References

Abadie, A. and Gardeazabal, J. (2003). The Economic Costs of Conflict: A Case Study of the Basque Country. The American Economic Review, 93 (1).

Abadie, A., Diamond, A. and Hainmueller, J. (2010). Synthetic Control Methods for Comparative Case Studies: Estimating the Effect of California´s Tobacco Control Program. Journal of the American Statistical Association, 105 (490).

Acemoglu, D., Johnson, S., Kermani, A., Kwak, J., and Mitton, T. (2016). The value of connections in turbulent times: Evidence from the United States. Journal of Financial Economics, 121(2), 368-391.

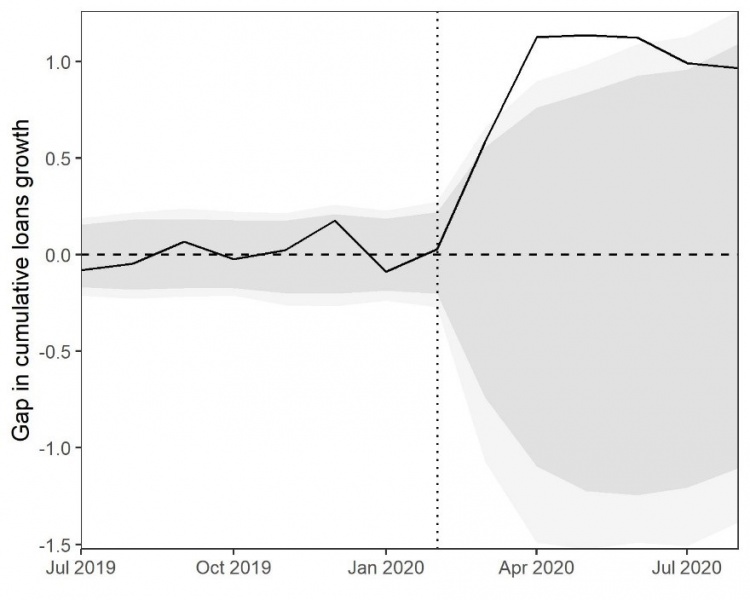

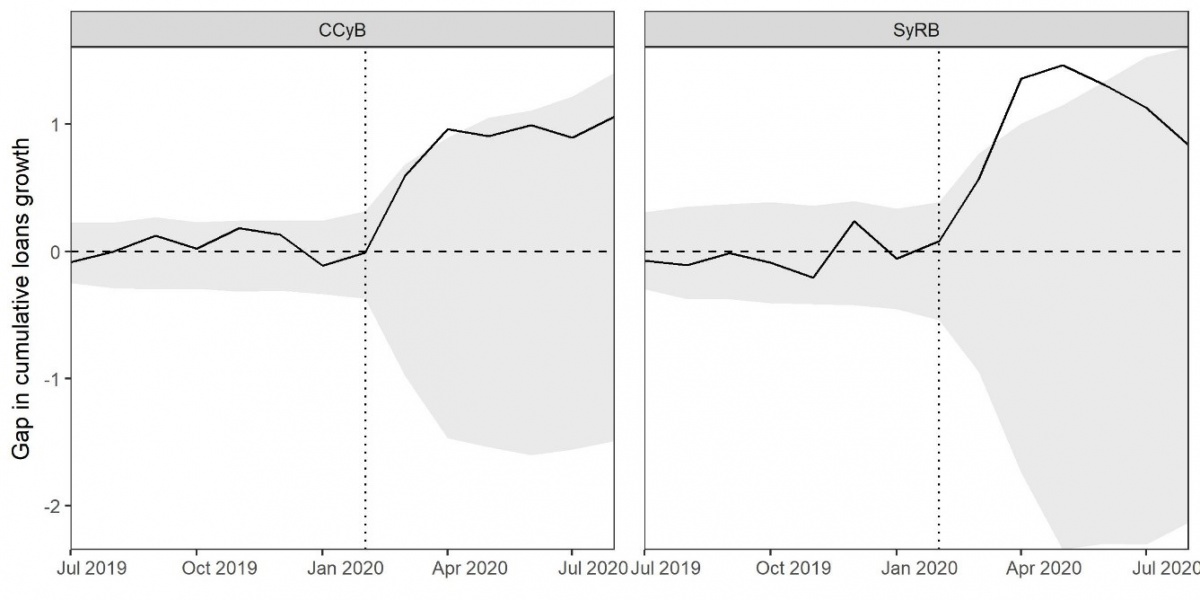

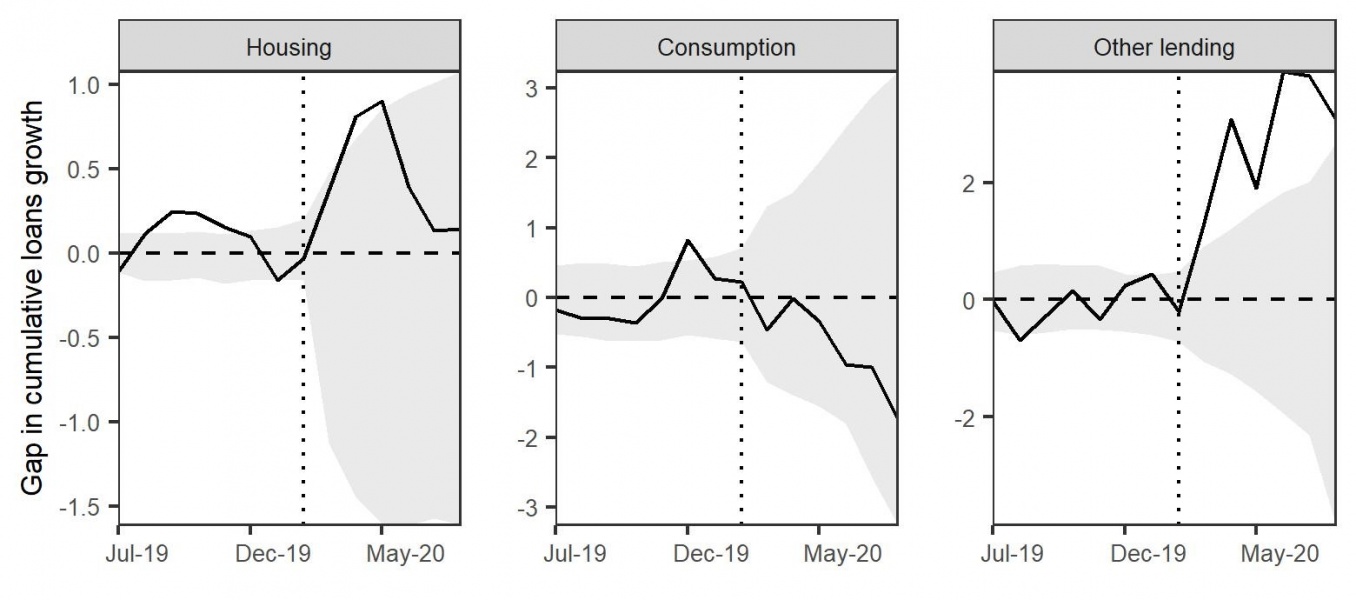

Avezum, L., Oliveira, V., and Serra, D. (2021). Assessment of the effectiveness of the macroprudential measures implemented in the context of the Covid-19 pandemic, Banco de Portugal, Working Papers. Available at: https://www.bportugal.pt/sites/default/files/anexos/papers/wp202107_0.pdf (Accessed: 21 July 2021).

Berger, E., Butler, A., Hu, E. and Zekhnini, M. (2020), Financial Integration and Credit Democratization: Linking Banking Deregulation to Economic Growth. Journal of Financial Intermediation 45:100857.

Boissay, F. and Rungcharoenkitkul, P. (2020). Macroeconomic effects of Covid-19: an early review. BIS Bulletin, no 7, April.