References

Acharya, Viral V, Denis Gromb, and Tanju Yorulmazer, 2012, Imperfect Competition in the Interbank Market for Liquidity as a Rationale for Central Banking, American Economic Journal: Macroeconomics 4, 184–217.

Agarwal, Sumit, Gene Amromin, Souphala Chomsisengphet, Tim Landvoigt, Tomasz Piskorski, Amit Seru, and Vincent Yao, 2022, Mortgage Refinancing, Consumer Spending, and Competition: Evidence from the Home Affordable Refinance Program, The Review of Economic Studies rdac039.

Agarwal, Sumit, Richard J. Rosen, and Vincent Yao, 2016, Why Do Borrowers Make Mortgage Refinancing Mistakes?, Management Science 62, 3494–3509.

Allen, Jason, Robert Clark, and Jean-François Houde, 2014, The Effect of Mergers in Search Markets: Evidence from the Canadian Mortgage Industry, American Economic Review 104, 3365–3396.

Andersen, Steffen, John Y. Campbell, Kasper Meisner Nielsen, and Tarun Ramadorai, 2020, Sources of Inaction in Household Finance: Evidence from the Danish Mortgage Market, American Economic Review 110, 3184–3230.

Bajo, Emanuele, and Massimiliano Barbi, 2018, Financial Illiteracy and Mortgage Refinancing Decisions, Journal of Banking & Finance 94, 279–296.

Barone, Guglielmo, Roberto Felici, and Marcello Pagnini, 2011, Switching costs in local credit markets, International Journal of Industrial Organization 29, 694–704.

Benetton, Matteo, Alessandro Gavazza, and Paolo Surico, 2021, Mortgage Pricing and Monetary Policy, Technical report.

Berger, David, Konstantin Milbradt, Fabrice Tourre, and Joseph Vavra, 2021, Mortgage Prepayment and Path-Dependent Effects of Monetary Policy, American Economic Review 111, 2829–2878.

Bhutta, Neil, Andreas Fuster, and Aurel Hizmo, 2021, Paying Too Much? Borrower Sophistication and Overpayment in the US Mortgage Market, Technical report.

Buchak, Greg, and Adam Jørring, 2021, Do Mortgage Lenders Compete Locally? Implications for Credit Access, Technical report.

Célerier, Claire, and Adrien Matray, 2019, Bank-Branch Supply, Financial Inclusion, and Wealth Accumulation, Review of Financial Studies 32, 4767–4809.

Emiris, Marina, and François Koulischer, 2021, Low Interest Rates and the Distribution of Household Debt, Working paper.

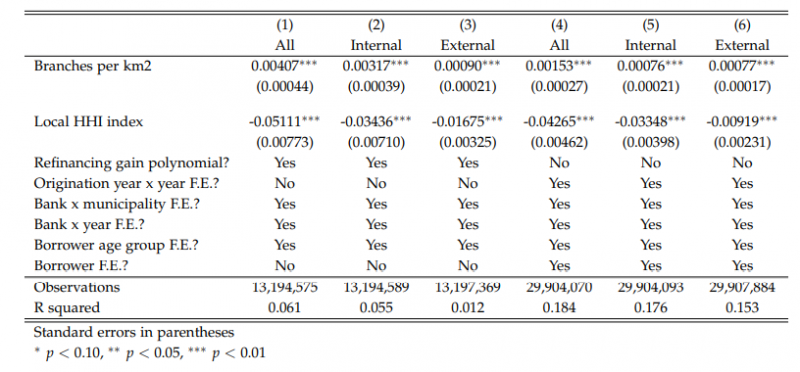

Emiris, Marina, François Koulischer and Christophe Spaenjers, 2022, Bank Competition and Bargaining over Refinancing, Working paper.

Ergungor, Ozgur Emre, 2010, Bank Branch Presence and Access to Credit in Low- to Moderate Income Neighborhoods, Journal of Money, Credit and Banking 42, 1321–1349.

Fisher, Jack, Alessandro Gavazza, Lu Liu, Tarun Ramadorai, and Jagdish Tripathy, 2021, Refinancing Cross-Subsidies in the Mortgage Market, Technical report.

Fuster, Andreas, Stephanie Lo, and Paul Willen, 2022, The Time-Varying Price of Financial Intermediation in the Mortgage Market, Technical report 26.

Ioannidou, Vasso, and Steven Ongena, 2010, “Time for a Change”: Loan Conditions and Bank Behavior when Firms Switch Banks, The Journal of Finance 65, 1847–1877.

Johnson, Eric J, Stephan Meier, and Olivier Toubia, 2019, What’s the Catch? Suspicion of Bank Motives and Sluggish Refinancing, Review of Financial Studies 32, 467–495.

Keys, Benjamin J., Devin G. Pope, and Jaren C. Pope, 2016, Failure to Refinance, Journal of Financial Economics 122, 482–499.

Nguyen, Hoai-Luu Q., 2019, Are Credit Markets Still Local? Evidence from Bank Branch Closings, American Economic Journal: Applied Economics 11, 1–32.

Rubinstein, Ariel, 1982, Perfect Equilibrium in a Bargaining Model, Econometrica 50, 97.

Scharfstein, David, and Adi Sunderam, 2016, Market Power in Mortgage Lending and theTransmission of Monetary Policy, Technical report.