The rise of new forms of private money has triggered an ‘old’ economic question about the appropriate balance between private and public interests in money and payments. The main aim of this paper is to explore how various digital means of payment may co-exist in the future: bank deposits, unbacked cryptos, stablecoins and Central Bank Digital Currency (CBDC). We summarize the spectrum of policy options for regulating unbacked cryptos and stablecoins, from freely allowing them to fully prohibiting and options in between these extremes. We argue that convertibility between public and private money should be a key principle for the design of CBDC as well as for the regulation of unbacked cryptos and stablecoins that may potentially be widely adopted as a future means of payment.

In the last decade rapid advancements in computer processing, electronic data storage and Internet connectivity have led to new private forms of value transfer that may turn out to be disruptive for ‘traditional’ money and payment systems. These private initiatives include unbacked cryptocurrencies, without any link to underlying financial assets, and so-called ‘stablecoins’ that are backed by assets to stabilize their value making them more attractive as a means of payment. At the same time, many central banks across the globe are currently working on a public alternative: Central Bank Digital Currency (CBDC). These new forms of money add to the mix of existing means of payment, predominantly cash and bank deposits.

This policy note begs three main questions:

These recent developments have triggered an ‘old’ economic question about the appropriate balance between public and private interests in money and payments. In this policy note, we argue that public and private money should coexist. Public money ensures trust and stability while private money ensures innovation and efficiency. However, the unregulated issuance of private money may lead to undesirable disruptions and increased financial risks. To mitigate these risks and safeguard the payment system, central banks and financial regulators have to step in. To restore the public-private balance, a digital update of public money is first required combined with an effective mix of various regulatory options depending on the role and expected future adoption of cryptocurrencies.

In most modern economies, payments have largely been relying on cash and commercial bank deposits but this landscape is now changing. The rise of cryptocurrencies is shifting the balance between public and private money. Arguably, to the extent that cryptocurrencies are accepted by users as a medium of exchange, store of value and unit of account, they can be regarded as the newest form of private money that is around.

These cryptos only exist in ‘cyberspace’ and are stored as digital tokens on digital ledgers. They allow peer-to-peer, direct transfers between consumers and merchants and their issuance is not controlled by monetary authorities. Using cryptographic identification techniques, Bitcoin ‘proved’ that this new form of private money could be used for payment in a decentralized payment system while avoiding the possibility of ‘double spending.’ Broadly, these cryptocurrencies can be divided into two main categories: unbacked cryptos and stablecoins.

The first category – unbacked cryptocurrencies – includes cryptos that are not linked to any financial asset or government claim and have no inherent value. Since the arrival of Bitcoin in 2009, more than 10000 unbacked cryptocurrencies have been created with a total market capitalization of $2900 bln.2 Grosso modo, unbacked cryptos derive their value from the self-fulfilling expectation that they will be used in the future. Although these ‘unanchored’ expectations may be (partly) based on future market adoption prospects, they seem to drive the extreme volatility of current unbacked crypto prices to a large extent (Bolt and Van Oordt, 2020).3 Hence, it is often concluded that Bitcoin appears to behave more like a speculative investment and that market adoption is likely to remain limited (see e.g. Halaburda et al., 2021). The second category – stablecoins – covers cryptos that are (allegedly) backed one-for-one by safe and liquid financial assets to stabilize their value. In theory, consumers that buy stablecoins can redeem their stablecoins at par for cash at any moment, similar to bank deposits. In practice, this is not always the case, however, as practices differ with respect to the quality of the asset backing, limits and fees to redemption, or redemption on the secondary market only, in line with the profit-making motive of private issuers.

Thus far, stablecoins constitute a relatively small proportion of crypto assets, i.e. just over 5% (Cunliffe, 2021). But market capitalization of stablecoins is rising fast: for the largest stablecoin issuers, it has risen by nearly 500% in 2021 (President’s Working Group on Financial Markets, 2021). As such, stablecoins have mainly been used for payments within crypto markets (Cunliffe, 2021) – for example, it has been estimated that half of all Bitcoin trades are executed using Tether (Kaiko, 2021). Tether is currently the world’s largest stablecoin and has recently been subject to controversy about its asset backing (FT, 20 October 2021).

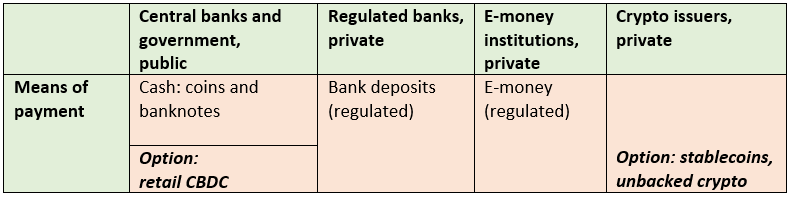

The potential emergence of unbacked cryptos, stablecoins and CBDC as a means of payments may add new options to the existing set of monies. This is illustrated in table 1, which contains public money, regulated forms of private money (i.e. bank deposits, e-money) and new private forms (unbacked crypto, stablecoins). The issue arises whether all forms of money can co-exist and if they do, how they should be regulated if at all.

Table 1. Current and potential future forms of money as a means of payment

A digital update of public money

A first key question comes up whether generally accessible public money should keep playing a role in an increasingly digitalized payment system? After all, private payments are generally more innovative, efficient and convenient, while the use case of a digital euro in the form of CBDC may not be immediately clear. Indeed, in our view, the value of providing CBDC would not directly derive from a technologically improved or more convenient payment instrument relative to those already supplied by the private sector. Rather, its main value added will lie in balancing public and private interests. Due to the decline of cash usage and the potential absence of public digital money for the public at large, the payment system would gradually move in the direction of a ‘corner’ solution of private money only. Monetary history as well as current developments in crypto markets suggest that over time this could put the public interest at risk with respect to trust and stability (Bolt, Lubbersen and Wierts, 2022).

This may explain why central banks have accelerated the development of CBDC as a public alternative. Already before 2019, CBDC was supported by a few countries where cash saw a steep decline (such as Canada or Sweden), some smaller countries (e.g. the Bahamas), and most importantly China, where platform payment providers have become dominant players. After 2019, it seemed that the sentiment has shifted to include the Euro and the dollar as well. Upon publication of the ECB (2020) report on CBDC, the ECB intensified its work on a digital euro and Christine Lagarde said that “we should be ready to issue a digital euro, should the need arise”. Moreover, FED Board member Lael Brainard (2020) said that “given the dollar’s important role, it is essential that the Federal Reserve remains on the frontier of research and policy development regarding CBDC”. Looking forward, the next question is how to design CBDC. In October 2021, the Eurosystem has launched a project investigation phase that will last two years. After that, a new decision will be taken as to whether or not to continue with a realisation phase for a digital euro.

Network effects, scale and adoption

The second key question is concerned with future adoption of new forms of money. That is, in the decades to come, which forms of money are likely to acquire mass adoption and which forms are likely to end up as ‘niche’ products or even disappear?

Not all possible retail means of payment will achieve mass adoption in the future. Economic research has shown that means of payment strongly benefit from network effects and standardisation (e.g. Brunnermeier et al., 2021; Den Butter and Mallekoote, 2018). Crucially, payment markets are ‘two-sided’, stressing the need that both payees and payers coordinate on using the same means of payment (e.g., Armstrong, 2006; Rochet and Tirole, 2006). Rising adoption on one side of the market, increases participation of the other side, and vica versa. Moreover, on the demand side people tend to habitually stick to their preferred way of payment, often supported by high merchant acceptance (e.g. Van der Cruijsen et al., 2017), while on the supply side payment service providers and merchants benefit from economies of scale and scope which effectively limit the number of offered payment methods (Bolt, 2013). Therefore, two-sided market structures, network effects, consumer behaviour and economies of scale and scope may lead to ‘winner-takes-most’ type of dynamics. That is, some means of payment will be dominant while others co-exist as ‘niche’ products.

Arguably, as digitalization progresses, cash payments are likely to (further) develop into a niche product over time while the proportion of people increases that is using digital payments. Does this imply that bank deposits will remain the core element of electronic payments? It may be, but it is not a certainty by all means. In particular, two-sided market theory may explain how heterogeneous private benefits and cross-group externalities among merchants and consumers affect the joint demand for unbacked cryptocurrencies to make payments. Privacy, data security and convenience may drive consumer usage of cryptos on one side of the market, while avoiding high fees charged by traditional payment providers may drive merchant adoption on the other side. However, it is often argued that extreme price volatility, slow payment processing and risk of fraud are main factors that prohibit the widespread adoption of unbacked cryptos, leaving it a niche payment product.

A more uncertain scenario would arise when private stablecoins become dominant players outside crypto asset markets as well, with global reach and wide adoption. The potential benefits of stablecoins for consumers include more convenient payment methods – in particular online and cross-border payments – and increased accessibility in countries without a well-developed payment system. Benefits for merchants may include lower fees. Although the project has been stopped, Facebook’s first announcement of the Libra/Diem project in 2019 serves as a ‘wake up call’: stablecoins issued by large technology companies with ‘deep pockets’ and huge global consumer bases, have the potential to reach mass adoption. At the same time, stablecoin issuers must convince their holders that at any point in time that its backing in assets is safe and reliable, so that ‘no questions are asked’ (Gorton and Zhang, 2021). If they can’t, the risk to run is looming again.

Regulatory options for unbacked cryptos and stablecoins

This brings us to the last key question: What are the main policy options for regulating unbacked cryptos and stablecoins? The main risks for unbacked cryptos probably relate to consumer protection (including transparency, conflicts of interest, fraud, cyber security), financial stability4 and market integrity. Regulating unbacked cryptos is challenging, since they operate as computer protocols on the internet and are designed to fall outside the regulatory perimeter.

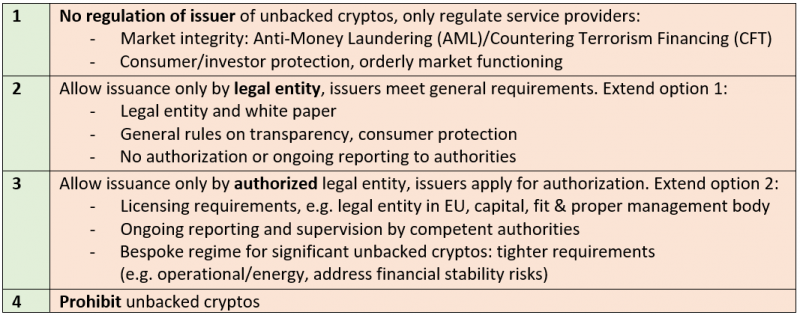

Table 2 summarizes our view on the main policy options for unbacked cryptos. It contains a spectrum from allowing unbacked cryptos subject to regulation of service providers (‘option 1’), to regulating crypto issuers as well (’option 2’ and ’option 3’) versus trying to prohibit unbacked cryptos as a more extreme alternative (‘option 4’). The choice between these options need not remain fixed over time, given that financial markets and regulation are constantly evolving. As different forms of private money develop, risks may evolve as well, and policymakers may need to adjust regulation.

The first option resembles the current regime in most advanced economies. Unbacked cryptos are allowed and AML/CFT rules have been extended to apply to cryptos as well. This has been done by including crypto wallets and exchanges as ‘obliged entities’ under the AML/CFT regime based on the standards of the Financial Action Task Force.5 It could be extended to include additional regulation by objective, e.g. for consumer protection and orderly market functioning.

Table 2. Policy options to regulate unbacked cryptos

An important challenge will be to create a regulatory focal point. The proposal by the European Commission (2020) for a Market in Crypto Assets Regulation (MiCAR) provides one solution for doing so. As described in option 2, it prohibits unbacked cryptos unless they meet general requirements, which includes the creation of a legal entity (but not necessarily in the European Union). This proposal also requires a white paper and contains several general requirements for consumer protection. Option 3 is to extend such a regime, e.g. by requiring authorization, a legal entity in the European Union and ongoing reporting. It is inspired by the MiCAR proposals for stablecoins, which require more intrusive regulation, as will be explained below. It would probably be suitable for the largest unbacked cryptos only, in proportion to the risks that they pose, as most of the thousands of unbacked cryptos remain small in usage and mainly exist as a computer protocol on the internet. Option 4, finally, is to ban unbacked cryptos, which would likely be difficult to enforce in practice.

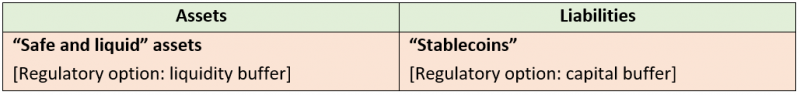

Stablecoins add traditional financial engineering to the storage and transfer function of distributed ledgers. To illustrate, table 3 shows a simple balance sheet of a stablecoin issuer with 100% coverage by safe and liquid assets (but not by central bank money).

Table 3. Stylised stablecoin balance sheet

We argue that the main risk relates to the profit-making motive and incentive of over-issuance with implications for monetary and financial stability.6 A main incentive to issue a stablecoin is to receive assets in trade for a stablecoin and then earn revenues on those assets, perhaps by placing them in government securities or fully depositing them in a bank to earn some interest (and be protected by deposit insurance). Once adoption and trust have initially been established, a private entity may have an incentive to increase the return on its assets, e.g. by moving to higher yielding, more risky assets (or even loans), decreasing coverage, and restricting access (e.g. imposing redemption fees or limiting – ‘not at par’ – convertibility). This calls for safeguards on the composition of the asset backing. Moreover, network and scale effects may lead to a globally dominant stablecoin, potentially increasing fees and risk even further and issuing more stablecoins than would otherwise be socially desirable. This could introduce credit, maturity and liquidity transformation and therefore bank-like risks, which may require adequate capital and liquidity buffers, as indicated in Table 3.

More generally, G7 (2019) and BIS (2021) identify a range of risks related to stablecoins, e.g. related to legal certainty, sound governance, the functioning of payment systems, cyber security, market integrity and, data privacy. In addition, stablecoins that may reach global scale have implications for monetary policy, financial stability, settlement finality and fair competition. Based on these risks, substantial reforms to regulation were announced since 2019. The FSB (2020) issued recommendations for regulating stablecoins, the European Commission (2020) published its proposal for a Market in Crypto Assets Regulation (MiCAR), the BIS (2021) applied its standards for systemically important infrastructures to stablecoins and the US President’s working group on (2021) proposed to allow stablecoin issuance by depository institutions only.

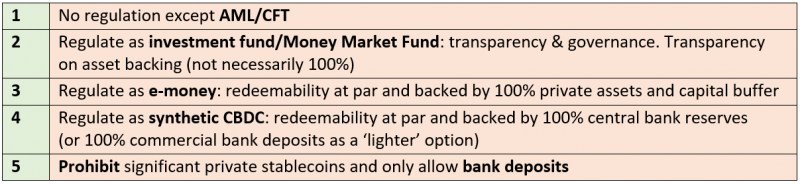

Table 4 provides our stylised overview of the main policy options. The options indicate different trade-offs between freely allowing private money innovations at one extreme (‘option 1’) and implementing the toughest regulation to fully mitigate monetary and financial risk at the other (‘option 5’). It is important to note however that the choice of these options need not remain fixed over time. In fact, as different forms of private money become more widely accepted, policymakers may decide they need more stringent regulation. An important question is how easily one could move from one regime to the next regime.

Table 4. Policy options to regulate stablecoins

Option 1 represents how stablecoins are currently regulated. Regulation is aimed at preventing money laundering and terrorist financing. This option allows most room for innovation and could be acceptable as long as stablecoins are used as a niche product.

Policy option 2 tightens the rules to better protect holders of stablecoins. This option resembles so-called ‘asset-referenced tokens’ from the EU regulatory proposals for a Regulation on Markets in Crypto Assets (EC, 2020). This option is more or less based on a similar framework applied to investment funds, largely focusing on transparency requirements regarding asset backing and conflicts of interest. This option leaves responsibility to the buyer of the stablecoin, who should understand the nature of the backing, or the lack of it. However, in the case of stablecoins, the option of less than 100% backing with a promise to maintain a stable value would create a risky debt-like claim. This could lead to run risk as described by Holmstrom (2015), i.e. why all financial panics involve debt.

Policy option 3 tightens the rules on asset backing, i.e. 100% backing and a small capital buffer. It resembles so-called ‘e-money tokens’ from the EU regulatory proposals for a Regulation on Markets in Crypto Assets (2020)7. In this case, the specifics of the asset backing still matter, e.g. which types of securities are allowed. This would then determine the possible existence of credit and liquidity risk, for which additional buffers are added. Moreover, it would still fall outside the monetary framework. This may explain why the ECB has stated to have serious concerns about issuing of e-money by non-credit institutions (ECB, 2021; ECB, 2008; ECB, 1998). The ECB has argued that in- and outflows of bank deposits to and from e-money have impact on banks’ liquidity, and that the implementation of monetary policy in the Euro area would become increasingly difficult and the desired policy outcomes more uncertain.

This brings us to option 4, i.e. creating more certainty and stability by requiring full backing in commercial or central bank money. This goes in the same direction of the option as referred to in the CPMI/ISCO report (BIS, 2021) for stablecoins that involve systemically important transfers of value as a financial market infrastructure. This report states that these should carry ‘little or no credit or liquidity risk’ and be ‘an acceptable alternative to the use of central bank money’. In case systemically important stablecoins would be given access to the central bank balance sheet, they could then be called ‘synthetic CBDC’ (Adrian and Mancini-Griffoli, 2019). In this case, the word ‘synthetic’ illustrates that the claim would still be on a private institution and not on the central bank, but nevertheless covered by 100% central bank reserves.

Finally, policy option 5 would prohibit significant private stablecoins altogether and only allow bank deposits. This resembles the proposal by the US President’s working group on (2021, p. 16), to “limit stablecoin issuance, and related activities of redemption and maintenance of reserve assets, to entities that are insured depository institutions”. Such a solution would maintain the current two-tier banking system, including its monetary arrangements and prudential constraints. It would not rely on the notion of 100% safe and liquid assets, but rather demand capital and liquidity buffers to cover the risks, as indicated in Table 3. At the same time, this may not be the most appropriate solution for entities that only want to provide payment services, but not issue loans (not being a bank). Policy option 5 would still allow some degree of innovation related to digital money, but only when it is issued by regulated banks and in line with the applicable regulatory framework.

Essentially, trust and confidence in private money heavily relies on the ability of private money issuers to convert their liabilities into private money of another private entity or – ultimately – into public money. Corner solutions with only public or private money are not desirable, given the need to balance trust, innovation and stability (BIS, 2003). Overall, the risks and corresponding policy options suggest stronger forms of regulation as adoption of crypto assets would increase. The overview of risks shows that these risks largely depend on their uptake, i.e. whether they become widely used as a means of payment or not. As soon as that point is reached, the principle of convertibility at par requires certainty on the backing. The precise format of such backing is still ‘under construction’, i.e., whether 100% commercial bank deposits would be good enough, whether it should be central bank money, or whether it would be desirable not to allow this option at all, and instead demand full compliance with banking regulation.

Getting the public-private balance in money and payments right is of key importance but easier said than done. In our view, public and private money should coexist. Public money ensures trust and stability, private money ensures innovation and efficiency. The appropriate balance will largely depend on future adoption of new forms of private money. If adoption remains limited a light regulatory regime will do, but if adoption increases so will the stringency of the regulation. Assuming that cash usage will keep declining and unbacked cryptos remain a niche product, a great deal will depend on how stablecoins will develop globally. If stablecoins become widely used as money, inside crypto asset markets and possibly even in the traditional economy, the stability of the payment system may be at risk without adequate regulation and convertibility at par with public money.

To restore the balance, public money needs to undergo a digital update. Just like cash, issuing CBDC will support the convertibility between private and public forms of money. At the same time, CBDC should be designed such that it will not fundamentally change the role of bank deposits. Hence, the key issue is one of technological adaptation. Monetary history is full of examples where uncontrolled money issuance caused financial panics and social disruptions, so central banks should not hang around but better get going!

Adrian, T. and T. Mancini-Griffoli (2019), The rise of digital money. IMF Fintech Notes, 19/01.

Armstrong, M. (2006), Competition in two-sided markets. RAND Journal of Economics, 37, 668–91.

Biais, B., C. Bisie re, M. Bouvard, C. Casamatta and A. Menkveld (2018), Equilibrium bitcoin pricing. Mimeo, available at SSRN.

BIS (2003), The role of central bank money in payment systems, Committee on Payment and Settlement Systems. Report.

BIS (2021), Application of the principles for financial market infrastructures to stablecoin arrangements. Consultative report, CPMI and IOSCO, October 2021.

Bolt, W. (2013), Pricing, competition and innovation in retail payment systems: A brief overview. Journal of Financial Market Infrastructures, 1(3), 73-90.

Bolt, W., V. Lubbersen and P. Wierts (2022), Getting the balance right: Crypto, stablecoin and CBDC, Journal of Payment Strategy & Systems, 16(1), 39-50.

Bolt, W. and M. van Oordt (2020), On the value of virtual currencies. Journal of Money, Credit and Banking, 52(4), 835-862.

Cunliffe, J. (2021), Is ‘crypto’ a financial stability risk? Speech given at SIBOS, Bank of England, 13 October 2021.

Brunnermeier, M., H. James and J-P. Landau, 2021, The digitalization of money. BIS Working Papers 941.

Den Butter, F. and P. Mallekoote (2018), The payment system as a public good? Journal of Payments Strategy & Systems 12(4), 304-313.

ECB (2021), Opinion of the European Central Bank of 19 February 2021 on a proposal for a regulation on Markets in Crypto-assets, and amending Directive (EU) 2019/1937 (CON/2021/4). Official Journal of the European Union, 29-4-2021, p. 1–9.

ECB (2020), Report on a digital euro. Report, October 2020.

ECB (2008), Opinion of the European Central Bank of 5 December 2008 on a proposal for a Directive on the taking up, pursuit and prudential supervision of the business of electronic money institutions (CON/2008/84). Official Journal of the European Union, 6-2-2009, p. 1–9.

ECB (1998), Report on electronic money. Report, ISBN 92-9181-012-6.

European Commission (2020), Proposal for a regulation on markets in crypto-assets, and amending Directive (EU) 2019/1937, COM(2020) 593 final. Report.

Financial Times (2021), Short-seller Hindenburg sets €1m ‘bounty’ for details on Tether’s reserves, 20 October 2021.

Frost, J., H.S. Shin and P.Wierts (2020), An early stablecoin? The Bank of Amsterdam and the governance of money. BIS Working Papers 902.

FSB (2020), Regulation, supervision and oversight of ‘global stablecoin’ arrangements. Final report and high-level recommendations, Basel.

FSB (2022), Assessment of risks to financial stability from crypto-assets, 16 February 2022.

G7 (2019), Investigating the impact of global stablecoins. Working Group on Stablecoins, report, October 2019.

Garratt, R. and N. Wallace (2018), Bitcoin 1, Bitcoin 2,…: An experiment on privately issued outside monies. Economic Inquiry, 56, 1887–97.

Gorton, G. and J. Zhang (2021), Taming wildcat stablecoins. Mimeo.

Halaburda, H., G. Haeringer, J. Gans and N. Gandal (2021), The microeconomics of cryptocurrencies. Forthcoming in Journal of Economic Literature.

Holmstrom, B. (2015), Understanding the role of debt in the financial system. BIS Working Papers 479.

Kaiko (2021), Half of all Bitcoin trades are executed using Tether. Kaiko research, 11 October 2021, https://blog.kaiko.com/half-of-all-bitcoin-trades-are-executed-using-tether-9d7595304ca2

President’s Working Group on Financial Markets (2021), the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency, Report on Stablecoins, November 2021.

Rochet, J-C. and J. Tirole (2006), Two-sided markets: A progress report. RAND Journal of Economics, 37, 645–67.

Van der Cruijsen, L. Hernandez and N. Jonker (2017), In love with debit card, but still married to cash. Applied Economics, 49(30), 2989-3004.

Yermack, D. (2015), Is bitcoin a real currency? An economic appraisal. In Handbook of Digital Currency, pages 31-43. Springer.

See www.coingecko.co , data as of November 7, 2021.

The determinants of unbacked crypto prices and its volatility are the focus of many papers, see also e.g. Biais et al (2020), Garratt and Wallace (2018), and Yermack (2015).

According to the FSB (2022), crypto markets could reach a point where they represent a threat to global financial stability due to their scale, structural vulnerabilities and increasing interconnectedness with the traditional financial system.

The European Commission has proposed to extend the AML/CFT regime to all crypto asset service providers. See Beating Financial Crime (europa.eu).

The profit-making motive may lead to an underlying conflict of interest between the stablecoin issuer, who manages the assets and receives the return, and the stablecoin owner, who relies on full backing (Frost et al., 2020).

In MiCAR, significant stablecoins are supposed to be regulated as ‘e-money’, the third official category of money, which exists already, but has remained very small so that it largely has remained off the radar. The main requirement for such ‘e-money tokens’ in MiCAR is that it has a 1-to-1 backing of safe and liquid assets with fiat money. However, many questions remain open. For example, it is unclear when a stablecoin becomes ‘significant’ and in case it becomes significant, how to change from an ‘asset referenced token’ to an ‘e-money token’.