This note is based on the paper: Škrinjarić , T. (2022), Augmented credit-to-GDP gap as a more reliable indicator for macroprudential policy decision-making, CNB Working Papers, W-65, Croatian National Bank, The views expressed in this study reflect the author’s opinions and are not necessarily those of Croatian National Bank.

The credit gap is a standardized and harmonized indicator providing a basis for countercyclical capital buffer calibration. For this purpose, it is necessary to use a stable, valid indicator that reflects the movement of the financial cycle of a country. This research deals with reducing the endpoint bias when estimating the credit gap using the Hodrick-Prescott filter. The findings are helpful for those institutions whose analyzes show that the HP filter is the best way to assess indicators that portend a future financial crisis. Several popular forecasting approaches are considered in the empirical part of the paper for the case of Croatian data to compare them and select the best based on several criteria. The results of this research can be used when making decisions in real-time, considering the simplicity of their application and the communication of the results. The resulting adjusted credit gaps reduce the bias in the gap series after the financial cycle turns, and provide stable signals to the macroprudential decision-maker.

Monitoring the financial cycle is one of the essential tasks of macroprudential policy. The last few years have seen an increased number of studies that try to find and define indicators that would adequately reflect the movement of a country’s financial cycle. One of the most commonly used indicators is the credit or Basel gap, calculated based on the Hodrick-Prescott (HP) filter. The Basel gap is a harmonized indicator of excessive credit dynamics in the economy. However, one of the main problems related to the HP filter is the end-point bias problem, which arises due to the way the optimization function of the filter itself is defined. The last points of the series are not given equal weight in the filtering process itself, so the resulting credit gap series always contains more uncertainty in those last points. It is precisely based on these that decisions are made about, for example, the amount of the countercyclical capital buffer (CCyB) in the case of monitoring the credit gap. Since the macroprudential policy decision-maker needs to have reliable and stable indicators on which he makes decisions, this paper focused on the mentioned problem so that the resulting indicators give more stable signals on which decisions are made.

The related literature is mainly concentrated in other central banks, given that it is a universal problem if HP gaps are applied in practice to monitor credit or real economy dynamics. Given the mentioned problem, one may ask why the HP approach is used. Namely, a lot of research shows that the indicators obtained using the HP filter are better at signaling crises than other approaches to calculating such indicators (Drehmann et al., 2010; Borio and Lowe, 2002; Borio and Drehmann, 2009; Galán, 2019, Detken et al., 2014)1. In that case, it is still necessary to refine the results of HP filtering, if possible, to make them more reliable. Precisely for the case of Croatia, the previous analysis showed that the indicators obtained by HP filtering are the best according to certain criteria (see Škrinjarić and Bukovšak, 2022).

That is why the next step of the analysis was made in this research. The indicators that best signaled the previous (GFC) crisis were improved based on certain corrections. They include expanding the original series of data that are being filtered with the forecasted values. Then, the extended series were filtered, but credit gap data were collected for the subsample where we have actual data (so no forecasts). The consequence of this approach is that it removes the last point problem for the last few observations related to the real data. Based on quarterly data from 4Q 1999 to 4Q 2021, several typical credit gap forecasting approaches are compared: autoregressive models, moving averages, linear forecasts, moving linear forecasts, and random walk. Considering the different specifications of all models, in the end, about 220 individual indicators were compared. In addition to the typical comparison criteria related to the quality of out-of-sample forecasting, several indicator stability criteria were also used, which were already mentioned as important for the decision-maker. This means that we observe criteria such as the stability of an indicator regarding the estimation of the same value over time2.

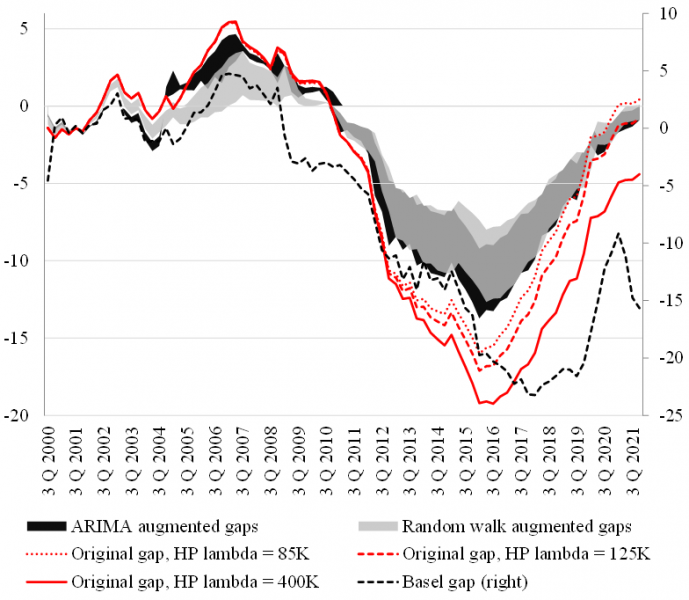

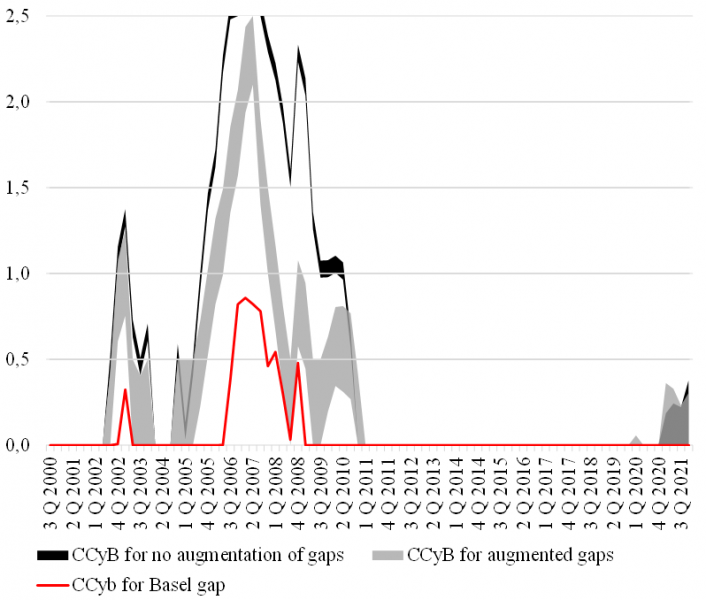

Based on all the comparison criteria, the indicators augmented with the autoregressive model and the random walk model were selected as the best. The results are shown in Figure 1. The left panel of Figure 1 presents the ranges of movements of corrected gaps with the two mentioned approaches. It compares them with the original credit gaps without corrections and the Basel gap, which is the starting point for making decisions about the countercyclical protective layer of capital. What can be observed is that the bias of corrected gaps towards negative values decreases after a change in the cycle; they close earlier than uncorrected gaps and are less volatile. The right panel of Figure 1 shows the calibrated values of the countercyclical capital buffer based on all gaps from the left panel. While the aforementioned protective layer could be built much later based on the Basel credit gap and at a much lower value, the problems above are mitigated if corrected gaps are used. It is in line with the gradual build-up of the countercyclical capital buffer.

Figure 1: Best augmented gaps for countercyclical capital buffer (CCyB) decision making

Panel a. Range of best augmented gaps, in p.p.

Panel b. Range of CCyB values, in % risk-weighted assets (RWA)

Source: Croatian National Bank, author’s calculation.

Notes: The grey shaded areas refer to the ranges of the best correction approaches: dark grey autoregressive models (ARIMA), light gray random shift (RW) model, while the red curves refer to the original credit gaps without corrections (Narrow 85K, Narrow 125K and Narrow 400K are gap for a narrower definition of credit with a smoothing parameter in the values of 85,000, 125,000 and 400,000). Basel refers to the credit gap prescribed under the Basel III agreement. On the right panel, the shaded area No augmentation and Augmented gaps refer to the value ranges of the countercyclical protective layer of capital without additional corrections and with corrections. The red Basel curve refers to the value of that capital layer for the corresponding Basel credit gap in the left panel.

The final decision about the gap estimation approach to obtain augmented gaps will depend on the policymakers’ prudence to act sooner or later concerning the results in terms of cyclical risk aggregation. Incorporating this type of analysis in the regular decision-making process could reduce the overall uncertainty. This would incentivize the policymaker to reduce the inaction bias and enable rule-based decisions, leading to more transparency and better communication with the public.

In conclusion, such results are helpful for several purposes in practice. First, they enable obtaining more stable indicators when making decisions about the countercyclical capital buffer. Second, they can be applied to other series of data that are important to monitor as well as the credit gap, as in the case of the construction of the composite indicator of cyclical systemic risk, which central banks monitor. Third, a more reliable variable of the credit or financial cycle is obtained, which is used as a given in other analyses, such as the evaluation of the macroprudential policy stance or empirical analyzes where the interaction of this with monetary and fiscal policies is considered. Of course, the decision-making process is always based on a range of other relevant criteria, such as the private sector debt burden, external imbalances, overvaluation of property prices, mispricing of risk, general economic conditions, as well as different economic and political events that could affect the indicators, the decisions, and overall macroprudential policy maker’s choices.

Beutel, J., List, S. and von Schweinitz, G. (2018). An evaluation of early warning models for systemic banking crises: Does machine learning improve predictions?. Discussion Paper Deutsche Bundesbank No 48/2018, Deutsche Bundesbank.

Borio, C. and Drehmann, M. (2009). Assessing the risk of banking crises – revisited. BIS Quarterly Review, pp. 29-46, Bank for International Settlements.

Borio, C. and Lowe, P. (2002). Assessing the Risk of Banking Crises. BIS Quarterly Review, pp. 29-46, Bank for International Settlements.

Detken, K., Weeken, O., Alessi, L., Bonfim, D., Boucinha, M., Castro, C., Frontczak, S., Giordana, G.,Giese, J., Jahn, N., Kakes, J., Klaus, B., Lang, J., Puzanova, N. and Welz, P. (2014). Operationalising the Countercyclical Capital Buffer: Indicator Selection, Threshold Identification and Calibration Options. ESRB Occasional Paper, No. 5, European Systemic Risk Board.

Deryugina, E., Ponomarenko, A. and Rozhkova, A. (2020). When are credit gap estimates reliable?. Economic Analysis and Policy 67, pp. 221–238.

Drehmann, M., Borio, C., Gambacorta, L., Jimenez, G. and Trucharte, C. (2010). Countercyclical capital buffers: exploring options. BIS Working Papers, No. 317, Bank for International Settlements.

Galán, J. E. (2019). Measuring Credit-to-GDP Gaps, The Hodrick-Prescott Filter Revisited. Documentos de Trabajo, No. 1906, Banco de España.

Hamilton, J. (2018). Why you should never use the Hodrick-Prescott filter. Review of Economics and Statistics, Vol. 100, No. 5, pp. 831-843.

Škrinjarić, T. (2022). Augmented credit-to-GDP gap as a more reliable indicator for macroprudential policy decision-making, CNB Working Papers, W-65, Croatian National Bank.

Škrinjarić, T., and Bukovšak, M. (2022). Novi indikatori kreditnog jaza u Hrvatskoj: unapređenje kalibracije protucikličkog zaštitnog sloja kapitala (New indicators of credit gap in Croatia: improving the calibration of the countercyclical capital buffer). CNB Reseach I-69, Croatian National Bank.

Although there exist studies that find better approaches to gap estimation compared to the HP filter (Hamilton, 2018; Beutel et al., 2018; Lang et al., 2019), we stay within the HP approach, as there are empirical studies of central banks that found the HP approach to be the best in previous financial crises signaling. Moreover, Deryugina et al. (2020) have shown, based on Monte Carlo simulations, that 12-15 years of data is sufficient to generate reliable credit-to-GDP gaps based on HP filtering and CCyB calibration anchoring.

The idea here is that the variation of the gap itself is smallest possible on average. This is somewhat comparable to the regression coefficient efficiency. Efficiency means that the parameter that is being estimated has the smallest variance. Similar holds here. As we are doing estimates in overlapping window fashion, a gap for the same period t’ is going to have a couple of dozen values that are re-estimated. This depends on the length of the rolling window. Now, as we collect all of those re-estimations, we want these estimates to have the smallest variability overall.