This policy brief studies the global footprint of Chinese banks, and compares it with that of other major bank nationalities. Chinese banks account for 24% of all cross-border lending to borrowers in emerging market and developing economies (EMDEs), more than double that of Japanese banks, the closest competitor. Further, almost half of all EMDE borrowers rely on Chinese banks as their most important lender.

Their global reach resembles that of banks from advanced economies (AEs), with greater distances deterring their cross-border lending to EMDE borrowers relatively more than that to AEs. Conversely, Chinese banks’ lending to EMDEs is deterred less by longer distances than that of their peer EMDE banks. Further, Chinese banks lend more to those EMDE borrowers with which strong bilateral trade relationships exist and, unlike other banks, they lend less to countries with large bilateral portfolio investments.

Chinese banks have become the largest cross-border lenders to EMDEs. Their type of global reach resembles that of AE banks, with distance to their borrowing EMDEs less of a barrier than other EMDE banks, and more like U.S. or European banks. While bilateral trade, FDI and portfolio investment positively correlate with lending for most banking systems, Chinese banks’ lending to EMDEs also strongly correlates with trade, but not with FDI and, unlike other banks, it correlates negatively with portfolio investment.

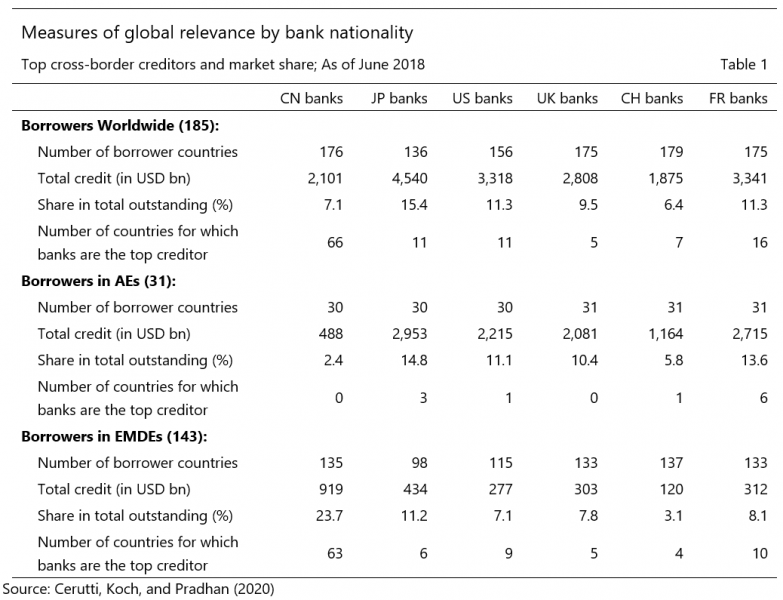

Chinese banks constitute the largest banking system in the world since 2016, with substantial cross-border claims on emerging markets. While this top position among major global banking systems is mostly driven by their domestic activity, Chinese banks have also been expanding abroad at great speed (Cerutti and Zhou 2018). As of mid-2018, they represent about 7 percent of total cross-border bank lending and reported claims on 176 out of 185 borrower countries/jurisdictions according to BIS locational banking statistics (BIS LBS).2 More precisely, Chinese banks lend to 135 out of 143 emerging market and developing economies (EMDEs), and to 30 out of 31 advanced economies (AEs). Moreover, 63 EMDEs already borrow more from Chinese banks than from any other bank nationality, highlighting that even though very small relative to their domestic claims, Chinese banks’ foreign claims are substantial, especially for many borrowing EMDEs (Table 1).

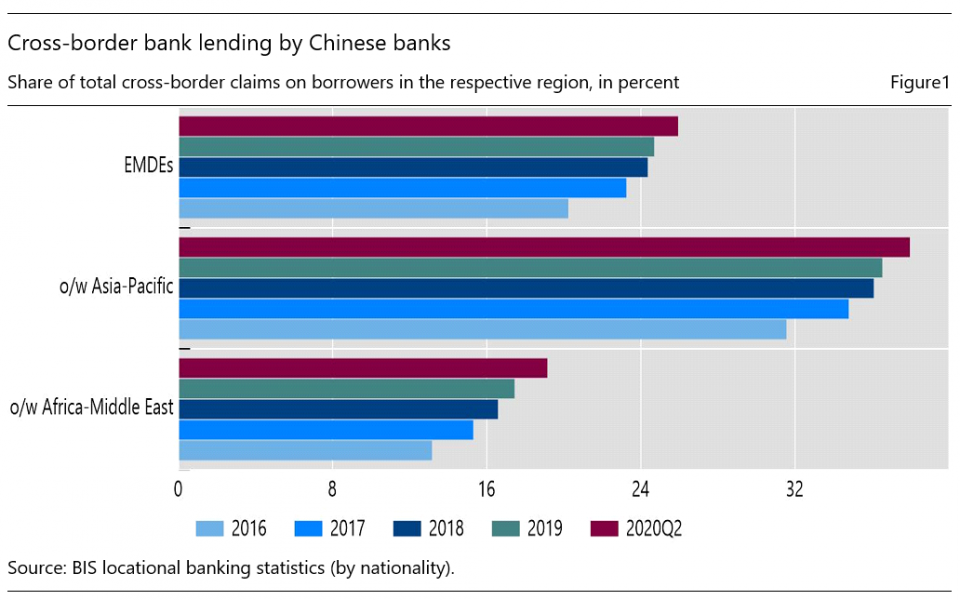

Even though lending by Chinese banks has decelerated in recent years with respect to 2016, their market share on cross-border bank lending to EMDEs has been increasing − even during the COVID-19 crisis − and it has reached 26 percent of the total in the second quarter of 2020 (Figure 1). While the largest share of Chinese banks is amongst Asia-Pacific borrowers, at about 38 percent, their share within Africa and Middle East borrowers is about half of that with 19 percent. The shares within Eastern European and Latin American EMDE borrowers are about one-half and one-third of Africa and Middle East, respectively. In terms of being the main lender, 28 of the 63 EMDEs that borrow more from Chinese banks than from any other bank nationality are in Africa and Middle East, 22 are in Asia-Pacific, 8 are in Latin America, and 5 in Eastern Europe.

These estimates are calculated taking into account the global network of foreign affiliates since, as highlighted by Cerutti, Koch, and Pradhan (2018), this is key to understanding international banks’ global presence. Across all bank nationalities, only about 60 percent of their cross-border lending is extended from their home country. Like most other banking systems, a substantial part of Chinese banks’ cross-border lending originates from affiliates operating outside Mainland China. Banks lend across borders with loans booked either from the home country of their headquarters, or also from the lending by their affiliates (branches or subsidiaries) located abroad (either in financial centres or third countries/jurisdictions).3

We analyse the geographical distribution of cross-border bank claims using a gravity approach. These models originate from the trade literature and have been frequently applied in empirical studies of cross-border finance (e.g., among others, Aviat and Coeurdacier 2007, Buch 2002, Lane 2006, Lane and Milesi-Ferretti 2008, Porter and Rey 2005). A series of theoretical contributions has supported such models for financial holdings (e.g., Okawa and van Wincoop 2012). In our cross-sectional setup, we exploit the multiple dimensions of our data to separate borrower- and lender specific aspects from bilateral factors. More concretely, we let individual lender- and borrower-country fixed effects absorb features that shape cross-border lending patterns from each angle. For instance, from the lenders’ perspective, these control for the fact that banks from richer countries with higher financial development often lend more. From the borrowers’ side, the fixed effects absorb the fact that more financially open countries typically borrow more.

Going beyond the traditional gravity variables, we explore the role of bilateral economic ties while controlling for traditional gravity variables and a new distance measure. To capture bilateral economic ties, we let past bilateral trade, FDI, and portfolio investment enter the analysis. This is in line with how portfolio flow studies proceed using either trade or FDI (e.g., Andrade and Chhaochharia 2010, Lane 2006, and Lane and Milesi-Ferretti 2008). These bilateral economic ties might help to reduce information asymmetries between borrower and lender countries. In that sense, we interpret a positive correlation between international banking and other types of economic interaction as reflecting a complementary effect. As traditional gravity measures of information asymmetries, we use colonial relationships, common language and the simple geographical distance between borrower and lender country. However, these traditional distance measures do not capture all aspects of the international banking business, as they ignore the location of affiliates outside of the parent banks’ home country. We compute an alternative distance measure to fill this gap. It weighs, across all locations (home and/or affiliates abroad) from where a given bank nationality extends claims on a specific borrower country, each location borrower distance by the relative importance of this location for the respective borrower-lender bank relationship. This novel distance measure ultimately provides an alternative bilateral proxy of information asymmetries.

Although Chinese banks’ global reach resembles that of advanced countries’ banks, there are a few differences with the factors associated with their expansion. Chinese banks seem to perceive distance (a proxy of information asymmetries) to their borrowing EMDE as less of a barrier than other EMDE banks, and behave more like U.S. and European banks. With respect to traditional measures like trade, FDI, and portfolio flows there are some interesting differences. The Chinese banks’ positive correlation between cross-border bank lending and trade with EMDE countries stands out. It is much stronger than the trade-lending relationship exhibited by Japanese and European banks, and is more in line with patterns exhibited by U.S. banks. On the other hand, unlike all other banking systems, their past portfolio investment is negatively correlated with cross-border lending to EMDE borrowers. This seems linked to China’s capital outflow restrictions and the fact that Chinese portfolio investment is mostly narrowly distributed within a few AE countries. As a matter of fact, when lending to AE borrowers, strong complementarities with portfolio investment emerge. Finally, there is only weak evidence on the relationship between Chinese FDI and cross-border lending.

Our findings provide some interesting policy implications. The growing international footprint of Chinese banks and their G-SIB status highlights the importance of understanding their global operations and business model. The strong positive correlation of Chinese banks’ cross-border lending with bilateral trade, and their unusual current negative correlation with portfolio investment (resulting from China’s low portfolio investments outside a few AEs) could interact with some ongoing macroeconomic trends. On the one hand, a prospective reduction in global trade (e.g., resulting from the shortening of value chains due to trade tensions and/or the impact of the COVID-19 virus) could be associated with a decline in Chinese cross-border bank lending, especially to EMDEs. On the other hand, the ongoing and planned liberalization reforms in the Chinese bond market could foster further inward and outward portfolio investment. If the liberalization of portfolio investment makes China more similar to other AE and EMDE countries, Chinese banks’ investments abroad could surge in an attempt to further diversify. This could lower information asymmetries for Chinese cross-border bank lending.

Andrade, S C and V Chhaochharia (2010): “Information immobility and foreign portfolio investment”, Review of Financial Studies, vol. 23, Issue 6, pp. 2429-2463.

Aviat, A and N Coeurdacier (2007): “The geography of trade in goods and asset holdings”, Journal of International Economics, vol. 71, pp. 22-51.

Buch, C (2002): “Are banks different? Evidence from international data”, International Finance, vol 5 (1), pp. 97-114.

Cerutti, Eugenio, Catherine Koch, and Swapan-Kumar Pradhan. 2018. “The Growing Footprint of EMDE Banks in the International Banking System,” BIS Quarterly Review, December.

Cerutti, Eugenio, Catherine Koch, and Swapan-Kumar Pradhan. 2020. “Banking Across Borders: Are Chinese Banks Different?” IMF Working Paper 20/249 and BIS WP 892.

Cerutti, Eugenio and Haonan Zhou. 2018. “The Chinese Banking System: Much More than a Domestic Giant,” VoxEU, February 9, 2018.

Lane, P (2006): “Global Bond Portfolios and EMU”, International Journal of Central Banking, vol. 2(2), pp. 1-23.

Lane, P and G M Milesi-Ferretti (2008): “International Investment Patterns”, Review of Economics and Statistics, vol. 90(3), pp. 538-549.

Okawa, Y and E van Wincoop (2012): “Gravity in International Finance”, Journal of International Economics, vol. 87, pp. 205-215.

Portes, R and H Rey (2005): “The determinants of cross-border equity flows”, Journal of International Economics, vol. 65, pp. 260-296.

Cerutti, Koch, and Pradhan (2020) mostly focused 185 borrowing countries/jurisdictions, for which different needed data are available for regression analysis. Chinese banks have reported lending to 196 out of the total 216 countries/jurisdictions captured in BIS data.

About one-quarter of Chinese banks’ cross-border lending to EMDEs originates from affiliates operating outside mainland China, Hong Kong SAR, Macao SAR, and Taiwan Province of China.