This policy brief is based on ECB Working Paper Series, No 3013 “Flexible asset purchases and repo market functioning”. The views and opinions expressed in this brief are those of the authors and do not necessarily reflect the position of the ECB.

Abstract

Repo markets play a crucial role in financial stability and the transmission of monetary policy. Central banks’ large-scale asset purchases can reduce the availability of sovereign bonds, leading to collateral scarcity and price distortions in repo markets. This policy brief highlights how flexible security selection for implementing asset purchases—where central banks prioritize buying less scarce bonds within the same jurisdiction—can mitigate repo market disruptions. Empirical evidence from the Eurosystem’s Public Sector Purchase Programme (PSPP) shows that such flexible purchases helped increase repo rates, and reduce collateral scarcity. This study suggests that incorporating bond-selection flexibility into the execution of asset purchase programs enhances monetary policy effectiveness while minimizing market distortions.

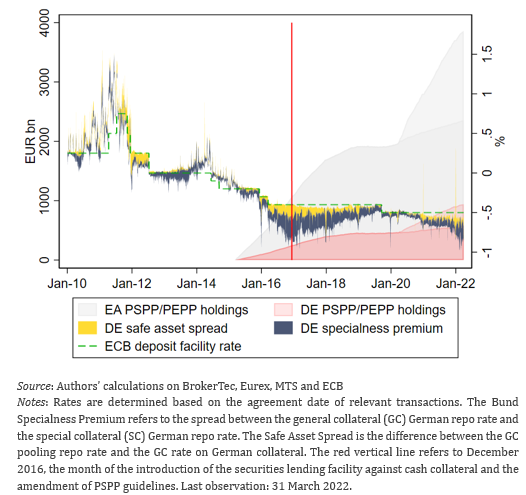

Since the start of the ECB’s asset purchase programmes, repo market conditions have changed significantly. Repo markets are essential for an efficient allocation of short-term liquidity and the risk mitigation of collateralisation contributes to financial stability. In these transactions, one party sells securities—often government bonds—with an agreement to repurchase them later. Large-scale central bank asset purchases, such as the ECB’s PSPP, can remove significant quantities of sovereign bonds from the market, creating collateral scarcity. The shortage of bonds increases their value in repo transactions, leading to lower repo rates. At the same time, certain bonds become more expensive to source, creating a “specialness” premium. These distortions contribute to market segmentation, which hinders the smooth transmission of monetary policy (Arrata et al. 2020, Pelizzon et al. 2025, Nguyen et al. 2023). Figure 1 illustrates the evolution of repo market specialness for German bonds, in particular the build-up of large negative specialness premia spreads (e.g. the spread between the general collateral German repo rate and the special collateral German repo rate) since the inception of Eurosystem asset purchases.

Figure 1. German repo specialness and Eurosystem asset holdings

To address these issues, central banks can adopt a flexible operational approach when implementing asset purchases. This approach allows to prioritize the acquisition of less scarce bonds, avoiding purchases of securities that are already in extra-short supply within the same jurisdiction. By adjusting their security selection according to changes in bond scarcity, asset managers can mitigate market distortions while still meeting their overall volume targets. The empirical evidence suggests that such flexibility helps stabilize repo market conditions, reducing unintended consequences associated with large-scale purchases.

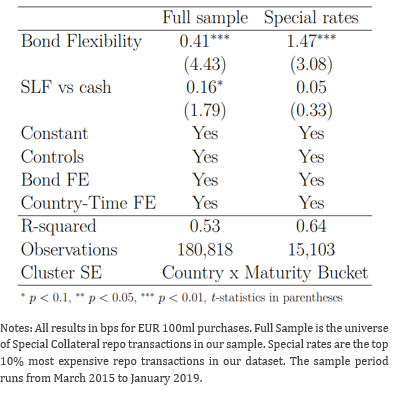

Our study covering the period 2015-2019 demonstrates the benefits of flexible selection of securities. The data shows that adjusting bond selection to avoid excessive scarcity led to an increase in repo rates by 0.41 basis points per EUR 100 million deviation from a market-neutral purchase strategy – where the central bank acquired bonds in proportion to their availability. As shown in Table 1, the effect increases for a subsample of most special bonds (1.47 basis points). Furthermore, the ECB’s Securities Lending Facility (SLF) has played a crucial role in alleviating collateral shortages, contributing to repo rate increases of 0.16-0.20 basis points per EUR 100 million of lending, depending on the specification.

The study’s empirical analysis highlights that repo market disruptions are more pronounced when bond purchases are executed without bond-selection flexibility. When the ECB’s purchases focused on scarce bonds, repo rates tended to fall, exacerbating the specialness premium. However, by shifting purchases toward bonds that were more readily available in the market, programme execution was able to mitigate these effects and reduce repo rate distortions.

Regression analyses confirm that deviations from a market-neutral purchase execution strategy, where the central bank acquired bonds in proportion to their availability, had a measurable impact on repo rates. Specifically, coefficients in Table 1 show that not purchasing (or purchasing less of) what the market-neutral allocation prescribes is associated with daily positive changes in repo rates, and therefore with lower specialness. These results are robust across different time periods and jurisdictions, reinforcing the conclusion that bond-selection flexibility is an effective tool for mitigating market distortions.

Table 1. Regression of ∆ repo rate on bond-selection flexibility

Further evidence indicates that the effectiveness of flexible security selection increased when combined with securities lending operations. The SLF allowed market participants to borrow government bonds against cash collateral, alleviating the supply constraints that asset purchases had imposed. Overall, these findings highlight the importance for the central bank of adopting an execution of purchases which adapts to repo market conditions, and integrating securities lending facilities into their toolkit, which together contribute to support market functioning. Central banks can hence reduce unintended market disruptions while maintaining the effectiveness of their broader monetary policy objectives.

The evidence suggests that flexible security selection in implementing asset purchase programmes can significantly mitigate repo market disruptions. Embedding tailored execution strategies into future central bank purchase programmes can enhance transmission and maintain efficient market functioning. This approach will help ensure that central bank interventions do not inadvertently disrupt short-term funding markets, thereby supporting a smoother transmission of monetary policy.

Arrata, W., Nguyen, B., Rahmouni-Rousseau, I., and Vari, M. (2020). “The scarcity effect of QE on repo rates: Evidence from the euro area”. Journal of Financial Economics, 137(3):837– 856.

Pelizzon, L., Subrahmanyam M. G., and Tomio D (2025). “Central bank–driven mispricing.” Journal of Financial Economics 166:104004.

Nguyen, B., Tomio D., and Vari M (2023). “Safe Asset Scarcity and Monetary Policy Transmission”.