Abstract

How do political parties talk about fiscal policy, and does the prevalence of certain fiscal ideas have consequences for public finances? With deficit and debt levels elevated in many parts of the world, our new paper asks whether political rhetoric in electoral democracies has indeed shifted towards more public spending and away from fiscal restraint. Analyzing several decades of party platforms in over sixty countries, we show that such trends are widespread, and largely predate the Covid-19 pandemic. Most importantly, changes in political discourse in favor of public spending tend to be followed by higher primary deficits over time. This suggests that bringing fiscal discipline back to the center of the political narrative will be crucial to fiscal sustainability.

Global public debt remains elevated and is expected to reach 100 percent of GDP by the end of this decade (IMF 2024). While the Covid-19 pandemic, rising geoeconomic fragmentation, and recent energy price shocks, have all added to public finance pressures, global public debt has in fact tripled since the mid-1970s (IMF 2023). In recent years, studies have emphasized the polarized nature of rhetoric and electoral campaigns, including a shift from traditional left-right divides to a more ideologically ambiguous rift between populist and establishment parties in both advanced and emerging economies (Funke et al. 2023, Guriev and Papaioannou 2022). But when it comes to fiscal policy, parties across the political spectrum are in fact becoming quite similar—their electoral platforms increasingly call for larger governments.

In our latest IMF working paper (Cao, Dabla-Norris, and Di Gregorio 2024), drawing on the Manifesto Project database (Lehman et al. 2023), we show that political discourse on fiscal issues has increasingly tilted in favor of higher government spending since the 1990s. Our paper examines more than 4,500 political manifestos in 65 advanced and emerging market economies.

For each party platform, we construct two separate measures of fiscal discourse, capturing a party’s implied or stated support for increasing public spending or for adopting a more prudent fiscal stance. We define “pro-expansion” discourse as the share of policy statements in a given platform favoring public spending on welfare, social services, and demand-side policies such as fiscal stimulus during economic crises. “Pro-restraint” discourse is defined as the share of manifesto content calling for an outright reduction of budget deficits or lower public spending.

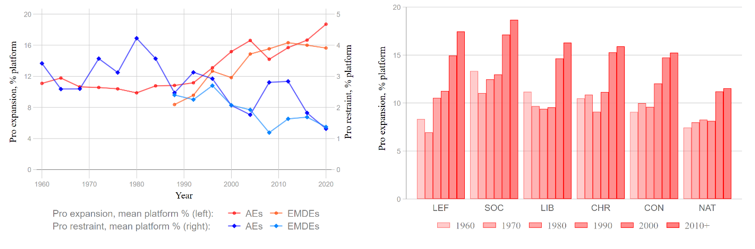

Our analysis shows that parties in both advanced and emerging economies have devoted a growing share of their platform space to pro-expansion discourse since the 1990s and progressively less space to fiscal restraint since at least the 1980s (Figure 1.a). These trends are broadly shared across the political spectrum, suggesting that this dynamic cannot be simply attributed to the rise of populism (Figure 1.b).

Figure 1.a and 1.b. Fiscal discourse trends by country group and party family

Data source: Manifesto Project database. Notes: for panel a, we first average the expansion and restraint discourse shares for all available party platforms in a given country-election, then in a given country-year, and then plot four-year averages drawing from all country-years. Panel b displays the decade-by-decade average of expansion discourse platform shares for all platforms in a party family, including – from left to right – leftist parties, socialists, liberals, Christian democrats, conservatives, and nationalists.

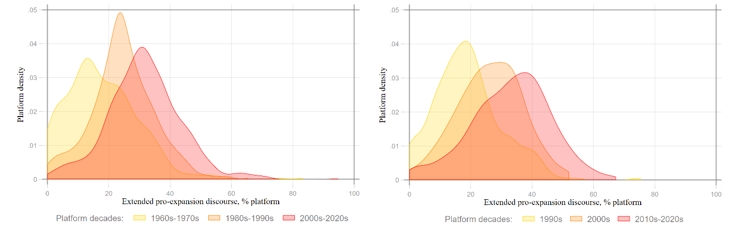

While our measures focus on social spending, reflecting large budget items such as entitlements, the trends we uncover also hold after accounting for the platform share for other potential spending items such as infrastructure, defense, fiscal incentives for firms, and environmental issues. Take Europe, for instance. The shift toward higher public spending is not limited to older EU member states but is equally evident in the transition economies#f1 (Figure 2.a and 2.b, respectively). This suggests a broad, regional trend where political parties, regardless of historical or economic backgrounds, have increasingly prioritized discourse around expanding public spending and reduced their emphasis on fiscal discipline.

Figure 2.a and 2.b. Extended expansion discourse in pre-2004 EU- and transition economies

Data source: Manifesto Project database. Notes: for each reported period, we plot the distribution of the shares of party platform in support of social spending, and intervention on infrastructure, defense, firm incentives, and environmental issues in available countries in the European Union in 2004 (panel a) and post-Soviet economies (panel b).

We also find that fiscal discourse is responsive to the general state of the economy. Specifically, discourse becomes more conservative under adverse economic conditions, but only to a limited extent. When we look at different elections within the same country, we find that platforms drafted when the budget deficit is 1 percentage point of GDP higher feature 0.22 percentage point less expansion discourse and 0.1 percentage point more restraint talk on average. Higher levels of public debt are also associated with more restraint discourse in emerging market and developing economies, suggesting that fiscal sustainability concerns came to the forefront when fiscal pressures build up. But this does not dent support for lax policies for too long.

Indeed, major fiscal events appear to shape political discourse only partially. Elections held within three years of a “debt surge”—a large increase in the public debt-to-GDP ratio—feature higher restraint discourse, but reductions in expansion discourse are more tenuous. And while the adoption of balanced budget rules encourages parties to devote more space to restraint rhetoric, it does not systematically lead to less pro-spending talk, in line with long-run trends.

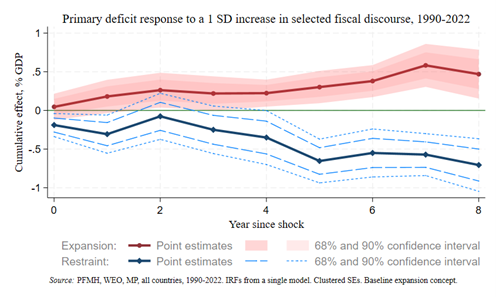

To the extent that parties are simply vying for votes with spending ideas while delaying the details of consolidation to the post-election period, fiscal outcomes may be largely independent from the narratives spun on the campaign trail. Our work suggests otherwise: when the political climate shifts in favor of relatively more spending rhetoric, fiscal policy adapts accordingly. To show this, we define fiscal discourse shocks as the change in average expansion and restraint platform shares across consecutive elections. Local projection methods are then used to estimate the response of fiscal variables to a shift in fiscal narratives.

We find that a one standard deviation (or about 5 percentage points) increase in the share of platform favoring expansionary rhetoric is followed by an increase in primary deficits of up to 0.5 percentage point of GDP across the next several years over the 1990-2022 period (Figure 3), with little difference between advanced and emerging economies. This deficit increase is driven primarily by a gradual expansion of spending initiatives, including social spending, rather than tax cuts. By contrast, in the aftermath of a restraint discourse shock, primary deficits ultimately fall, relying primarily on greater revenue collection efforts.

Figure 3. The aftermath of fiscal discourse shifts: primary deficit

Data sources: Manifesto Project, Public Finance in Modern History, and World Economic Outlook. The bold blue and red lines connect the estimated impulse responses associated to a one standard deviation shock in restraint and expansion discourse, respectively. Shaded areas (for expansion shocks) and dashed lines (for restraint) reflect the 68% and 90% country-clustered confidence intervals estimated for each impulse response. Estimates come from a single regression for both shock types. Year 0 correspond to a national election year. For more details, see Cao, Dabla-Norris, and Di Gregorio (2024).

Fiscal policy undoubtedly reflects underlying societal pressures and ongoing structural transformations. With population aging, climate change, and skill-biased technological change, voters likely demand that governments do more. And, with political polarization on the rise, the temptation to use the public budget to score electoral points may also be stronger than ever. But politicians bear at least part of the responsibility in crafting narratives: our paper shows that, while fiscal discourse has been turning more favorable to higher spending for several years, there does not seem to be an equally systematic long-run increase in popular support for larger governments or for more redistribution.

Through the political process, fiscally-generous narratives tend to translate into larger burdens on public finances. The crucial question is how to pay for this largesse. In an increasingly shock-prone world where fiscal buffers have been eroded, large deficits and elevated debt levels call for greater fiscal prudence, but this may be hard to achieve in practice when political forces pull in the opposite direction. Policymakers, voters, and pundits alike may soon need to go back to the drawing board and tinker with how to reconcile fiscal and political sustainability.

Cao, Yongquan, Era Dabla-Norris, and Enrico Di Gregorio. 2024. “Fiscal Discourse and Fiscal Policy.” IMF Working Paper No. 2024/194, International Monetary Fund, Washington, DC.

Funke, Manuel, Moritz Schularick, and Christoph Trebesch. 2023. “Populist Leaders and the Economy.” American Economic Review, 113(12): 3249–3288.

Guriev, Sergei, and Elias Papaioannou. 2022. “The Political Economy of Populism.” Journal of Economic Literature, 60(3): 753–832.

Lehmann, Pola, Simon Franzmann, Tobias Burst, Sven Regel, Felicia Riethmuller, Andrea Volkens, Bernhard Weßels, and Lisa Zehnter. 2023. “The Manifesto Data Collection. Manifesto Project (MRG/CMP/MARPOR). Version 2023a.”

International Monetary Fund. 2023. Global debt is returning to its rising trend. IMF Blog. https://www.imf.org/en/Blogs/Articles/2023/09/13/global-debt-is-returning-to-its-rising-trend

International Monetary Fund. 2024. “Putting a Lid on Public Debt.” Fiscal Monitor. https://www.imf.org/en/Publications/FM/Issues/2024/10/23/fiscal-monitor-october-2024

We refer to pre-2004 EU countries as those countries which had joined the European Union before its 2004 enlargement, including Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden and the United Kingdom. Transition economies refer to the following countries: Albania, Armenia, Azerbaijan, Belarus, Bosnia-Herzegovina, Bulgaria, Croatia, Czech Republic, Estonia, Georgia, Hungary, Latvia, Lithuania, Moldova, Montenegro, North Macedonia, Poland, Romania, Russia, Serbia, Slovakia, Slovenia and Ukraine.