The opinions expressed are those of the authors and do not necessarily represent those of the European Central Bank, SSM or the Eurosystem. We are grateful for comments by Marcel Bräutigam, Alessandro Piloli and Francesco Vacirca. Research assistance by Immo Frieden is gratefully acknowledged.

In the aftermath of the reform process following the Global Financial Crises (GFC), Central Counterparties (CCPs)1 have developed into financial market infrastructures providing critical post-trading services for financial markets around the globe. The existence of persisting price differences for identical derivatives products traded at CCPs in different locations is both of primordial policy as well as practical interest. It indicates the persisting competitive advantage or disadvantage of pricing in a certain CCP (commonly known as the “CCP basis”) and potentially also offers arbitrage opportunities.

We focus on interest rate swap (IRS) markets, given the size of the market, its importance for real economy hedging needs and its relevance in the current EU policy date. Currently, the bulk of swaps is cleared in the UK, including euro-denominated IRS (EUR IRS). Despite several calls of EU policy makers to reduce exposures to UK CCPs, banks have been timid in voluntarily moving their swap portfolios. Frankfurt-based Eurex Clearing (Eurex), the main contender to absorb swaps business from the UK, was often perceived as “too expensive” compared to the incumbent LCH Ltd (LCH) in London. This is reflected in the Eurex-LCH basis, the price differential for swaps between the two CCPs.

The continued dependency of EU market participants on UK CCPs for the clearing of key derivatives markets is considered a major concern for the resilience of EU financial markets and an obstacle to the successful completion of the Capital Markets Union (CMU).2 The latest revision to the European Market Infrastructure Regulation (EMIR 3) introduced a requirement for EU market participants to clear some swaps through an “active account” at an EU CCP.3

Analysing the development and circumstances of other major CCP bases, we aim to provide an exploration of the potential drivers of the CCP basis. Overall, the basis is the result of a complex set of circumstances which include structural market characteristics, as well as regulatory and monetary policy driven features. We conclude by providing an outlook on the possible challenges and opportunities of the active account requirement in the context of the basis.

An interest rate swap is a contract where two counterparties agree to exchange interest rate payments based on a defined principal amount, typically a fixed rate against a floating rate (e.g. EURIBOR).4 Within this context, the basis is the price difference observed in the fixed rate for otherwise identical interest rate swap transaction cleared at two different CCPs.

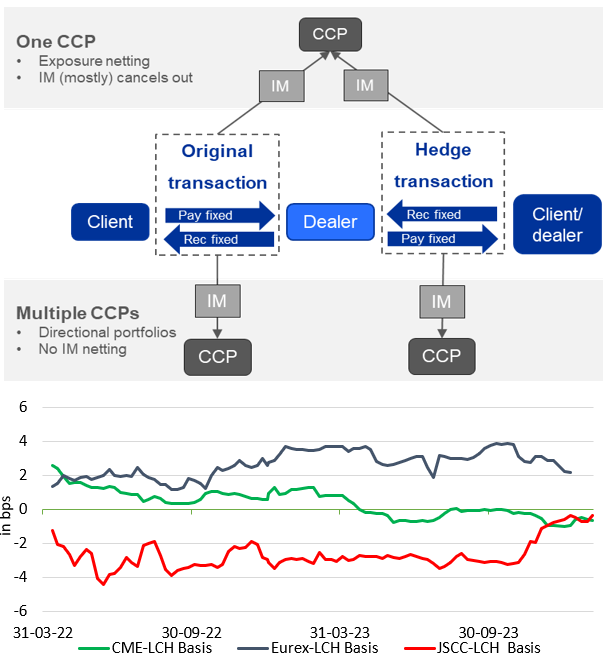

When a dealer enters an interest rate swap trade, e.g. with a client, the dealer will look for an equal opposite transaction to be perfectly hedged. This can either be achieved by finding a client with an opposite trading order, or – more typically – via a dealer-to-dealer trade. If the dealer can clear both transactions stemming from the original client trade and the hedge at the same CCP, their exposures are offset. Consequently, collateral requirements in the form of initial margin (IM) net out5 and the dealer is balanced both at the dealer and CCP level.

However, if the dealer cannot find a counterparty with an opposite transaction at the same CCP, the dealer will revert to a second CCP to be hedged. This creates two directional portfolios at two CCPs resulting in margin requirements at both CCPs. While balanced at dealer level, the dealer is no longer balanced at the CCP level and will recoup the additional costs by quoting a higher price to the client.

Figure 1: Mechanics of CCP basis and its recent evolution (10-year maturity; weekly averages)

Source: Bloomberg.

The basis is thus at least partly a reflection of whether a CCP can demonstrate a balance of buyers and sellers to a swap transaction and thus its ability to serve the dealer with both sides of the trade. This is ultimately driven by client demand to either pay or receive fixed flows. Whether a client faces higher or beneficial prices depends on which side of the transaction it trades.

From an economic perspective, the basis creates an arbitrage opportunity that should incentivise market participants to balance out the two liquidity pools until the price differential between the two clearing locations cancels out. In other words, the basis should only be a temporary phenomenon. However, historical data on the development of the basis tell a different story.

As a first step, we compare the recent global evolution of the basis. The three main contracts are from the Chicago Mercantile Exchange (CME) for US dollar-denominated swaps, Eurex for euro-denominated swaps and the Japanese Securities Clearing Corporation (JSCC) for Japanese yen-denominated swaps. All three variables compare the local swap rates with those at LCH for the most liquid tenor (10 years), hence all key parameters of the transactions are identical except for the choice of CCP.6

Both the Eurex-LCH and the CME-LCH basis have historically been positive, albeit the latter recently dropped below zero. The JSCC-LCH basis has been negative for most of the period under review but turned positive in the beginning of 2024.7 Although occasionally oscillating around zero or even changing sign, the price differential appears to be persistent in one or the other direction, indicating that the basis is to some degree a structural phenomenon.

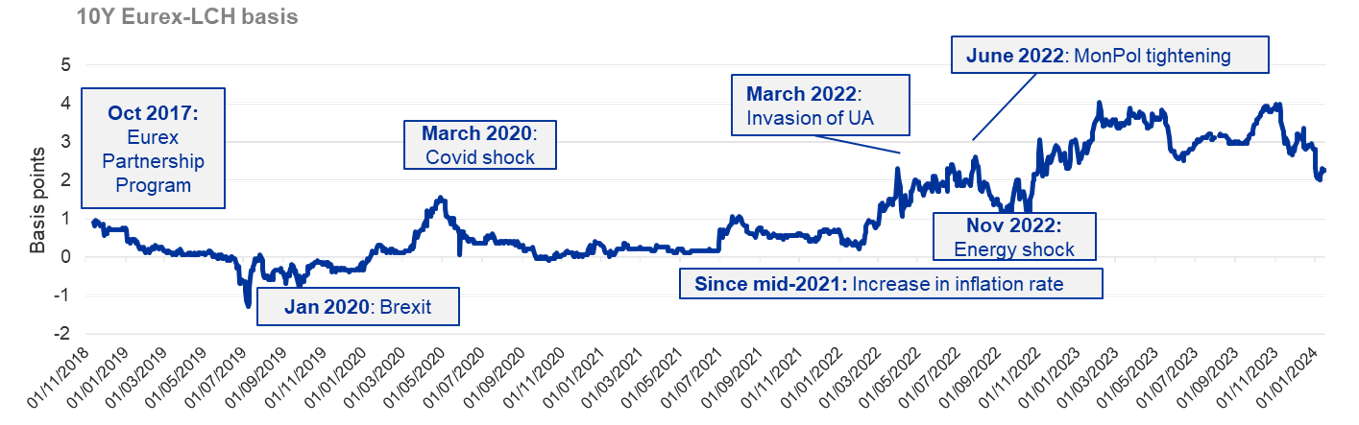

We now take a more detailed look at Eurex, which currently accounts for 20% of euro-denominated interest rate derivatives notional, with the remainder of the market concentrated at LCH.8 Anecdotal evidence suggests that Eurex’ client composition is dominated by buy-side clients (investment funds, insurers) with similar hedging needs, such as hedging a bond portfolio with payer swaps, leading to a positive basis quoted against LCH in the 10-year market.9 Eurex is primarily active in euro-denominated swaps and offers margin offsets between its swap and fixed income derivatives segments (e.g. Bund futures).

Since 2018 the Eurex-LCH basis had remained close to zero, but in 2022 a significant increase in size and volatility could be observed. Several events are worth highlighting:

Very low interest rates and favourable funding conditions up to 2022 may have made it cheaper to collateralise two directional portfolios at Eurex and LCH. Coupled with an incentive programme that could have helped to “pay away” the basis, market participants may have been able to drive down the basis. Market dislocation such as the covid-19 shock may have temporarily driven up the basis but the general trend of the basis was at a level close to zero.

Figure 2: Evolution of EUR basis and key events

Source: Bloomberg.

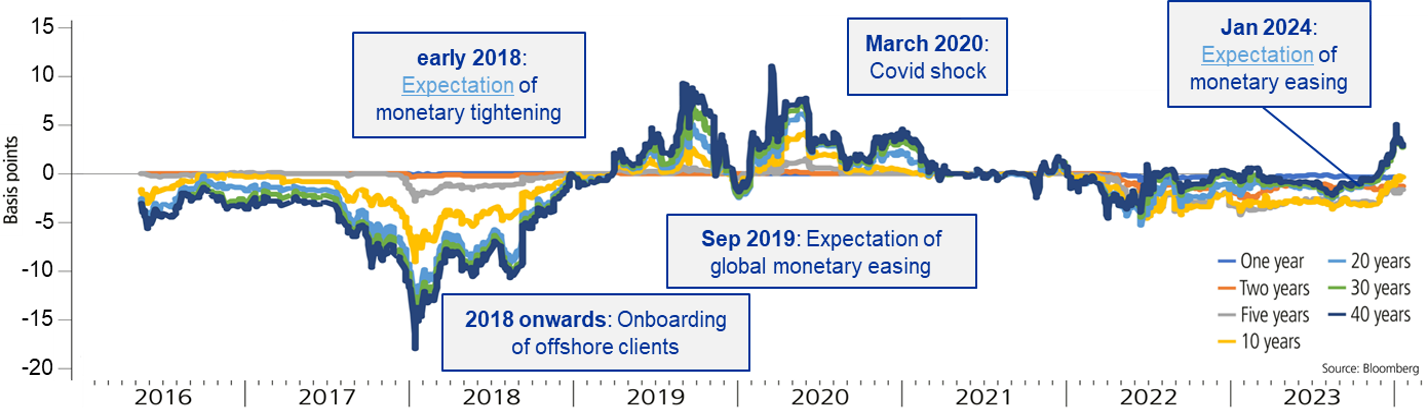

We now discuss the yen basis. The Japanese financial market has geographical clearing restrictions in place and is therefore of particular interest to EU policy makers in the context of the relocation debate. JSCC has a market share of 70% for Japanese yen IRS in terms of notional outstanding, with the rest of the market cleared at LCH.11 JSCC offers clearing only for yen-denominated IRS and similar to Eurex allows margin offsets with its fixed income derivatives segment (e.g. Japanese government bond futures).

The Japanese location policy requires firms registered in Japan to clear yen-denominated swaps through JSCC when transacting with other firms registered in Japan. Exemptions apply for certain intragroup transactions, allowing Japanese dealers to bypass the location mandate.12 LCH is licensed to clear yen-denominated swaps only for non-Japanese firms. The location policy has led to a ringfenced domestic market for yen-denominated swaps where Japanese firms are confined to JSCC; and an offshore market for international firms at LCH, including most notably US clients for which JSCC is not licensed to clear.13

Before 2018, JSCC exhibited a sizeable negative basis. This is attributed to the dominance of domestic banks that were hedging their loan books with receiver swaps. From 2018 onwards, JSCC had been expanding access to its services to cover more non-Japanese entities. It is reported that the onboarding of offshore hedge funds that took advantage of the arbitrage opportunities between JSCC and LCH contributed to a significant reduction in the basis.14

According to JSCC, the JSCC-LCH basis has ever since been mainly driven by repositioning of international firms at LCH, including dealer banks hedging their Japanese client exposures, or US firms that cannot access JSCC, while liquidity remains stable at JSCC. These international firms would speculate on changes in the Bank of Japan’s (BoJ) monetary policy stance by taking on respective swap positions at LCH, making them relatively more or less expensive compared to JSCC:

In all instances, however, the increase in size and the volatility of the basis was short lived and quickly returned to its trend level when market expectations did not materialise.

Figure 3 : Evolution of yen basis and key events

Source: Graph from risk.net; modifications by authors (key events added; mirrored along x-axis, see footnote 7).

As outlined above, the basis ultimately stems from an imbalance of hedging needs within one CCP. Where Eurex, CME and JSCC appear to have a directional, local client demand,17 LCH is used by all dealers for their diverse hedging needs, thus exhibiting heterogeneous client base.

The following determinants can explain the existence of a basis:

The exact size of the basis, however, depends on the extra costs of collateralising two directional portfolios at two CCPs, which may be driven by several variables 18:

These variables may be more or less relevant for the evolution of the basis depending on the tenor. For example, interest rate expectations differ along the yield curve and may not impact all market segments with hedging needs in the same way.

The price differential may be a matter of basis point but multiplied by the volumes cleared in the trillion-dollar swaps market, the basis becomes economically significant,19 leading to the question why a seemingly lucrative arbitrage opportunity can be observed over a prolonged period. The persistence of the basis suggests that there may be some frictions standing in the way of a “free lunch” in IRS markets.

Market access may be one determinant of arbitrage opportunities. Only once JSCC expanded access to its services to non-Japanese jurisdictions, did international customers with hedging needs opposite to the directional local market take advantage of the yen basis. Currently, US clients are barred from clearing at JSCC which constraints their ability to exploit the basis.

However, even when markets are relatively open, the costs of arbitraging away the basis may surpass the gains. 20 There is anecdotal evidence that a basis of at least 4 basis points is required for an arbitrage transaction to be economical. 21 This implies that a basis beyond a certain threshold should disappear by the power of arbitrage, and that a basis below this threshold could be considered structural due to the market specificities and the costs could be considered structural given the market specificities and the costs of arbitrage. In times of low funding costs, this arbitrage threshold may be lower, as may have been the case for Eurex before 2022. As of today, the basis at Eurex may be simply too small for international players to seize that opportunity.

In line with our discussion of the imbalance of payers and receivers to swap transactions as a potential key driver for the basis, measures that could potentially lead to a distortion of the balance, or exacerbates an existing imbalance, could be counterproductive.

EMIR 3 requires EU firms to clear some swap trades through an “active account” at an EU CCP. Although the design of the requirement is unlikely to lead to a considerable shift of exposures away from LCH into the EU, its ultimate impact on the Eurex-LCH basis will depend on the overall direction of the relocating swap portfolios.22 At the same time, gradually moving swap exposures into the EU could be an opportunity for further growth at EU CCPs in this segment, eventually attracting international market participants that could diversify the hedging demand. With EU CCPs already accessible for non-EU firms23, a more concerted push may be necessary to incentivise movement on the “right side of the basis”.

Going forward, EU policy makers will have to carefully trade off the two objectives of ensuring financial stability in the EU over the long term and building up EU-based clearing capacities, and achieving competitive prices for EU and international firms. Balance remains key.

Evangelos Benos, Wenqian Huang, Albert J. Menkveld, and Michalis Vasios. (2022) The Cost of Clearing Fragmentation. Mimeo.

Ismael Alexander Boudiaf, Immo Frieden and Martin Scheicher. (2024) The Market Liquidity of Interest Rate Swaps. ESRB Working Paper No. 2024/147

Ismael Alexander Boudiaf, Martin Scheicher, and Francesco Vacirca. (2023) CCP Initial Margin Models in Europe. ECB Occasional Paper No. 2023/314

Oana Furtuna, Susanne Kretschmann and Francesco Vacirca. (2023) The derivatives clearing landscape in the euro area three years after Brexit (June, 2024). Financial Integration and Structure in the Euro Area 2024.

Available here: https://www.ecb.europa.eu/press/fie/box/html/ecb.fiebox202406_02.en.html.

Nina Boyarchenko, Thomas M. Eisenbach, Pooja Gupta, Or Shachar, and Peter Van Tassel. (2018) Bank-Intermediated Arbitrage. Federal Reserve Bank of New York, Working Paper No. 858.

Darrell Duffie (2010) Presidential Address: Asset Price Dynamics with Slow Slow-Moving Capital. Journal of Finance, Volume 65, Issue4, Pages 1237 1237-1267.

Darrell Duffie (2018) Post Post-Crisis Bank Regulations and Financial Market Liquidity. Baffi Lecture.

Martin Scheicher (2023) Intermediation in US and EU bond and swap markets: stylised facts, trends and impact of the COVID COVID-19 crisis in March 2020. ESRB Occasional paper, No. 24.

A clearing house acts as buyer to every seller and vice versa to clear securities or derivatives transactions executed by its participants (“Clearing Members”).

See Furtuna et al (2024) for further background.

Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL amending Regulations (EU) No 648/2012, (EU) No 575/2013 and (EU) 2017/1131 as regards measures to mitigate excessive exposures to third third-country central counterparties and improve the efficiency of Union clearing markets, 19 February 2024, available here.

See Boudiaf et al (2024) for further background.

IM requirements fully cancel out if the trades were considered in isolation, while in reality portfolio effects could lead to cross cross-margining on the basis of currencies or products, or add add-ons (e.g. for concentrated positions) apply. We do not consider variation margin as VM is typically transferred from the CM with a portfolio that has lost value to the CM whose positions have gained value. Default Fund contributions are also not considered.

The basis is defined as the difference for the fixed rate of a plain plain-vanilla swap trade. A positive basis means that that the price for a fixed payer position is higher at e.g. Eurex than at LCH, corresponding to an oversupply of fixed payers. Conversely, entering a fixed receiver position would be more beneficial at Eurex than at LCH, which should attract fixed receivers to Eurex (and CME where the same conditions are in place). A negative basis thus means that it is more beneficial to enter a fixed payer position at JSCC than at LCH, corresponding to an oversupply of fixed receivers. JSCC would naturally attract fixed payers.

The basis between JSCC and LCH is typically quoted as “LCHLCH-JSCC” and thus exhibits a positive basis. For the purpose of illustration and comparability, we use the JSCC JSCC-LCH basis, therefore referring to a negative basis.

See Furtuna, Kretschmann, Vacirca (2024) for further background.

https://www.risk.net/derivatives/7956324/eurex eurex-lchlch-basisbasis-hitshits-newnew-highshighs-amidamid-ratesrates-vol?check_logged_in=1

See Scheicher (2023) for further background on fixed income market stress after the Covid shock.

Setting-EU-CCP-policy-much-more-than-meets-the-eye.pdf (ceps.eu)

US-based clients can clear yen yen-denominated swaps only at LCH due to the incompatibility of Japanese insolvency law with US LSOC requirements for US client funds. JSCC unsuccessfully applied for an exemption with the CFTC several times. See link.

LCH-JSCC basis turns negative on BoJ policy shift – Risk.net

According to Benos et al. (2021) the CME CME-LCH basis can be partly explained by local US banks hedging their fixed fixed-rate mortgage portfolios which creates a preference to pay fix and receive floating.

For an illustration of the costs of netting benefits in centrally cleared derivatives, see Duffie et al (2014).

Benos et al. (2021) estimate the gains from exploiting the price differential at USD 80 million daily.

Researchers have studied the limits of arbitrage ” across many markets. Duffie (2010) provides a general framework. Boyarchenko et al (2018) find that the maximum leverage allowed and the implied return on basis trades is considerably lower in the post post-GFC regulation, despite sizable spreads in a range of markets.

At the time of publication, it is not clear whether Eurex will be the only beneficiary of this policy. Madrid Madrid-based BME Clearing announced its plans to launch an incentive programme to serve an international customer base. StockholmStockholm-based Nasdaq Clearing also pledged to offer euro euro-denominated swaps clearing.

Eurex has been approved by the Commodity Futures Trading Commission (CFTC) as a registered Derivatives Clearing Organization (DCO) and can provide clearing services to US clients. Available here.