All authors are with the Bank for International Settlements. This policy brief builds on arguments developed in BIS (2024). The views represented herein are those of the authors and not necessarily those of the Bank for International Settlements.

Artificial intelligence (AI) is poised to reshape the economy by affecting aggregate demand (via consumption and investment) and aggregate supply (through productivity). We lay out a basic framework to think about AI’s impact on macroeconomic outcomes, with a particular focus on the labour market. Aggregate supply will likely increase, as AI is a general-purpose technology that lifts productivity across sectors. Firm investment and household consumption are also expected to rise. But the strength of the effect on aggregate demand will also depend on households’ and firms’ anticipation of the gains from AI as well as the skills mismatch in labour markets, which dictate how quickly displaced workers can find new jobs. If aggregate demand trails (leads) supply, AI could have a disinflationary (inflationary) impact in the short to medium term, with potential implications for inequality and fiscal sustainability.

Advances in artificial intelligence (AI) have raised hopes of a boost to economic growth (Baily et al (2023)) but also fuelled fears of large disruptions to labour markets and greater inequality. A key channel through which AI can affect growth is through its effects on productivity. Recent evidence suggests that generative AI (gen AI) can increase worker productivity, especially in tasks that require cognitive abilities, as well as spur firm growth and innovation (Brynjolfsson et al (2023), Noy and Zhang (2023), Babina et al (2024), BIS (2024)).1 At the same time, to the extent that AI-driven technological advances are labour-saving, employment and wages could fall (Korinek and Juelfs (2022)). Machines could increasingly become substitutes for labour, at a rate that may not be matched by the economy’s capacity to find new tasks for displaced workers.

In this policy brief we lay out the key mechanisms through which AI may affect macroeconomic outcomes, with a focus on the labour market and AI’s impact on output and inflation. At a high level, AI is likely to affect macroeconomic outcomes via changes in aggregate supply (through productivity) and demand (through investment, consumption and wages). By increasing productivity, AI will likely increase aggregate supply and hence output. Higher investment and consumption will also raise aggregate demand; but the ultimate effects on demand and therefore on inflationary pressures will also depend on how quickly displaced workers can find new jobs (the “skills mismatch”), and whether households and firms correctly anticipate future gains from AI. In the short-run, supply could outstrip demand, which could lower inflationary pressure, but those effects could reverse over time as demand catches up through higher incomes.

AI is a prime example of a general-purpose technology (GPT), like the steam engine, electricity or the internet. These technologies have historically driven major changes in society and the economy by enabling new applications across various fields. The adoption pattern of GPTs typically follows a so-called J-curve: it is slow at first, but eventually accelerates. And over time the pace of adoption of these technologies has been speeding up. Relative to previous GPTs, AI features two distinct characteristics: its remarkable speed of adoption, reflecting ease of use and negligible cost for users as it only requires an internet connection, and the ubiquity of adoption already at an early stage. Its rapid advance throughout the economy reflects the general assessment that AI will increase productivity growth.

AI may affect productivity through various channels, but two stand out. First, it can directly increase the productivity of workers. Available micro evidence suggests as much, especially for tasks that require high cognitive abilities (Brynjolfsson and McAfee (2017), Noy and Zhang (2023), Peng et al (2023), Gambacorta et al (2024)). The second channel is to spur innovation and hence future productivity growth (Baily et al (2023)) – the hallmark of a GPT.

The macro-economic impact of AI on productivity growth could be sizeable, expanding the economy’s productive capacity and thus raising aggregate supply. The estimates provided by the literature for AI’s impact on annual labour productivity growth (ie output per employee) are thus substantive, although their range varies.2 This effect is likely to generate disinflationary pressures.

But AI will also affect aggregate demand through various channels. For one, higher productivity growth will influence aggregate demand through changes in firms’ investment. Firms are already investing heavily in the necessary IT infrastructure and integrating AI models into their operations – beyond what they already spend on IT in general. The growing adoption of AI is expected to increase firms’ output and overall capital expenditure further. An additional boost to investment could come from reduced uncertainty. AI is a prediction machine, so its adoption will likely lead to more accurate predictions at a lower cost, reducing uncertainty and further contributing to raise firms’ capital expenditure.

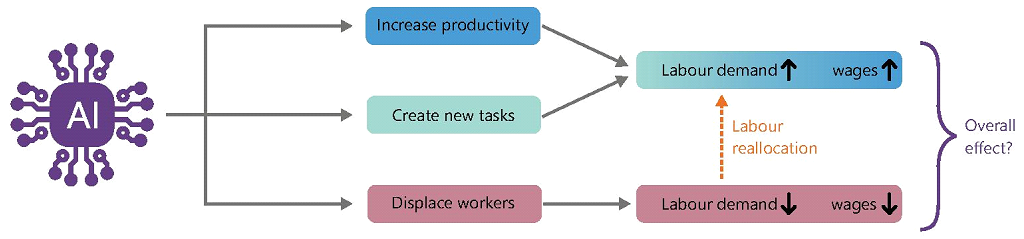

Another key component of aggregate demand is household consumption. The impact of AI on consumption will critically depend on how the labour market is affected, especially labour demand and wages. At a high level, the overall impact will depend on the relative strength of three forces (Graph 1): by how much AI raises productivity, how many new tasks it creates, and how many workers it displaces by making existing tasks obsolete.

Labour demand and wages could increase for at least two reasons. First, to the extent that AI is a GPT that raises total factor productivity across industries, the demand for labour is set to increase (Graph 1, blue boxes). Second, much like it happened with previous GPTs, AI could also create altogether new tasks, further increasing the demand for labour and spurring wage growth (green boxes). These forces imply that AI would increase aggregate demand.

Graph 1: The impact of AI on labour demand and wages

Source: authors’ illustration.

However, not all tasks and occupations are equally affected by AI (Felten et al (2021)). While there is broad agreement that AI will increase productivity in aggregate, substantial uncertainty remains as to whether AI will complement or substitute workers in specific occupations. Some occupations may benefit from AI, whereas others might become obsolete. To assess the overall impact, at least two approaches are possible to deal with this uncertainty. One is to rely on judgement to categorise individual tasks and occupations as being at risk of displacement or potentially benefitting from complementarity due to AI (see for example Pizzinelli et al (2023) and Cazzaniga et al (2024)). While explicitly resolving the uncertainty of the effects of AI, this approach introduces idiosyncratic judgement, with the risk that the final impact across occupations is assumed from the start. An alternative approach is to use measures of exposure that are silent about substitution vs complementarity, and assess how general equilibrium forces lead to labour reallocation across sectors (Aldasoro et al (2024a)).

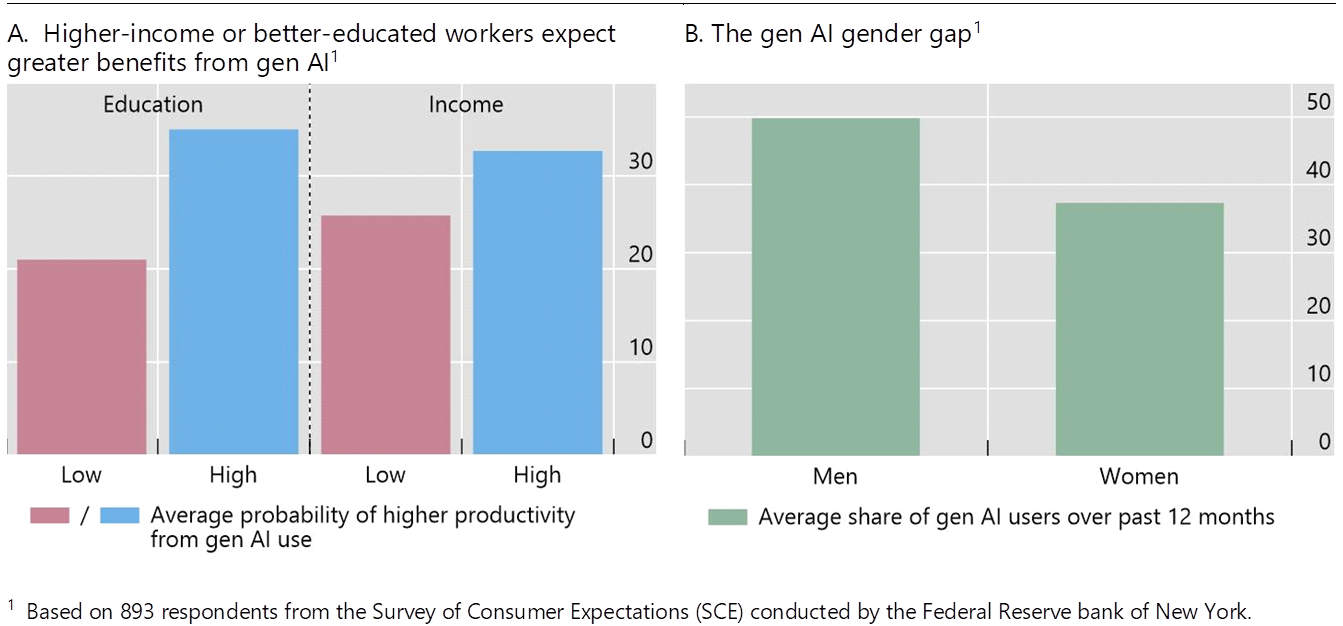

Despite this uncertainty, it is likely that some occupations will be negatively affected. Accordingly, increased AI adoption would displace some workers (Graph 1, red boxes). This could lead to lower employment and wage growth, with distributional consequences. Recent survey evidence for US households suggests that better-educated individuals or those with higher incomes think they will benefit more from the use of gen AI than those with lower educational attainment or incomes (Graph 2.A, Aldasoro et al (2024b). Similarly, gen AI adoption is much lower among women compared to men, largely reflecting users’ knowledge about the technology (Graph 2.B, Aldasoro et al (2024c)).

AI could thereby have implications for inequality (Pizzinelli et al (2023)). For one, through a displacement effect AI might eliminate jobs faster than the economy can create new ones, potentially exacerbating the structural long-term rise in income inequality. This could be worsened further if some occupations can use AI to augment their cognitive content and productivity more than others. As a result, the “digital divide” could widen, with individuals lacking access to technology or digital literacy skills being further marginalised. This includes the elderly, who are especially at risk of exclusion.

Graph 2: Benefits and use of gen AI (In per cent)

Sources: Aldasoro et al (2024b,c); Federal Reserve Bank of New York: Survey of Consumer Expectations.

Sources: Aldasoro et al (2024b,c); Federal Reserve Bank of New York: Survey of Consumer Expectations.

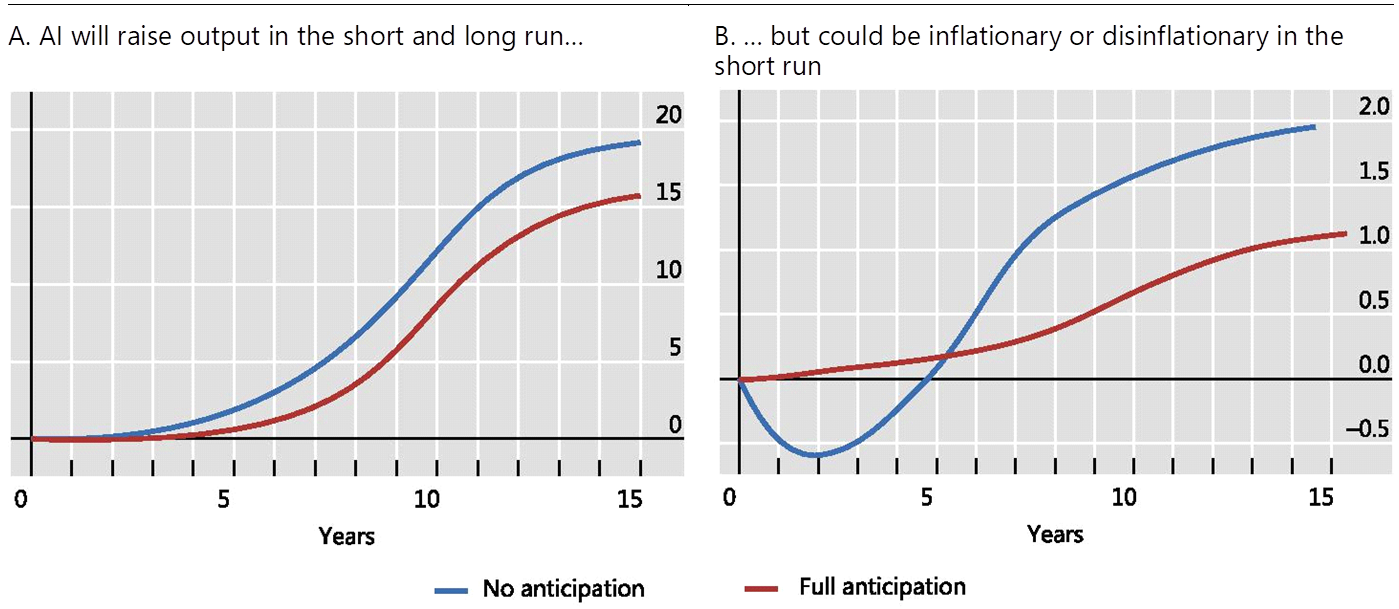

By influencing productivity, investment, labour markets and consumption, AI will affect output and inflationary pressures. As discussed above, by increasing productivity AI will raise aggregate supply. Similarly, through the effects on investment and consumption, aggregate demand will increase. Through higher aggregate supply and demand, output increases (Graph 3.A). In the short term, if households and firms fully anticipate that they will be richer in the future, they will increase consumption at the expense of investment, slowing down output growth.

The overall effect on inflationary pressures will also depend on households’ and businesses’ anticipation of future gains from AI, as well as the skills mismatch between newly created and obsolete tasks. If individuals do not fully anticipate future increases in income, they will increase today’s consumption only modestly. Aggregate demand effects could thus lag increases in aggregate supply, meaning that AI would act as a disinflationary force in the short run (blue line in Graph 3.B). In contrast, if households anticipate future gains, they will consume more, making AI’s initial impact inflationary (red line in Graph 3.B). Evidence from past GPTs suggest that the former (disinflationary) scenario appears more likely. But in either scenario, the demand for capital and labour steadily increase as economic capacity expands and wages rise over time.

Higher inflationary pressures could eventually materialise if these demand effects dominate over time. The strength of these demand effects will also be a function of the mismatch in skills required in obsolete and newly created tasks. The greater this mismatch (other things being equal), the lower employment growth will be as displaced workers take longer to find new work. Moreover, some segments of the population might become permanently unemployable. Consumption and aggregate demand would be lower, strengthening the disinflationary impact of AI.

Graph 3: The impact of AI on output and inflationary pressures (In per cent)

Source: Adapted from Aldasoro et al (2024a). The vertical axis measures the change in percent relative to the initial steady state value of output and inflation.

Source: Adapted from Aldasoro et al (2024a). The vertical axis measures the change in percent relative to the initial steady state value of output and inflation.

Finally, the impact of AI on fiscal sustainability remains uncertain. On one hand, increased productivity and economic growth driven by AI could help reduce the debt burden by generating higher tax revenues and lowering the need for government borrowing. However, this positive impact could be tempered by the possibility of higher interest rates accompanying faster growth, which would increase the cost of servicing existing debt. Additionally, the government might need to implement fiscal programmes to address AI-induced labour market disruptions, such as job displacement and prolonged unemployment, which would add to public spending. Sharp increases in income inequality may prompt demands for substantial redistributive measures and changes in taxation, with unclear effects on overall fiscal sustainability. Given this uncertainty, fiscal policies must be prepared for the possibility of highly disruptive scenarios (Brollo et al (2024)).

Moreover, the economic benefits from AI may not fully cover the rising expenditures required for other significant challenges. For instance, the transition to a green economy and the financial demands of an aging population will likely necessitate substantial public investment and social spending. These factors suggest that while AI could contribute to fiscal sustainability by boosting growth, it is unlikely to completely offset the increasing fiscal pressures from environmental initiatives and demographic changes in the coming decades.

Acemoglu, D (2024): “The simple macroeconomics of AI”, Economic Policy, forthcoming.

Aldasoro, I, S Doerr, L Gambacorta and D Rees (2024a): “The impact of artificial intelligence on output and inflation”, BIS Working Papers, no 1179.

Aldasoro, I, O Armantier, S Doerr, L Gambacorta and T Oliviero (2024b): “Survey evidence on Gen AI and Households: Job Prospects Amid Trust Concerns”, BIS Bulletin, no 85.

Aldasoro, I, O Armantier, S Doerr, L Gambacorta and T Oliviero (2024c): “The gen AI gender gap”, BIS Working Papers, forthcoming.

Alderucci, D, L Branstetter, E Hovy, A Runge, and N Zolas (2020): “Quantifying the impact of AI on productivity and labor demand: Evidence from US census microdata”, Allied social science associations—ASSA 2020 annual meeting.

Babina, T, A Fedyk, A He and J Hodson (2024): “Artificial intelligence, firm growth, and product innovation,” Journal of Financial Economics, vol 151: 103745.

Bank for International Settlements (BIS) (2024): “Artificial intelligence and the economy: implications for central banks”, Annual Economic Report, Chapter III, June.

Baily, M, E Brynjolfsson and A Korinek (2023): “Machines of Mind: The Case for an AI-Powered Productivity Boom,” Brookings, 10 May.

Briggs, J (2024): “Reconciling estimates of the growth impact of generative AI”, Global Economics Comment, Goldman Sachs Research, June.

Brollo, F, E Dabla-Norris, R de Mooij, D Garcia-Macia, T Hanappi, L Liu and A D M Nguyen (2024): “Broadening the gains from generative AI: the role of fiscal policies”, IMF Staff Discussion Note, no 2024/002, June.

Brynjolfsson, E and A McAfee (2017): “The Business of Artificial Intelligence”, Harvard Business Review.

Brynjolfsson, E, D Li, and L Raymond (2023): “Generative AI at work”, NBER Working Paper, no 31161.

Cazzaniga, M, F Jaumotte, L Li , G Melina, AJ Panton, C Pizzinelli, E J Rockall and MM Tavares (2024): “Gen-AI: Artificial Intelligence and the Future of Work”, International Monetary Fund.

Czarnitzki, D, G P Fernández, and C Rammer (2023): “Artificial intelligence and firm-level productivity”, Journal of Economic Behavior & Organization, vol 211, pp 188-205.

Damioli, G, V Van Roy and D Vertesy (2021): “The impact of artificial intelligence on labor productivity”, Eurasian Business Review, vol 11, pp 1-25.

Gambacorta, L, H Qiu, D Rees and S Shian (2024): “Generative AI and labour productivity: A field experiment on code programming”, BIS Working Papers, forthcoming.

Korinek, A, and M Juelfs (2022): “Preparing for the (non-existent?) future of work”, Center on Regulation and Markets Working Paper, no 3, Brookings.

Noy, S, and W Zhang (2023): “Experimental evidence on the productivity effects of generative artificial intelligence.” Science, pp 187-192.

Peng, S., W Swiatek, A Gao, P Cullivan, and H Chang, H (2024): “AI Revolution on Chat Bot: Evidence from a Randomized Controlled Experiment”, arXiv preprint arXiv:2401.10956.

Pizzinelli C, AJ Panton, MM Tavares, M Cazzaniga and L Li (2023): “Labor market exposure to AI: Cross-country differences and distributional implications”, International Monetary Fund, October.

Yang, C-H (2022): “How artificial intelligence technology affects productivity and employment: firm-level evidence from Taiwan”, Research Policy, vol 51, no 6: 104536.

Early studies also suggest positive effects on firm performance. See for example Yang (2022) and Czarnitzki et al (2023) for Taiwan and Germany, respectively. For revenue growth, see Alderucci et al (2020). Damioli et al (2021) present evidence for labour productivity.

On innovation, see Brynjolfsson et al (2018). Estimates range from 0.5 to 1.5 percentage points over the next decade; see eg Baily et al (2023) and Goldman Sachs (2023). Acemoglu (2024) provides lower yet still positive estimates, and Briggs (2024) attempts to reconcile these various estimates.