This policy brief should not be reported as representing the views of the ESM. The views expressed in this policy brief are those of the authors and do not necessarily represent those of the ESM or ESM policy.

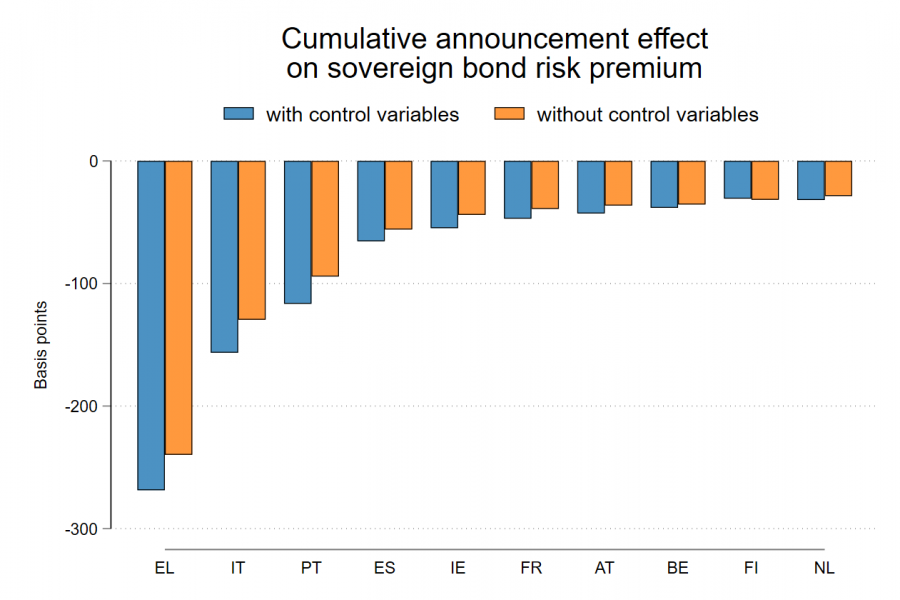

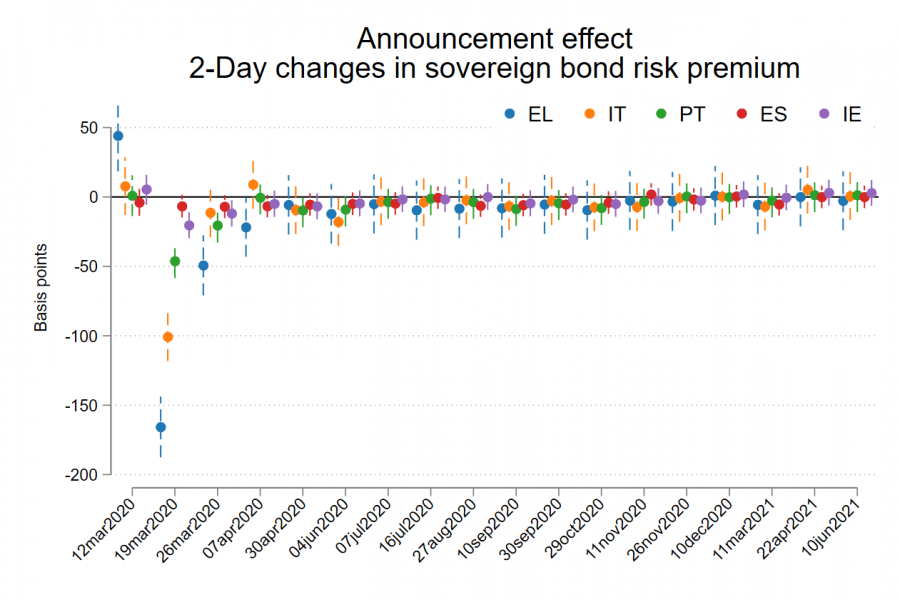

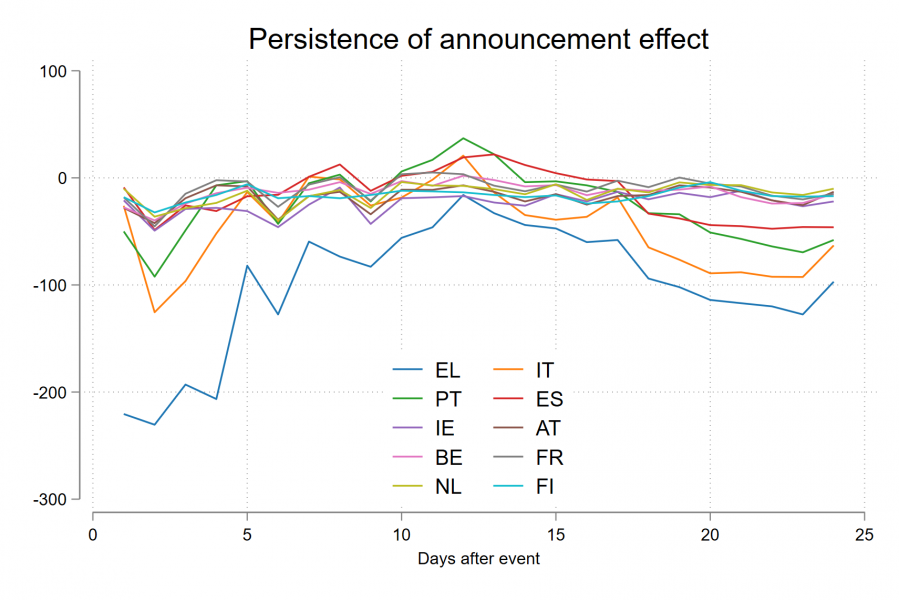

Strong announcement effects and only a transient role for the expected total size and actual purchases are the hallmarks of a highly credible policy response. In our reading of the results, the ECB succeeded in coordinating market beliefs into a ‘good equilibrium’ in which self-fulfilling debt crises are ruled out (Blanchard, 2022; and Lorenzoni and Werning, 2019). And in the good equilibrium, the marginal impact of actual and expected central bank purchases became negligible.

That said, our ability to discriminate between the immediate liquidity channel and the portfolio rebalancing channel is limited, as the announcement effects that we document could feed into both transmission channels at the same time (Bailey, 2020).

Used with the permission of Bloomberg Finance L.P.