The views expressed in this policy brief are those of the authors and do not necessarily represent the views of the European Central Bank.

This policy brief examines the asymmetry in the spillover effects of US monetary policy on the rest of the world. Utilizing a dynamic general equilibrium model that incorporates financial frictions, cross-border lending, and global supply chains, we investigate how US monetary policy shocks affect emerging market economies (EMs). We find clear asymmetries in the transmission of US monetary policy, with significantly larger spillovers during contractionary episodes under both conventional and unconventional monetary policy changes. This asymmetry is driven by occasionally binding balance sheet constraints faced by banks, which result in disproportionately worse outcomes during periods of monetary tightening; and is further intensified by second-round effects in emerging markets. Additionally, policymakers’ aversion to exchange rate volatility exacerbates these detrimental effects. Our findings emphasize the persistent and substantial impact of US monetary policy on the global economy, highlighting the necessity for emerging markets to account for these asymmetries in their policy frameworks.

The US monetary policy, particularly since the global financial crisis (GFC), has had significant spillover effects on other countries. This is unsurprising given the Federal Reserve’s (Fed) central role in the global financial system and its substantial policy responses to both the GFC and the COVID-19 pandemic. During the GFC, the Fed cut interest rates to near zero and employed quantitative easing (QE). Recently, it sharply reversed this stance in response to post-pandemic inflation and energy price shocks, utilizing both conventional and unconventional tools. These policy shifts are closely monitored by global policymakers due to their substantial cross-border impacts.

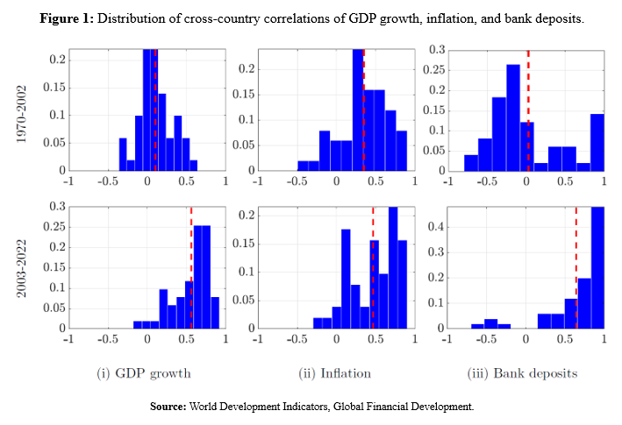

Several factors contribute to the magnitude and significance of these spillovers, including the transformation of the global economy through the emergence of global value chains and deeper financial connections. We document these changes in Figure 1, which displays the correlations in GDP growth, inflation, and bank deposits between the US and a sample of emerging markets (EMs) from 1970 to 2022. Comparing the periods 1970-2002 and 2003-2022, there is a notable increase in cross-country correlations. For instance, the correlation in GDP growth rose from 0.1 to 0.56, and the correlation in bank deposits surged from 0.03 to 0.64, reflecting intensified global interdependencies. These changes mean that policy shocks in major economies, like the US, reverberate globally, influencing domestic dynamics worldwide. Existing research highlights notable asymmetries in the domestic effects of US monetary policies. However, there is limited evidence of the asymmetries in the spillovers of monetary policies.

In our research, we utilize a non-linear two-country dynamic stochastic general equilibrium (DSGE) model based on Garcia-Lazaro et al. (2021) that incorporates international trade, credit networks, and financial frictions similar to Karadi and Nakov (2021). This model allows us to study the effects of US policy changes on EMs, which are particularly vulnerable due to their trade openness and reliance on external finance.

Our findings highlight significant asymmetries in the global spillovers from US monetary contractions versus expansions. Given that EM banks also face occasionally binding constraints, EM output is doubly impacted, intensifying the unfavorable spillover effects from US monetary tightening and increasing the size of these asymmetries. With their greater reliance on global supply chains and external financing of capital, EMs face a double whammy, bearing the brunt of both sets of balance sheet constraints. Additionally, EM policymakers’ aversion to exchange rate fluctuations exacerbates the negative effects of US monetary contractions, further magnifying global spillovers.

Figure 1. Distribution of cross-country correlations of GDP growth, inflation, and bank deposits.

We examine four scenarios involving US monetary policy shocks and their spillover effects on emerging markets: (i) a 100 basis point increase in the US interest rate, (ii) a 100 basis point decrease in the US interest rate, (iii) expansionary unconventional monetary policy (QE) in the US, equivalent to asset purchases of 10% of US annual GDP, and (iv) contractionary unconventional monetary policy (QT) in the US, equivalent to asset sales of 10% of US annual GDP. Our analysis is conducted through simulations of each policy shock individually. We explore three model configurations to capture varying degrees of complexity: (i) a model with trade in final consumer goods only, (ii) a model with trade in final consumer goods and intermediate inputs (supply chains), and (iii) a model with trade in final goods, supply chains, and credit networks between the US and EMs.

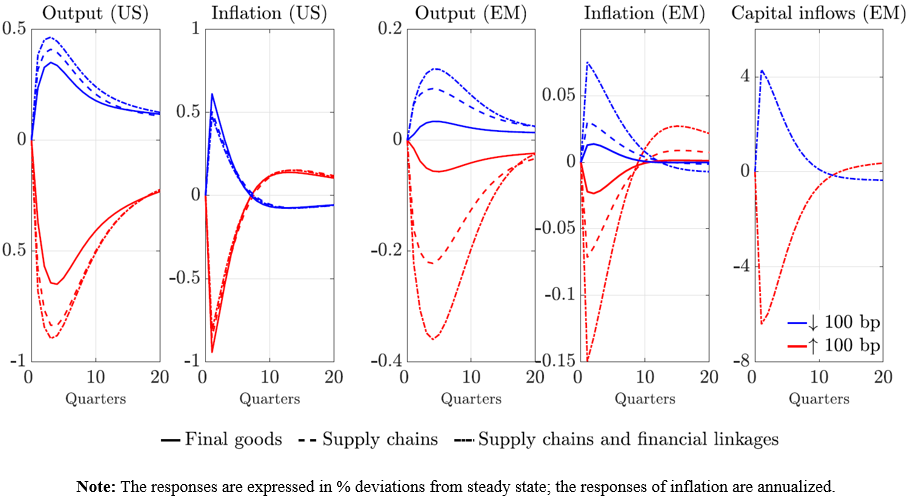

A 100 basis point increase in the US policy rate (represented by red lines in Figure 2) results in a 0.65% decline in US output in the benchmark model, which includes only trade in final goods. This decline is driven by reduced consumption, investment, and net exports due to a stronger US dollar. As we extend the model to include supply chain linkages, the US output loss increases to 0.76%, due to decreased demand for EM intermediate goods. With the addition of cross-country capital financing, the reduction in US output becomes 0.9%, reflecting diminished capital availability for production in both economies.

The impact on EM outcomes varies with the model’s complexity (third and fourth panels of Figure 2). In the benchmark scenario, a 100 basis point increase in the US policy rate causes a modest 0.06% reduction in EM output. This effect grows to 0.22% with supply chain linkages and further to 0.36% when financial linkages are included. The greater reliance of EMs on intermediate inputs and external financing amplifies the spillovers from US monetary tightening.

Conversely, a 100 basis point decrease in US interest rates (denoted by blue lines) results in a smaller, asymmetric response. US output increases by 0.35% to 0.46%, while EM output rises by only 0.03% to 0.13%. This asymmetry is attributed to occasionally binding balance sheet constraints that exacerbate negative outcomes during episodes of monetary tightening.

Similarly, a 100 basis point increase in the policy rate results in a 0.94% decrease in inflation, while a 100 basis point decrease raises inflation by 0.61%. In EMs, the impact of US monetary policy on inflation varies with model specifications, ranging from a 0.02% decrease in the benchmark model to a 0.15% decrease with financial linkages. Conversely, monetary easing results in a smaller increase in EM inflation, ranging from 0.01% to 0.08%.

Figure 2. Responses of output and inflation to the US conventional monetary policy shocks.

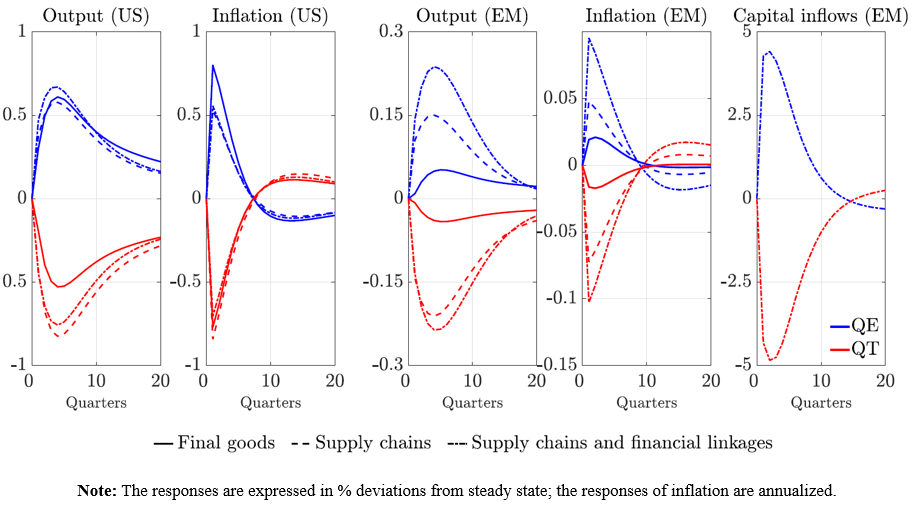

A key question that arises is whether the asymmetries observed in the spillover effects of US monetary policy also extend to changes in unconventional monetary policy (UMP), such as QE and QT. Figure 3 illustrates the responses of output and inflation to QE and QT shocks. The results highlight that the asymmetry in the domestic effects of tightening versus loosening US monetary policy persists under UMP. Specifically, QT reduces US output by 0.53% in the baseline model and by 0.76% when incorporating supply chains and financial linkages. Conversely, QE increases US output by 0.67% in the extended model, compared to a similar effect in the baseline scenario.

Regarding spillovers, in a model with trade in final goods only, the effects of US QE and QT on EM output and inflation are relatively small. However, when accounting for supply chains and financial linkages, these spillovers are significantly amplified, revealing the crucial role these channels play in magnifying the effects and asymmetries of US monetary policy on other economies.

Figure 3. Responses of output and inflation to the US unconventional monetary policy shocks.

A critical aspect of monetary policy in emerging economies is the significant role played by exchange rate considerations. This sensitivity, often referred to as the “fear of floating” (FoF) following Calvo and Reinhart (2002), reflects policymakers’ concerns about exchange rate volatility and its impact on the domestic economy. Two key features of EMs contribute to this phenomenon: high pass-through from exchange rates to domestic prices and substantial liability dollarization. In economies with significant foreign currency exposures, policymakers often adjust their monetary policies to mirror foreign actions, attempting to stabilize the exchange rate.

To explore the implications of FoF on the transmission of external monetary policy shocks, we introduce an augmented Taylor rule that incorporates exchange rate movements. When faced with a contractionary US monetary policy that leads to a stronger dollar, domestic policymakers are likely to raise their policy rates to mitigate the depreciation of their currency.

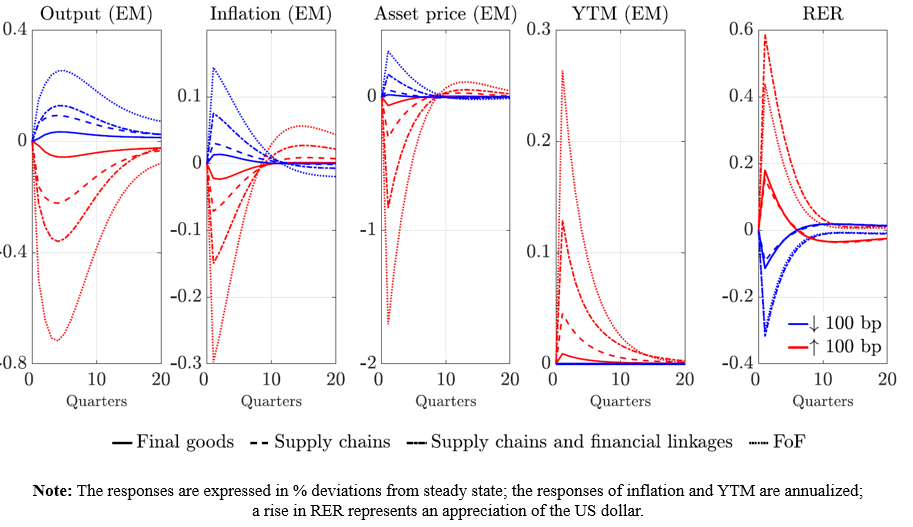

Figures 4 and 5 illustrate the evolution of various EM variables in response to US conventional and unconventional monetary policy shocks, incorporating FoF effects. These figures reveal that FoF significantly influences both real and financial variables in EMs. Specifically, the attempt to stabilize the exchange rate during a US monetary contraction results in higher domestic interest rates, which exacerbates output losses and further depresses inflation. The decline in output and inflation is notably more severe under FoF compared to scenarios without this behavior.

Figure 4. Responses of the EM economy to the US conventional monetary policy shocks.

The key impact of FoF is on exchange rate variability. For example, under FoF, the depreciation of the EM currency is constrained, decreasing from 0.59% to 0.44% following US monetary tightening (see Figure 4). Conversely, monetary easing leads to a reduced appreciation of the EM currency, from 0.32% to 0.30%. Similar patterns are observed in response to UMP (see Figure 5).

Raising domestic interest rates, while aimed at stabilizing the exchange rate, has significant implications for macroeconomic and financial stability. Higher rates can worsen domestic economic conditions, with output contractions doubling under FoF compared to scenarios without. Furthermore, the reduced depreciation curtails the expenditure-switching channel, limiting potential gains from improved competitiveness.

While higher interest rates can negatively impact financial stability, containing currency depreciation can be beneficial for countries with significant foreign currency liabilities. This dual impact complicates the assessment of the effects on financial stability. For instance, asset prices fall more sharply and yields rise significantly under FoF, reflecting heightened financial risks. Capital flows are also affected, with reduced responsiveness to US monetary policy shocks.

Figure 5. Responses of the EM economy to the US unconventional monetary policy shocks.

Our findings point to the significant and asymmetrical global spillovers from changes in US monetary policy, with a significantly larger impact during contractionary episodes compared to expansionary ones. This asymmetry arises primarily from the occasionally binding constraints in the banking sector, which exacerbate the unfavourable effects of monetary tightening by reducing liquidity and magnifying adverse outcomes. These findings are robust across both conventional and unconventional monetary policy tools.

Moreover, our results reveal that these asymmetrical spillover effects are not only transmitted across borders but are also magnified due to the balance sheet constraints in other countries, leading to substantially greater deteriorations in domestic outcomes in emerging economies.

Despite the post-Bretton Woods era’s shift towards greater financial globalization, aversion to exchange rate fluctuations has persisted in EMs, driven by their increased reliance on external finance. This reliance has amplified the cost of exchange rate variability, making the “fear of floating” (FoF) a persistent concern. Both conventional and unconventional US monetary policies have amplified effects in the presence of FoF, highlighting the need for EM policymakers to carefully balance exchange rate stability with broader economic and financial considerations.

Calvo, Guillermo A., and Reinhart, Carmen M. (2002), Fear of floating, The Quarterly Journal of Economics 117(2), 379–408.

Garcia-Lazaro, Aida and Mistak, Jakub and Ozkan, F. Gulcin (2021), Supply chain networks, trade and the Brexit deal: a general equilibrium analysis, Journal of Economic Dynamics and Control 133, 104254.

Karadi, Peter and Nakov, Anton (2021), Effectiveness and addictiveness of quantitative easing, Journal of Monetary Economics 117, 1096-1117.