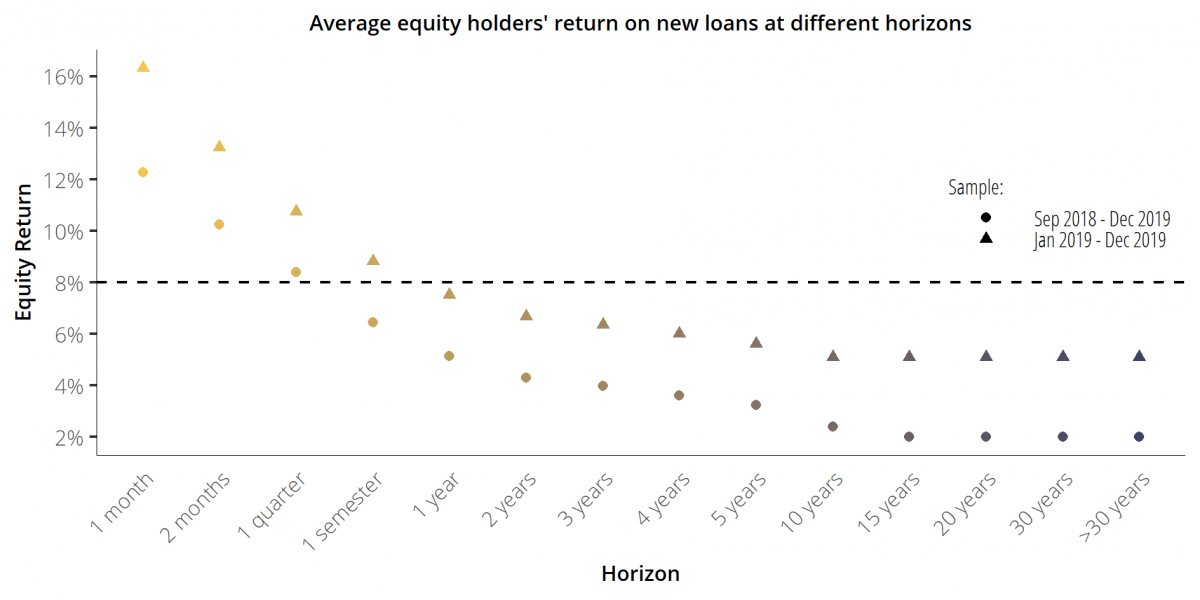

Using detailed loan level data we analyze the pricing of firm loans originated in Portugal between September 2018 and December 2019. Our results show that, on average, loans are overpriced in the short-run and underpriced in the long-run. Loans with maturity longer than a year, loans to the construction, real estate, and transportation and storage sectors, and loans to high credit risk borrowers are on average underpriced. Loans to other borrowers are generally overpriced.

A decrease in spreads on new loans and low bank profitability raises concerns that banks are underpricing loans. From the end of the sovereign debt crisis to the end of 2019, bank credit to Portuguese firms fell and banks reported an increase in competition. Spreads on new loans decreased and bank profitability, while improving during this period, remained lower than its historical long-term average. In a bid to remain competitive, banks may have offered loan spreads lower than the level needed to compensate banks’ equity holders for bearing risk.

Underpriced loans can lead to fragilities in the financial system and pose a risk to financial stability. Banks originating underpriced loans are less able to build up capital by accumulating profits, are less attractive to outside investors, and are more likely to make losses if credit risk increases suddenly.

In a recent paper (Mateus and Pinheiro, 2021) we assess the pricing of firm loans in the period between September 2018 and December 2019.2 We analyze whether the net interest and fee income of loans to Portuguese firms is sufficient to cover loans’ expected credit losses, operating costs, and capital costs. We then analyze the borrower and loan characteristics driving the differences in the pricing of firm loans.

Using granular loan-level data we compute the risk-adjusted return of each loan net of capital costs. The risk-adjusted return of each loan accounts for the loan’s net interest and fee income, expected credit losses, and operating fees. The loan’s capital costs accounts for the loan’s contribution to a bank’s capital. We estimate the risk-adjusted return and the loan’s capital costs using loan, borrower, and bank data.

Results on the pricing of loans are mixed. On average loans are overpriced by 11 basis points if we focus on short-run loan returns. In the long-run, however, loans are underpriced by 29 basis points. While the absolute level of underpricing is seemingly small, it has a sizable effect on shareholders’ return. An average underpricing of 29 basis points reduces shareholders’ return on corporate loans by 6 percentage points compared to a setting with no underpricing.

Loan underpricing in the long-run seemingly decreases over time during the sample period. In the sample of loans originated in 2019, loan underpricing in the long-run reduces to 7 basis points on average and the corresponding shareholders’ return on corporate loans reduces only by 2.9 percentage points compared to a setting with no underpricing.

Notes: Each point in the figure should be interpreted as the return banks’ equity holders are expected to earn on new firm loans over a specific horizon if banks keep on originating loans as they did during the sample period.

Loans with maturity longer than a year are generally underpriced. This result is behind loan returns being insufficient to adequately compensate banks’ equity holders in the medium to long-run if banks keep on originating loans as in the sample period.

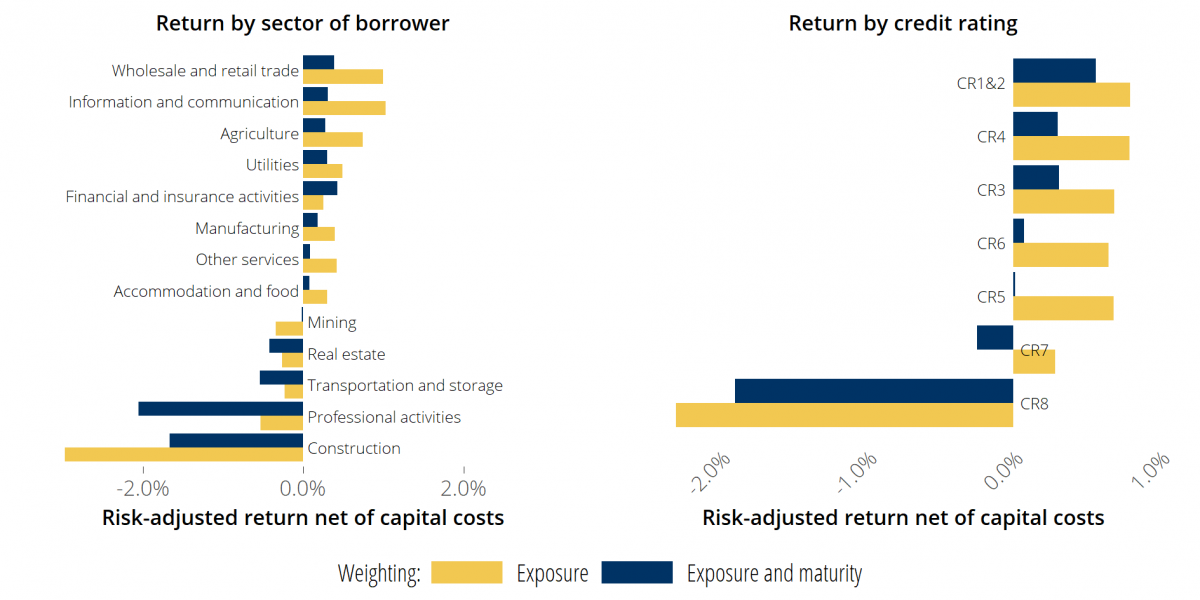

Loans to firms operating in the construction, real estate, and transportation and storage sectors are underpriced. To the extent that underpriced loans yield lower returns than fairly priced loans, this result highlights these sectors as potential sources of fragility to the financial system. It also raises questions about the strength of the recovery of these sectors from the 2008-2012 crisis.

Notes: In both plots the average of risk-adjusted returns net of capital costs is both exposure-weighted and exposure and maturity-weighted. On the plot on the right credit ratings CR1&2 and CR8 are, respectively, the highest and lowest credit quality ratings.

Loans to low credit quality firms are on average underpriced. The increase in the spread charged to low credit quality firms does not compensate the increase in credit risk. Loans to low credit quality firms represent 17.7 percent of all loans originated between September 2018 and December 2019.

Lastly, and in contrast with these results, we find that loans to high credit quality borrowers, and loans to the manufacturing and to the wholesale and retail sectors are overpriced.

Our analysis points to a couple of vulnerabilities in the Portuguese banking system with respect to corporate loans’ pricing. First, banks’ profitability and their ability to generate internal capital may decrease in the medium to long-run on account of loans with maturity longer than a year being underpriced. Second, the underpricing of loans to firms with high credit risk and to firms in the construction, real estate, and transportation and storage sectors, suggests these firms are not performing as strongly as other firms and may thus be more sensitive to the business cycle. In a recession, they may be a source of loan losses for banks.

While results on loan underpricing point to vulnerabilities in the Portuguese banking system it is important to keep them in perspective. The sample we analyze represents a small fraction of bank’s stock of credit to firms – less than 16 percent – and of bank’s total assets – less than 5 percent. Thus, the overall effect on bank profitability of the loan underpricing that we document is likely limited. It is also worthwhile emphasizing that the low equity returns on new firm loans that Portuguese banks are expected to earn in the medium to long-run is in line with the low profitability that euro area banks are experiencing since the financial crisis. In the period between 2008 and 2019, the yearly equity returns of euro area banks was never higher than 6 percent.

See Mateus, M., and Pinheiro, T. (2021), Bank pricing of corporate loans. Banco de Portugal Economic Studies, VII(2), 21–43. https://www.bportugal.pt/en/paper/bank-pricing-corporate-loans