This policy brief is based on Van Leuvensteijn et al. (2024). The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank, Eurosystem, and affiliated institutions.

This policy brief introduces a new competition measure at the firm level, called marginal relative profitability (MRP). It extends the market-level Boone (2008) indicator by measuring firm-level competition vis-à-vis peers. The MRP is calculated as the elasticity between normalised profitability and normalised efficiency, with efficiency measured in terms of marginal costs. It reflects competition as a process of rivalry with a strong link between theory and empirics and exploits the relationship between profitability and efficiency: inefficient firms leave the market, are taken over, or adjust. Three applications to banks in the four largest euro area countries and Austria illustrate the potential use of the MRP: measure competition, test market structure hypotheses, and identify weak non-competitive banks. Our study not only relates to a vast amount of literature on the measurement of competition, but also to empirical studies that analyse or use bank competition.

Competition is a complex notion and not directly observable. Many methods to measure the degree of competition exist, with variation in complexity, reliability, and theoretical underpinning. The only measure among non-structural measures that is based on the concept of competition as a process of rivalry is the Boone (2008) indicator. We introduce a new performance measure of competition by extending the Boone indicator to the individual firm level. The original Boone indicator provides a single estimate of the extent of competition for an entire market segment, called relative profit difference indicator and is based on a robust theoretical model. Our new measure of competition at the individual firm level is called marginal relative profitability (MRP) and allows to focus on the distribution of competition among firms. The theoretical derivation within Boone’s model is described in detail in Section 3 in Van Leuvensteijn et al. (2024). For this policy brief we focus on the theoretical intuition of the MRP.

In a nutshell, its intuition is that when a small change in efficiency – derived from marginal costs estimated from a trans-log cost function for each country – can cause a large change in profits, a firm exercises competitive pressure on its peers and gains profits. The MRP measures competition vis-à-vis relevant peers and is the elasticity between normalised (in the sense of relative to peers) profitability (NP) and normalised efficiency (NE) of a particular firm, see Eq. (1). It thus measures the increase in normalised profitability in percentage of a one percentage increase in normalised efficiency. Firms can influence the level of marginal costs and thus the level of efficiency, for example by digitalisation of processes or by innovation with the introduction of new services. A high MRP indicates the ability of a firm to stir its profits relative to its peers by making processes more efficiently. This elasticity could be high for example due to the successful branding of a firm or service. In other words, other parameters of competition find their expression in this elasticity.

MRP = dNP / dNE (1)

MRP = marginal relative profitability;

NP = normalised profitability;

NE = normalised efficiency.

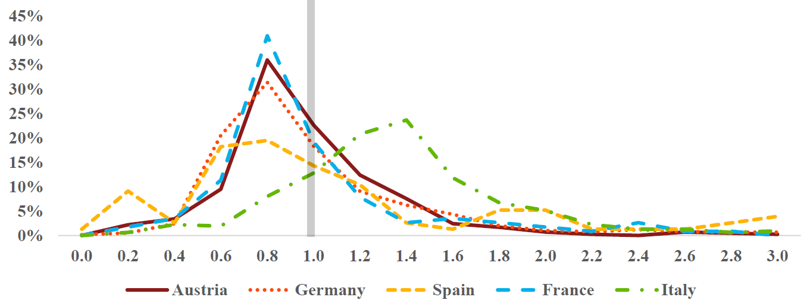

We apply this extended Boone indicator to individual bank-level competition in the loan market. We present three applications of MRP to commercial, cooperative, and savings banks in Austria, Germany, Spain, France, and Italy from 2013-2020. The first application shows that individual bank-level MRP distribution as plotted in Figure 1 is skewed to the left, indicating that many banks have little incentive to increase their profits by operating more efficiently. This is not only an important finding for authorities dealing with market power, but also for bank analysts. The dispersion in individual bank-level MRP is found to be comparatively wide in Spain and narrow for savings banks. Our new MRP metric correlates significantly consistently with the Lerner index for all banks in all countries, but not significantly with other competition measures. i.e., net interest income-asset ratio and market share. Regressing one bank-level competition measure on a constant and the three other competition measures considered confirm a common finding in the literature of a lack of consistency among competition measures (see, among others, Carbo et al. 2009). This, in turn, illustrates the multifaceted nature of measuring competition. Consequently, the complementary value added of our new MRP metric is potentially large, because it is based on a competitive dimension of rivalry different from other measures.

Figure 1: Little incentive to become more efficient as many banks have an elasticity between relative efficiency and profits below one

Notes: This figure plots the density of individual-bank MRP by country. A low MRP indicates a low ability of a bank relative to its country peers to stir its profits by making processes more efficiently. The source is Figure 3 in Van Leuvensteijn et al. (2024).

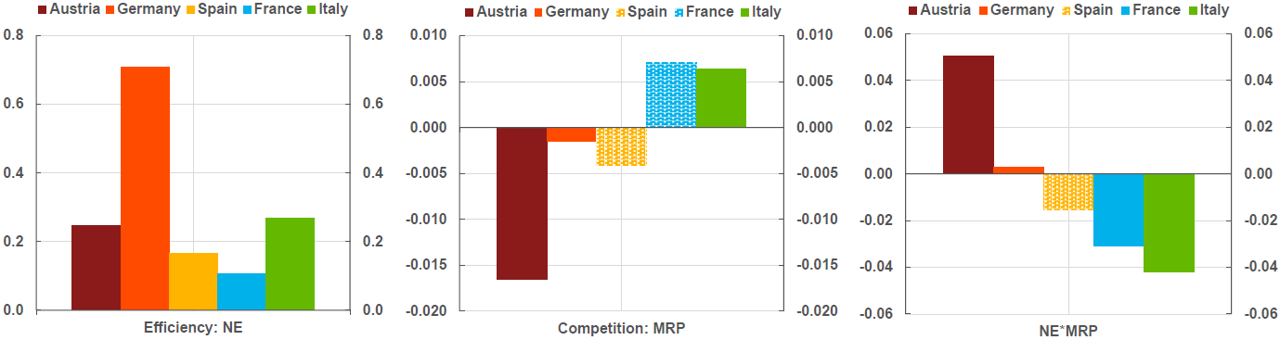

The second application uses MRP to estimate the relationship between profitability on the one hand and competition, efficiency and the combination of competition and efficiency on the other hand to test the efficient-structure (ESH), structure-conduct-performance (SCPH) and “quiet life” hypotheses (QLH). Empirical support for a market structure hypothesis depends on different significant sign combinations of efficiency (captured by NE), competition (captured by MRP), and the interaction between the two (captured by NE times MRP) on profitability (NP). In Austria and Germany, a significant negative relationship between profitability and competition is found together with a significant positive effect of the interaction between efficiency and competition on profitability (see second and third panel of Figure 2). This result is in support of the QLH for both countries. Those “quiet life” banks exploit their efficiency advantage, e.g., due to their economies of scale, to have an easy life. They are insulated from the disciplinary competitive power of their peers, making them inactive in taking profit-enhancing efficiency measures. This finding in favour of the QLH helps in the design of antitrust or regulatory policies. The QLH implies that policies should be aimed at a combination of measures focused on the improvement of efficiency and competition. For the other countries no evidence in support of the quiet life hypothesis is found. For France and Italy not only a significant positive effect of efficiency on profitability is found (first panel of Figure 2), but also a significant negative relationship between profitability and the interaction between efficiency and competition (third panel of Figure 2), which indicates strong support for the efficient-structure hypothesis (ESH).

Figure 2: Estimates support a quiet-life hypothesis for banks in Austria and Germany and an efficient-structure hypothesis in France, Italy, and Spain

Notes: This figure plots the estimated relationship with profitability to test market structure hypotheses for all banks by country. Based on the sign and significance of the estimated coefficients for normalised efficiency, normalised profitability, and the interaction between the two, the average bank is found to enjoy a “quiet life” in Austria and Germany and to face an efficient structure in France, Italy, and Spain. A shaded bar denotes that the estimated relationship with profitability is not significant at the 5% significance level: Spain second and third panel, France second panel. The source is Table 7 in Van Leuvensteijn et al. (2024).

The same market structures are generally found by bank specialisation, with as main exception support for the SCPH for Spanish commercial and saving banks, i.e., a significant negative relationship between profitability and competition. For the median of highly competitive banks, classified as banks with a MRP larger than two, not only the ESH holds but also a consistent positive relationship between profitability and competition. This finding is supportive for what we call a “busy life” hypothesis (BLH). The BLH is a special case of the ESH and with opposite signs as for a QLH. It is a situation of a high level of competitive rivalry that is profitable, as it encourages innovation and efficiency gains.

The third and final application of our MRP approach shows that it helps to identify weak non-competitive banks. Weak banks are defined as banks with the lowest quartile of NE as well as the lowest quartile of NP. Comparing the MRP of those banks with the MRP of the whole sample, shows that for all three bank specialisations in Italy the MRP is consistently below those of the whole sample. This finding indicates that weak Italian banks across bank specialisation are found to have been consistently non-competitive in relative terms. The identified share of weak non-competitive banks is in Italy for all three bank specialisations in double digit terms. This application illustrates the usefulness of MRP as a selection tool for policymakers and analysts.

The introduced new measure of firm-level competition has potential wide use for antitrust authorities, financial supervisors, central banks, analysts, and researchers to gain better insights into the degree of competition at the individual firm level. Our new MRP metric provides a promising starting point for future analysis of firm-level competitiveness and research studies, especially in identifying firms with specific characteristics, such as comparatively weak non-competitive firms or at the other end of the spectrum “best-in-class” firms.

Boone, J. (2008). A new way to measure competition. Economic Journal, 118(August): 1245–1261.

Carbó, S., Humphrey, D., Maudos, J., and P. Molyneux (2009). Cross-country comparisons of competition and pricing power in European banking. Journal of International Money and Finance, 28(1): 115–134.

Van Leuvensteijn, M., Huljak, I., and G.J. de Bondt (2024). A new measure of firm-level competition: an application to euro area banks. ECB Working Paper, 2925.