This policy brief is based on European Central Bank Working Paper Series No 2960.

Abstract

In this SUERF policy brief we quantify the impact of geopolitical tensions on trade of manufacturing goods over the period 2012-2022. To capture the influence of geopolitical tensions, we augment a state-of-the-art gravity model with a measure of geopolitical distance based on the UN General Assembly voting. The econometric analysis offers robust evidence that geopolitical distance has become a trade friction and its impact has steadily increased over time. Our results suggest that a 10% increase in geopolitical distance, like the observed increase in the US-China distance since 2018, is associated with a reduction in trade by about 2%. Our findings also highlight a differential and stronger impact on advanced economies and the emergence of friend-shoring.

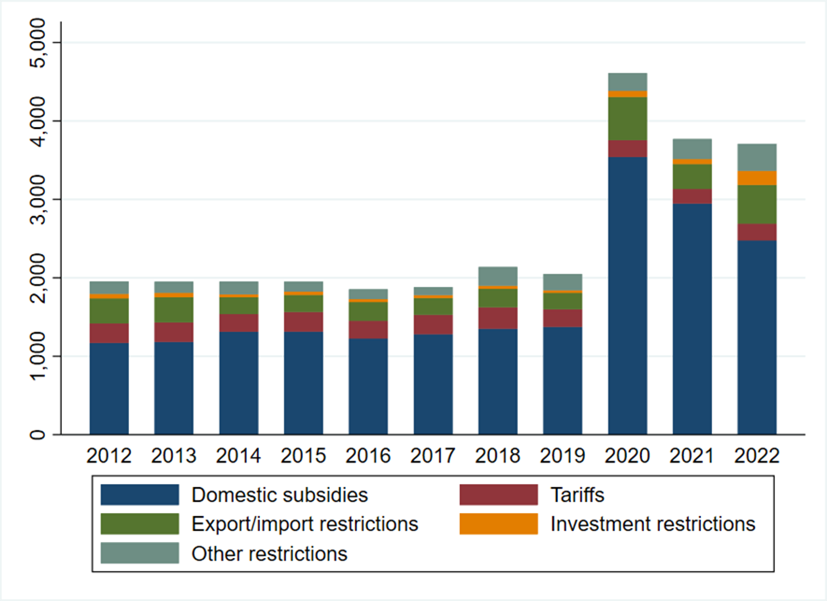

Since the global financial crisis, trade has been growing more slowly than GDP, ushering in an era of “slowbalisation” (Antràs, 2021). As suggested by Baldwin (2022) and Goldberg and Reed (2023), among others, such a slowdown could be read as a natural development in global trade following its earlier fast growth. Yet, a surge in trade restriction measures has been evident in recent years (see Figure 1) and geopolitical concerns have been heightened in the wake of Russia’s invasion of Ukraine, casting further doubts about the resilience of supply chains and ultimately of global trade, with pressing concerns for national security and strategic competitiveness.

Figure 1. New Trade Restrictions.

Source: Global Trade Alert (GTA) and authors’ calculations. Notes: This chart shows the number of new trade interventions imposed in each year. The GTA database documents all unilateral changes in the relative treatment of foreign versus domestic commercial interests. Only interventions that the GTA deems “certain to discriminate against foreign commercial interests” are included.

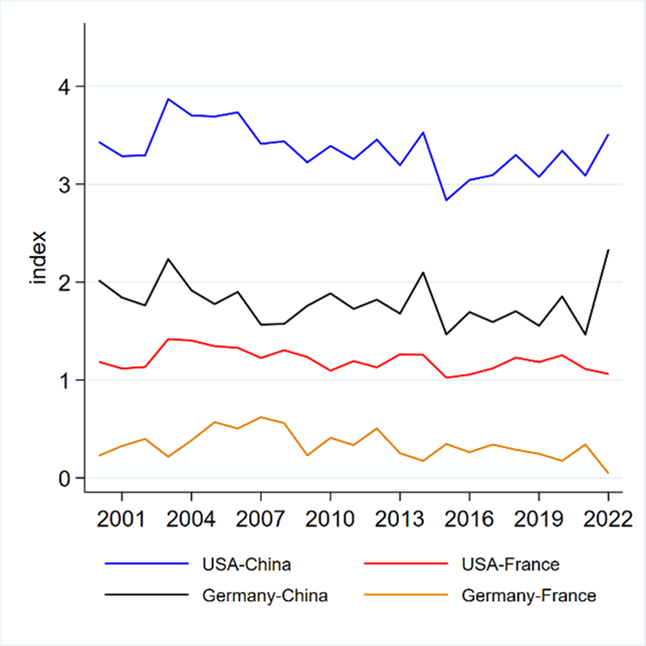

Against this backdrop, a recent and fast-growing literature has analysed the implications of a fragmentation of trade along geopolitical lines (Aiyar et al. 2023, Campos et al., 2023, Gopinath et al., 2024). In Bosone and Stamato (2024), we provide new evidence and quantify the timing and the impact of geopolitical tensions on manufacturing trade over the last decade. To do so, we augment a state-of-the-art gravity model estimated for 63 countries over the period 2012-2022 to include a measure of geopolitical distance based on UN General Assembly (UNGA) voting records from Bailey et al. (2017). As an illustration, Figure 2 plots the evolution over time of the geopolitical distance between four country pairs: US-China, US-France, Germany-China, and Germany-France. This chart shows a consistently higher distance from China for both the US and Germany, as well as the impact of the Russia-Ukraine war in 2022, when the geopolitical distance between Germany and China rises sharply and the one observed between Germany and France falls almost to zero.

Figure 2. Geopolitical distance between selected countries.

Source: Bailey et al. (2017). Notes: Higher values mean higher geopolitical distance.

Geopolitical distance is then included in a standard gravity model with a full set of fixed effects, which allow us to control for unobservable factors affecting trade. We also control for international border effects and bilateral time-varying trade cost variables (e.g., tariffs and a trade agreement indicator). This way, we minimise the possibility that the index of geopolitical distance captures the role of other factors that could drive trade flows. We then estimate a set of time-varying elasticities of trade flows with respect to geopolitical distance to trace the evolution of the role of geopolitics from 2012 to 2022. To the best of our knowledge, we cover the latest horizon on similar studies on geopolitical tensions and trade. We tackle the issue of reverse causality between geopolitical distance and trade by I) excluding energy-related products from trade flows to rule out the potential bias deriving from the use of energy flows as political leverage by opposing countries (Baran, 2007; Yergin, 2020) and by II) adopting an instrumental variable (IV) strategy based on the exposure to terrorism proposed by Enders et al. (2011) as our instrument for geopolitics and trade.1 Ultimately, IV results converge substantially to those obtained with PPML excluding energy flows. For this reason, we consider the latter specification as our baseline. We present our results based on three-year averages of data.

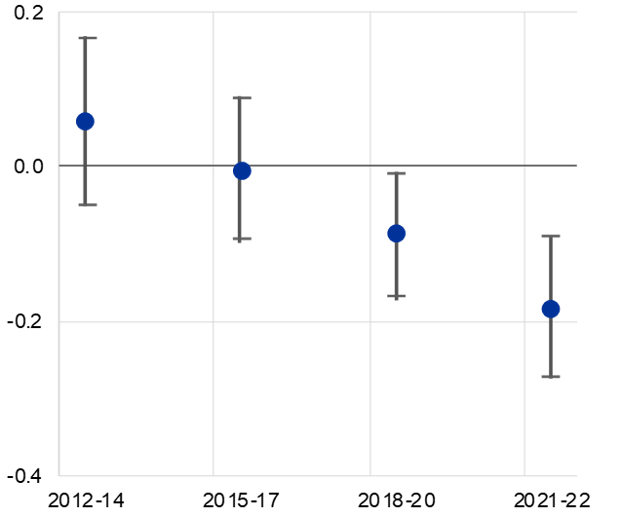

We find that geopolitical distance has been a significant determinant of trade flows since 2018 and its impact has steadily increased over time (see Figure 3). The fall in the elasticity of geopolitical distance is mostly driven by deteriorating geopolitical relations, most notably between the US and China and more generally between the West and the East. This is reflected in increasing trade restrictions in key strategic sectors associated to the COVID-19 pandemic crisis, economic sanctions imposed to Russia and the rise of import substituting industrial policies. The impact of geopolitical distance is economically significant: a 10% increase in geopolitical distance (like the observed increase in the USA-China distance since 2018) is found to decrease bilateral trade flows by about 2%.

Figure 3. Time-varying impact of geopolitical distance on trade flows (elasticity).

Sources: Bosone & Stamato (2024). Notes:Dots are the coefficient of geopolitical distance, represented by the logarithm of the ideal point distance interacted with a time dummy, using 3-year averages of data and based on a gravity model estimated for 67 countries from 2012 to 2022. Whiskers represent 95% confidence bands. The dependent variable is bilateral trade in manufacturing goods, excluding energy. Estimation performed using the PPML estimator. The estimation accounts for bilateral time-varying controls, exporter/importer-year fixed effects, and pair fixed effects.

New evidence shows that the recent wave of industrial policies and trade-distorting corporate subsidies is primarily driven by Advanced Economies (AEs), with strategic competitiveness being the dominant motive behind these measures (Evenett et al., 2024), thus pointing to a higher sensitivity over time of AEs’ trade to geopolitical distance compared to Emerging and Developing Economies (EMDEs).

We test this argument by allowing for a differential impact of geopolitical distance on trade of AEs and EMDEs. Specifically, we interact geopolitical distance with a dummy variable such that the exporter is an advanced country trading with the rest of the world and with a dummy such that the importer is an advanced country trading with the rest of the world, respectively.

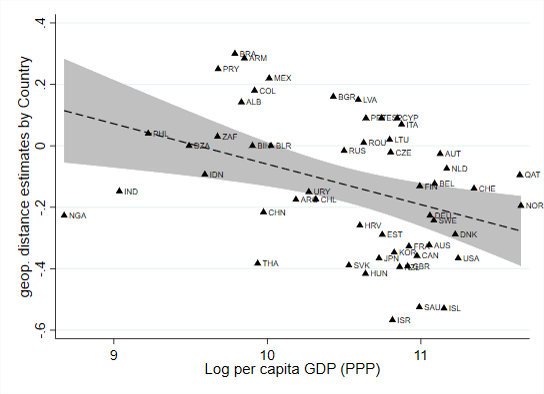

Results are displayed in Figure 4, which correlates the estimated geopolitical distance elasticities of imports at the country level for the 2021- 2022 period with an indicator of economic development, i.e., per capita income. We show that the effect of geopolitical distance is heterogeneous across different levels of economic development and that high-income countries show higher sensitivity. Precisely, a negative correlation is clearly visible (coefficient around -0.4) and most AEs, such as the US, Japan and the United Kingdom, report negative and significant estimates, in line with the conjecture that richest countries have been driving the reorientation of trade.

Figure 4. Country-specific coefficients of geopolitical distance on imports and per capita income.

Source: Bosone & Stamato (2024). Notes: This graph shows geopolitical distance elasticities of imports in the period 2021-22 at the country level and log per capita GDP in nominal US dollars. The underlying country-specific estimates are obtained from a gravity specification based on three-year averages of data, with time-varying gravity variables, exporter-time, importer-time and exporter-importer fixed effects. The dependent variable is bilateral trade excluding energy. Estimates are obtained using the PPML estimator. Ukraine excluded.

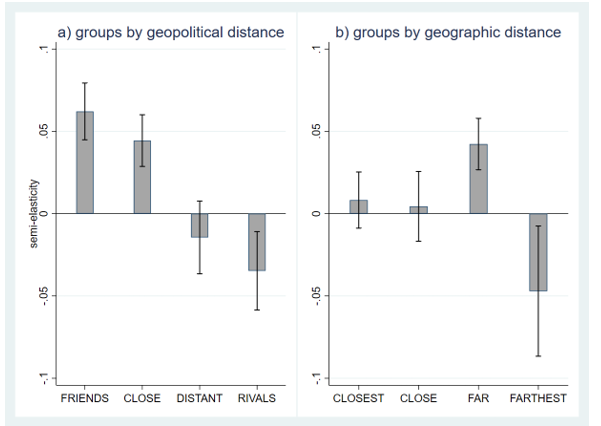

Recent narratives surrounding trade reconfiguration and economic interdependence increasingly argue for localisation of supply chains through near-shoring and strengthening production networks with like-minded countries through friend-shoring (Yellen, 2022). To offer quantitative evidence on these trends, we first regress bilateral trade flows on a set of four dummy variables that identify the four quartiles of the distribution of geopolitical distance across country pairs (Figure 5, panel a). Next, to explore near-shoring, we regress bilateral trade flows on four dummy variables identifying the quartiles of country pairs according to their geographic distance (Figure 5, panel b). To capture the effect of growing geopolitical tensions on trade, each dummy is equal to 1 for trade within the same quartile from 2018 and zero otherwise.

Our estimates provide strong evidence of friend-shoring, as trade between geopolitically aligned countries has increased by more than 6% since 2018, compared to the period 2012-17, whereas trade within “rivals” is found to decline by about 4%. While we do not find evidence of near-shoring, we witness a significant increase in trade between far country pairs, offset by a relatively similar decline in trade between farthest country pairs. Ultimately, our results suggest that trade reconfiguration is materialising along geopolitical lines, driven by friend-shoring strategies rather than near-shoring.

Figure 5. Effect of trading within geopolitical groups (left) and geographic groups (right) since 2018.

Source: Bosone & Stamato (2024). Notes: Bars represent the estimated semi-elasticity of trade to country groups according to their geopolitical distance (left) and to geographic distance (right). The whiskers represent 95% confidence bands. Estimates in both panels are obtained by PPML on the sample period 2012-2022 using consecutive years and controlling for bilateral time-varying variables, exporter-time fixed effects, importer-time fixed effects and exporter-importer fixed effects. In the left-hand side panel we also control for pre-existing trends in trade flows within groups. The dependent variable is bilateral trade excluding energy.

Our findings not only suggest that geopolitical tensions have become a significant driver of trade, but also that AEs show higher sensitivity to geopolitical distance over time than EMDEs and that the geopolitical reconfiguration of trade is being driven by friend-shoring, rather than near-shoring.

This scheme highlights the emergence of new forces, which are no longer based on profit-oriented strategies alone, but also on geopolitical alignment. Yer, friend-shoring strategies, coupled with efforts to promote reindustrialisation, encompass a trade-off between risk minimisation and cost efficiency. Such costs, reflected in reduced competition, a loss of specialization and weaker economies of scale, would increasingly weigh on this trade-off, as the fragmentation of trade along geopolitical lines deepens and countries face severe losses in terms of reduced trade and welfare. Furthermore, a deepening of fragmentation would also inhibit efforts to address other global challenges, from climate change and green transition to an efficient regulatory framework in both trade and the global payment system.

Aiyar, M. S., Chen, M. J., Ebeke, C., Ebeke, M. C. H., Garcia-Saltos, M. R., Gudmundsson, T., … & Trevino, M. J. P. (2023). Geo-economic fragmentation and the future of multilateralism. Staff Discussion Note SDN/2023/001. International Monetary Fund, Washington DC.

Antràs, P. (2021). De-globalisation? global value chains in the post-covid-19 age. In Central banks in a shifting world: Conference proceedings—ECB forum.

Bailey, M. A., Strezhnev, A., & Voeten, E. (2017). Estimating dynamic state preferences from united nations voting data. Journal of Conflict Resolution, 61(2), 430–456.

Baldwin, R. (2022). The peak globalisation myth: Part 3 – How global supply chains are unwinding. VoxEU.org, 2 September.

Baran, Z. (2007). Eu energy security: time to end Russian leverage. Washington Quarterly, 30(4),131–144.

Blomberg, S. B., & Rosendorff, B. P. (2009). A Gravity Model of Globalization Democracy, and Transnational Terrorism. In Guns and Butter: The Economic Causes and Consequences of Conflict. The MIT Press.

Bosone, C., & Stamato, G. (2024). Beyond borders: How geopolitics is changing trade. ECB Working Paper 2024/2960.

Campos, R. G., Estefanía-Flores, J., Furceri, D., & Timini, J. (2023). Geopolitical fragmentation and trade. Journal of Comparative Economics, 51(4), 1289-1315.

Enders, W., Sandler, T., & Gaibulloev, K. (2011). Domestic versus transnational terrorism: Data, decomposition, and dynamics. Journal of Peace Research, 48(3), 319–337.

Evenett, S. (2022). What endgame for the deglobalisation narrative? Intereconomics, 57(6), 345–351.

Goldberg, P. K., & Reed, T. (2023). Is the global economy deglobalizing? And if so, why? And what is next? Brookings Papers on Economic Activity, Spring.

Gopinath, G., Gourinchas, P. O., Presbitero, A., & Topalova, P. B. (2024). Changing Global Linkages: A New Cold War? IMF Working Paper 2024/076.

Piazza, J. A. (2007). Draining the swamp: Democracy promotion, state failure, and terrorism in 19 middle eastern countries. Studies in Conflict & Terrorism, 30(6), 521–539.

Yellen, J. L. (2022, apr). Remarks on the way forward for the global economy. Speech at the Atlantic Council. Washington DC.

Yergin, D. (2020). The new map: Energy, climate, and the clash of nations. Penguin Uk.

Specifically, our approach involves using the difference in terrorism incidents between country pairs as a bilateral time-varying instrument for geopolitical distance, as historical evidence (e.g. Piazza, 2007; Blomberg & Rosendorff, 2009) shows a positive link between democracy and terrorism.