The policy brief is based on the ECB Occasional Paper Series, No 347 2023 “Macroprudential stress test of the euro area banking system”. The views expressed are those of the authors and do not necessarily reflect those of the ECB or the Eurosystem.

This paper presents the results of the 2023 macroprudential stress test of the euro area banking system, covering the 98 largest euro area credit institutions across 19 countries, using the Banking Euro Area Stress Test (BEAST) model. The approach models bank reactions to changing economic conditions. It examines the effects of an adverse scenario, as defined for the European Banking Authority’s 2023 stress test, on economies and the financial system as a whole by acknowledging a broad set of interconnections between banks, other market participants and the real economy. Our results highlight the resilience of the euro area banking system and the important role that adjustments by banks play in the propagation of shocks to the financial sector and real economy.

Every two years since 2016, the European Central Bank (ECB) macroprudential stress test (MST)1 provides additional insights into the resilience of the European banking sector relative to the latest EU-wide stress tests conducted by the ECB/European banking supervision and coordinated by the European Banking Authority (EBA).2

The MST uses the BEAST model3 to run a top-down exercise that considers the development of 98 significant banks and 19 euro area economies, covering more than 80% of the euro area banking sector. It complements the EBA microprudential stress test report by:

(i) including the endogenous reaction of banks to the macroeconomic scenariosbut also include lending dynamics and changes in asset/liability structure;

(ii) considering relevant amplification mechanisms between bank solvency and funding costs (see Budnik et al., 2023);

(iii) considering the feedback loop between the banking sector and the real economy. In line with the latest EBA stress test, it also incorporates the effects stemming from the phasing-out of non- conventional monetary policy. Compared with the EBA exercise, the results are characterised by significant deleveraging and de-risking, driven by an increase in credit risk, as well as a substantial shift in the liability structure and a rise in the cost of funding.

The assessment of bank resilience is based on the two scenarios employed in the 2023 EU-wide stress test exercise. The baseline scenario is based on the December 2022 broad macroeconomic projections, which envisioned an initial slowdown in economic growth in 2023, followed by an economic rebound over the following two years. The adverse scenario was designed to reflect the main financial stability risks identified by the General Board of the European Systemic Risk Board (ESRB), namely a period of prolonged, subdued economic growth coupled with high inflation and higher interest rates. Higher inflation is partly driven by rising energy prices, potentially resulting in rising insolvencies among non-financial corporations and households. Additionally, potentially increased geopolitical tensions and a depressed economic growth outlook could lead to significant asset price corrections, following a broad-based tightening of financial conditions.4

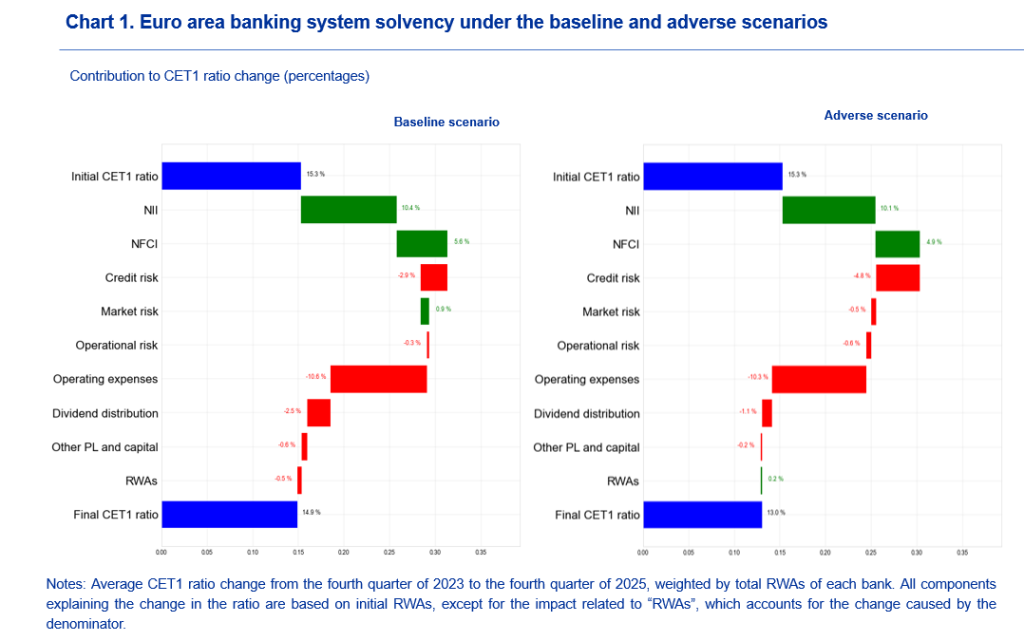

A key finding of the exercise is that the euro area banking sector remains resilient under the specific adverse scenario. The system-level Common Equity Tier 1 (CET1) ratio falls under the adverse scenario by approximately 2.3 percentage points by the end of 2025. The fall in CET1 is contained by banks’ deleveraging and de-risking partially offsetting heightened credit risk. Compared to the baseline scenario, where the CET1 ratio is unchanged from its starting point, net interest income (NII) and net fee and commission income (NFCI) have a smaller positive contribution to the CET1 ratio (Chart 1).

Compared with the EBA stress test, the MST estimates a lower depletion of the CET1 ratio in 2025 for the adverse scenario, reflecting the fact that banks can act to protect their ratio by means that are not part of the EBA methodology. The EBA stress test results indicate an aggregate depletion of the fully loaded CET1 ratio by about 4.9 percentage points, implying a ratio of 10.4% at the end of the projection horizon, significantly lower than the MST’s aggregate CET1 ratio of 13%. The estimated final capital impact is slightly lower than in the 2021 and 2019 MST exercises, suggesting improvements in bank balance sheets and their better capitalization.

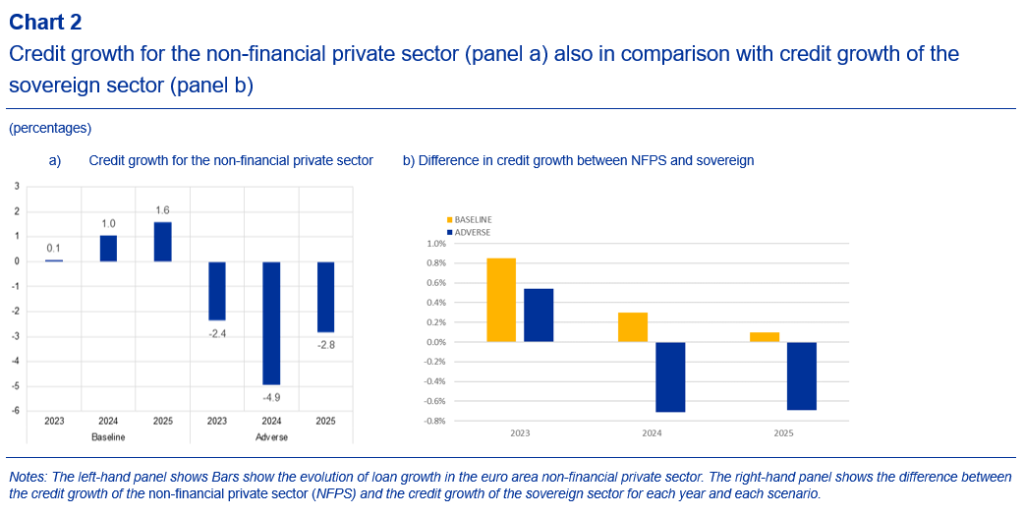

Under the adverse scenario, the key drivers of depletion of the CET1 ratio include heightened credit risk, represented by an uptick in impairments, and a surge in funding costs. The non-performing loans (NPL) ratio for non-financial private sector loans increases from 2.4% in 2022 to 6.2% by 2025 under the adverse scenario, with the projected rise in NPLs being highest for consumer loans, which are usually considered riskier. The rise in credit losses from additional provisioning needs signals increased financial stress within the non-financial private sector, reflecting the economic challenges simulated under the adverse scenario. These negative dynamics are partially offset by bank reactions to navigate the economic downturn. The MST captures how banks’ strategic adjustments to their balance sheets under stress feed back into the real economy. This approach allows for a more comprehensive understanding of the banking sector’s resilience. Particularly under the adverse scenario, the reduction of loans (Chart 2a) and the reallocation of exposures toward the safer sovereign sector (Chart 2b) result in lower risk weights, partially offsetting losses related to credit risk.

By deleveraging and de-risking, banks reinforce their own solvency positions but could potentially negatively affect economic growth. However, the impact on the real economy is limited given banks’ robust financial positions. Compared with the microprudential exercise, the number of banks breaching the maximum distributable amount (MDA) trigger is significantly lower as banks adjust their lending behaviour in view of the economic downturn. Under the adverse scenario, banks accounting for 27.6% of banking sector risk-weighted assets (RWAs) breach the combined buffer requirement. The number of banks breaching the (MDA) triggers in 2025 is 12, and only four of them, accounting for 5.1% of banking system Risk Weighted Assets (RWA), experience a sufficiently large capital depletion that pushes them below the minimum capital requirement. The low number of banks experiencing a such shortfall results in a limited feedback loop from the banking sector stress to the real economy.

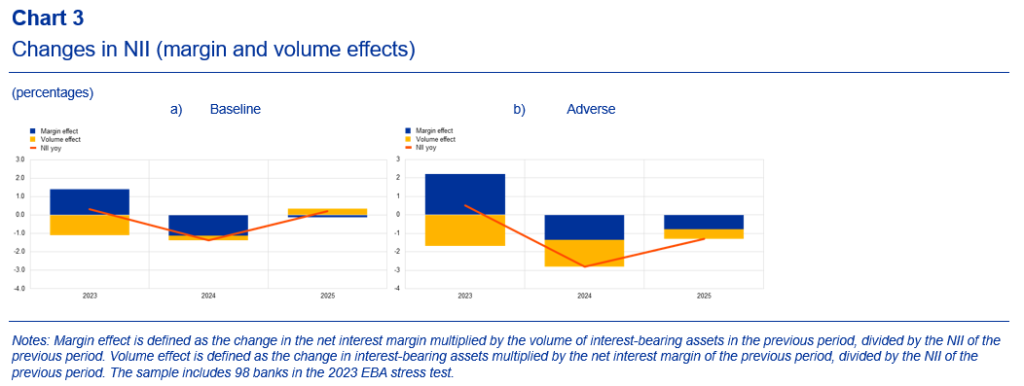

Under the adverse scenario, bank profitability faces substantial challenges, turning negative on aggregate. Euro area banks remain slightly profitable in 2023, primarily driven by higher net interest income (NII) resulting from a continued widening of margins. However, by 2024 and 2025, the rise in banks’ funding costs and the deceleration of the economy begin to pose headwinds to profitability (Chart 3b). Under both scenarios, the initial favourable effects of rising rates on NII are followed by a noteworthy contraction owing to growing funding costs and a contraction in lending volumes (Chart 3). The NII increase in 2023 is fuelled by a growing net interest rate margin due to an asymmetric pass-through of short-term interest rates. While increases in short-term interest rates are directly passed through to lending rates, rates on sight deposits, which are the main source of funding for banks, are relatively stickier. As the scenarios unfold, rates on liabilities, such as term deposits, continue to rise until changes in short-term rates are fully passed through, resulting in an overall contraction of the intermediation margin. Furthermore, the weak loan dynamic at the onset of the baseline and throughout the entire adverse scenario contributes to a deceleration in NII. Under the adverse scenario, the contributions of banks’ balance sheet size and liability composition to NII are negative over the projection horizon. By contrast, under the baseline scenario, the volume effect is much smaller and even contributes positively to NII in 2025. The average funding costs rise by approximately 150 basis points as reference rates increase and banks rely on more costly sources of funding, due to depositors shifting from sight to more costly term deposits and due to the phase out of favourable central bank lending programs (TLTRO III).

The MST results show that the euro area banking system is relatively well-prepared for the tested scenario, with the CET1 ratio decreasing by 2.3 percentage points in three years, primarily due to the reduction in NII and a substantial increase in credit risk.

Compared with the EBA stress test, the MST estimates a lower depletion of the CET1 ratio in 2025 for the adverse scenario, reflecting the fact that banks can act to protect their ratio by means that are not part of the EBA methodology. The difference can be mostly attributed to the following deviations from the EBA’s methodological assumptions: (i) the EBA exercise assumes a sizeable pass-through of short-term rates to deposits, thus dragging down NII, whereas the macroprudential stress-testing exercise estimates a limited pass-through to deposits; and (ii) the EBA exercise assumes a static balance sheet, whereas in our model banks are allowed to partially offset the impact of the adverse scenario on their CET1 ratio by lowering credit volumes, also taking into consideration the reduction in credit demand related to the development in economic activity and shifting their lending towards the sovereign sector. This leads to a reduction in RWAs but also exacerbates the sovereign-bank nexus.

Budnik, K., Groß, J., Vagliano, G., Dimitrov, I., Lampe, M., Panos, J., Velasco, S., Boucherie, L. and Jancoková, M. (2023), “BEAST: A model for the assessment of system-wide risks and macroprudential policies”, Working Paper Series, No 2855, ECB, Frankfurt am Main, October.

European Central Bank (2023), “2023 stress test of euro area banks”, Frankfurt am Main, July.