This policy brief is based on the paper: Malovaná, S., Hodula, M., Gric, Z., Bajzík, J. (2023): Borrower-Based Macroprudential Measures and Credit Growth: How Biased is the Existing Literature? Journal of Economic Surveys (forthcoming). The views expressed are those of the authors and not necessarily those of the Czech National Bank.

This policy brief presents the main findings of Malovaná et al. (2024) where we analyze over 700 estimates from 34 studies on the impact of borrower-based measures (such as loan-to-value, debt-to-income, and debt-service-to-income ratios) on bank loan provision. Our dataset reveals notable fragmentation in the literature concerning variable transformations, methods, and estimated coefficients. We run a meta-analysis on a subsample of 422 semi-elasticities from 23 studies employing a consistent estimation framework to draw an economic interpretation. We confirm strong publication bias, particularly against positive and statistically insignificant estimates. After correcting for this bias, the effect indicates a credit growth reduction of -0.6 to -1.1 percentage points following the occurrence of borrower-based measures, significantly lower than the unadjusted simple mean effect of the collected estimates.

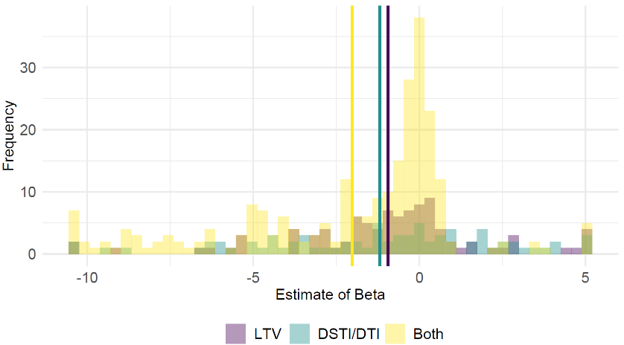

Despite the growing use of macroprudential borrower-based measures (such as loan-to-value, debt-to-income, and debt service-to-income limits), there is limited consensus on how well the toolkit works in practice. In fact, the empirical literature has so far not fully succeeded in rigorously quantifying the effects of various borrower-based measures on bank lending and has displayed significant fragmentation in terms of the estimated coefficients (Figure 1). The interest in the effect of borrower-based (loan-targeted) measures on bank lending is natural, given the regulation directly targets bank credit. In fact, domestic bank credit growth is often seen as the intermediate target of macroprudential policy because of its direct link to boom-bust financial cycles (Schularick and Taylor, 2012).

Figure 1: The Mean Effect of Borrower-based Measures on Annual Credit Growth Is Negative

Note: The figure showcases a histogram of the estimated beta for all collected estimates on the relationship between bank annual credit growth and borrower-based measures expressed as index or dummy variable (see equation 1). The beta gives percentage point change in annual credit growth in response to one-unit increase in the borrower-based index or dummy. LTV stands for loan-to-value ratio; DSTI/DTI stands for debt service-to-income ratio or debt-to-income ratio; both stands for measures encompassing multiple borrower based measures. The solid vertical lines indicate the mean of winsorized estimates; collected estimates are winsorized at 2.5% from each side.

We assign a pattern to the observed differences in the estimated effect of the impact of imposing borrower-based measures on bank loan provision. To this end, we collect more than 700 estimates of the semi-elasticity from 34 articles. To explain the differences, we collect an additional 24 variables that reflect the context in which the estimates were produced. With this newly created database, we first derive the “average” effect of LTV, DTI and DSTI limits on bank lending when used individually and in combination with one another. Since the borrower-based measures are becoming a standard policy tool to address imbalances in the residential mortgage loan market, the estimated average (general) effect of individual tools could be of value to policy practitioners when deciding over the regulatory policy placement. However, beyond average effects, the policy makers, lenders, and the public at large are keen to better understand the heterogeneity in the effects. Therefore, we explain why the estimates from the literature vary across different studies and describe what the most commonly employed empirical strategy is. We then use state-of-the-art meta-analytic techniques to estimate the true effect of imposing borrower-based measures on bank lending, as well as the model averaging methods used to identify the significant drivers of the heterogeneity of the observed estimates.

In taking a panoramic view of the collected estimates, we expose three stylized facts. First, the average estimated effect of borrower-based measures on annual bank credit growth is negative with a mean value of -1.6 pp but can vary widely as the estimates range from -8.8 pp to 3.1 pp at the 5% level of significance. Since most studies work with dummy-type indices to capture the regulatory change, the identified effect does not refer to the intensity or binding nature of the measure taken, but only to its introduction or change. Second, the mean effect of imposing value-based individually (LTV) and in combination with income-based (DTI, DSTI) limits on bank lending is observably different in terms of size of the reported coefficient. Reported estimates of the joint impact of LTV, DTI and DSTI limits are found to be more than two times higher than those of applying just the LTV limit. We find the application of DTI and DSTI limits to reduce the credit growth more than the LTV limit. Third, more recent studies report more negative estimates of the impact of borrower-based measures on bank lending, but it is not clear whether the observed trend reflects change in the strictness of the regulation or improved data and techniques used by more recent studies.

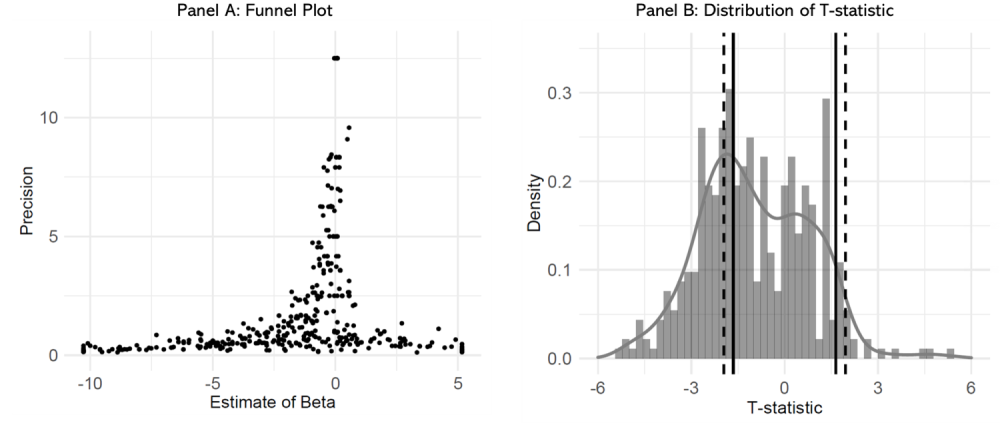

Meta-analysis also allows us to correct for the presence of publication bias, another potential problem associated with the average estimated effect. Publication bias arises when researchers do not publish all their estimates, but only those that are significant or with the “correct” sign (Stanley, 2005). In the context of the effect of borrower-based measures on bank lending, it is safe to assume that the expected sign is negative. Given numerous possibilities in both, the study design and the choice of a proper estimation approach, one can always “try harder” to find significant or “correctly signed” estimates (Card and Krueger, 1995; Stanley et al., 2013). To test and correct for publication bias, we use a battery of state-of-the-art statistical tests. We find that researchers strongly prefer negative estimates and discard positive ones (Figure 2). The bias-corrected coefficient is almost half the size of the uncorrected mean of the collected estimates. This shows that the literature generally overestimates the negative effect of borrower-based measures on bank lending. The documented publication bias is found to be driven by semi-elasticities that have the “correct” negative sign and are “just” significant at the 10% level. In other words, researchers over-report negative significant estimates and under-report positive significant ones. Interestingly, we also identify over-reporting of positive non-significant estimates, suggesting that researchers are “just fine” to report a positive effect as long as it is not statistically significant.

Figure 2: Positive and Insignificant Estimates Are Under-reported

Note: Estimates are based on a sample that encompasses 422 observations drawn from 23 studies. Panel A: Precision is calculated as an inverse of standard error. In the absence of publication bias the funnel should be symmetrical around the most precise estimates. We exclude estimates with extreme magnitude or precision from the figure but include all in the regressions. Panel B: The vertical lines denote the critical value associated with 5% (dashed line) and 10% (solid line) statistical significance. We exclude estimates with large t-statistics from the figure but include all in the regressions. In the absence of publication bias the distribution of the t-statistics should be approximately normal.

Of course, the mean effect may conceal important differences in the context in which the coefficients are obtained. Using Bayesian and frequentist model averaging methods, we indeed show that certain study characteristics are systematically associated with reported results. The most important are the ones related to model specification, estimation methods, and data characteristics. Among other, our results points to the presence of a strong endogenenity bias related to the estimation of the effects of borrower-based measures on bank lending. Endogenenity of credit and macroprudential policy biases estimates towards zero. We find that studies that took measures to assure exogenenity of the policy shock are found to report more negative estimates. This may be linked to our another finding that studies using confidential data also report more negative effect. Confidential data are usually capturing development at the level of a single entity or a product (e.g. bank, firm or loan) and studies using such data can in theory be more successful than others in correctly identifying exogenous regulatory shocks. We further find that contemporaneously specified models deliver lower negative semi-elasticity estimates than those specifying lagged model, suggesting that the impact of the measures takes time to materialize (at least in the data).

Our paper contributes to the rich empirical literature on the effects of macroprudential policy measures. Most widely cited papers in the relevant literature build on cross-country data and capture the occurrence of macroprudential policy measures (including the borrower-based measures) using dummy-type indices (Lim et al., 2011; Kuttner and Shim, 2016; Cerutti et al., 2016; Akinci and Olmstead-Rumsey, 2018). Studies typically find that the application of macroprudential measures lower the real credit growth rate and slow-down house price growth. While the dummy-approach allows to compare the effects of regulation across countries, it falls short on capturing the intensity of the given measure. For instance, decreasing the LTV limit from 100% to 80% is treated the same as changing the limit from 80% to 70%. This may cast doubt on the ability of the literature to correctly estimate the effects of macroprudential policy. However, even intensity-adjusted indices are not without flaws as they are unavoidably subjective and failing to capture the binding nature of the policy shock.

This is where a synthesis of the literature, such as ours, provides an important service to the field – by putting together estimates from different studies, meta-analysis can estimate the average effect of regulation as well as to examine the systematic dependencies of reported results on study design and to filter out the effects of misspecifications. It thus informs the policymakers and a wider professional public on the effects of macroprudential policy measures. The cross-country studies are complemented by a second group of papers using micro-level evidence, mostly based on the use of one or few policy tools in a single country. While the micro-founded evidence offers more precise estimates of the effects taking place, it represents a single-country perspective at the very best (Igan and Kang, 2011; Acharya et al., 2020; Hodula et al., 2023). The meta-analytical summary can then serve as a benchmark against which country-specific studies may assess their estimates.

Our meta-analytical evidence has important policy implications. Overall, the empirical summary of the literature provided in the paper shows that borrower-based measures are effective policy tools in terms of directly restricting (mortgage) credit growth. However, we find that the existing negative estimates are systemically exaggerated due to the presence of publication selection and insufficient identification power of the employed modelling framework. A central banker, wishing to calibrate the effect of introduction or tightening of borrower-based measures into her stress-testing framework, would have a difficult job finding the correct semi-elasticity value. The evidence provided in the paper can serve as a useful benchmark against which countries – with no historical experience with the use of borrower-based measures – can back up their forecasting or stress-testing models.

Interested readers might also want to refer to our sisterly meta-analysis published in Malovaná et al. (2023) where we collect over 1600 estimates on the relationship between bank capital and lending and construct 40 variables to capture the context in which these estimates are obtained. Accounting for potential publication bias, we find that a 1 percentage point (pp) increase in capital (regulatory) ratio results in around 0.3 pp increase in annual credit growth, while changes to capital requirements cause a decrease of around 0.7 pp.

Acharya, V.V., Bergant, K., Crosignani, M., Eisert, T., McCann, F.J., 2020b. The Anatomy of the Transmission of Macroprudential Policies. Working Paper 27292. National Bureau of Economic Research.

Akinci, O., Olmstead-Rumsey, J., 2018. How Effective Are Macroprudential Policies? An Empirical Investigation. Journal of Financial Intermediation 33, 33–57.

Card, D., Krueger, A.B., 1995. Time-Series Minimum-Wage Studies: A Meta-Analysis. American Economic Review 85, 238–243.

Cerutti, E., Claessens, S., Laeven, L., 2016. The Use and Effectiveness of Macroprudential Policies. BIS Paper No. 86. Bank for International Settlements.

Hodula, M., Melecký, M., Pfeifer, L., & Szabo, M., 2023. Cooling the Mortgage Loan Market: The Effect of Borrower-Based Limits on New Mortgage Lending. Journal of International Money and Finance, 132, 102808.

Igan, M.D., Kang, M.H., 2011. Do Loan-to-Value and Debt-to-Income Limits Work? Evidence from Korea. IMF Working Paper WP/11/297. International Monetary Fund.

Lim, C.H., Costa, A., Columba, F., Kongsamut, P., Otani, A., Saiyid, M., Wezel, T., Wu, X., 2011. Macroprudential Policy: What Instruments and How to Use Them? Lessons from Country Experiences. IMF Working Paper WP/11/238. International Monetary Fund.

Kuttner, K.N., Shim, I., 2013. Can Non-Interest Rate Policies Stabilize Housing Markets? Evidence From a Panel of 57 Economies. BIS Working Papers 433. Bank for International Settlements.

Malovaná, S., Hodula, M., Bajzík, J., & Gric, Z., 2023. Bank Capital, Lending, and Regulation: A Meta-Analysis. Journal of Economic Surveys.

Schularick, M., Taylor, A., 2012. Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870-2008. American Economic Review 102, 1029–1061.

Stanley, T.D., 2005. Beyond Publication Bias. Journal of Economic Surveys 19, 309–345.

Stanley, T.D., Doucouliagos, H., Giles, M., Heckemeyer, J.H., Johnston, R.J., Laroche, P., Nelson, J.P., Paldam, M., Poot, J., Pugh, G., 2013. Meta-Analysis of Economics Research Reporting Guidelines. Journal of Economic Surveys 27, 390–394.