a low interest environment and the way in which to promote sustainable profitability. We have provided evidence that groups which diversify abroad are more able to mitigate the negative effects that complexity may have on risk, as long as there is low macroeconomic correlation and the focus abroad does not imply a reduction in control. Moreover, our analysis suggests that a reduction in the level of banking group risk would result from the reduction of affiliates that are multi-group structures or are jointly controlled entities or joint ventures. It thus supports the current regulatory approach directed to fostering a simplification of banking group structures to contribute to resolvability. It also supports the initiatives to promote the creation of cross-border groups. Although it is a bank’s management which is responsible for taking the decision on the group’s structure, regulatory policy can facilitate adjustments to constitute less risky groups, and thus to develop banks with sustainable profitability.

Acharya, V. V., Hasan, I. and Saunders, A. (2006) “Should banks be diversified? Evidence from individual bank loan portfolios” The Journal of Business, 79 (3), pp. 1355 – 1412.

Argimón, I (2017) “Decentralized multinational banks and risk taking: the Spanish experience in the crisis”. Banco de España, Working Paper, 1749.

Argimón, I., Rodríguez-Moreno, M. (2022) “Risk and control in complex banking groups”. Journal of Banking & Finance, 134, 106038.

Ashcraft, A. (2008) “Are bank holding companies a source of strength to their banking subsidiaries?” Journal of Money, Credit and Banking, vol 40, No 2-3. pp 1515 – 1528.

Avraham, D., Selvaggi, P. and Vickery, J. I. (2012) “A Structural View of U.S. Bank Holding Companies” Economic Policy Review, Vol. 18 (2), pp. 65 – 81.

Berger, A.A., El Ghoul, S., Guedhami, O. Roman, R.A. (2017) “Internationalization and Bank Risk” Management Science, vol 63 (7).

Berges, A, Ontiveros, E. Valero, F.J. (2012) “The Internationalization of the Spanish financial system” in Malo de Molina, J. L. and Martín-Aceña, P. “The Spanish financial system. Growth and development since 1900”. Palgrave.

Carmassi, J. and Herring, R. (2016) “The Corporate Complexity of Global Systemically Important Banks” Journal of Financial Services Research, 49, pp.175 – 201.

Cetorelli, N and Goldberg, L.S. (2014) “Measures of global bank complexity” FRBNY Economic Policy Review. December 2014.

Cetorelli, N and Goldberg, L.S. (2016) “Organizational complexity and balance sheet management in global banks” FRBNY Staff Report No 772. March 2016.

Cetorelli, N., Mandel, B.H., and Mollineaux L. (2012) “The Evolution of Banks and Financial Intermediation: Framing the Analysis” FRBNY Economic Policy Review, June 2012.

Cetorelli, N., McAndrews, J. and Traina, J. (2014) “Evolution in Bank Complexity” FRBNY Economic Policy Review / December 2014, pp 85 – 106.

Chernobai, A., Ozdagli, A. and Wang, J. (2021) “Business complexity and risk management: Evidence from operational risk events in U.S. bank holding companies”. Journal of Monetary Economics, 117, pp. 418-440.

Correa, R. and Goldberg, L. (2020) “Bank complexity, governance and risk” International Finance Discussion Paper. Board of Governors of the Federal Reserve System Num 1287.

M.R. Goetz, L. Laeven, L. Levine (2016) “Does the geographic expansion of banks reduce risk?” Journal of Financial Economics, 120, pp. 346-362.

Krause, T., Sondershaus, T. and Tonzer, L. (2017) “Complexity and bank risk during the financial crisis” Economics Letters, 150, pp. 118-121.

Laeven, L., and Levine, R., (2009) “Bank governance, regulation and risk taking” Journal of Financial Economics, 93 (2), pp. 259 – 275.

Liang, N. and Rhoades, SD.A. (1988) “Geographic diversification and risk in banking” Journal of Economics and Business, 40, pp. 271 – 284.

The opinions in this Policy Brief are solely the authors’ and do not necessarily represent those of Banco de España or the Eurosystem.