This policy brief is based on BIS working paper No 1218. The views expressed in this project are those of the authors and do not necessarily reflect those of the Bank for International Settlements, the National Bank of Belgium, or the Eurosystem.

Abstract

This policy brief studies how banks’ sectoral specialization affects firms’ innovation activities. Our findings reveal that this effect depends on the degree of “asset overhang,” defined as the risk that an innovation has negative spillovers on banks’ legacy loan portfolio. In sectors with high asset overhang, specialized banks tend to constrain innovation, likely due to the perceived risks of technological spillovers eroding the value of their legacy loan portfolio. In contrast, bank specialization fosters innovation in sectors with low asset overhang, where banks can leverage their expertise to support firms’ opaque, innovative investments without fearing negative spillovers.

The banking sector affects corporate innovation through various channels. Prior research has for instance shown that bank competition and lending relationships have a positive impact on firms’ innovation activities (Cornaggia et al., 2015; Herrera and Minetti, 2007), while zombie lending has a negative effect (Schmidt et al., 2023).

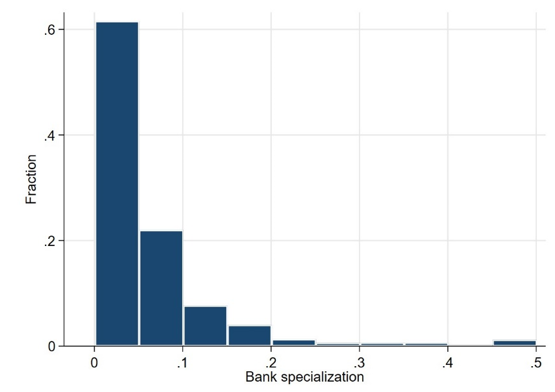

Despite these contributions, no research has studied the role of bank specialization, which is the notion that banks concentrate their lending disproportionately in specific sectors (Blickle et al., forthcoming). This research gap is surprising as bank specialization is a defining feature of banks’ business model. Figure 1 plots the distribution of U.S. banks’ sectoral specialization, showing that—although the loans to a given sector typically account for less than 5% of banks’ (syndicated) loan portfolio—there are cases in which a single sector accounts for more than 40%, illustrating that banks specialize their lending in specific sectors.

Using two unique datasets, we study how banks’ sectoral specialization affects firms’ innovation activities and the potential mechanisms underlying this effect, thereby filling an important gap in the literature. Moreover, the conclusions drawn from our analysis contribute to a better understanding of how the interaction between financial markets and product markets shapes innovation.

Figure 1. The distribution of bank specialization

Note: Authors’ own computations. This histogram shows on the X-axis bins of bank specialization values and on the Y-axis the fraction of bank-sector-year combinations in that specific bin.

Theoretically, the effect of bank specialization on corporate innovation is ambiguous. On the one hand, banks that specialize in particular sectors may develop unique expertise (Blickle et al., forthcoming), enabling them to better assess and support the opaque and risky investments needed for firms’ innovation activities (Hall and Lerner, 2010; Rajan and Zingales, 1998). On the other hand, innovation can generate spillovers, where one firm’s innovation may negatively affect other firms’ performance or assets (Aghion and Howitt, 1992; Bloom et al., 2013). Since specialized banks are more exposed to the spillovers of such technological shocks, they may be more inclined to impede innovation, especially in sectors where the risk of such spillovers is high.

To test these opposing hypotheses, we use two unique and complementary datasets. Our first dataset combines U.S. syndicated loan data with patent data. Our second dataset combines micro-level innovation survey data administered by the European Commission and credit register data from a representative European country (Belgium). These complementary datasets enable us to draw more robust conclusions about the role of bank specialization across different types of firms, forms of innovation, and geographic areas.

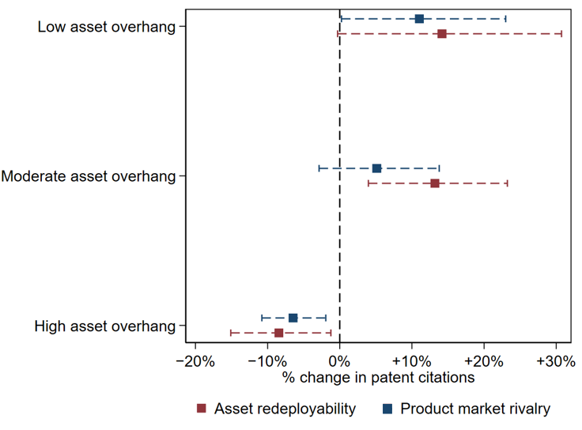

Our empirical analysis reveals that bank specialization has a nuanced impact on corporate innovation that varies with the degree of “asset overhang,” which is the risk that an innovation has negative spillovers on banks’ legacy loan portfolio (Degryse et al., 2024). Figure 2 visually shows how bank specialization affects firms’ patent citations—a key measure of innovation quality—across sectors with differing levels of asset overhang. As indicated at the bottom of the figure, we measure asset overhang using (1) a measure of asset redeployability (Kim and Kung, 2017) and (2) a measure of product market rivalry (Bloom et al., 2013). The former captures the extent to which a firm’s assets can be put to alternative uses within and across sectors in the event of an adverse (technology-induced) shock, while the latter captures the extent to which a firm’s market share or profitability could be eroded due to other firms’ innovations—thereby covering the two main mechanisms through which new technologies can impose externalities on existing technologies (Aghion and Howitt, 1992).

Figure 2 shows that specialized banks contribute positively to innovation in sectors with low asset overhang, but become a barrier to innovation in sectors with high asset overhang. Specifically, our estimates indicate that, in sectors with low asset overhang, a one standard deviation increase in bank specialization is associated with a 10% increase in the number of patent citations, while the opposite holds in sectors with high asset overhang. These results hold for patent quantity (number of patents), patent quality (number of citations) as well as patent novelty (breadth and depth of citations). Moreover, our results also hold when we conduct our analysis using micro-level innovation survey data combined with credit register data from Belgium—which covers all types of innovations irrespective of whether those innovations are patented, and many small private firms that are heavily dependent on bank credit.

Figure 2. The impact of bank specialization on corporate innovation for various degrees of asset overhang

Note: Authors’ own computations. This figure shows the estimated impact of a one standard deviation increase in bank specialization on firms’ patent citations for various degrees of asset overhang. 95% confidence intervals are represented by dashed lines. Asset overhang is measured based on asset redeployability (in red) or product market rivalry (in blue).

Our results can be explained through financial contracting mechanisms. In sectors with low asset overhang, we find that specialized banks provide more favorable loan terms—such as longer maturities and less restrictive covenants—to firms in more innovative sectors, allowing firms the financial flexibility to invest in long-term, risky projects. In contrast, in sectors with high asset overhang, specialized banks impose tighter financial constraints, impeding firms’ ability to invest in potentially disruptive technologies.

Recent evidence shows that banks tend to concentrate their lending disproportionately in specific sectors. This has important economic implications related to banks’ lending decisions (Blickle et al., forthcoming), evergreening practices (De Jonghe et al., 2024), and the transmission of economic shocks to the real economy (Iyer et al., 2022; Paravisini et al., 2023). This policy brief adds to this strand of research by analyzing how bank specialization affects firms’ innovation activities—an important channel through which bank specialization could affect economic growth. We show that the effect can be positive or negative depending on the underlying “asset overhang,” which refers to the risk that an innovation has negative spillovers on banks’ legacy loan portfolio.

These results have important policy implications as they highlight the dual facets of bank specialization. In sectors with low asset overhang, where the risk of technology-induced spillovers on banks’ legacy loan portfolio is small, specialized banks boost innovation. In contrast, in sectors with high asset overhang, specialized banks hinder innovation. These findings contribute to a better understanding of how the interaction between financial markets and product markets shapes innovation.

Aghion, P. and Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60(2):323–351.

Bloom, N., Schankerman, M., and Van Reenen, J. (2013). Identifying technology spillovers and product market rivalry. Econometrica, 81(4):1347–1393.

Blickle, K., Parlatore, C., and Saunders, A. (forthcoming). Specialization in banking. Journal of Finance.

Cornaggia, J., Mao, Y., Tian, X., and Wolfe, B. (2015). Does banking competition affect innovation? Journal of Financial Economics, 115(1):189–209.

De Jonghe, O., Mulier, K., and Samarin, I. (2024). Bank specialization and zombie lending. Management Science.

Degryse, H., Roukny, T., and Tielens, J. (2023). Asset overhang and technological change. Working Paper.

Hall, B. H. and Lerner, J. (2010). The financing of R&D and innovation. In Handbook of the Economics of Innovation, 1:609–639.

Herrera, A. M. and Minetti, R. (2007). Informed finance and technological change: Evidence from credit relationships. Journal of Financial Economics, 83(1):223–269.

Iyer, R., Kokas, S., Michaelides, A., and Peydró, J.-L. (2022). Shock Absorbers and Transmitters: The Dual Facets of Bank Specialization. Working Paper.

Paravisini, D., Rappoport, V., and Schnabl, P. (2023). Specialization in bank lending: Evidence from exporting firms. The Journal of Finance, 78(4):2049–2085.

Rajan, R. G. and Zingales, L. (2001). Financial systems, industrial structure, and growth. Oxford Review of Economic Policy, 17(4):467–482.

Schmidt, C., Schneider, Y., Steffen, S., and Streitz, D. (2023). Does zombie lending impair innovation? Working Paper.