This brief should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the authors and do not necessarily reflect those of the ECB.

Recent dysfunction in UK gilt markets has put the spotlight on the operations of Liability Driven Investors (LDIs). In this SUERF Policy Brief, we explain what LDIs are and ask whether their presence in markets is an advantage or liability for policymakers. We show that the actions of LDIs strengthen the transmission mechanism from policy rates to the yield curve and enhance the impact of quantitative easing/tightening programmes, especially when interest rates are low. From the perspective of monetary policy efficacy, having LDIs in the market is then an advantage for policymakers. However, the same cannot always be said of the leveraged and derivative positions that some LDIs take, which can threaten financial stability and may induce volatility that is a potential liability to policymakers.

The investment strategies of LDIs emphasise the cash flows needed to fund present and future liabilities. Insurance companies and defined benefit pension funds are good examples. They have liabilities that stretch over long horizons in the form of guaranteed payments on pension plans and payouts on life insurance policies. The present value of such long-term liabilities depends on the rate at which they are discounted, which in a world of changing interest rates poses a risk to their balance sheets. This is a duration risk, since it affects the average number of years at which the long-term liability is paid off. The main concern is falling interest rates, since they push up liabilities and may threaten solvency.

LDIs can hedge the duration risk in their liabilities by purchasing assets that also vary with interest rates. The simplest way to do this is via government bonds, since their market value also increases when interest rates fall. By holding a suitable portfolio of government bonds, LDIs can ensure that fluctuations in long-term liabilities are matched by similar changes in the value of their assets, immunising balance sheets and protecting their equity. Falling interest rates becomes less of a problem because assets and liabilities move together. The strategy is referred to as liability-driven as it is the desire to offset the duration risk in liabilities that determines the demand for government bonds.

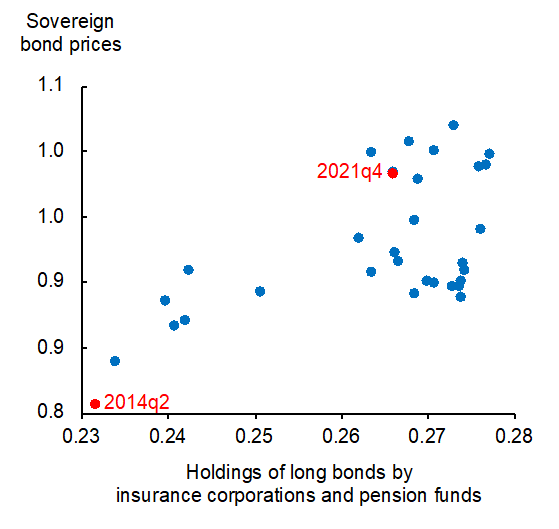

A simple example of an LDI investment strategy is offered by Domanski, Shin and Sushko (2017). As interest rates fall, the present value of long-term liabilities increases and becomes even more sensitive to changes in the interest rate. The sensitivity of bond prices also rises, making them a better hedge against duration risk, but not by enough to counteract the additional riskiness in liabilities. LDIs must then load up on even more government bonds, implying that they have demand curves that are downward-sloping in bond yields and upward-sloping in bond prices. This model’s prediction is tentatively supported by the Security Holding Statistics in Figure 1, which shows a positive relationship over time between long bond prices and the share of all long bonds being held by insurance companies and pension funds in the Euro Area.

Figure 1: Long bond prices and the share of all long bonds held by insurance corporations and pension funds in the Euro Area

In the simple example, LDIs buy government bonds because they want the asset side of their balance sheets to be exposed to the same duration risks as their long-term liabilities. However, there is nothing in the theory that pins down how they should structure that exposure. They could purchase just a few long bonds whose market prices move a lot with the interest rate, or they could hold lots of shorter maturity bonds that are not so sensitive. All that really matters is the aggregate exposure of their assets to interest rate risk. If the yield curve is arbitrage-free then the market price of risk is the same at all maturities, in which case LDIs are indifferent between alternative portfolios that deliver the same aggregate exposure. In practice they are likely to favour long bonds, e.g., to reduce transactions costs.

In Carboni and Ellison (2022), we put LDIs and arbitrageurs together in a macrofinance model to see what their presence implies for monetary policy. The arbitrageurs have limited appetite for risk, but are free to invest in bonds of all maturities so markets are not segmented and the yield curve is arbitrage-free. The arbitrageurs can be thought of as banks or money market funds. The behaviour of LDIs mimics that of the preferred-habitat investors in the well-known framework of Vayanos and Vila (2021), albeit acting in reverse because the authors assume that demand curves are downward-sloping in bond prices. LDIs have demand curves that are upward-sloping, so we will need a looking glass to reconcile our findings.

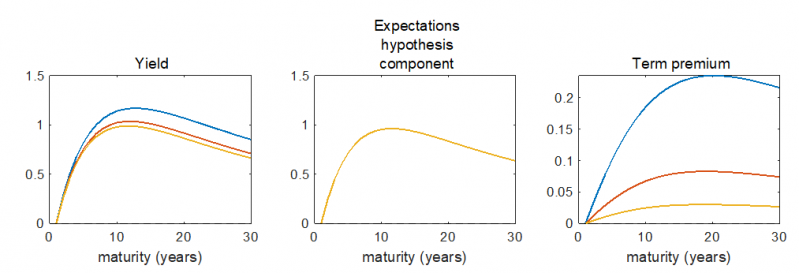

The results are in Figure 2. Consider a monetary policy intervention in the form of forward guidance that raises expected future policy rates but keeps the current policy rate fixed. Absent LDIs, there is nothing in the model that breaks the expectations hypothesis and the yield curve moves in line with the increased sum of expected future policy rates. In the middle panel of Figure 2, it changes most at the long bond maturities targeted by forward guidance. Now add LDIs, with their demand curves that slope upwards in bond prices. They respond to the rise in yields by wanting to reduce their bond holdings. They can do this by selling bonds in the market, but only if arbitrageurs are prepared to buy them. They will, but only once offered a premium large enough to cover their limited appetite for risk. The necessary premium is in the right panel of Figure 2. It is added to the change in the expectations component to give the overall impact on the yield curve in the left panel.

Figure 2: Change in yields after monetary policy intervention

The different coloured lines in Figure 2 show what the monetary policy intervention does to yields when they are already high (5%, yellow), medium (2%, red) or low (0%, blue). It is clear that LDIs make monetary policy stronger, especially when interest rates are low. Hanson and Stein (2015) dub this a “recruitment channel”, whereby the actions of LDIs enhance the passthrough from policy rates to the yield curve. In this case the complementary actions of LDIs strengthen the impact of monetary policy interventions. If the central bank sells bonds then LDIs react by offloading some of their own bonds, further depressing bond prices and pushing yields yet higher. LDIs are an advantage here, reducing the policy intervention needed to achieve a given outcome.

Carboni and Ellison (2022) identify a second channel by which LDIs make monetary policy stronger, through the general equilibrium impact of interventions on their profitability. Assuming sufficiently competitive markets, LDIs price their products in the expectation of making normal profits. If interest rates are low then LDI profitability is under pressure – it is difficult to make profit when a lot of their assets are tied up in low-yielding bonds. Weak profit margins are reflected in low annuity returns and payments to life insurance policies, which reduce returns to saving and stimulate consumption. If interest rates increase then LDIs are released from some of the burden of holding bonds and can invest more of their funds in higher-yielding assets such as equities. Their profit margins improve, which through competition feeds into higher returns, reinforcing the impact of increasing market rates.

If it is falling interest rates that put pressures on LDIs, why did UK LDIs face severe financial distress in response to rising gilt yields? Shouldn’t an increase in interest rates improve the solvency of LDIs as the present value of liabilities falls more than the present value of assets, and their balance sheets become less exposed to interest rate risk? If LDIs completely hedge their duration risk then yes, but in practice few LDIs take such extreme positions and most only partially insure themselves against interest rate risk. They do this to offer better expected returns to customers, which they can if they accept additional interest rate risk on their balance sheets.

LDIs can increase expected returns by selling some of their bonds and investing in higher-yielding assets such as equities. That would have an incremental effect on expected returns at the cost of some additional risk, but to get a bigger impact they need a way to leverage their position. They are already holding government bonds, so one strategy is to use some of them as collateral for borrowing and invest the loan proceeds in high-yield assets. Whoever they borrowed the funds from becomes their senior creditor, effectively subordinating the claims that make up the long-term liabilities on LDI balance sheets – a pension fund has to repay its collateralised loans before it pays out on pensions. Other more sophisticated strategies based on interest rate swaps and derivatives can achieve similar outcomes, but rely on well-functioning derivative markets.

The dangers of collateralised borrowing are well-known. If interest rates rise then the value of the bonds used as collateral falls and there is a danger that LDIs will be in breach of their loan covenants. To meet the resulting margin calls, LDIs have to raise additional capital quickly and the easiest way to do this is often by selling their most liquid assets, government bonds. But in doing so they depress the market price of bonds even further and there is a danger of developing a downward spiral in which falling bond prices force a selloff of bonds that causes prices to fall even more. If the spiral continues then some LDIs may become insolvent and need to be wound up, dumping even more bonds on the market. Similar dynamics can occur if problems with counterparties in derivative markets mean that LDIs are not as well hedged as they thought they were. It is easy to see LDIs here as a liability for policymakers.

Under ideal conditions, LDIs make it easier for monetary policy to affect the yield curve and credit conditions, which gives the policymaker more control over the economy and is broadly advantageous. Where problems arise is if the strategies of LDIs are not completely liability driven, either through their own choices or because it is not possible to completely hedge liabilities in the market. If LDIs engage in collateralised borrowing or take derivative positions to boost returns then they can threaten financial stability, as can any large leveraged financial institution. This is a liability for policymakers, but the problem is not the liability driven strategy in itself. Instead, it is the way that LDIs deviate from liability driven strategies in their purest form, either by collateralised borrowing or by relying on derivative markets.

Carboni, G. and M. Ellison (2022), Preferred Habitat and Monetary Policy Through the Looking-Glass, ECB Working Paper No. 2022/2697. https://papers.ssrn.com/sol3/Delivery.cfm/RePEc_ecb_ecbwps_20222697.pdf?abstractid=4182220&mirid=1

Domanski, D., Shin, H. S. and Shusko, V. (2017) The Hunt for Duration: Not Waving but Drowning?, IMF Economic Review, 65, 113-153

Hanson, S. G. and Stein, J. C. (2015) Monetary Policy and Long-Term Real Rates, Journal of Financial Economics, 115(3), 429-448

Vayanos, D. and Vila, J.-L. (2021) A Preferred-Habitat Model of the Term Structure of Interest Rates, Econometrica, 89(1), 77-112

Letter from Sir Jon Cunliffe, Deputy Governor, Financial Stability Bank of England to Rt. Hon. Mel Stride MP, Chair of the Treasury Committee, 5 October 2022. https://committees.parliament.uk/publications/30136/documents/174584/default/