This policy brief is based on Bank of Albania Working Paper 08 (95) 2024. The views expressed herein are of the authors and do not necessarily represent the views of the Bank of Albania or Raiffeisen Bank International AG.

Despite the current global shift towards higher interest rates to combat rising inflation, revisiting the era of low interest rates remains critically important. The prolonged period of near-zero rates provides a unique context to study the sustained impacts of such monetary policies on bank profitability and financial stability. The insights gained can offer valuable lessons for future policy frameworks. The strategic adaptations banks made during this time – such as modifying business models, managing non-performing loans, and diversifying income streams – highlight resilience mechanisms applicable in future economic conditions.

Moreover, the structural and behavioral effects of low interest rates continue to influence current financial practices and the broader monetary policy environment. Examining how banks navigated the challenges of a low-rate environment enhances our preparedness for potential future similar scenarios and help developing more robust strategies to ensure financial stability.

The past years have been quite challenging for central banks with a series of unprecedented events, including the global financial crisis (GFC), a period of very-low inflation for too long, the COVID-19 pandemic, and geopolitical issues, accompanied by several supply-side shocks. Each of these events has uniquely impacted inflation and growth, necessitating a dynamic and multifaceted response from monetary authorities. Like many other central banks, the Bank of Albania implemented a series of monetary policy measures to support macroeconomic stability. Key among these measures was the central bank’s continuous lowering of the policy rate, aimed at addressing deflationary pressures. This gradual reduction brought the interest rate near to the zero lower bound, demonstrating the commitment to its primary objective, while supporting economic welfare and financial stability, albeit with certain trade-offs, including the risk of reduced bank profitability and market distortions.

Prolonged low interest rates may compress banks’ net interest margins, potentially dampening profitability, especially for smaller banks with traditional business models. Moreover, increased demand for loans could lead to a potential rise in credit risk materialized through non-performing loans (NPLs).

This paper aims to explore the impact of accommodative monetary policies, especially near-zero interest rates, on the net interest income of banks, which serves as their primary revenue stream, by allowing also for non-linearities between the two variables. It utilizes comprehensive data spanning all commercial banks operating within the Albanian banking sector from 2004 to 2020, categorized into three distinct groups based on their respective proportions of assets within the sector. The analysis extends beyond to incorporate alternative metrics, such as the short-term rate and the slope of the yield curve, providing a more comprehensive understanding of how changes in central bank policy interact with market conditions to influence the performance of banking institutions. The findings indicate a non-linear association between the level of the interest rate and the banks’ profitability solely for small banks, whereas for larger banks, the observed effects tend to be statistically insignificant.

Interest rates affect banks’ net interest income, defined as the difference between interest income and interest expenses, through several key mechanisms (Borio et al., 2015). It is worth noting that liabilities tend to exhibit greater sensitivity to interest rate fluctuations compared to assets due to disparities in their respective maturities, manifesting as a phenomenon known as “maturity mismatch.” Banks typically adopt a lending strategy characterized by longer-term loans and shorter-term borrowing, resulting in an asymmetry that renders liabilities more susceptible to interest rate (price) adjustments. In high-interest environments, banks benefit from significant markdowns on deposit rates compared to market rates, boosting net interest income when rates rise. However, in low-interest environments, as rates approach zero, deposit rates cannot fall significantly below zero, compressing the markdown and reducing net interest income gains from further rate cuts. Thus, net interest income rises more steeply with rate hikes at higher interest levels but flattens with rate cuts at lower levels, illustrating a diminishing return as rates near zero.

Lower interest rates typically reduce the attractiveness of holding deposits, leading to a decline in deposit volumes (quantity), while simultaneously stimulating increased demand for loans due to the lower cost of borrowing [Wang, 2020; Rostagno et al., 2019)]. The magnitude of the effects is, of course, determined by the sensitivity (elasticity) of the demand for loans and deposits to market rates. The ultimate impact on net interest income depends on which of the effects, the price or the quantity one, outweighs the other.

Moreover, heightened lending activity stimulated by the prevailing lower market rates initially enhances profitability. However, over the course of a few years, the repayment capacity of borrowers may deteriorate leading to the emergence of non-performing loans that erode banks’ profitability over time.

Banks’ net interest income is affected also by the yield curve. A steeper yield curve typically boosts net interest income by widening the spread between long-term lending rates and short-term borrowing costs. However, this benefit is partly temporary, as market rates eventually adjust to match forward rates, and a drop in the term premium can harm profitability (Dietrich and Wanzeried (2012). The lasting positive impact occurs if banks can exercise oligopolistic power. Additionally, changes in the yield curve’s slope influence the volume of fixed-rate mortgages, as before, depending on the relative elasticity of the demand for loans to deposit supply with respect to the slope of the yield curve.

Starting in 2000, the Bank of Albania shifted its monetary policy approach to market instruments, moving away from direct control measures. Specifically, it was determined that the BoA’s principal tool for executing monetary policy would be the rate of 1-week repo agreement.

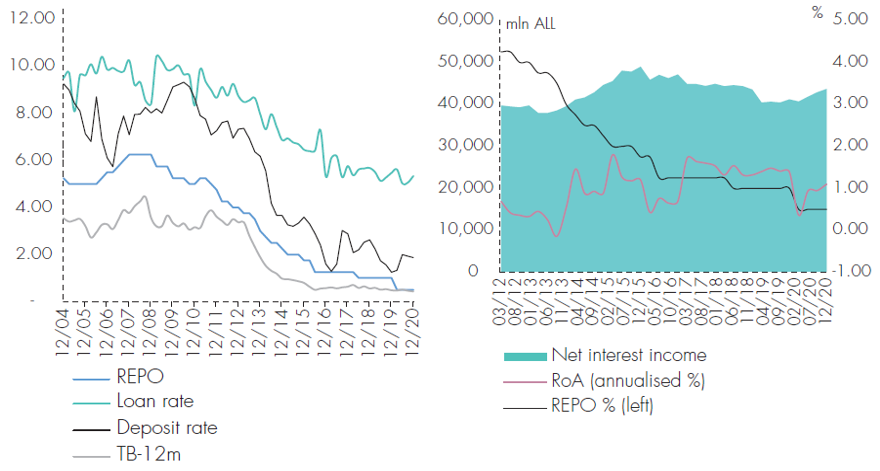

The downward trend of the repo rate starting from 2007 was followed more strictly by the interest on deposits compared to loans, because short-term deposits have much more diversity in contract types compared to short-term loans. Loans interest rates are also closely related to the performance of the 12-month treasury bills yields issued by the Albanian government.

From 2004 to 2017, the banking system’s profitability, though volatile, remained positive, with net interest income consistently accounting for over 80% of income. Between 2009 and 2013, net income and return on assets (ROA) were relatively low due to increased NPLs and higher loan loss provisions (LLP) following rapid credit growth from 2004 to 2009. Post-2013, profitability recovered, especially in 2015, driven by efforts to clear balance sheets of long-term “lost” loans.

Figure 1: Evolution of interest rates and banking sector’s net profits

Source: BoA and authors’ calculations.

Source: BoA and authors’ calculations.

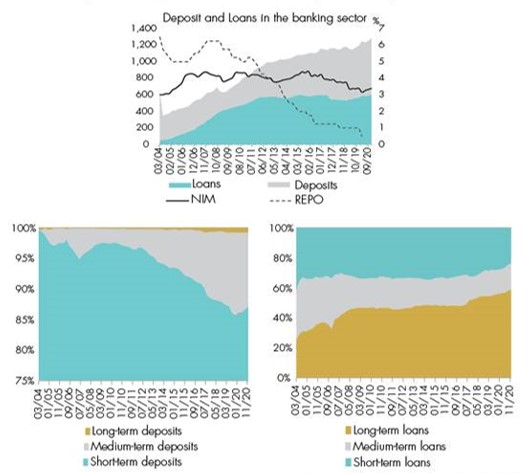

Since the end of 2013, the faster pace of decrease in deposit interest rates towards credit rates have led to banks’ financing costs falling faster than interest income, contributing to the expansion of net interest income. About 90% of customer deposits in the banking sector have maturities of up to one year. Their frequent renewal was at lower interest rates due to repo rate declines.

The data show that net interest income has not been directly affected by the documented decline in the interest rates. This can be explained by these main reasons. One is that a falling interest rate only applies to new loans. Since loan growth is weak after 2011, this would mostly affect the rolling-over of existing loans. The lower rate therefore only gradually feeds into net interest income. Moreover, it is possible that banks increasingly manage to compensate for the falling rates with a rise of fees (loan origination fees, net of loan origination costs, are recognized as interest income). The latter possibility would suggest that banks can successfully adjust their ability to generate profits to the quantitative easing environment. On the other hand, banks tend to lend long-term maturity loans, which are secured by collateral, to reduce the credit risk. Approximately 50% of the outstanding credit is composed by long-term maturity (over 5 years). When interest rates fall, banks’ financing costs usually fall faster than their interest income and the net interest income increases. Over time, interest income (interest received by customers) has declined as loans are repaid or renewed at lower interest rates. However, the faster fall in deposit rates than credit rates have contributed to the continued expansion of net interest income from customers’ interests and, consequently, to total net interest income.

In addition to the interests received by clients, interest received from securities has also contributed to the development of net interest income. Since 2010, banks have significantly increased their exposure to government securities by investing in government bonds, which have high investment return rates. The continuous decline in the repo rate (since the beginning of 2009) has been accompanied by a fall in the interest rate on loans, however its negative effect on interest income is observed only after 2011. This is also closely related to the fact that banks tend to “lend long-term loans and short-term loans” hence the average loan maturity tends to exceed the average maturity of deposits.

Figure 2: Composition of banking sector loans and deposits by maturity

Source: BoA and authors’ calculations.

Source: BoA and authors’ calculations.

In addition, we split the analysis into three bank groups according to bank size: The banks which have a share of their total assets to the overall banking sector assets below 2% are considered small banks; those that have a share larger than 2% and lower than 7% are considered medium banks; and those with a share larger than 7% are considered large banks.1

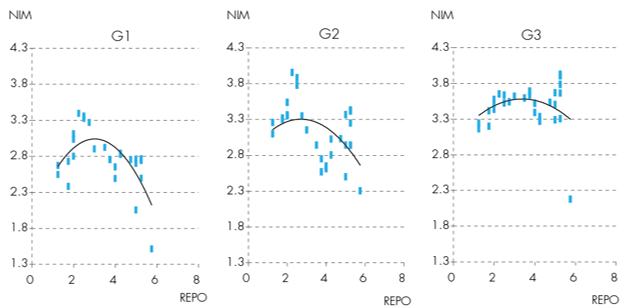

Figure 3 presents the net interest margin (NIM), the quadratic trend of NIM and monetary policy rate (repo) for each bank groups. The concave relationship between the two variables is more evident for small banks compared to the other two groups.

Figure 3: Relationship between monetary policy rate and net interest margin according to bank groups

Source: BoA and authors’ calculations.

Source: BoA and authors’ calculations.

Note: G1—small banks; G2—medium banks; G3—large banks.

Then, we proceed with a robust methodology to test if the patterns observed in the graphs are reflective of an actual underlying relationship. We employ an Ordinary Least Squares (OLS)-based Panel Corrected Standard Errors (PCSE) procedure to examine the existence of such a nonlinear relationship between the net interest margin and the monetary policy rate. To ensure a comprehensive analysis, we consider both macroeconomic conditions and bank-specific characteristics while examining the effects of the monetary policy rate on net interest margin.

The findings of this study reveal significant non-linear relationship between monetary policy rate and net interest margin, but only for small banks. This confirms our prior belief that small banks are more sensitive to changes in monetary policy, specifically during periods of low interest rates compared to high interest rate environments.

Interestingly, the findings suggest that policy easing measures tend to yield relatively greater benefits for medium-sized and large banks, which possess a lower proportion of deposits in their liabilities. Concurrently, banks engaged in more extensive maturity transformation activities exhibit a more positive response to a steepening yield curve.

The findings have implications for potential adverse side effects of accommodative monetary policy for too long, especially on the most vulnerable banks. Of course, the overall effect of monetary policy on banks’ profits will also depend on the macroeconomic conditions, with economic growth being an important determinant of banks’ margins. In particular, this will depends critically on the effectiveness of monetary policy in increasing aggregate demand in an environment of low levels of the monetary policy rate.

Bank of Albania (2023), https://www.bankofalbania.org.

Borio, C., L. Gambacorta and B. Hofmann (2015), “The Influence of Monetary Policy on Bank Profitability”, Bank of International Settlements Working Papers No. 514, BIS, Basel.

Dietrich, A and G Wanzenried (2011), “Determinants of bank profitability before and during the crisis: evidence from Switzerland”, Journal of International Financial Markets, Institutions and Money, vol 21, issue 3, pp 307–27.

Rostagno, M., Altavilla, C., Carboni, C., Lemke, W., Motto, R., Saint-Guilhem, A. and Yiangou, J. (2019), “A tale of two decades: the ECB’s monetary policy at 20”, Working Paper Series, No 2346, ECB.

Wang, O. (2020), “Banks, Low Interest Rates, and Monetary Policy Transmission”, Working Paper Series. European Central Bank.

This is a conventional categorization proposed by the Department of Supervision of BoA.