This Policy Brief is based on Bank of Italy Occcasional Paper Series No 833. The views expressed are those of the authors and do not involve the responsibility of the institutions to which they belong.

Using the unanticipated and exogenous Covid-19 shock as a unique laboratory, we study business continuity at banks, where limitations to social mobility jeopardized branch-executed services. Namely, we conjecture that business resilience was higher if a bank had increased its degree of digitalization more than its peers, shifting from branch- to online-executed services. In particular, we speculate that such investments should unfold greater readiness in migrating retail customers towards online payments during the pandemic, contributing to operational resilience. Exploiting thinly disaggregated supervisory data, our empirical analyses provide robust support to our hypothesis. Hence, digitalization seems to breed resilience at banks against unforeseen natural events and technological investments may also protect from unpredictable risks, indirectly confirming the complementarity of the twin Green-Digital transition.

In March 2021 the Basel Committee on Banking Supervision (BCBS) released a document titled Principles for Operational Resilience – POR (BCBS, 2021). The document advances a principles-based approach to improving operational resilience by effectively managing operational risks that may arise from disruptions like pandemics, natural disasters, cyberattacks, or technological failures. The POR approach builds on the previous BCBS (2011) framework for operational risk management, to reflect banks’ experiences during the Covid-19 pandemic and their critical role in providing financial services.

Overall, banks demonstrated great ability to adapt during Covid-19 in response to new dangers and hazards hitting various parts of their organization. Banks’ operational resilience descended from their capacity to withstand, adapt to, and recover from those threats through a wide range of solutions provided for guaranteeing business continuity during the pandemic.

The unanticipated and exogenous Covid-19 shock acts as a unique laboratory for studying business continuity at banks, where limitations to social mobility hindered the provision of branch-executed services. Namely, we argue that the IT investment pursued by a bank boosted its digitalization and increased its business resilience, allowing to shift more customers from branch- to online-executed services.

The Covid-19 crisis promptly attracted economic research due to the nature of the crisis, which was first and foremost health-related, but had major economic consequences, comparable to the Great Crash of 1929 and to the Global Financial Crisis (GFC) of 2008. However, the Covid-19 crisis stands out vis-à-vis preceding crises by featuring the largest and most unanticipated external shock of all times, spreading recession in both industrialized and developing countries, and prompting a quick, broad and bold array of public policy responses.

The actions to contain the disease forced governments to implement various forms of lockdown hindering all economic activities that depended on interpersonal relationships. Thus, the restrictions the Covid-19 shock caused for branch-executed traditional banking operations help gauge how banks reacted to the lockdown conditions, moving customer services to digital channels.

Several authors analyzed how Covid-19 impacted financial sector and banks (Albanese and Ciocchetta, 2021; Demirgüç-Kunt et al., 2021). Other papers broadened the perspective to the impacts of Covid-19 on households’ consumption, with a spending drop mostly concentrated on goods and services whose supply was directly restricted by the shutdown (Buono and Conteduca, 2020; Andersen et al., 2022).

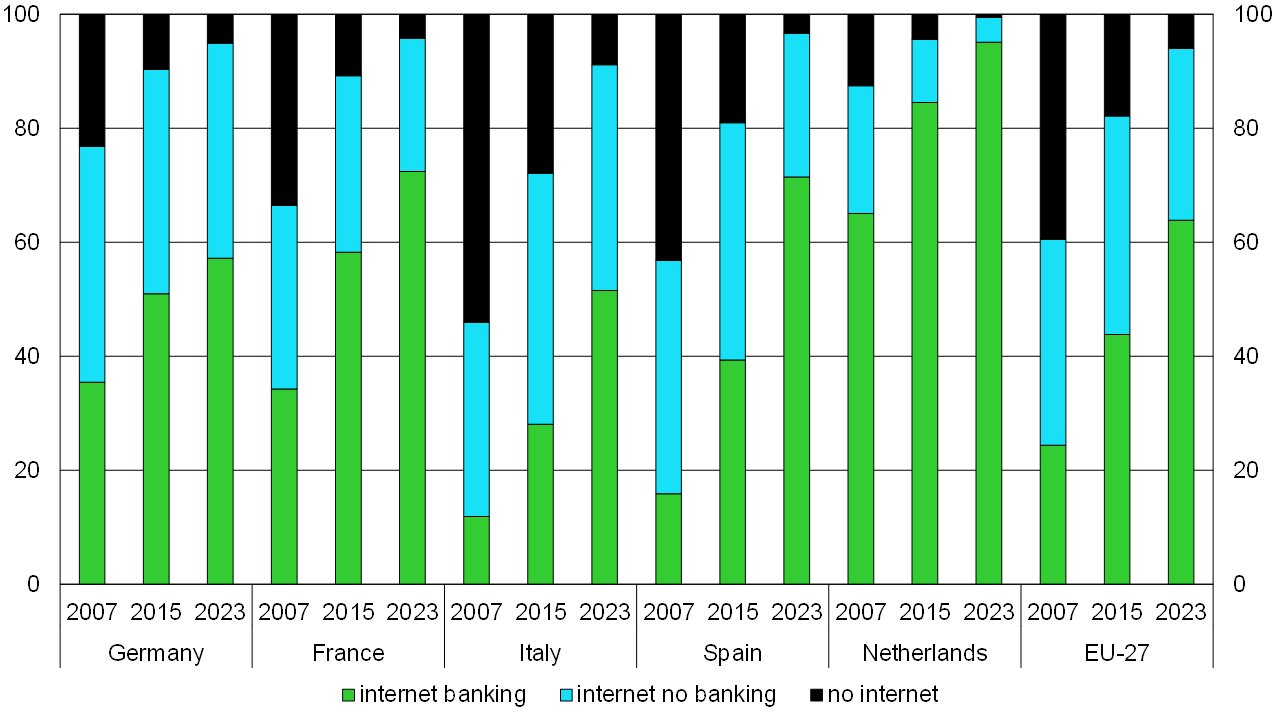

Changes in consumer habits also affected the way in which banking services were used, with a significant shift from traditional to online channels. Changes were particularly significant in Italy, where retail customers featured one of the lowest propensities towards digital services among European countries (Figure 1). As the most recent Eurostat statistics show, this gap has been considerably reduced after 2020, testifying that Italian banks were able to cope with their customers’ new demand for digital services.

Figure 1: The diffusion of internet and internet banking among the European countries

(percentage values)

Source: Eurostat.

Source: Eurostat.

Awareness of the relevance of technology in bank management goes back a long way, although Internet usage and fast-growing technologies like cloud computing and AI are making disruptive innovation in banking more likely. IT and infrastructure are changing the ways in which financial services are offered and sought.

Although technology adoption in the Italian financial sector is rapid, banks’ use is highly heterogeneous (Banca d’Italia, 2021). Big intermediaries have heavily invested in digitalization, but smaller institutions are also improving to keep up with technological progress (Arnaudo et al., 2022) and all banks invest in staff training and technology capabilities, adjusting organizational structures.

Banks’ ability to meet changing customers demand is linked to their technology investments in previous years (Arnaudo et al., 2022). Technology-intensive business models have been showed to improve credit supply (Mocetti et al., 2017). Thus, it is intriguing to study how Covid-19, with its social mobility restrictions caused by total or partial lockdowns, shifted a large part of banks’ customer relationships from branch- to online-executed services.

BCBS (2021) defines operational resilience as a bank’s ability to maintain critical operations during disruption. An operationally resilient bank is less prone to experience operational lapses and disruptions losses, reducing the impact of incidents on critical operations and related services, functions and systems. Process automation and technology affect operational resilience. Despite being itself a source of operational risk (e.g. through cyber-attacks or system outages), IT could have allowed banks to continue serving clients and conduct business during the pandemic.

Indeed, business continuity is relevant and difficult to investigate, because of the lack of exogenous shocks affecting several banks simultaneously and almost homogeneously to verify how different organizations have reacted.

The Covid-19 pandemic tested banks’ digital and operational skills. Infection risk and social segregation rules forced financial institutions to rethink their staffing strategy and distribution network, which no longer met client expectations. Many economic sectors, including financial services, changed with Covid-19 in Italy, with a significant impact on consumer spending behavior (Buono and Conteduca, 2020). During the second quarter of 2020, banks had up to 90% fewer branch-executed operations, while digital engagement increased due to the forced migration to online channels.

Italy declared a “lockdown” on March 4, 2020, imposing social distancing measures. This path is similar to other countries, but Italy’s government policies has been more restrictive (Conteduca et al. 2020). The lockdown started a process that changed how people lived, interacted and bought things and services. Starting with basic necessities, Covid-19 impacted how consumers viewed their own and others’ health, with an increasing concern on job security and economic effects. These economic worries influenced consumer purchasing decisions, quickly altering their purchasing patterns in order to replace services they previously used in-person with new online channels. This also applied to banking. Some needs were discretionary, and the pandemic reduced banking customers’ use of them, but others, like daily payments, forced even technology-naïve customers to “go digital”.

We believe that banks that had increased their degree of digitalization before Covid-19 responded faster, offering a replacement service as soon as their physical branches closed. The other banks possibly managed to reduce the gap with some delay. We consider that a shorter adaptation lag is important, especially for basic banking services like payments, and it is an indication of operational resilience.

This level of response must be considered in light of the former role of branches as a preferred commercial channel for clients, particularly for complex requests, specialized consulting, and for the less technologically and financially educated customers.

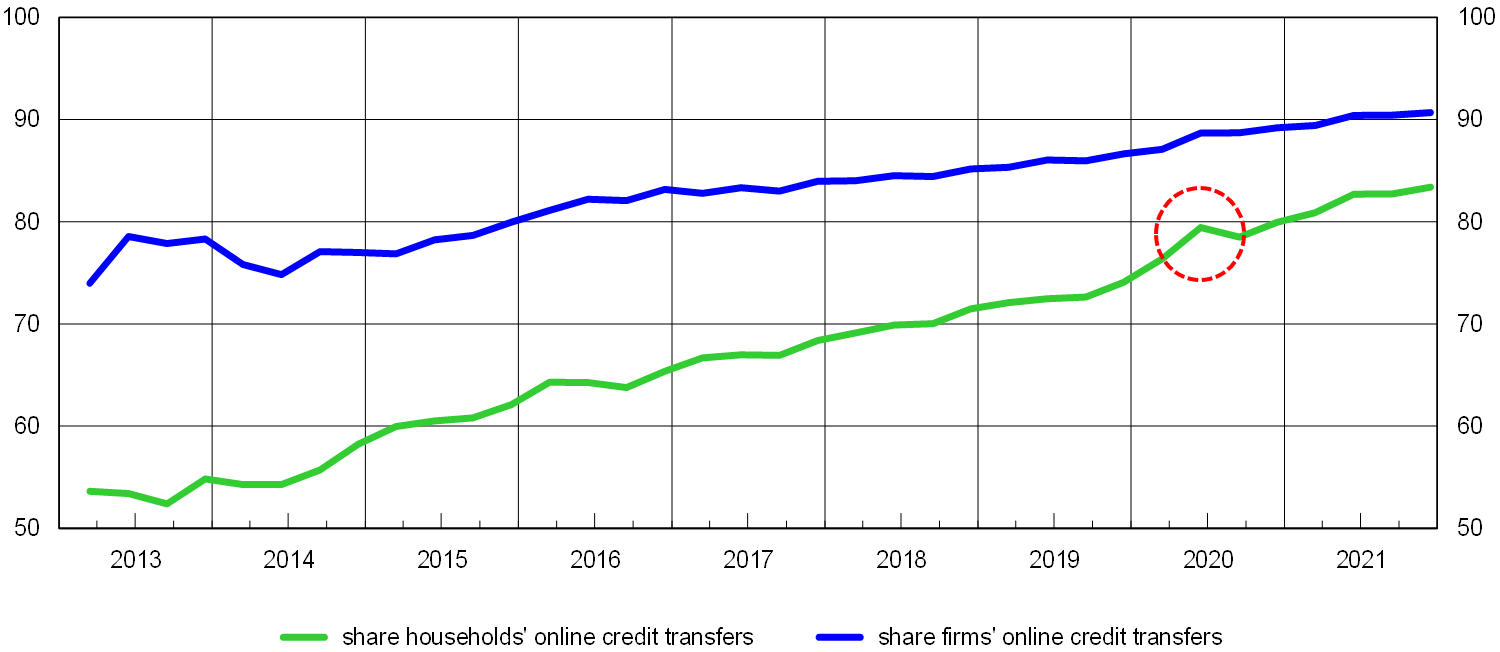

Thus, we find it interesting to examine banks’ most basic services, where the ability to quickly switch to online supply may represent operational resilience. We look at the share of online bank transfers made by retail customers during the crisis as a proxy for the bank’s ability to guarantee an effective payment system during the pandemic. This is particularly interesting during the peak of the Covid-19 pandemic. We consider retail transfers rather than corporate ones, as the former have reacted more strongly than the latter to the pandemic crisis. Retail customers during the lockdown experienced difficulties of physical access to branches, while corporates had already used the online channel before the pandemic. Thus, the less-than-complete diffusion of the online channel among retail customers before the pandemic crisis and the severity of infection control measures make the Italian Covid-19 episode a perfect test to see how bank digital preparedness affects operational continuity.

The Italian case provide general insights for two reasons. First, bank branches are a key part of the Italian banks’ commercial strategy, and their capillary positioning on the territory makes them useful for analyzing how the lockdown has affected different territories. Second, Italy was one of the worst-hit countries by the pandemic in the early 2020s and was the first European nation to restrict individual mobility and promote social distance (Pepe et al., 2020). The intensity of those initiatives varied by Italian regions to reduce pressure on the national health system (Vinceti et al., 2020), providing a measure of the lockdown’s intensity, helpful to verify the banks’ operational capacity in heterogeneous local environments.

We use quarterly data on Italian households’ 2019-20 online credit transfers, to test bank operational resilience in serving customers during the second quarter 2020 (when the Covid-19 crisis erupted). Remote banking became more popular in 2020, as social distancing and free movement limits were imposed to contain the virus. Figure 2 shows that in 2020, in the retail payment segment, the share of online credit transfers over total credit transfers increased above and beyond the long-run upward trend. Household payment habits were forced to change by the Covid-19 shock, even for customers that would have never, or only slowly, changed their bank service preferences. Therefore, our econometric analysis (not reported here) focuses on the second quarter 2020 to assess how banks responded quickly to the lockdown and ensured that retail customers could use online bank transfers instead of branch activity. To this end, we build a rich bank-province-quarter dataset that allows us to take into account demand-related factors (including heterogeneous propensities to use digital services across the Italian provinces), to neatly disentangling supply-related dynamics, i.e. the continuity in banks’ operational capabilities. To calculate a measure of banks’ IT investments, we rely on the results of the Regional Bank Lending Survey carried out by Banca d’Italia which, among other things, asks banks whether they had invested in Fintech projects and the type of digital services provided to their customers.

Figure 2: The share of online credit transfers

(percentage values)

Source: Banca d’Italia’s Supervisory Reports.

Source: Banca d’Italia’s Supervisory Reports.

We studied business continuity at banks, where social mobility restrictions hindered branch-executed services during Covid-19. We showed that banks that were more digitalized before Covid-19 easily switched some customer relationships from branch-to-online services. To quantify bank’s operational resilience, we examined retail online transfers. Digitalization appears to make banks more resilient to natural events, indirectly confirming the complementarity of the twin Green-Digital transition. Our results suggest that authorities should encourage technological advancement in banking and finance beyond short-term profitability and competitive advantages. They should be aware that IT investments may yield long-term benefits and respond to unforeseeable events. Our findings support a long-term perspective and may help explain why several public authorities have been proactive in catalyzing Fintech investments in their jurisdictions or internationally.

Albanese, A. and F. Ciocchetta. 2021. Which banks were more effective in supporting credit supply during the pandemic?, Banca d’Italia Covid-19 Note.

Andersen, A.L., E. Toft Hansen, Johannesen N. and A. Sheridan, 2022. Consumer responses to the COVID-19 crisis: evidence from bank account transaction data, The Scandinavian Journal of Economics, 124 (4), 905–929.

Arnaudo, D., Del Prete, S., Demma, C., Manile, M., Orame, A., Pagnini, M., Rossi, C., Rossi, P., and G. Soggia, 2022. The digital transformation in the Italian banking sector, Banca d’Italia Occasional Paper, 682.

Banca d’Italia, 2021. Survey on the adoption of fintech in the Italian financial system.

BCBS – Basel Committee on Banking Supervision, 2011. Principles for the Sound Management of Operational Risk, BIS, June.

BCBS, 2021. Principles for Operational Resilience, BIS, March.

Buono, I. and P. Conteduca, 2020. Mobility before government restrictions in the wake of Covid-19, Banca d’Italia Covid-19 Note.

Conteduca, F.P., Mancini, M., Rossi L. and F. Tonelli, 2020. Fighting Covid-19: measuring the restrictiveness of government policies, Banca d’Italia Covid-19 Note.

Demirgüç-Kunt, A., Pedraza, A. and C. Ruiz-Ortega, 2021. Banking sector performance during the Covid-19 crisis, Journal of Banking and Finance, 133, 106305.

Mocetti, S., Pagnini, M. and E. Sette, 2017. Information technology and banking organization, Journal of Financial Services Research, 5, 313–338.

Pepe E., Bajardi, P., Gauvin, L., Privitera, F., Lake, B., Cattuto, C. and M. Tizzoni, 2020. Covid-19 outbreak response, a dataset to assess mobility changes in Italy following national lockdown. Scientific Data, 7 (230).

Vinceti, M., T. Filippini, K. J. Rothman, F. Ferrari, A. Goffi, G. Maffeis, N. Orsini, 2020. Lockdown timing and efficacy in controlling Covid-19 using mobile phone tracking, EClinicalMedicine.