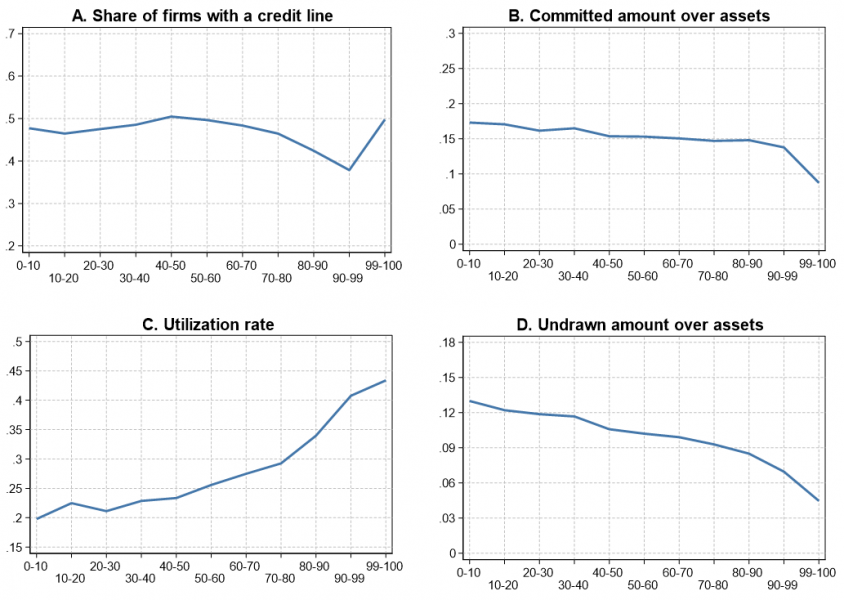

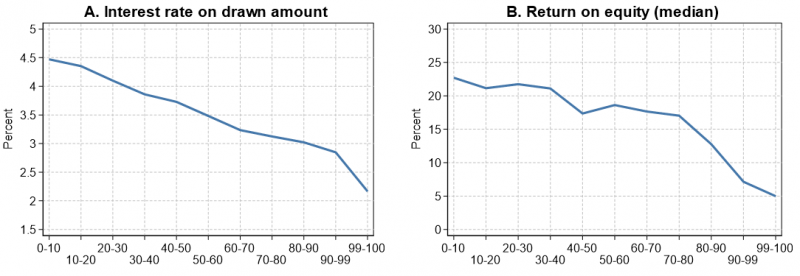

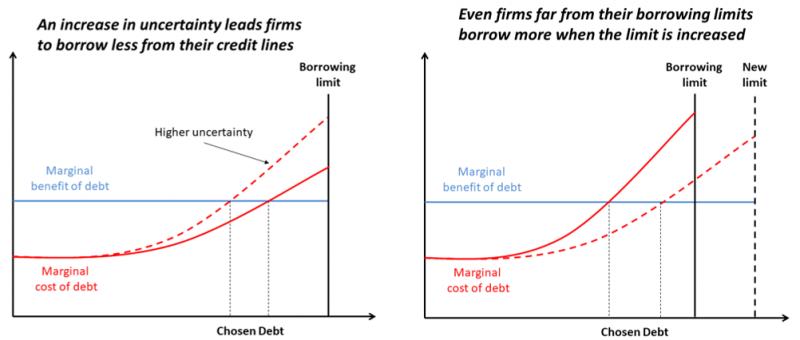

Are credit constraints an important and widespread phenomenon in the corporate sector? In a recent working paper (Amberg et al., 2023), we use an administrative Swedish credit register to document that firms throughout the size distribution—from micro-sized enterprises to the largest firms in the economy—have access to fairly large amounts of unused and reasonably priced borrowing capacity via credit lines. This implies that they are unconstrained according to conventional definitions of credit constraints. We argue, however, that the conventional view that credit constraints are widespread and important can be reconciled with the empirical facts outlined in the paper if we adopt a dynamic conception of credit constraints. In this policy brief, we summarize the main empirical facts from our paper and explain how they can be reconciled with the view that credit constraints matter.