Following the global financial crisis, several macroeconomic models with a rich banking sector were developed. They are particularly useful for assessing the overall macroeconomic impact of the Basel III reforms. Based on a report by the Basel Committee on Banking Supervision (BCBS, 2021), this policy brief highlights the different transmission channels of prudential policies by distinguishing according to the type of models, structural and empirical, and concludes that so far more attention was given to the modelling of solvency as opposed to liquidity requirements. It also reveals that, when both short term costs and long term benefits of regulation are fully imbedded in the models, Basel III had a positive effect on GDP and lending.

Beyond the analysis of the impact of Basel III on the resilience of individual banks, it is important to understand and quantitatively assess the role of the different channels of transmission of Basel III reforms at the macroeconomic level. Structural quantitative macroeconomic models that have been developed since the Global Financial Crisis and that capture the transmission mechanisms of prudential policies allow us to assess their overall impact on key macroeconomic variables, notably on GDP and lending. Central banks and supervisory agencies have been at the forefront in the development and application of such models. This brief gives an overview of a report of the Basel Committee on Banking Supervision (BCBS, 2021) focusing on two dimensions. First, we review the different channels of transmission of financial shocks (including regulatory changes) highlighted in the economic literature in the last 15 years. It distinguishes between, on the one hand, standard quantitative Dynamic Stochastic General Equilibrium (DSGE) models and empirical time-series macroeconomic models routinely used by central banks and, on the other hand, alternative models that investigate potential additional channels, and new issues. Second, we provide simulations of regulatory scenarios replicating the implementation of Basel III reforms, using “off-the-shelf” macro-finance models at the European Central Bank, the Board of Governors of the Federal Reserve System, the Central Bank of Norway and the Bank of France.

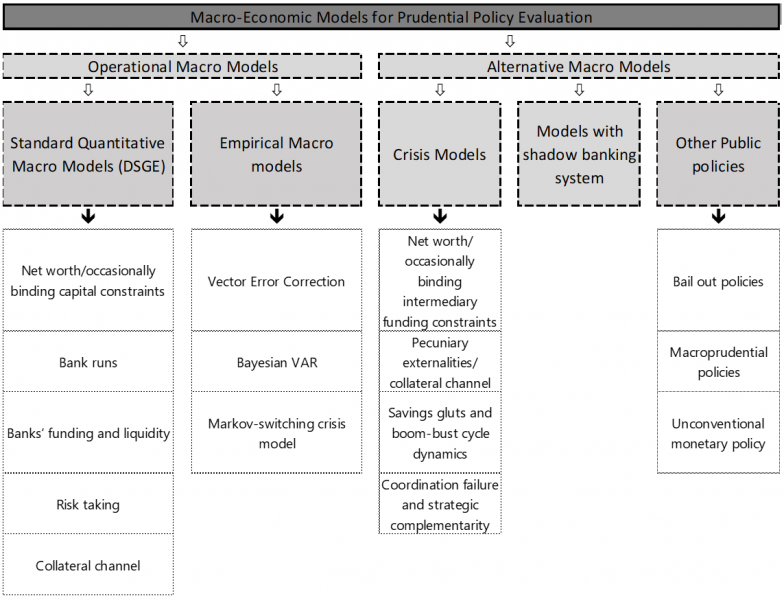

A very large number of new models emerged since BCBS (2010), which propose an early assessment of the impact of Basel III reforms. Table 1 provides a map of these models, highlighting the transmission channels of prudential policies. DSGE models integrate a bank capital channel and assess the cost of solvency regulations in terms of reduced lending. Some of these models also include estimates of benefits in terms of smaller probability of defaults/runs/financial crises. A few provide results on liquidity. But, in general, these models still concentrate mostly on capital requirements and more rarely on liquidity. Empirical macro models look at the opportunity cost to the macroeconomy of changes in capital ratios and (in one case) liquid asset ratios. They tend to show that the impact of higher capital on economic output is limited. Alternative models consider other policies (unconventional monetary policies, etc) as well as new, highly relevant challenges like response of the financial system and the economy to crisis, and interactions with the shadow banking system. However, the latter models are not sufficiently operational yet to allow for an empirical assessment of the impact of the regulatory changes.

Table 1. Overview of macroeconomic models with a banking sector

Source: Table constructed on the basis of BCBS (2021)

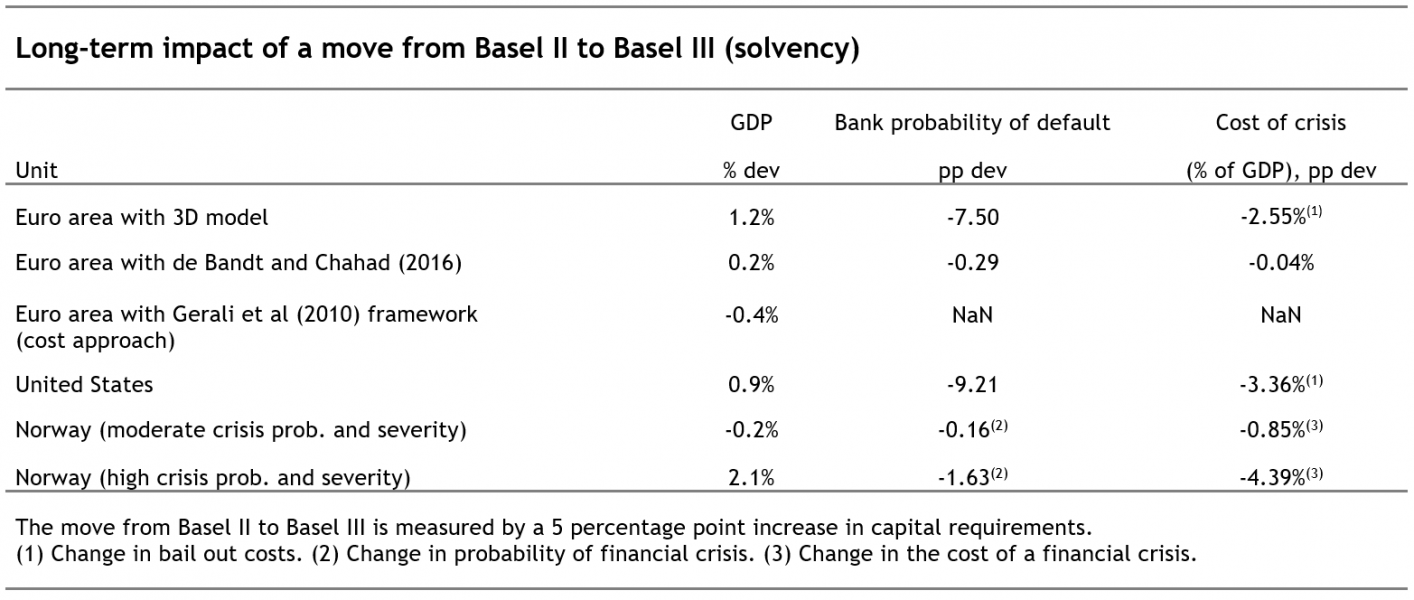

The second part of BCBS (2021) provides simulations of regulatory scenarios replicating the implementation of Basel III reforms, using available macro-finance models. The models we consider have been developed at the European Central Bank, the Board of Governors of the Federal Reserve System (based on Mendicino et al., 2018), the Central Bank of Norway (based on Kockerols, Kravik and Mimir, 2021) and the Bank of France (based on Gerali et al., 2010, and de Bandt and Chahad, 2016). The simulations provide novel estimates of the impacts of Basel III. Table 2 concentrates on the implementation of higher solvency requirements. The variety of models and jurisdictions on which the macroeconomic impact of Basel III is assessed ensures the robustness of the findings. Some models do not measure the benefits, others include costs and benefits of the regulation, so that the benefits of Basel III may be inferred by difference with the output of the models that assess both costs and benefits.

Table 2. Impact of a Basel III solvency shock

Source: BCBS (2021)

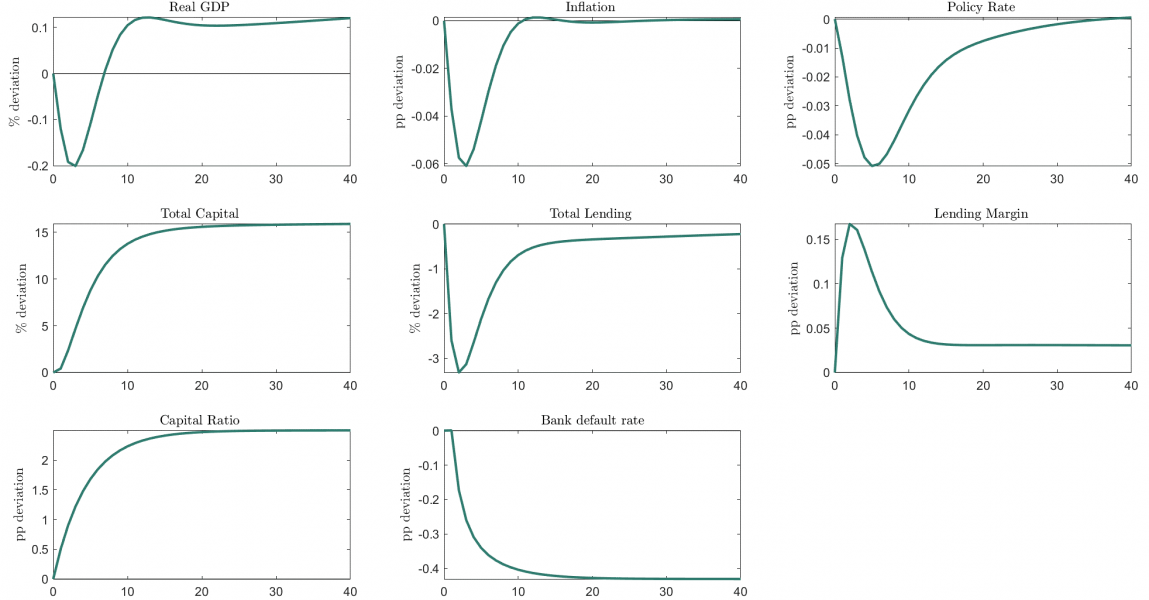

In a nutshell, whenever the costs and benefits of regulation are introduced in the model, the effects of Basel III are positive on GDP (this is the case for the 3D model applied to the euro area and the United States, as well as the model by de Bandt and Chahad (2016) with run probability). The positive effect on GDP during the transition from Basel II to Basel III may however be associated with a temporary slowdown accommodated by monetary policy (Chart 1). In additional exercises, we assess the costs related to the transition from Basel II to Basel III. First, the Central Bank of Norway’s NEMO model concludes that the net benefits of Basel III depend on the magnitude of the crisis probability and severity. In the case of moderate crisis probability and severity, Basel III has a small negative effect on GDP although it reduces both the crisis probability and the severity. However, when both the probability and the severity of crises nearly double, Basel III has positive effects on GDP as its net benefits become substantial. Second, using the Gerali et al. (2010) framework for the euro area, which only identifies the cost of implementation of the regulation, yields a negative effect on GDP, but this result is an obvious consequence of the absence of modelling of the benefits of regulation. Comparing these results with those of the other models for the euro area, the long-run benefits of the Basel III framework were evaluated to lie between 0.6% and 1.6% of GDP.

Chart 1. Impact of a solvency shock –transition from 14% capital ratio to 16.5% in the euro area with 3D Model

Source: BCBS (2021)

All in all, one needs to emphasise that the results of the models crucially depend on the assumptions regarding the magnitude and the sensitivity of the bank default probability or the financial crisis probability. This is consistent with BCBS (2010) and Birn et al. (2020). Expectations regarding the likely impact of the regulation also play a significant role in the positive assessment of the impact of Basel III regulations.

Furthermore, all models exhibit a reduction in macroeconomic and financial volatility when moving from Basel II to Basel III, but the impact is not very sizeable.

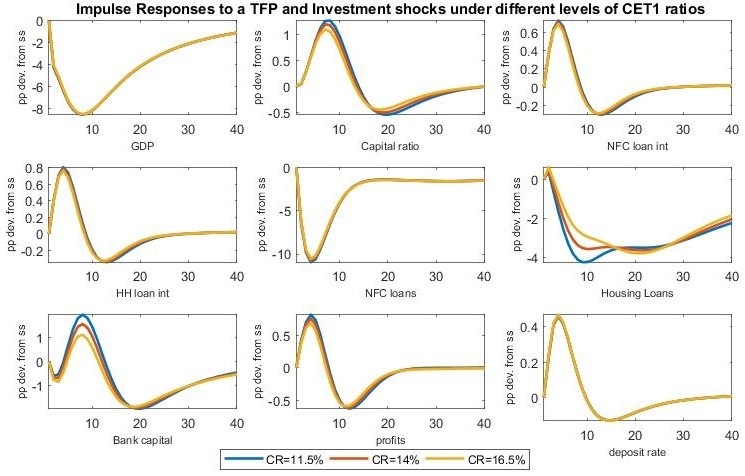

In addition, the models are used to provide a first assessment of the resilience of the post-Basel III banking system to very large shocks replicating the current Covid-19 environment. Chart 2 is based on a version of the Gerali et al. (2010) model for the euro area with a TFP shock (-14.4%) complemented by an additional shock to private investment (-27.6%). Such a calibration of shocks is designed to replicate a GDP drop by 8% one year after the shock arrives. The collateral channel prevails, and lending falls. However, the benefits of Basel III are more visible for housing loans than for NFC loans. Indeed the reduction in housing loans is more significant in Basel II than in the two Basel III scenarios, showing that the collateral channel is somewhat less strong when banks are better capitalised. In addition, banks exhibit a cyclical reaction: in the short run, the increase in lending rates positively affects profits and capital.

Chart 2. Impact of a Covid-19-type shock – Impulse response function of an adverse shock on TFP and investment (euro area) with Gerali et al. (2010) framework, for different levels of CET1 capital

Source: BCBS (2021)

While the modelling of the macroeconomic impact of solvency requirements advanced significantly in the last decade, the overview of macroeconomic models with a banking sector shows that the assessment of liquidity requirements is still an area for research, as most models still concentrate on the costs of liquidity, not on its benefits. Preliminary evidence based on general equilibrium models indicates that the macroeconomic impact of Basel III has the expected positive sign on GDP; however, the effect is not large. More work is still needed to provide the full assessment of the costs and benefits, in particular in terms of lower contagion risk.

Kockerols, T, E M Kravik and Y Mimir (2021), “Leaning against persistent financial cycles with occasional crises”, mimeo, Norges Bank.

The authors thank M. Behn, M. Birn, K. Budnik, R. Fiori, J. Schroth, and G. Sutton for their contribution to BCBS (2021).