On the basis of insurance companies’ bond investments, I examine how shifts in investors’ demand for corporate bonds affect non-financial bond issuers. When demand for their bonds increases, firms’ financing costs decrease, which encourages them to increase their bond debt and invest more. These effects crucially depend on how credit-constrained firms are. My findings emphasise the critical role that institutional investors play in shaping non-financial firms’ financing decisions and real economic activity.

Corporate bonds serve as a vital source of financing for non-financial firms. In the United States, non-financial firms’ bond liabilities exceeded USD 6.7 trillion in 2022, which is more than their loan liabilities.1 While firms in the euro area are relatively less reliant on bond financing, its importance has also been growing in recent years (Berg et al., 2021; Darmouni and Papoutsi, 2022).2

This increasing significance of bond financing places bond investors in the spotlight. How important are certain groups of investors for firms? Do they have any effects on firms’ financing costs and decisions? These questions are key for understanding the interaction between non-bank financial intermediaries and the real economy. In Kubitza (2023), I address these questions, using data on insurance companies domiciled in the United States.

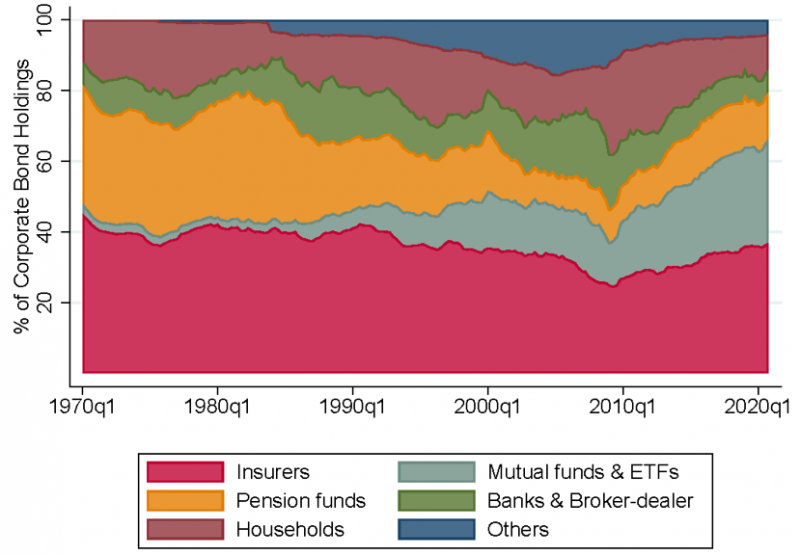

Corporate bonds are primarily held by institutional investors, such as insurance companies (Chart 1). Compared with (less standardised) bank loans, bond ownership is more dispersed, and investors commonly purchase bonds in the secondary market (where previously issued bonds are traded).3 The traditional view has been that financial markets are highly elastic. This would mean that shifts in investor demand that are unrelated to a firm’s fundamentals would have no significant impact on the firm’s financing costs and decisions. Recent studies challenge this view, documenting that stable funding from bond investors can lower a firm’s financing costs during times of financial stress (Becker and Ivashina, 2014; Coppola, 2022). But how important are these investors in normal times, when financial markets are relatively liquid and firms face relatively few financial constraints?

Chart 1: Corporate bond holdings by investor type

Notes: This chart depicts the share of corporate bond holdings by investor type in the United States after excluding foreign holdings. ETFs are exchange-traded funds. A broker-dealer trades in securities on behalf of its clients and also on its own behalf. Source: Z.1 Financial Accounts of the United States, Release Table L.213.

I use data on more than 1,500 US insurance companies to identify shifts in their bond demand. Insurers hold nearly 40% of US corporate bonds (Chart 1). Their primary source of financing is insurance premiums from households, i.e. payments made by policyholders for protection against losses caused by events such as car accidents or windstorms. Higher premium income, for example owing to increased salience of risks stemming from natural disasters, leads to more bond purchases by insurers in the secondary bond market. Given the magnitude of insurance premiums – which amounted to approximately USD 1.7 trillion in 2019 in the United States – changes in premium income correspond to significant shifts in insurers’ demand for financial investments, especially corporate bonds.4

The set of firms that insurers invest in (their “investment universe”) tends to remain virtually the same over time. In fact, insurers are nearly 14 times more likely to make new purchases of a firm’s bonds if they have invested in that firm previously. Building on this evidence, I use the insurance premiums collected by US insurers that have been past bondholders of a firm to isolate shifts in the insurance sector’s demand for that firm’s bonds.

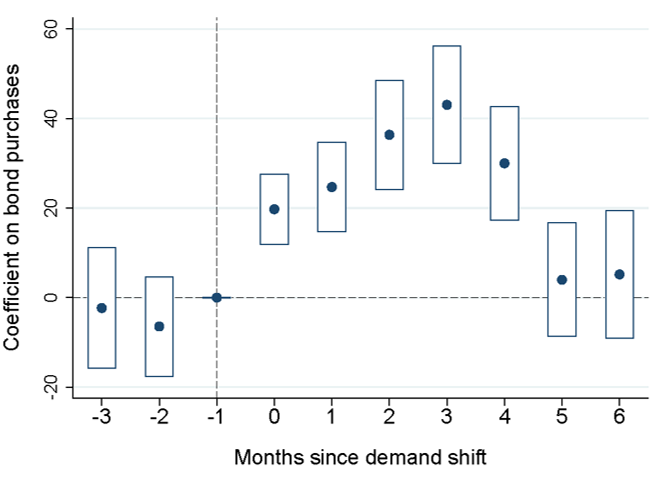

It seems unlikely that a firm’s investment opportunities would correlate more with households’ insurance take-up when insurers have previously invested in that firm. Under this assumption, fluctuations in insurance premiums – and resulting bond purchases by insurers – would be unrelated to the investment opportunities of the firms that insurers invest in. Several observations do in fact support this assumption. For example, bond prices in the secondary market increase significantly following an increase in insurers’ bond purchases that is driven by insurance premium growth (Chart 2). The price dynamics rule out the possibility that these results reflect changes in firm-driven bond supply (which would reduce prices) rather than insurer-driven bond demand. As bond prices rise, firms’ financing costs in the primary bond market (where new bonds are issued) decrease.

Chart 2: Secondary market bond prices and insurers’ bond demand

Notes: The chart depicts price dynamics in the secondary market for bonds of firms that see an increase in purchases of their bonds resulting from premium income increases in months 0, 1 and 2, relative to bonds of other firms. Specifically, it plots the estimated price impact (dots) and its 90% confidence interval (boxes) in basis points when insurers purchase an additional 1% of a firm’s outstanding bonds in the quarter of months 0, 1 and 2. The estimates are based on regressions of the cumulative return on bonds in the secondary bond market (computed relative to month -1) on insurers’ bond purchases as a share of the firm’s outstanding bond debt, using insurance premiums as an instrumental variable.

Firms are highly responsive to positive shifts in insurers’ investment demand. When, driven by strong insurance premium growth, insurers conduct additional purchases amounting to 1% of a firm’s outstanding bonds, the firm’s bond debt grows by roughly 6 percentage points (or 0.29 standard deviations) faster. Thus, firms tend to exploit favourable financing conditions to borrow more in the corporate bond market.

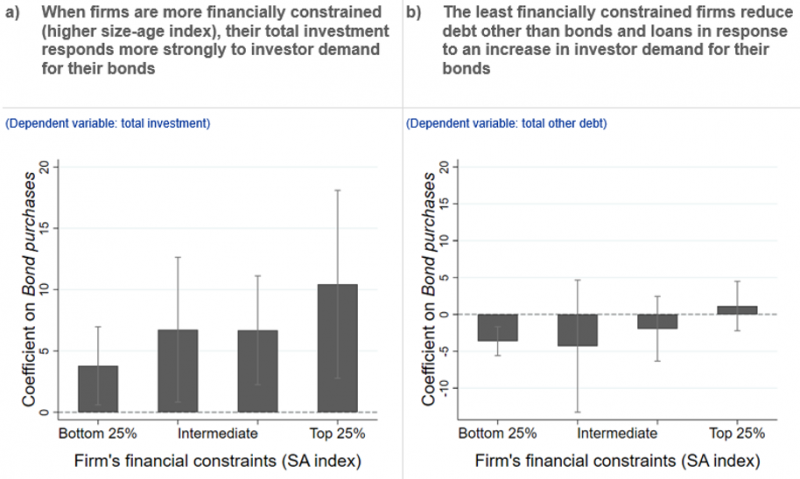

An important question is whether firms use the additional funding to replace other forms of debt (e.g. bank loans) or to boost investment. My results show that firms’ financial constraints have a significant effect on their behaviour (Chart 3). Smaller and newer firms are typically more financially constrained and, thus, are less able to seize profitable investment opportunities ex ante. I find that these firms use the additional funding to significantly boost their investment activities, such as acquisitions. By contrast, the least financially constrained firms use the additional funding to pay off other debt that is likely more costly than bonds or bank loans, such as asset-backed securities.

Chart 3: Firms respond differently depending on their financial constraints

Notes: The chart depicts the response of a non-financial firm’s (a) total investment and (b) total “other debt” to the insurance sector’s premium income-driven bond purchases. Specifically, it plots the estimated coefficients and 90% confidence intervals (shown by the whiskers) for bond purchases relative to outstanding bonds (using insurance premium growth as the instrumental variable) separately for firms in different cross-sectional quartiles of the size-age (SA) index from Hadlock and Pierce (2010) in regressions with (a) total investment and (b) total “other debt” as the dependent variable. A larger SA index indicates tighter financial constraints. Total investment is the sum of acquisition expenditures and capital expenditures. Total “other debt” is total debt outstanding less bonds, commercial paper, capital leases and bank loans.

Finally, while mildly constrained firms mostly use the funding to increase their investment, unlike other firms they experience a negative stock price reaction. A possible explanation for this result is that favourable financing conditions allow the managers of mildly constrained firms to pursue less profitable investment projects, e.g., “pet projects”, that shareholders might object to – i.e., free cash flow problems (Jensen, 1986).

In summary, the results suggest that the implications of shifts in bond demand differ greatly across firms. On the one hand, increases in bond demand can ease financing frictions for very constrained firms. On the other hand, they may also exacerbate free cash flow problems for mildly constrained firms.

As non-financial firms are becoming increasingly reliant on bond financing, it is imperative to understand the role of bond investors in corporate decisions and economic activity. This research reveals that investors, through their impact on bond prices, can have a significant influence on the financing and investment decisions of non-financial firms.

Thus, while the transition from bank-based to market-based economies may diminish the influence of banks on firms, it likely amplifies the importance of investor demand. The scale and efficiency of investors’ influence hinges to a great extent on their impact on prices in financial markets, as well as the nature and intensity of the financing constraints that non-financial bond issuers are subject to.

Because bond issuers are typically less credit constrained than bank-reliant firms (Cantillo and Wright, 2000), a larger investment response might be expected to loan supply shocks than to bond investor demand shocks. However, aggregate effects of investor demand also depend on bond market liquidity, the share of firms with bond market access and the impact of bond investor demand on firms’ propensity to enter the bond market. In economies with a growing bond market, such as the euro area (Darmouni and Papoutsi, 2022), investors may have a particularly strong impact on bond prices and firms may be eager to expand their bond financing, suggesting that investor demand may be highly important even though a large share of firms currently rely on bank financing.

Becker, B. and Ivashina, V. (2014), “Cyclicality of credit supply: Firm level evidence”, Journal of Monetary Economics, Vol. 62, pp. 76-93.

Berg, T., Saunders, A. and Steffen, S. (2021), “Trends in corporate borrowing”, Annual Review of Financial Economics, Vol. 13, pp. 321–340.

Bolton, P. and Scharfstein, D. S. (1996), “Optimal debt structure and the number of creditors”, Journal of Political Economy, Vol. 104, pp. 1-25.

Cantillo, M. and Wright, J. (2000), “How do firms choose their lenders? An empirical investigation”, Review of Financial Studies, Vol. 13, pp. 155-189.

Coppola, A. (2022), “In safe hands: The financial and real impact of investor composition over the credit cycle”, Working Paper.

Darmouni, O. and Papoutsi, M. (2022), “Europe’s growing league of small corporate bond issuers: New players, different game dynamics”, VoxEU Column, 8 July 2022.

Hadlock, C. J. and Pierce, J. R. (2010), “New evidence on measuring financial constraints: moving beyond the KZ index”, Review of Financial Studies, Vol. 23, pp. 1909-1940.

Jensen, M. C. (1986), “Agency costs of free cash flow, corporate finance, and takeovers”, American Economic Review, Vol. 76, pp. 323-329.

Kubitza, C. (2023), “Investor-driven corporate finance: evidence from insurance markets”, Working Paper Series, No 2816, ECB.

Source: Federal Reserve Economic Data (FRED database) from the US Federal Reserve Bank of St. Louis.

Non-financial firms’ debt securities amounted to 11% of total debt securities and loans combined in the euro area in the fourth quarter of 2022, according to the Quarterly Sector Accounts published by the ECB.

The US secondary bond market boasts a total daily trading volume of nearly USD 40 billion. US insurance companies purchase 62% of their bond holdings in the secondary market. Previous studies emphasise that dispersed bond ownership is an important difference between bonds and loans (e.g. Bolton and Scharfstein, 1996).

Premium income varies based on factors such as socioeconomic characteristics, and it increases significantly for property & casualty insurers after natural disasters.