Using an integrated micro-macro model à la Gross and Población (2017), we make a first attempt at gauging the impact of the Covid-19 pandemic on Portuguese households and banks. To this end, we examine how the borrower-based measure, put into place in 2018, might have been successful in dampening the negative economic effects of the pandemic on households’ debt-servicing capacities and thereby onto the banking system. We find that the borrower-based measure leads to (i) a reduction in households’ loss rate (LR), caused by both a decrease in households’ probability of default (PD) and loss given default (LGD), and (ii) an increase in the capital ratio of the banking system, compared with a scenario where these limits are not in place.

The Covid-19 pandemic has deeply affected the Portuguese economy. Â large number of businesses had to close down during several lockdown periods. Despite different support measures put into place by the Portuguese government (moratoria on loans, government-backed loans, lay-offs, etc.), not all businesses were able to survive the crisis, which has led to a reduction in some households’ income and an increase in the unemployment rate. Now that most of the public moratoria have expired, it will become clear which households that hold mortgage debt will be able or not to start servicing this debt again. This is an important question not only in terms of households’ debt sustainability but also for the banking sector, as this might lead to a renewed increase in non-performing loans, also depending on further measures that may be implemented in the meantime.

Based on the macroeconomic projections from Banco de Portugal and using an integrated micro-macro model developed by Gross and Población (2017), our recent paper (Neugebauer et al., 2021) makes a first attempt at gauging the potential impact of the Covid-19 pandemic on Portuguese households and banks. To this end, we examine if the borrower-based measure, which has been put into place in 2018, has been successful in dampening the negative economic effects of the pandemic on households’ debt-servicing capacity and thereby on the banking system. We do this by comparing the respective results with a scenario where the measure is not in place.

The Portuguese borrower-based measure has been put into place in 2018 as a reaction to easing credit standards that were coupled with high levels of indebtedness and low saving rates of Portuguese households. Therefore, Banco de Portugal, as the Portuguese macroprudential authority, has adopted measures that target new loans to households, including mortgages as well as consumer credit. These measures have been issued on 1 February 2018 in the form of a Recommendation, which sets limits to some of the credit criteria that are used by financial institutions when assessing the creditworthiness of borrowers. They target the Loan-to-Value (LTV) ratio, the Debt-Service-to-Income (DSTI) ratio as well as the maturity of new loans and the regular payments of interest and capital. The main aim of this measure is to prevent credit institutions and financial companies from taking on excessive risk when granting credit to households.2

The resilience of borrowers is important in challenging economic environments that are characterized by high uncertainty. The Covid-19 pandemic is an example of such a challenge. The containment measures that the great majority of countries across the globe has implemented to safeguard public health resulted in a synchronized global sudden stop in economic activity. This makes the global Covid-19 crisis unique, as it has negatively impacted both supply and demand (Boissay and Rungcharoenkitkul, 2020). Here, we assess the effectiveness of the aforementioned borrower-based measure in the context of the Covid-19 pandemic. To this end, we conduct a counterfactual analysis that looks at the effectiveness of the measure. In particular, we look at its effect on the loss rate (LR) of borrowers (households) as well as the LR’s respective impact, via potential credit-related losses, on the capital/resilience of credit institutions. Borrowers’ loss rates are estimated in a scenario in which the measure is in place versus a scenario in which it is not, using an integrated micro-macro model as developed by Gross and Población (2017) and applied to Slovakia by Jurča et al. (2020). The effectiveness is analyzed considering each limit separately as well as all limits jointly.

The model employed in this paper requires micro as well as macro data. At the micro level, we use the Portuguese part of the Eurosystem’s Household Finance and Consumption Survey (HFCS) for the year 2017 (most recent available waive). We restrict our sample to borrowing households only.

At the macro level, we collect data on the unemployment rate (seasonally adjusted), nominal compensation per employee, short-term interest rate (3 months), stock price index (Dow Jones Euro Stoxx 50), nominal residential property price index and nominal domestic credit from financial institutions to the private sector at a quarterly frequency for the period 2005Q1 – 2020Q4. These variables feed into the VAR model in Module 1. In the context of the Covid-19 pandemic, we also use the 3-year March 2021 economic projections of Banco de Portugal, from 2021Q1 to 2023Q4.

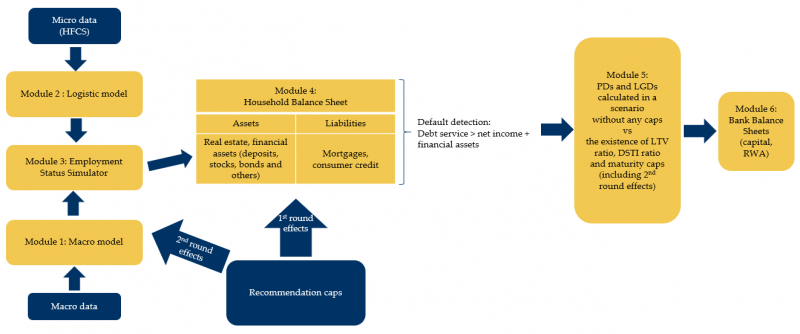

The integrated micro-macro model used in this analysis, which consists of six modules, estimates three risk parameters for households: Probability of Default, Loss Given Default and the Loss Rate. These can be calculated with or without imposing limits on the LTV and DSTI ratios and to maturity, thus making it possible to measure the impact of their implementation. In a first stage, risk parameters, calculated on the basis of micro data, are affected by developments in macroeconomic and financial variables (unemployment rate, residential property prices, stock price index, income per employee – including wages, premia, income in kind paid by employers to employees – and credit to the non-financial private sector) – the so-called 1st round effects. The developments in the macroeconomic and financial variables are based on the March 2021 economic projections of Banco de Portugal. These define the evolution of micro data from each household’s balance sheet (assets and liabilities). In a second stage, the shock to credit demand, caused by imposing limits on credit standards, influences macroeconomic and financial variables, which then in turn have an impact on the risk parameters calculated in the first stage – the so-called 2nd round effects. Figure 1 illustrates the basic structure of the model, showing the different modules and their respective interlinkages. For full details of the modelling approach, see Neugebauer et al. (2021).

Figure 1. Structure of the integrated micro-macro model

We compute the individual and the combined effect of the limits of the borrower-based measure on the households’ LRs. The borrower-based measure is defined here as an LTV ratio cap of 90%, a shocked DSTI ratio cap of 50%, and a maturity cap for mortgage loans of 40 years. Finally, we link the effect on households’ LRs to the capital ratio of the banking system.

The objective of using the Covid-19 scenario is to quantify the expected increase in the resilience of households and reduction in bank mortgage portfolio losses resulting from implementing a combination of borrower-based macroprudential measures.

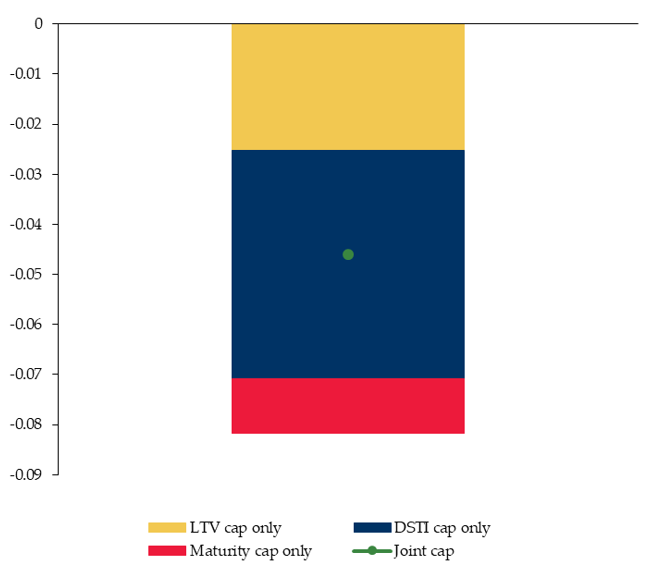

The results, based on an average of 1,000 macroeconomic simulations re-centred around the Covid-19 scenario, point to a reduction in households’ LRs with the borrower-based measure in place. The joint effect of the three caps, in the context of the Covid-19 pandemic, is a reduction in the LR by 0.046 p.p., after taking the 2nd round effects into account (Figure 2).

Imposing the LTV ratio, DSTI ratio and maturity limits separately, after taking the 2nd round effects into account, we also find that the DSTI ratio cap is the one that reduces the borrowers’ LR the most. The LTV ratio cap decreases the LR by 0.025 p.p. The DSTI ratio cap reduces the LR by 0.046 p.p. The maturity cap decreases the LR by 0.011 p.p.

Figure 2. Change in LR after 2nd round effects | In percentage points

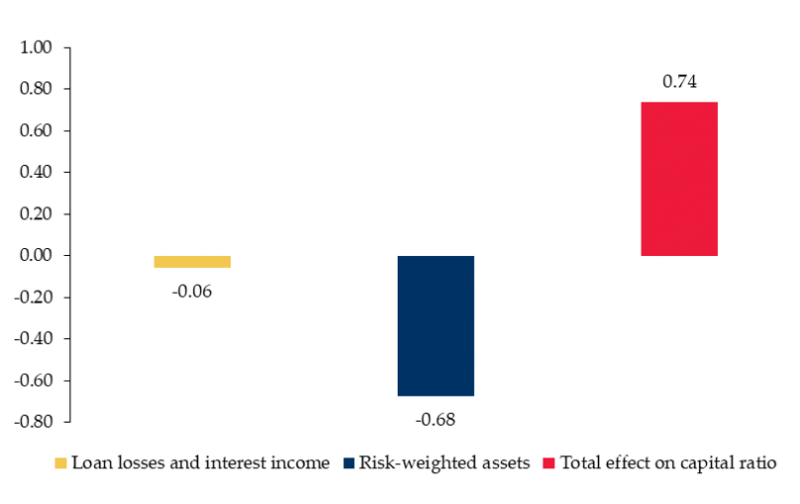

The model also suggests a positive impact of the borrower-based measure on the capital ratio of the banking system in the context of the Covid-19 pandemic. The introduction of the macroprudential measure leads to an increase in the capital ratio of the banking system by 0.74 p.p. (Figure 3).

The introduction of the measure results in a reduction of credit and interest income losses, which increases banks’ capital. Moreover, it leads to a reduction in the risk weights for mortgage loans and a reduction of lending to households with higher risk, given that the credit lending criteria become more restrictive, which decreases risk-weighted assets. The latter effect is particularly strong.

Figure 3. 3-year cumulative change in risk weighted capital ratios | In percentage points

We have aimed at assessing the effectiveness of the Portuguese borrower-based measure in the context of the Covid-19 pandemic, following the methodology by Gross and Población (2017). Our results suggest that the Portuguese borrower-based measure is indeed successful in increasing the resilience of households as well as of the banking system. However, due to the lack of more recent data on the Covid-19 pandemic, results should still be considered as preliminary and more research will be needed once new data becomes available.

Boissay, F. and Rungcharoenkitkul, P. (2020). Macroeconomic effects of Covid-19: an early review. BIS Bulletin, No. 7, April.

Gross, M., Población, J. (2017). Assessing the efficacy of borrower-based macroprudencial policy using an integrated micro-macro model for European households. Economic Modelling Vol. 61, February, Pages 510-528.

Jurča, P., Klacso, J., Tereanu, E., Forletta, M., Gross, M. (2020). The effectiveness of borrower-based macroprudential measures: a quantitative analysis for Slovakia. IMF Working Paper No. 20/134.

Neugebauer, K., V. Oliveira, Â. Ramos (2021). Assessing the effectiveness of the Portuguese borrower-based measure in the Covid-19 context. Banco de Portugal Working Paper 10/2021, Banco de Portugal.

The views expressed in this article are those of the authors and do not necessarily reflect the views of Banco de Portugal nor of the Eurosystem.

For more information on the specificities of the Portuguese borrower-based measure, see https://www.bportugal.pt/en/page/ltv-dsti-and-maturity-limits.