This policy brief is based on European Central Bank Working Paper Series No 2923 . The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank (ECB).

Abstract

How do bank deposits shape lending? We estimate the impact of the deposit channel of monetary policy by looking at a large, and unexpected, increase in policy rates which led to many banks experiencing deposits outflows. By using an extensive credit register that includes the vast majority of bank-firm lending relationships in euro area countries, we find that banks experiencing deposit outflows reduce credit rather than increase the interest rate they charge (to the same borrower relative to other lenders). The effect is larger for banks coming into the hiking period with a larger unhedged duration gap. This result is consistent with banks prioritizing the management of their duration gap, which is linked to the value of their deposits franchise, rather than short-term profitability considerations linked to their loan book.

Recent research highlights the importance of deposits as a transmission channel of monetary policy (Drechsler et al., 2017). With the deposit channel, when policy rates rise, banks earn more via the increase on the markdown on deposits. As the opportunity cost of holding deposits goes up, savers move out of sight deposits and into higher yielding products, from term deposits to money market funds. However, rather than repricing the yield on deposits, which would increase the cost of the whole stock, or issuing securities at market rates, banks prefer to let marginal savers move out. Their market power allows banks to implement only a low pass-through of policy rates and keep a high markdown on the vast majority of deposits.Thus banks choose to reduce lending to compensate net funding outflows. This mechanism highlights the importance of banks’ differences in funding structures in explaining how increases in interest rates affect the loan supply.

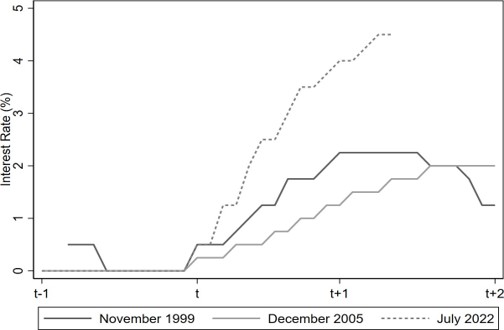

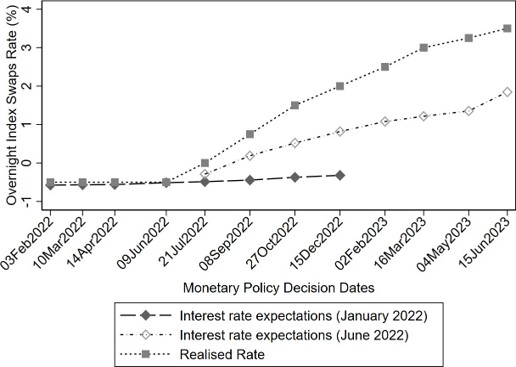

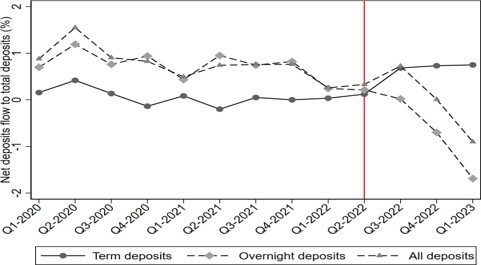

From June 2022 to September 2023, the European Central Bank (ECB) increased aggressively its main policy rate by more than 400 basis points, the largest increase since the creation of the euro (Figure 1). The extent of the increase was largely unforeseen (Figure 2) as it reflected a spike in inflation connected to exogenous shocks, meaning that banks would not have thought of adjusting their actions in advance (see Gagliardone and Gertler, 2023). In its wake banks also experienced the biggest reductions in sight deposits since the creation of the euro in 1999. Part of the outflow was compensated by an increase in term deposits but the overall net outflow implies a sizeable reduction in the total volume of deposits (Figure 3). This offers a unique opportunity to clearly identify banks’ funding dynamics, with possible nonlinear effects related to the magnitude and speed of the policy action.

We analyze how movements in deposits modulate the transmission of monetary policy and impacted the supply of credit. We use a detailed credit register to document how the funding shock is transmitted to lending, identifying the borrowers and the banks’ priorities in terms of profitability and asset and liability management.

Figure 1. Tightening cycles: monetary policy in the Euro area (annualized interest rate, monthly data)

Source: ECB.

Note: The chart includes all hiking cycles since the start of the Euro. Monthly data. t indicates the month of the first rise of the relevant policy rate (interest rate on the main refinancing operations (MRO) up to May 2014 and the deposit facility rate (DFR) thereafter). t +1 indicates 12 months after the first rise of the policy rate.

Figure 2. Expected and realized monetary policy rates (annualized interest rates)

Source: ECB

Note: Euro area monetary policy rate expectations are obtained from forward overnight indexed swap rate where the settlement is the date of the ECB’s Governing Council monetary policy meeting. On the x-axis are the dates of the ECB’s Governing Council monetary policy meetings.

Figure 3. Deposit net flow by type (overnight, term and total deposits)

(percentages)

Source: ECB

Note: Overnight (and term) flows of deposits are calculated as the difference between overnight (and term) deposits outstanding at time t and t-1 to lagged total deposits out- standing. Quarterly data ranging from the first quarter of 2020 to the first quarter 2023.Net flows of deposits is calculated as the difference between deposits outstanding at the end of quarter t and t-1 over the deposits outstanding at the end of quarter t-1. The vertical dashed line indicates the start of the monetary policy tightening.

We find that during the period of intense monetary tightening deposit outflows had a substantial impact on the credit supply and thus on the transmission of monetary policy across banks. Banks that experienced a persistent reduction in deposits decreased the supply of credit to the same borrower by around 2 percentage points more compared to other institutions. The results are consistent when accounting for both unobserved bank characteristics with bank fixed effects and for (changing) country economic conditions with country-time fixed effects. These results confirm the existence of the bank deposit channel (Drechsler et al., 2018b) also or especially during a crucial episode of sharply tightening interest rates. The results on lending rates are in contrast with those of quantities. We find that as monetary policy rates surge, banks experiencing deposit outflows do not charge higher rates, compared to other banks. This result remains also when (unobserved) bank and (changing) economic conditions are taken into account. Contrary to what is posited in standard models, banks don’t transmit an increase in the cost of funding by a corresponding relative increase in the cost of lending, they adjust only via quantities: less funding with deposits translates directly into less lending; banks actively choose which borrowers to ration rather than increasing rates and letting the demand for loans adjust consequently.

Our second key finding is that new borrowers and loans with fixed rate or longer maturities suffer the most from the supply constraints imposed by banks. This is consistent with banks wanting to minimize changes to their duration gap, in line with findings by Drechsler et al. (2018a) and Hoffmann et al. (2019). Deposit outflows, which reduce the duration of funding, are therefore compensated by reducing fixed rate loans, which other things being equal have a longer duration than those with floating rates, and loans with longer maturities. It appears that banks put more weight on preserving the balance between assets and liabilities via a stable duration gap, than on short-term profitability considerations which would have led to other choices, such as decreasing lending to less profitable borrowers. Consistent with this, we find that borrowers of those banks entering the hiking phase more exposed to monetary policy increases (i.e. those with a larger interest rate risk measured by their duration gap) were more affected by the supply constraints connected to the outflow in deposits. Indeed, at low rates many banks aimed to extract the maximum value from their deposits franchise by taking interest rate risk and increasing their duration gap, since deposits were considered a stable form of long-term funding particularly periods in of low interest rates. Banks also reduced lending to new borrowers, consistent with a desire to avoid adverse selection. Finally, banks with more capital don’t seem to behave differently from banks with less capital, but this could be due to the fact that most banks are well above even the higher regulatory thresholds and therefore the capital constraint might not have been binding.

We study how banks transmit increases in interest rates to the loan supply. We use the largest (unexpected) rise in interest rates since the creation of the euro to understand the impact on lending, starting from the effects of a large drop in sight deposits. We build on a comprehensive credit register which includes bank-firm lending relationships (above 25.000 euro) in the majority of euro area countries, which we match with bank-level information on banks’ deposit funding and financial conditions. We find that banks experiencing persistent deposits outflows restrict directly credit to certain borrowers, rather than adjust rates and let markets clear. Our findings seem to be driven by augmented exposure to interest rate risk as the effect is larger for banks with a larger duration gap, and credit is less available for loans with fixed rates or longer maturities. Our results indicate that during periods of increasing rates, banks’ assets and liabilities management could be crucial for the transmission of monetary policy. Banks try to preserve their duration gap, which is linked to the value of their deposit franchise, by rationing credit rather than by transmitting the increase in policy rates to borrowers.