The views expressed here are those of the authors and not necessarily those of the Bank for International Settlements (BIS). We thank Claudio Borio, Gaston Gelos, Benoît Mojon, Hyun Song Shin and Alexandre Tombini for helpful comments on an earlier version. We thank Cecilia Franco, Rafael Guerra, Alejandro Parada and Pablo Tomasini for excellent research assistance.

Abstract

Trade and geopolitical tensions could drive important shifts in trade and investment flows. In this note we present evidence of such a realignment to date. We show that, as US imports from China have fallen, a few countries (in Asia and the Americas) have increased exports to the US. Capital flow data give a more mixed message, with a decline in foreign direct investment (FDI) in China but relatively stable FDI in Latin America, the Caribbean and other emerging markets. FDI in some countries in Latin America, and in Poland and South Africa, is higher than what is expected based on historical relationships. Overall, these shifts could weigh on economic growth, increase inflation and threaten financial stability.

In the last few years, the world has seen shifts in trade and investment flows. Geopolitical developments, trade tensions, natural catastrophes and a variety of economic and non-economic factors have led firms and private investors to reassess decisions around global value chains (GVCs), foreign direct investment (FDI) and portfolio investment. A potential broad realignment – ie a persistent change – of trade and investment could have implications for growth, inflation and financial stability. This note seeks to frame a discussion on this potential realignment and implications for policy makers.

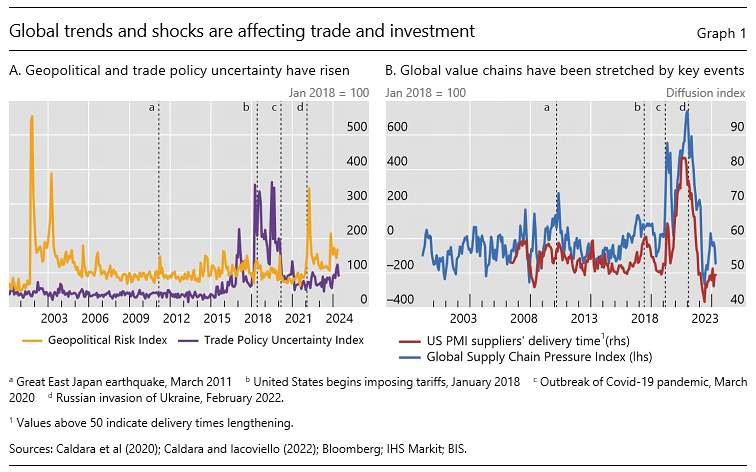

What can drive a realignment of trade and investment flows? The last decade saw a string of trade conflicts between key economies and a surge in geopolitical tensions. While average tariffs remain low, a series of (actual and expected) tariff and non-tariff measures on selected goods are disrupting both trade and investment flows. Trade policy uncertainty rose significantly after the 2016 US elections and skyrocketed just before the US imposed tariffs on selected Chinese and other goods in 2018 (Graph 1.A). After a decade and a half of low readings, a measure of geopolitical uncertainty surged as Russia invaded Ukraine in 2022. Several countries – especially advanced economies (AEs) – imposed sanctions and many Western firms and financial investors disinvested from their Russian assets.

Trade and geopolitical conflicts could result in reshoring, nearshoring or friendshoring of economic activity and capital.#f1 This could reduce exports from China, particularly but not only to the US, as production shifts to countries that are geographically closer or politically more aligned with the destination country. Sanctions could lead to a rebalancing of portfolios and direct investment away from countries that are subject – or might become subject – to them. In the extreme, further countries might become “uninvestable” for some investors. Sanctions may not only affect investors from the countries imposing them but also those based in other jurisdictions since non-compliance could result in punitive measures, eg market access or exclusion from dollar clearing.

Trade and geopolitical conflict could also add fuel to a shift in GVCs. Already in 2011, natural catastrophes such as the Thai floods and the Great East Japan earthquake and tsunami disrupted semiconductor and auto supply chains (Graph 1.B). While damaging, their effect was dwarfed by the much broader impact of the Covid-19 pandemic. The desire for more resilient GVCs could prompt firms to diversify their suppliers or shift to jurisdictions less likely to be subject to tariffs, sanctions or other protectionist measures. An extreme scenario based on a further escalation of trade tensions could even see the establishment of independent value chains for different economic blocs.

The increase in tensions has occurred against the backdrop of other major economic changes. In addition to global megatrends related to the energy transition, demographics, and the digital transformation,#f2 the shift in China’s growth model stands out. China has become the globe’s foremost manufacturing centre and the most important goods exporter, accounting for over 30% of global goods production and exports. Increased know-how, economies of scale and rising wages, among other factors, pushed the country up the value-added ladder into electronics, electrical vehicles, and other sophisticated products. This has opened the market for other countries with abundant low-skill labour. It may translate into higher capital inflows to these countries as they expand their export capacity. China is also a key source of demand for commodities, and the demand for different types of commodities swells and ebbs with economic developments there.

These ongoing economic changes will be reflected in the external accounts of countries, but at different velocities. Trade and portfolio flows may shift rapidly and seamlessly. FDI, in contrast, may depend on the regulatory framework and proximity, both in geopolitical and geographical terms. We look at available evidence, focusing on countries in the Americas.

In the second section of the note, we look at the evidence of realignment from trade. Trade and portfolio flows should lead, in time and destination, the realignment of FDI which we analyse in the third section. In the fourth section we discuss potential implications and conclusions.

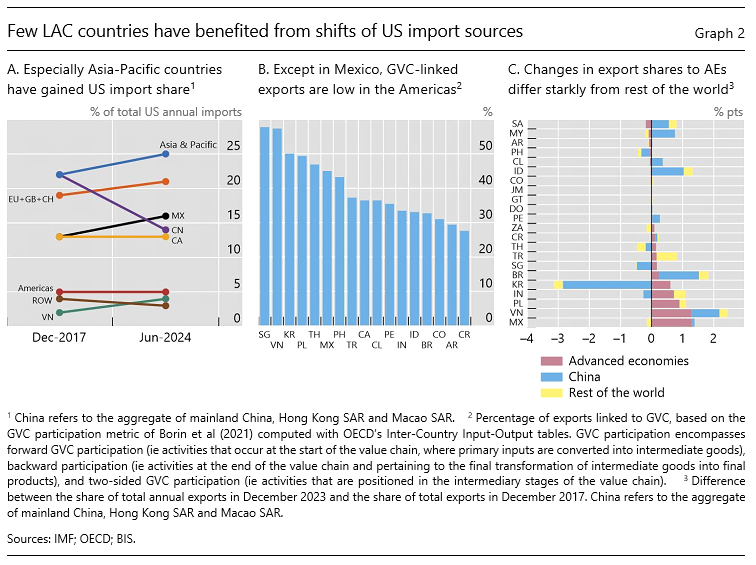

Some shifts in world trade patterns have been observable in recent years. Since 2018, when the US introduced new tariffs on Chinese imports, China’s share in US annual imports fell by 8 percentage points to 14% by June 2024. US imports from China were thus 21% lower in the period January 2018 to June 2024 than what they would have been had China kept its share of US imports constant as of end-2017. Economies in Asia, particularly India and Vietnam, have seen their import shares rise (Graph 2.A). Mexico and Canada – likely destinations for nearshoring – benefited modestly, yet enough for Mexico to surpass China as the largest source of US imports in late 2023.

Beyond Mexico and Canada, the only countries in the Americas that saw their US import shares increase significantly were Paraguay, Costa Rica, Nicaragua, the Dominican Republic, Panama and Chile. Their gains contrast with losses in the US import share of Argentina, Brazil, Colombia and Peru.#f3 This probably reflects the limited integration into GVCs of these economies. Indeed, most countries in Latin America and the Caribbean (LAC) – except Mexico – concentrate on upstream export products like fuels, metals and food. As result, less than one third of exports from Argentina, Brazil and Colombia are linked to GVCs, compared with 30% and 60% in India and Vietnam (Graph 2.B). Mexico is in the middle, with 46% of its exports linked to GVCs. As documented by Aguilar et al (2024), countries that were already highly integrated into GVCs benefited more from the shift in US imports away from China.#f4

At the same time, some LAC countries have shifted exports away from AEs and towards China and other emerging market economies (EMEs). For all LAC economies except Brazil, Costa Rica and Mexico, the share of exports to AEs as a block fell between 2017 and 2023 (Graph 2.C). This partly reflects greater demand by China for commodity imports from Brazil, Chile and Peru.#f5

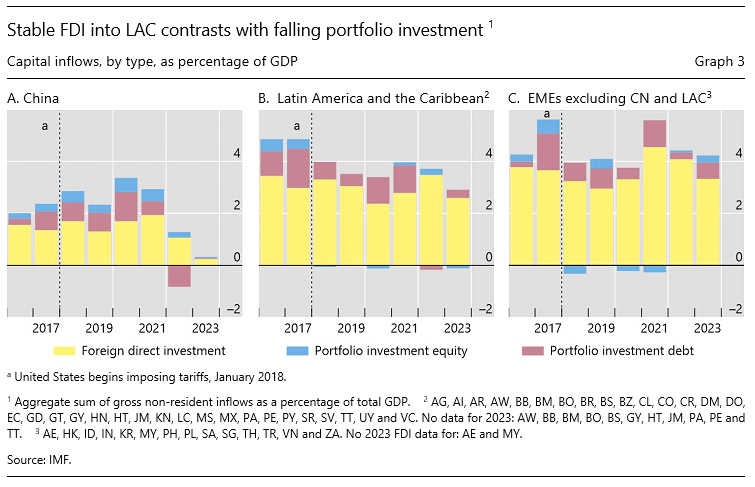

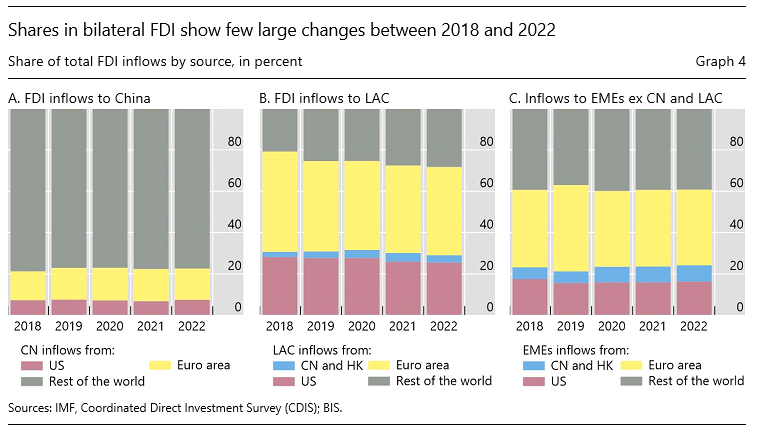

If trade patterns change in response to structural shifts, capital may follow, but capital flow data give a more mixed message on realignment than trade data. Chinese balance of payments data shows a sharp drop in both FDI and portfolio inflows in 2022 and 2023 (Graph 3.A). This would be in line with various realignment stories. However, source country data from the US and the euro area – available until 2022 – do not show a large shift; their share in FDI flows to China is stable (Graph 4.A).

In contrast to changes in trade flows, lower FDI and portfolio investment flows to China were not offset by higher flows elsewhere. FDI in LAC in 2022 and 2023 was roughly similar to the values recorded in previous years, whereas portfolio debt and portfolio equity investment were considerably lower (Graph 3.B).

This relative stability of aggregated FDI hides significant variation in the sources of FDI to LAC. Declining US and euro area FDI has been somewhat compensated by flows from other sources, including China. Chinese FDI in LAC was larger in 2020 and 2021 but fell in 2022 (Graph 4.B). The growth in 2020–1 may have reflected that Chinese firms are looking to increase access to LAC goods markets, to secure sources of commodities or even to circumvent trade barriers. Chinese FDI in LAC was very small throughout the period, but with a clear upward trend.#f6

Flows to EMEs other than China and LAC were relatively stable over 2018–23. FDI declined in 2022 and 2023 from a record value in 2021 but remained in line with the levels of previous years (Graph 3.C). The sources of FDI also barely changed (Graph 4.C). Portfolio investment was volatile, and without a clear trend.

Some countries in LAC saw higher FDI than suggested by historical relationships. We estimate counterfactual investment flows using a fixed effects regression model for gross FDI to EMEs.#f7 The model predicts FDI to 25 EMEs based on macroeconomic and financial data over the period 2001–23. Annual data on inflows in the period 2021–23 can be compared with this benchmark.

Estimates suggest that FDI seems to respond to global factors, the lag of domestic GDP growth and the lag of FDI. Regarding the global variables, rises in geopolitical risk or trade policy uncertainty translate into lower FDI. By contrast, when the US economy accelerates, FDI rises.

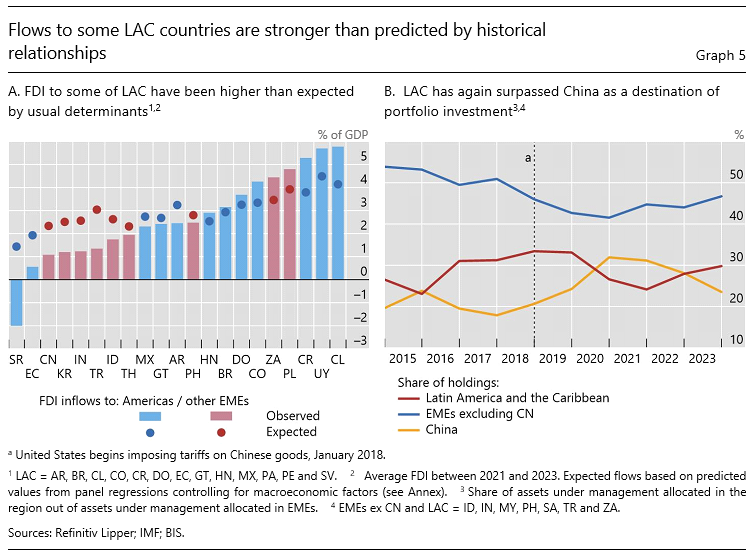

The counterfactual estimates suggest that Brazil, Chile, Colombia, Costa Rica, the Dominican Republic, Honduras and Uruguay all saw higher FDI inflows than expected in 2021–23 (Graph 5.A).#f8 Guatemala and Mexico received somewhat smaller FDI than predicted and Argentina, Ecuador and Suriname recorded levels well below what the historical relationships would suggest. Model estimates also show that Poland and South Africa received more FDI in 2021–23 than predicted by historical relationships.

For portfolio flows, one driver of changes may be demand by investors for non-Chinese assets.#f9 China’s share in assets under management of funds fell after 2021, in line with the fall in FDI, whereas that of LAC and of other EMEs increased (Graph 5.B). During 2023 the LAC share of assets under management again surpassed that of China.

This note has highlighted the undergoing realignment of trade and the incipient realignment of investment flows driven by trade and geopolitical tensions. From trade data, there is evidence of shifts in trade patterns, with an eight-percentage point drop in US imports from China, an increase in exports from certain Asian economies and a modest increase from some economies in the Americas (Canada, Chile, Costa Rica, the Dominican Republic and Mexico). Capital flow data give less clearcut evidence to date, with a sharp fall in FDI in China but relatively stable FDI in Latin America, the Caribbean and other emerging markets. Simple regressions show that FDI inflows to several countries in the Americas, and to Poland and South Africa, are higher than what would be predicted based on historical relationships.

A realignment of trade and investment flows could entail risks in the outlook of the global economy. While the effect will vary and some countries could stand to benefit from reshoring or near-shoring, the overall impact of relocating to higher-cost production locations is likely to be negative. Shifts in trade flows could also put upward pressure on inflation. Changes in both trade and investment flows (eg due to sanctions or some countries becoming “uninvestable”) could pose risks to financial stability. In particular, some assets may suddenly lose value, and financial institutions may make losses that erode their solvency and are propagated through the financial system.#f10 The realignment of trade and investment – towards a new equilibrium with higher production costs and a substitution of inputs – will affect global GDP and prices. In the transition, which may take several years, economic growth may be lower and inflation higher.#f11 The specific impact on each country will depend on several factors, some of which relate to the ability to benefit from the realignment, such as the integration in GVCs. Others relate to the availability of low-cost labour and natural resources, not least the commodities required for the green transition.

In the short run, countries that are close to the largest economies and already integrated into GVCs, such as Mexico, Canada, and some Central American countries, can reap the benefits of trade realignment and nearshoring. Other economies, which are geographically distant or less integrated, could leverage their advantage in terms of low-cost labour and abundant natural resources.

For commodity exporters, such as Brazil, Chile, Colombia and Peru, a key question is how any possible realignment affects commodity markets. In principle, lower global demand should exert downward pressure on commodity prices. However, this may be offset by other factors. For example, energy prices could remain high if key producers remain shut out of large swathes of the market. Some metal prices, eg those for copper and lithium, may rise in response to the boost in demand from the energy transition. The size and direction of the terms of trade shock can thus vary significantly across countries and over time. Some countries may suffer outflows as foreign investors reduce exposures to fossil fuels, while others may be able to attract inflows related to the energy transition. Assessing the net impact of these factors on real exchange rates, for example, is a complex task.

The policy response to the macro effects of a potential realignment is not straightforward. Central banks and other macroeconomic policymakers may want to see through the lower growth and higher inflation brought about by this supply shock. They may limit themselves to addressing indirect effects and smoothing the transition to a new equilibrium. But after several years of inflation that was well above target, this may be difficult; the public may view such apparent inaction as insufficient commitment to low inflation. In most countries of the Americas, fiscal policy is also constrained by high debt levels and the need for consolidation to bring public finances on a sustainable path.

Of course, the magnitude of macroeconomic risks hinges on the nature of geopolitical shocks and their evolution. In order to mitigate such risks to economic growth and welfare, the most effective policy would be for governments to reassert their commitment to open multilateral trade and an integrated global financial system.

Regions in the Americas

The Caribbean: Anguilla, Antigua and Barbuda, Aruba, The Bahamas, Barbados, Bermuda, Dominica, Grenada, Haiti, Jamaica, Montserrat, St Kitts and Nevis, St Lucia, St Vincent and the Grenadines, and Trinidad and Tobago.

Central America: Belize, Costa Rica, El Salvador, Guatemala, Honduras and Panama.

South America: Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Guyana, Paraguay, Peru, Suriname and Uruguay.

Global peers

Other emerging market economies (EMEs): China, Hong Kong SAR, India, Indonesia, Korea, Malaysia, the Philippines, Poland, Saudi Arabia, Singapore, South Africa, Thailand, the United Arab Emirates, Türkiye and Vietnam.

Depending on data availability, country groupings used in graphs and tables may not cover all the countries listed. The grouping is intended solely for analytical convenience and does not represent an assessment of the stage reached by a particular country in the development process.

Aguilar, A, J Caballero, J Frost, and A Parada (2024): “Evidence of nearshoring in the Americas?”, BIS Bulletin, no 94.

Aguilar, A, J Caballero, J Frost, J Hernández, V Nuguer and C Upper (2024): “Are investment flows following the trade realignment?”, mimeo.

Aiyar, S, J Chen, C Ebeke, R Garcia-Saltos, T Gudmundsson, A Ilyina, A Kangur, T Kunaratskul, S Rodriguez, M Ruta, T Schulze, G Soderberg and J Trevino (2023): “Geoeconomic fragmentation and the future of multilateralism”, IMF Staff Discussion Notes, no 1.

Alfaro, L and D Chor (2023): “Global supply chains: the looming great reallocation”, NBER Working Papers, no 31661, September.

Americo, A, J Johal and C Upper (2023): “The energy transition and its macroeconomic effects”, BIS Papers, no 135, May.

Borin, A, M Mancini and D Taglioni (2021): “Economic consequences of trade and global value chain integration: a measurement perspective”, World Bank Policy Research Working Papers, no 9785, September.

Caldara, D and M Iacoviello (2022): “Measuring geopolitical risk”, American Economic Review, vol 112, no 4, pp 1194–225.

Caldara, D, M Iacoviello, P Molligo, A Prestipino and A Raffo (2020): “The economic effects of trade policy uncertainty,” Journal of Monetary Economics, vol 109, pp 38–59.

Claessens, S (2019): “Fragmentation in global financial markets: good or bad for financial stability?”, BIS Working Papers, no 815, October.

International Monetary Fund (IMF) (2023a): “Geoeconomic fragmentation and foreign direct investment’, IMF World Economic Report, April.

——— (2023b): “Trade integration and implications of global fragmentation for Latin America and the Caribbean”, Regional Economic Outlook – Western Hemisphere, October, Chapter 2.

Javorcick, B, L Kitzmüller, H Schweiger and M Yıldırım (2024): “Economic costs of friendshoring“, The World Economy, pp 1–38.

Lagarde, C (2023): “Central banks in a fragmenting world”, speech at the Council on Foreign Relations’ C Peter McColough Series on International Economics, 17 April.

Mesquita-Moreira, M, J Blyde, C Volpe, M Dolabella and I Marra (2022): “The reorganization of global value chains: what’s in it for Latin America and the Caribbean?”, IDB Working Papers, no 1414, December.

Qiu, H, H S Shin and L Zhang (2023): “Mapping the realignment of global value chains” BIS Bulletin, no 78, October.

Tombini, A (2024): “Can Latin America win in globalisation?”, speech at JP Morgan investor seminar, 17 April.

Reshoring can be defined as shifts in production to the country in which goods and services are sold. Nearshoring can be defined as shifts in production to countries that are geographically near. Friendshoring can be defined as shifts in production to countries that are geopolitically aligned.

See Tombini (2024). Americo et al (2023) study the macroeconomic consequences of the energy transition in more depth, including the effects on the current account.

Based on the counterfactual that countries would have had their share of US imports constant as of end-2017, observed imports in the period January 2018—June 2024 were 33% larger for Paraguay, and larger for Costa Rica (31%), Nicaragua (12%), the Dominican Republic (9%) and Chile (6%). Conversely, observed imports were lower for Argentina (3%), Brazil (6%), Colombia (9%), and Peru (15%). See Aguilar et al (2024) for further analysis of the shifts in US import sources.

Using firm-level cross-border links, Qiu et al (2023) show that GVCs lengthened between late 2021 and early 2023, as US firms decreased their direct supplier links with Chinese firms. Firms from other jurisdictions, notably in Asia, interposed themselves in the China-US supply chain. See also Alfaro and Chor (2023), IMF (2023b) and Mesquita-Moreira et al (2022).

Associated with this shift, all countries in the region increased their share of world exports between 2018 and 2023, except for Argentina.

In line with the change in trade flows, US FDI in Mexico increased somewhat, while euro area FDI was flat. Moreover, between 2017 and 2022 FDI flows from China to most LAC countries have risen as percentage of total inflows to each country (from a low base): Brazil from 0.7 to 1.2%; Argentina from 0.9 to 2.9%; Mexico and Chile from 0.2 to 0.3%; Bolivia from 0.0 to 1.0%; Paraguay from 0.3 to 0.5% and El Salvador from 0.0 to 0.3%.

See Aguilar et al (2024) for further details on the estimation.

Results are in line with FDI in EMEs being vulnerable to geopolitical risk. See IMF (2023a).

Anecdotally, fund managers have recently noted client demand for EME indices that exclude China.

See Claessens (2019) for a discussion of trade-offs of fragmentation for financial stability.

See Lagarde (2023), IMF (2023a) and Caldara and Iacoviello (2022) regarding the potential (and past) impact of geopolitical risk. Relatedly, Alfaro and Chor (2023) find that the shifts in US import sources has been associated with higher unit import prices. Aiyar et al (2023) and Javorcick et al (2024) show evidence of lower global growth as a consequence of geoeconomic fragmentation.