In light of the Covid-19 pandemic and its effects on the economy and financial markets, supervisors and policy makers at the international level are concerned that banks could refrain from using its capital buffers to support lending due to pay-out restrictions following the breach of the combined buffer requirement (CBR). In this note we analyze potential impediments to buffer usability by banks. In particular, possible stigma effects arising from additional tier 1 (AT1) coupon restrictions are discussed as a crucial obstacle to buffer usability leading to a negative spill over effect on the overall bank funding cost and finally to a significant decline in credit supply. We run a series of empirical tests to asses the effects of a shrinking distance to the maximum distributable amount (MDA) threshold which reject the hypothesis that stigma effects are significant. Based on our findings, we reflect on the suggested ways to redesign the capital buffer framework to address possible shortcomings. In this regard, we provide a preliminary assessment of potential policy options, also given that the Basel Committee as part of its longer-term evaluation of the Basel III reforms will review the effectiveness of the buffer framework and in light of the macroprudential review of the European Commission.

The covid-19 pandemic has led to unprecendented challenges. Its overall impact on the economies and on financial markets is far from being known. Recent developments due to second covid-19 waves have darkened the economic outlook, but signs of a sooner recovery are looming given the recent breakthrough in the research of Covid vaccines. Banks have been able to weather the effects of the covid-19 pandemic so far. Higher regulatory capital ratios which were introduced after the great financial crises have been successful in mitigating systemic risks and in strengthening the resilience of the banking sector.

But, the financial stability environment remains challenging, since losses have not fully materialized yet due to unprecedented government measures. It is expected that the phasing-out of support measures will force down banks’s capital ratios in the near future. In this regard, buffer usability will be crucial to avoid unintended deleveraging effects and a credit crunch to the economy.

Concerns at international level exist that banks are not willing to draw on their capital and to dip into their buffers due to possible stigma effects. In this note stigma effects are associated with higher funding costs for banks given an increase in the probability of pay-out restrictions due to shrinking distances to the maximum distributable amount (MDA) threshold.

Falling below the MDA threshold and hence, a breach of the combined buffer requirement (CBR) instead automatically leads to proportional restrictions of profit distributions for dividends/share buybacks, AT1 coupons and bonuses as well as the requirement by banks to establish a capital conservation plan. In the case of losses, it may even result in a de facto restriction of pay-outs, thus preserving capital in the ailing bank. To that effect, capital buffer requirements differ legally from Pillar 1 and Pillar 2 requirements as a breach of the CBR does not require supervisory action.2 In addition, the different nature of the capital conservation buffer, the global and other systemically important institutions buffer, the systemic risk buffer and the countercyclical capital buffer allows designated authorities to address systemic risks effectively.3

The framework, which was put in place in 2014, is now well established and understood by investors. Its consequences are transparent and predictable and they are priced in AT1 instruments and other affected/relevant financial instruments.

Although the legal consequences of an MDA breach are not severe, potential stigma effects are cosidered as possible impediment to buffer usability. Higher funding costs due to stigma effects would ultimately lead to a decline in credit supply with unintended negative repercussions on the real economy.

To assess whether stigma effects of using capital buffers exist and whether these effects are significant, in the first place, we consider recent examples of AT1 coupon cancellations or non-call events and their implications on AT1 fundings costs as well as on banks’ weighted average cost of capital (WACC). In the second place, we run a series of empirical tests to check the hypothesis whether stigma effects are significant.

Banks’ decision to grant loans crucially depends on funding costs. Regarding the current regulation of the buffer framework AT1 coupon restrictions are discussed as one crucial obstacle to buffer usability. Given that additional tier 1 (AT1) is the second highest quality of regulatory capital, it bears risks by discretionary coupon cancellations and by restrictions on distrubutions in case of an MDA breach. On the one hand, coupon cancellations support banks’ common equity tier 1 (CET1) capital ratio, on the other hand, banks may be reluctant to cancel AT1 coupons to preserve both investor confidence and access to funding.

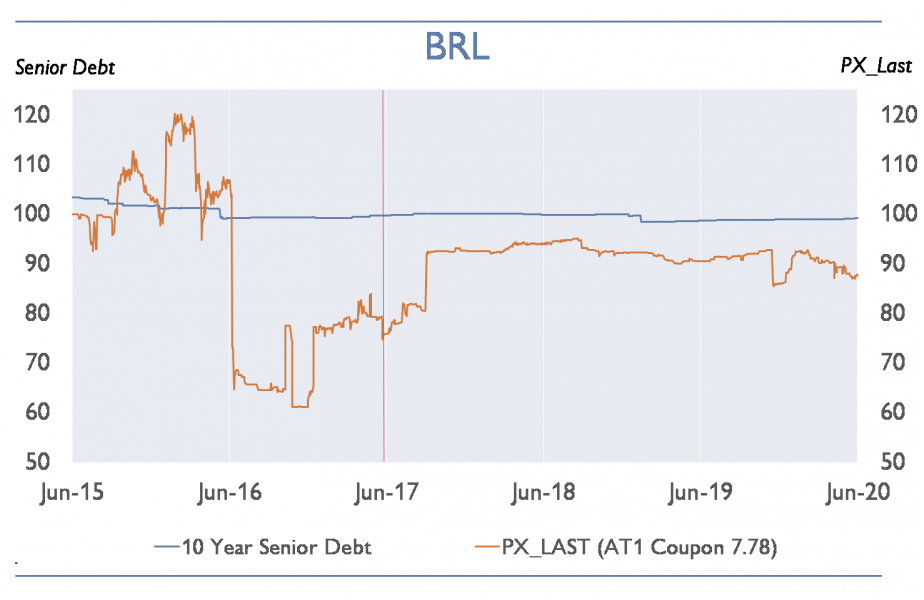

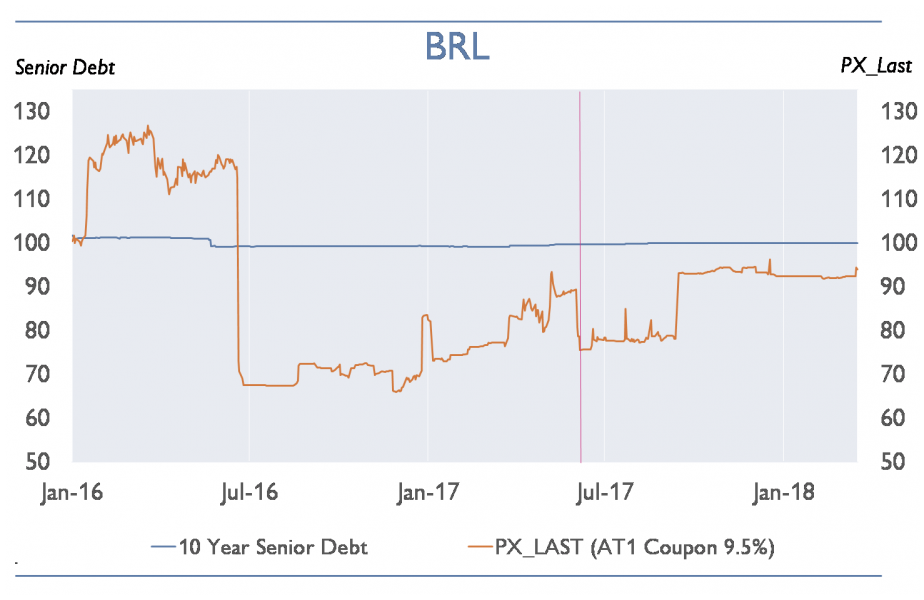

To date, AT1 investors have only suffered a very limited number lossess involving low amounts. This limits the size of our sample. It consists of five AT1 extension events and two other cases. The latter referes to Banco Popular’s capital securities (AT1 and Tier 2), which were written down on June 6, 2017, and Bremer Landesbank’s AT1 coupon cancellation on June 23, 2017. Chart 1 shows that the cancellation of the AT1 coupons by Bremer Landesbank did not lead to significant negative price effects of its outstanding AT1 instruments.4 The ask-price of its AT1 instrument with a 7.78% coupon (left-hand panel of chart 1) recovers within 2 months. The ask-price of the bank’s AT1 instrument with a 9.5% coupon takes four months to recover. The blue lines in chart 1 refer to the price of the bank’s 10-year unsecured senior benchmark bond. It remained stable when the coupons were cancelled.

Chart 1: No significant impact of the coupon cancellation of Bremer Landesbank on the price of its AT1 instruments5 (orange line) or that of its senior unsecured debt instruments (blue line)

|

|

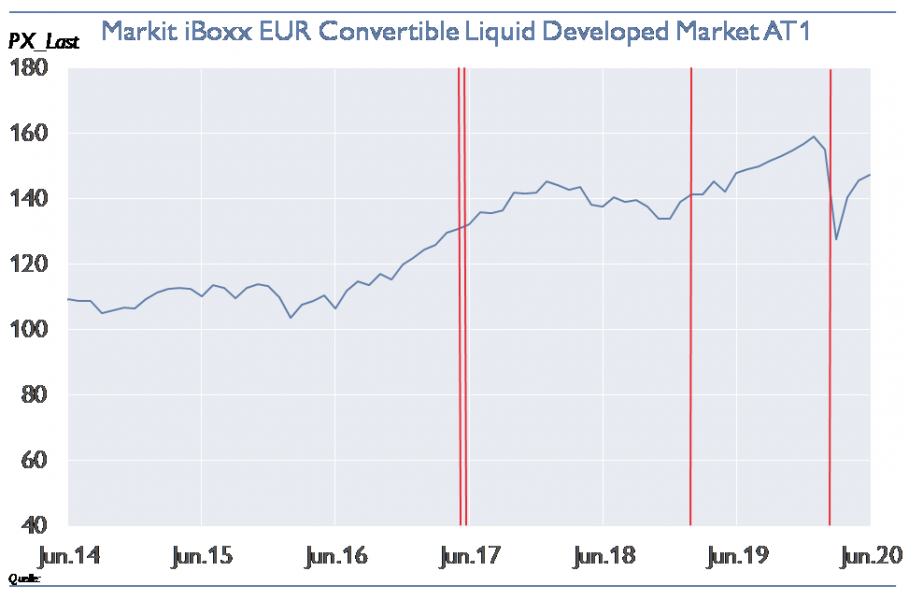

According to the sceptics of buffer usability, both events should have also led to disruptions of the EUR AT1 market, but this market proved resilient. The blue line in chart 3 shows that the broader market even increased in the face of the two events (the two left red vertical lines). According to Fitch, the market’s resilience was due to the more stable and mature market, which had been aided in part by regulatory developments (especially by the increasing macroprudential buffer requirements since 2014), and adequate CET1 ratios at most issuing banks in Europe.6

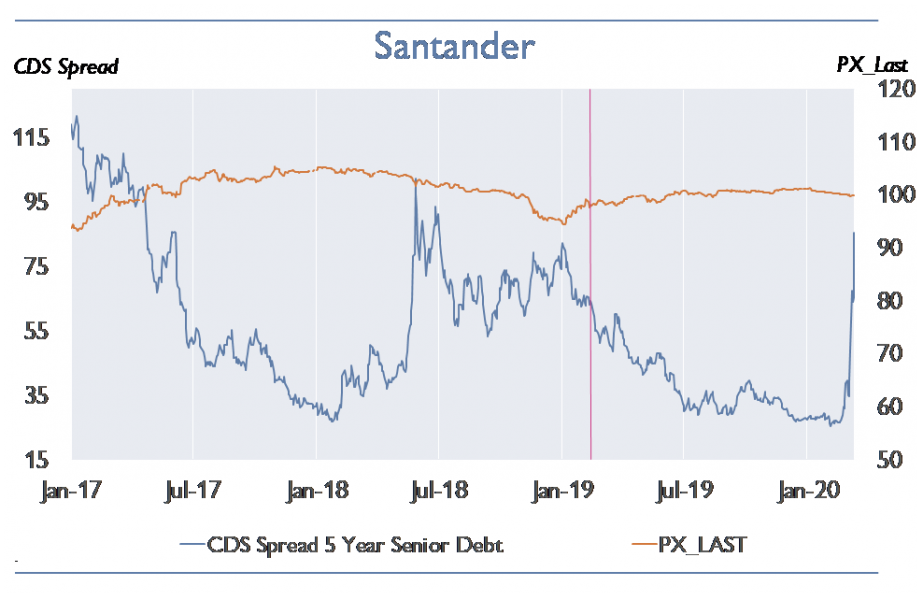

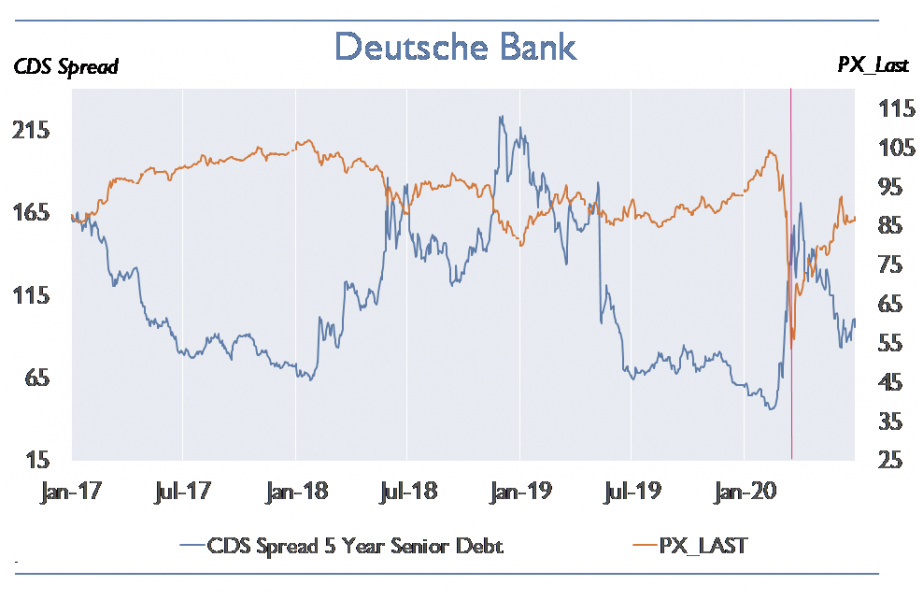

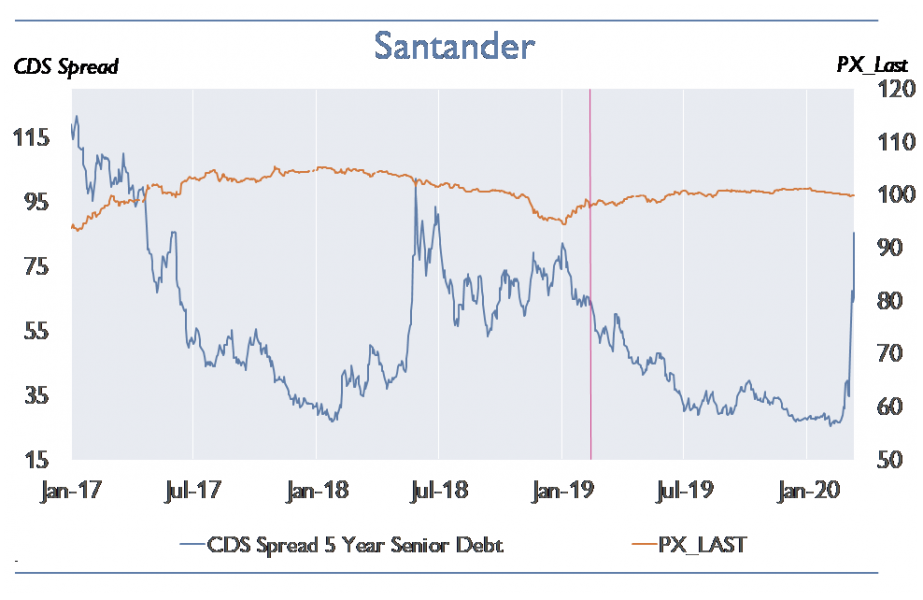

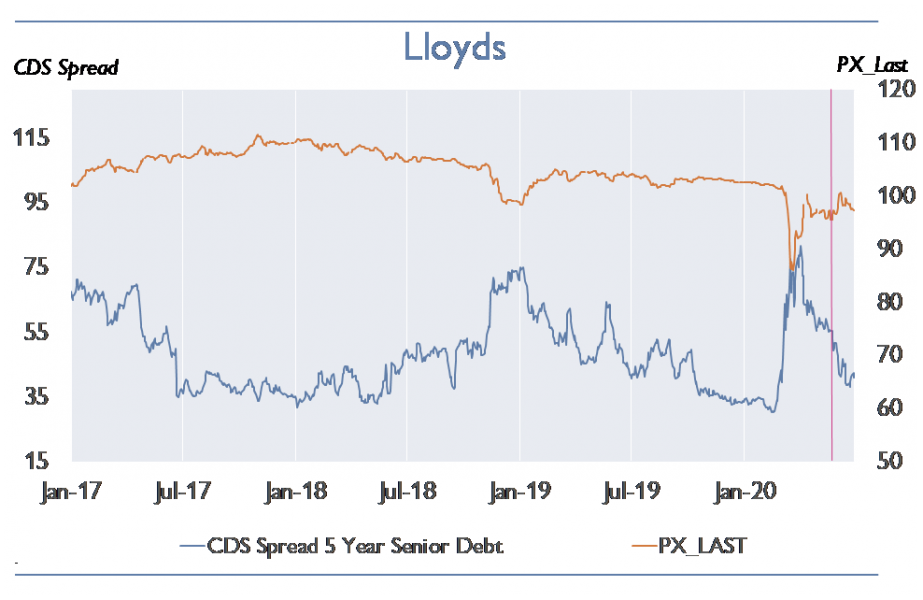

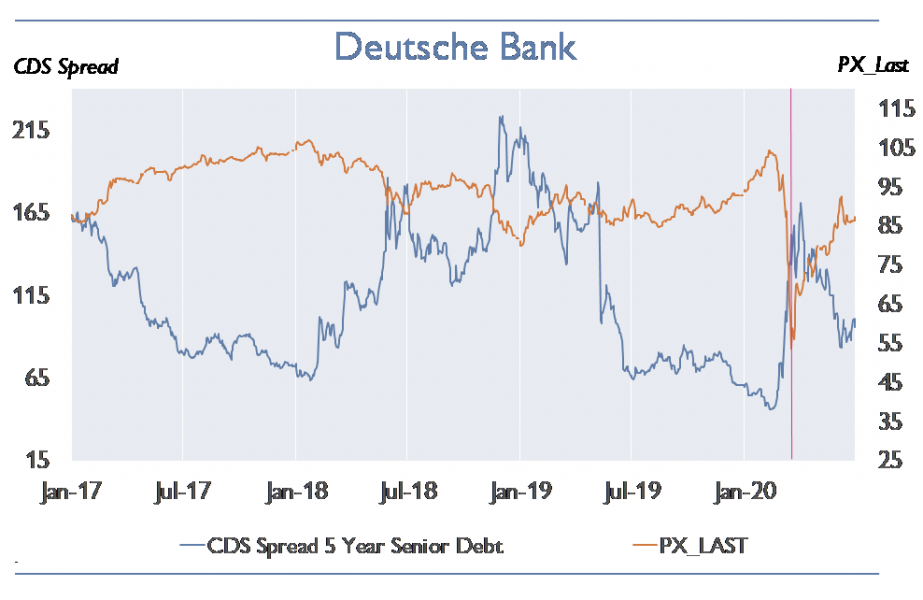

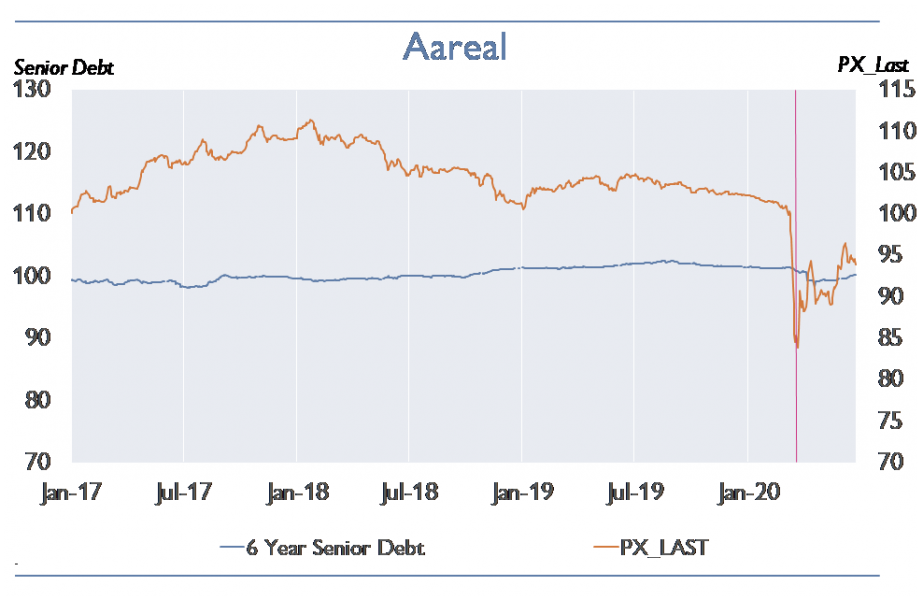

As AT1 instruments are perpetual bonds in Europe, refinancing needs tend to be limited and largely endogenous to the decision of the bank. However, investors expect banks to call at the earliest possible point in time.7 In 2019 Santander (February 12) and in 2020 Deutsche Bank (March 11), Aareal Bank (March 20) and Lloyds (May 22) extended AT1 bonds. Still, the market impact of these AT1 extensions was very limited, with short term price losses of the extended bonds and rather quick price recoveries (see charts in the annex). Santander’s AT1 price (orange line in the left-hand panel of chart 2) remained stable in the face of the extension of the instrument. The price of Lloyds’ AT1 instrument even increased slightly and for a short period after the extension. Also, its 5-year CDS spread decreased after the event. The price reactions for Deutsche Bank (right-hand panel) and Aareal Bank were more pronounced. Since prices have also been affected by the Covid-19 pandemic, it is difficult to determine the exact impact of the extension events. This notwithstanding, both AT1 prices recovered within three months. The CDS spread of Deutsche Bank recovered fully within three months; that of Aareal Bank remained stable. The events did not have a negative impact on the EUR AT1 market (chart 3).

The charts also show that the banks’ unsecured funding costs (proxied by their CDS spreads for their five-year unsecured senior bonds) fell significantly after the banks’ failure to call their AT1 instruments. It seems that the markets think that such action strengthens the respective bank and reduces the probability of default. Holders of AT1 instruments may have lost out but unsecured bond holders benefited.

Chart 2: Price and CDS spread charts of Santander and Deutsche Bank for AT1 with extension events (red line) do not show a significant increase in funding costs

|

|

Chart 3: Impact of coupon cancellations and extensions on AT1 market in a normal market environment

Based on the no-arbitrage principle, the evidence of relatively modest and short-lived increases of AT1 and unsecured bond funding costs implies that there was no funding freeze for the banks in the sample, either.

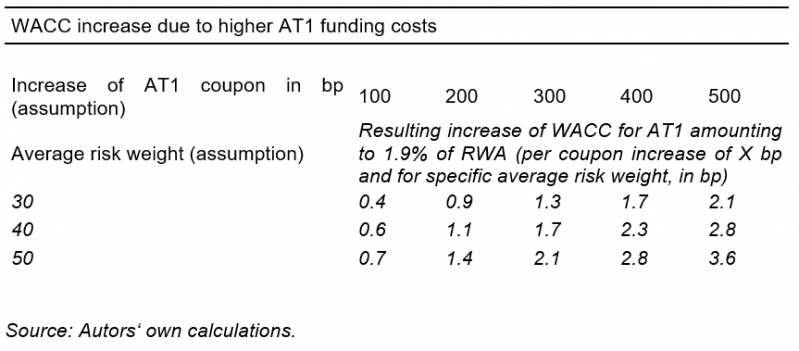

Moreover, the impact on the overall funding costs of banks (weighted average cost of capital, WACC) is very limited. We run an impact assessment to analyse the WACC increases (see table 1 in the annex). Our findings show that these only are modest and range from 0.4 to 3.6 basis points. In an extreme scenario of a 500-basis-point increase in AT1 coupons, an average significant institution will only experience a 2.1- to 3.6-basis-point-higher WACC depending on their average risk weight.8 Such modest increases of the WACC would certainly not prevent banks from providing profitable loans; otherwise, loan spreads would have to increase by 0.4 to 3.6 basis points, which is unlikely to have any macroeconomic effects.9

Consequently, it is more profitable for banks to grant loans even if that implies somewhat higher AT1 funding costs, rather than to forego profitable lending opportunities and lose market share.

In this section, we present the findings of a series of empirical tests which we run to check the hypothesis whether stigma effects are significant.

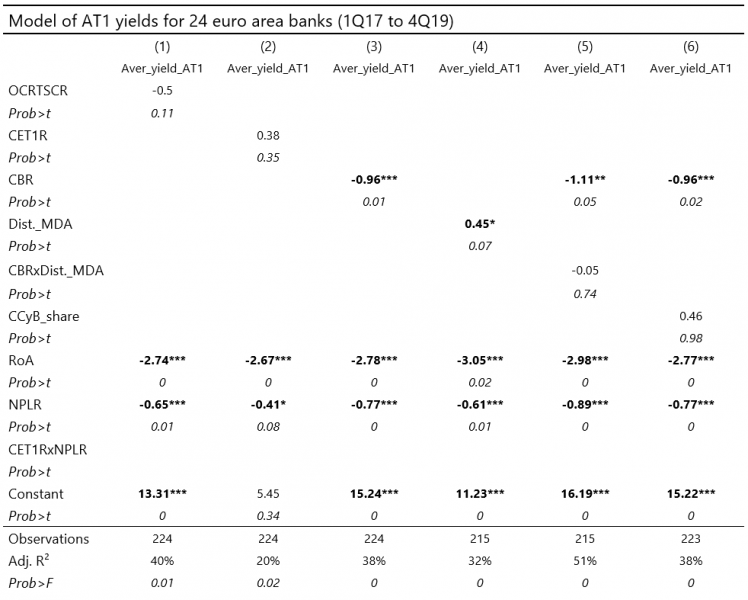

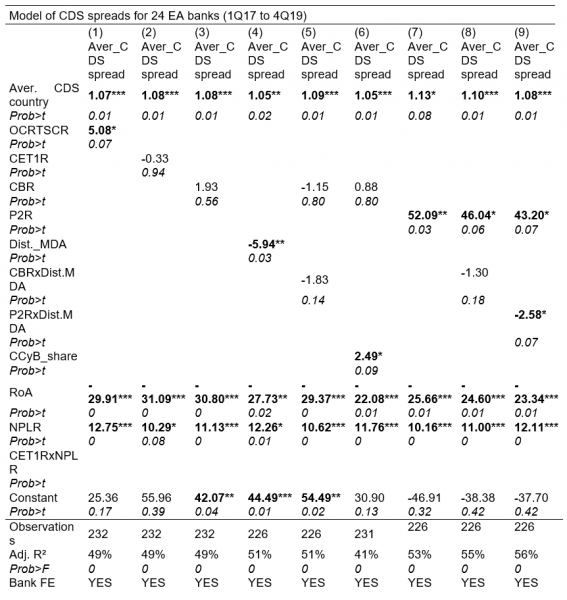

Our sample consists of 24 large euro area banking groups supervised by the SSM10. We used quarterly data from 1Q2017 to 4Q2019 and we applied OLS panel regressions with bank fixed effects without time fixed effects.

We test the following hypotheses:

The impact of a higher CBR on AT1 funding costs might be ambiguous: a higher CBR reduces the probability of conversion/write-down of the AT1 instrument (i.e. due to the automatic stabilizers associated with an MDA breach), which probably reduces AT1 funding costs11; however, for a given level of CET1, a higher CBR might reduce the distance to the MDA and, thus, increase the probability of a coupon cancellation, which could increases bank AT1 funding costs (as cancelled AT1 coupons cannot be recovered in later periods).

Our quantitative analysis shows that a higher CBR reduces the funding costs of AT1 instruments, as the probability of conversion/write-down of AT1 decreases, inter alia due to the automatic stabilizers associated with a breach of the MDA.

Furthermore, our analysis rejects the hypothesis that a lower distance to the MDA and hence, a higher risk of an AT1 coupon cancellation increase banks’ unsecured funding costs, which are more relevant. The distance to MDA does not have a significant effect. The drivers of banks’ AT1 funding costs and of their unsecured funding costs differ, in line with the different ranks in the debt structure of banks in going and gone-concern and in line with the different approaches rating agencies take in rating these instruments.

The hypothesis that a higher share of releasable buffers would reduce AT1 funding costs, or even unsecured funding costs is also rejected (for more details see tables 2 and 3 in the annex).

These findings suggest that the costs of a crisis-induced reduction of the structural components of the CBR outweigh the benefits from both a financial stability and investors’ perspective. Moreover, an ad-hoc release of structural buffers might even increase bank AT1 and unsecured funding costs.

The empirical analysis is based on a small sample. However, it shows that the current debate on the distance to the MDA and its effects on bank behavior are overly simplistic. More empirical evidence for the stigma hypothesis is required, before any ad hoc changes to the established buffer framework should be enacted.

Our findings regarding the impact of the distance to the MDA are corroborated by the analysis of bank ratings issued by rating agencies with respect to the effect of macroprudential buffers on credit ratings.

All three major rating agencies take the distance to the MDA into account when rating AT1 instruments.12 Ceteris paribus, AT1 bonds of banks that are closer to the MDA threshold – for any given level of the CET1 (CBR) – receive a lower rating as they carry a higher risk of coupon non-payment. In addition, Moody’s considers the distance to trigger breach (conversion write-down trigger) when rating high-trigger securities13. In this regard, they include the distance from the bank’s current CET1 ratio to the capital level set as the trigger in their rating model.14 Ceteris paribus, a release of a structural buffer would improve ratings by increasing the distance to the MDA for any given level of CET1, but it would negatively affect the rating if it were accompanied by a lower distance to the conversion trigger (i.e. when banks use the additional space and actually reduce their CET1 ratio).

However, the distance to the MDA does not affect banks’ overall credit rating:

According to S&P, the breach of certain regulatory capital buffers may not automatically affect the issuer credit rating (ICR) or senior bond ratings.15 While S&P agrees on potential positive effects of short-term lower capital levels during the Covid-19 crisis, a weakened prospective capitalization of banks would lower the rating over time.16

As a result, even if AT1 investors would benefit from lower MDA thresholds, this would come at the expense of all other stakeholders. To make matters worse, the automatic stabilization mechanism of MDA restrictions would not become effective as intended and might even reduce prospective capitalization and, hence, ratings. This could lead to a downward spiral with lower bank capital levels, lower ratings and, ultimately, higher refinancing costs (see Schmitz et al., 2019, and the literature cited therein).

As evidence shows, potential yield increases in AT1 instruments due to coupon cancellations or non-call events are relatively small and short-lived. Even during the shock on financial markets in March 2020 caused by the Covid-19 pandemic we could not find any proof for a funding freeze. Moreover, their impact on banks’ AT1 funding costs, and hence, on their Weighted Average Cost of Capital (WACC) is very limited.

In addition, credit substitution effects provide incentives for buffer use because of losing market share while deleveraging rather than deploying buffers in case of high loan demand. Consequently, it is more profitable for banks to grant loans.

In general, empirical evidence shows that banks’ deleveraging is mainly driven by raising capital and reducing interbank and external (non-Euro area) assets20 rather than by reducing profitable lending to the real economy.21 This held true even for the financial crisis.22

Moreover, it is essential to distinguish between idiosyncratic and system-wide loan supply. Even if a bank would decide to reduce profitable loan supply to preserve capital because of a potential stigma, this does not allow for conclusions regarding aggregate loan supply. It is a fallacy of composition to extend the argument of a stigma effect from individual banks to aggregate loan supply: If only a few banks within a banking system are in jeopardy of falling below the MDA-threshold and reduce lending, sound banks will simply fill the gap by providing more loans to the real economy. Only if a majority of banks jointly reach the MDA-threshold, sound banks may not be able to fully substitute the lower credit supply of their competitors. However, there would no longer be a stigma effect when many banks breach the MDA threshold.

As a general point, increasing incentives for banks to raise equity is a defining part of regulatory reform since the financial crisis, i.e., by a regulatory push for subordinated debt (AT1, T2, TLAC/MREL), aimed at reducing the implicit government subsidy of debt and strengthening the risk-sensitivity of bank funding costs. Some impact on risky lending is intentional and wholly appropriate. Denouncing bank incentives to improve capitalization as “disincentives for lending” puts into question the entire current regulatory framework. Strengthened incentives for banks to improve risk-bearing capacity are one of its cornerstones.

Given that the Basel Committee as part of its longer-term evaluation of the Basel III reforms will review the effectiveness of the buffer framework and in light of the macroprudential review of the European Commission, we will reflect on the suggested ways to redesign the buffer framework by providing a preliminary assessment of the potential policy options.

Release of structural buffers, including the Capital Conservation Buffer (CCoB)

Concerns that structural capital buffers are not fully usable in case of need and that banks prefer to deleverage rather than to dip into buffers and to support lending are prompting the debate on temporarily releasing structural buffers. In particular, a full or partial release of the CCoB is considered.

If a release of structural buffers is considered in the medium term, it is important that structural risks can still be addressed appropriately. Therefore, it would be rewarding to introduce accompanying measures as recapitalization plans and an exit strategy for replenishing buffers in a flexible manner.

In addition, it would be important that safeguards are introduced to avoid that banks use the additional headroom for distributions (acquisitions, own trading or external investments) and to ensure that it is used for lending in the euro area.

Moreover, the replenishment of buffers would crucially depend on the applicability of dividend restrictions (either the automatic stabilizers in the case of buffer use or dividend restrictions in the case of buffer releases).

In our view, releasing structural buffers would have several shortcomings compared to a simple buffer usage within the existing framework. There is broad consensus that banks should preserve capital in times of crisis. Prudent lending and ensuring financial stability are of high value, hence, the quality of lending is relevant, too. Buffer use and lending should not be pursued at any price.

As long as hard evidence on impediments to buffer usability has not been found and signs of a credit crunch have not materialized so far, a release of structural buffers23 should be considered carefully. Especially, if accompanying measures and safeguards were not introduced, we do see the risk of an even more severe systemic crisis in the medium to long term.

In line with the BCBS, we strongly believe that banks should use their buffers to absorb losses and maintain profitable lending in times of crisis. The use of capital buffers in times of crisis is intended to strengthen the stability of the banking system.24 Under the current framework, the consequences of dipping into the CBR are an essential feature to foster the risk-bearing capacity of banks in going concern (suspension of dividends, AT1 coupons, bonuses for top management or share buy-backs) and to avoid a further reduction of capital.

However, during the Covid-19 pandemic some countries have lowered structural buffers or the CCoB (e.g. in Brazil, the central bank reduced the CCoB from 2.5% to 1.25% for one year25). Releasing the CCoB was regarded as one promising option to address the lack of countercyclical capacity for macroprudential authorities (only a few countries have introduced anticyclical capital buffers since the Global Financial Crisis, so that the possibility to lower these buffers was quite low during the pandemic).

A larger share of releasable buffers in the medium term

A rebalancing of cyclical over structural buffers is seen as an option to create more macroprudential space in the medium term. This policy option is intended to enhance the potential of macroprudential policy to support the real economy in times of stress and to better smooth the effects of events like the Covid-19 shock.

However, we do not see only merits in reshuffling to more releasable buffers. Until now, there is no evidence that banks lend more when buffers are released. Based on our empirical analysis, we did not find any evidence that a larger share of releasable buffers has a positive impact on banks’ AT1 funding costs, or even unsecured funding costs.

In this regard it is questionable whether this policy option would be an appropriate measure to address potential stigma effects. Especially, if structural buffers were reduced permanently, the lack of addressing structural risks in the framework could have negative consequences on financial stability and hence on banks’ funding costs.

In addition, we are not convinced that a larger share of releasable buffers is better suited to provide predictability of changes in capital requirements as frequent changes in regulatory requirements stand in clear contrast to predictability as it increases regulatory uncertainty and compliance costs. In turn, predictability is key for investors’ confidence, especially in times of crisis.

Thus, if a rebalancing is considered in the medium term, it should be pondered carefully based on a thorough impact assessment. As stated above, a clear mechanism for the timely replenishment of capital buffers would be necessary to support banks’ willingness to use buffers and to ensure stability and predictability. Moreover, it would be important that the release of the CCoB is accompanied by safeguards to ensure that the freed capital is used for lending and not for distributions.

Restrictions on dividend distributions

In the EU, the SSM26, the ESRB27 and the EBA28 have issued recommendations for banks not to pay dividends during the Covid-19 pandemic. These recommendations were released after the SSM alleviated the capital composition of the P2R.29 During the pandemic many banks argued with harmful stigma effects when using their buffers, while at the same time banks decided to pay out dividends.

Given this discrepancy, under the current framework it would be important that a release of structural macroprudential buffers is accompanied by dividend restrictions. Especially in times of crisis, there is a need to maintain sufficiently high capitalization to bear future losses and to prevent social suboptimal risk-taking behavior of banks.

Payout-restrictions improve the effectiveness of buffer releases by preserving capital in the system and by increasing the likelihood that freed capital is used for lending. This could also be the case regarding a release of countercyclical capital buffers.30 On the contrary, if pay-outs were not suspended, the beneficial effects of a release on credit supply would be offset.31

In addition, system-wide restrictions are non-discriminatory blanket measures32 that could eliminate the collective action problem and reduce stigma, thereby increasing the likelihood that the capital buffers will be used.33 However, restrictions can only be a short-term measure and they would have several drawbacks.

First, pay-out restrictions do not fit into the overall framework. A system-wide ban as a stand-alone measure would be stricter than the current proportionate framework that foresees a step-wise escalation mechanism throughout the capital stack [i.e. sanctions reaching from moral suasion (P2G), proportionate dividend restrictions (macroprudential buffers) up to the withdrawal of a banking license]. Nevertheless, recent examples show that supervisors seem to prefer to lower the MDA threshold and combine it with restrictions on dividend distributions instead of letting the automatic MDA mechanism work.34

Second, system-wide restrictions on dividends would not distinguish between sound and troubled banks and, thus, could create moral hazard. Banks would have less incentives to stay above the MDA threshold and they could be incentivized to distribute more in normal times, especially if they anticipate general dividend restrictions, which then would leave them particularly ill-prepared for a systemic crisis event.

Third, restrictions are likely to increase the cost of equity for European banks. In contrast to a coupon cancellation for AT1 investors, for equity investors, restrictions only imply a suspension of dividend payments. Dividends can be cumulative so that investors receive them at a later date. Nonetheless, a dividend ban could be perceived as a negative signal. Uncertainty increases and capital instruments could become less attractive to investors, which would be reflected in lower stock market prices.

In particular, when a shock is expected/already materializing (as was the case with Covid-19 in March 2020), bank shareholders might have an incentive to reduce their exposure to bank losses, as PTB ratios are often below 1. This became evident recently when the ECB recommended that banks refrain from dividend payments35.

Based on this, releasing buffers combined with restrictions on dividends seem to go with higher bank funding costs in the medium to longer term.

As stated above, we do not see any evidence that a potential reluctance to use buffers is driven by stigma. Based on this, the most prudent policy option would be to let the current MDA framework continue to act as an automatic stabilizer by preserving capital within the banking system.

Discussion on the role of AT1 instruments in the medium to long term

In addition, the role of AT1 in the capital stack and the distinction between going- and gone-concern capital instruments will be under consideration in the medium to long term.

In this regard, the conversion/write-down threshold for AT1 instruments, which in most cases equals 5.125% of CET1, could be seen as too low since AT1 instruments will only be converted/written down in gone concern and not in going concern.

At this low level of CET1 capital, the franchise value of the respective bank would be quite small (debt overhang problem) so that equity holders’ incentives to recapitalize the bank would be very low.

Concerning this, one possible option would be to raise the conversion/write-down threshold for AT1 instruments so that AT1 can be used in going concern or, a second option to generally phase out AT1 instruments. But, the latter should only be considered as a measure of last resort.

If a phasing out is considered in the medium term, we deem it advisable to beforehand assess which impact such a phase-out would have on shareholders’ incentives to recapitalize the bank in the face of decreasing capitalization.

The phasing out of AT1 instruments would only be a prudent policy option if and only if there were empirical evidence for the stigma effect and its significantly negative impact on aggregate credit supply.

Policymakers should be careful when taking this serious step as this could open a Pandora’s box of regulatory forbearance. The same would be the case if the MREL/TLAC requirement were breached (costs of issuing MREL/TLAC under stress). Consequently, subordination and senior non-preferred debt requirements would be at stake with the potential of thwarting major efforts that have been made in establishing a functioning resolution framework to date.

Moreover, lowering the MDA threshold by structural capital buffer releases (discussed above) could be interpreted as supervisory protection of AT1 holders. Policymakers are currently even considering temporarily excluding AT1 pay-out restrictions, which would explicitly protect and subsidize AT1 holders. However, a preferential treatment of AT1 holders would undermine the risk-bearing capacity of these instruments in going concern and could perpetuate investors’ perception that AT1 instruments are debt like and not equity like.

In this note we analysed potential stigma effects associated with the breach of the combined capital buffer requirement in the current pandemic and potencial policy proposals for changes to the existing buffer framework in the medium term.

Our findings suggest that using capital buffers is more profitable for banks than deleveraging and losing profitable market share. Recent examples show that potential yield increases in AT1 instruments due to coupon cancellations or non-call events are relatively small and short-lived. Moreover, their impact on banks’ AT1 funding costs, and, hence, on their weighted average cost of capital is very limited.

In addition, we run a series of empirical tests which reject the hypothesis that stigma effects are significant: A higher CBR reduces the funding costs of AT1 instruments. The distance to MDA as well as the share of releasable buffers (in the CBR) do not have a significant effect on AT1 or unsecured debt funding costs.

In general, the current framework should not be diluted further during the crisis. Strengthened incentives for banks to raise equity have proved to be a cornerstone of regulatory reform since the financial crisis. This was evidenced by a regulatory push for subordinated debt (AT1, T2, TLAC/MREL), which reduces the implicit government subsidy of debt and enhances the incentive structure by improving the risk-sensitivity of bank funding costs.

As stated by the Group of Central Bank Governors and Heads of Supervision (GHOS) on 30 November 2020 using capital buffers should take priority at present and the macroprudential framework should be maintained. During times of crisis, this is the most prudent policy option. Any quick fixes to the regulatory buffer requirements – even if only applied temporarily – would be detrimental to our common goal to promote stability and predictability. This is supported by our analysis and arguments put forth in this note and was repeatedly emphasized by the BCBS.

If a rebalancing of cyclical over structural buffers is considered in the medium term, a thorough impact assessment would be of utmost importance to avoid potential drawbacks compared to the existing framework. Any shortcomings of the buffer framework should be assessed holistically – yet only after the crisis – as part of the European Commission’s macroprudential review (EC Report 2022).

Barakova, I, M. Birn, A. v. Hafften, M. Kutlukaya, C. Martin, D. Ruffino, S. W. Schmitz, V. Seidl, K. Steiner, T. Teramura, O. Toader (2019): Survey on the interaction of regulatory instruments: results and analysis, BCBS Working Paper 35, https://www.bis.org/bcbs/publ/wp35.pdf.

Diner, V., F. Vallascas (2016): Do banks issue equity when they are poorly capitalized?, Journal of Financial and Quantitative Analysis 51 (5), 1575-1609.

Eidenberger, J., S. W. Schmitz, K. Steiner (2014): The Priorities of Deleveraging in the euro area and Austria and its implications for CESEE, Financial Stability Report 27, https://www.oenb.at/dam/jcr:83caf122-96cf-41aa-a5ed-7a844ab4988d/fsr_27_special_topics_01.pdf.

Kopp, M., C. Ragacs, S. W. Schmitz (2010): The Economic Impact of Proposals to Strengthen Bank Resilience – Estimates for Austria, Financial Stability Report No. 20, 2010, 90-119.

CHARTS

Chart 4: Price and CDS spread charts of Santander, Lloyds, Deutsche Bank and Aareal Bank for AT1 with extension events (red line) do not show a significant increase in funding costs

|

|

|

|

TABLES

Table 1

Table 2

Table 3

Source: own calculations; bold: significance at the 1% (***), 5% (**) or 10% level (*).

List of banks used for the analysis:

ABANCA Corporación Bancaria S.A., ABN AMRO Bank N.V., AXA Bank Belgium SA, Banco Bilbao Vizcaya Argentaria, S.A., Banco Comercial Portugués, SA, Banco de Sabadell, S.A., Banco Santander, S.A., Bank of Ireland Group plc, Bankinter, S.A., BAWAG Group AG, Belfius Bank NV, Caixa Geral de Depósitos, SA, CaixaBank, S.A., DekaBank Deutsche Girozentrale, Deutsche Bank AG, DZ BANK AG, Deutsche Zentral-Genossenschaftsbank, Erste Group Bank AG, Ibercaja Banco, S.A., ING Groep N.V., Intesa Sanpaolo S.p.A., KBC Group NV, Nordea Bank Abp, UniCredit S.p.A., Coöperatieve Rabobank U.A.

The views expressed in this note are exclusively those of the authors and do not necessarily reflect those of the OeNB or the Eurosystem.

A Pillar 2 guidance shortfall, in contrast, leads to increased supervisory intensity.

A detailed introduction of the capital buffer regime would go beyond the scope of this paper. Further information can be found here: https://www.esrb.europa.eu/pub/pdf/other/140303_flagship_report.pdf

Further AT1 coupon cancellations by banks with a broad international investor base are not known to the authors.

At the beginning of June 2016, it became public that Bremer Landesbank had gotten into serious financial

difficulties due to their shipping loan portfolio. https://www.spiegel.de/wirtschaft/unternehmen/nord-lbuebernimmt-

bremer-landesbank-blb-komplett-fuer-262-millionen-euro-a-1110382.html

Barclays Credit Research: CoCos – will they, won‘t they? 13 March 2020.

Including 25% tax deduction on AT1 coupon payment

For a mapping of increases of loan spreads based on the OeNB macro-economic model AQM (Austrian Quarterly Model) see Kopp, M., C. Ragacs, S. W. Schmitz (2010) “The Economic Impact of Proposals to Strengthen Bank Resilience – Estimates for Austria”, Financial Stability Report No. 20, 2010, 90-119.

See annex for the list of the 24 banks used for the analysis.

The expected impact of the conversion of AT1 instruments on AT1 and unsecured senior funding costs might depend on the conversion threshold. Most AT1 instruments in the EA are based on the minimum conversion trigger of 5.125% CET1 ratio.

https://www.spglobal.com/ratings/en/research/articles/200611-bank-regulatory-buffers-face-their-first-usability-test-11527594; https://www.fitchratings.com/research/banks/bank-rating-criteria-28-02-2020, see page 72; https://www.moodys.com/researchandratings/research-type/methodology/rating-methodologies/003006001/003006001|005001000/-/0/0/-/0/-/-/-/-1/-/-/-/en/global/pdf/-/rra: “Banks Methodology”, see page 78.

“To determine whether a security has a high trigger, we generally use Basel III’s threshold for regulatory capital treatment of Common Equity Tier 1 (CET1) to risk weighted assets less than 5.125% as the cut-off point.” https://www.moodys.com/researchandratings/research-type/methodology/rating-methodologies/003006001/003006001|005001000/-/0/0/-/0/-/-/-/-1/-/-/-/en/global/pdf/-/rr: “Banks Methodology”, see page 77.

https://www.moodys.com/researchandratings/research-type/methodology/rating-methodologies/003006001/003006001|005001000/-/0/0/-/0/-/-/-/-1/-/-/-/en/global/pdf/-/rr: “Banks Methodology”, see pages 84, 85.

https://www.fitchratings.com/research/banks/bank-rating-criteria-28-02-2020, see page 37.

https://www.fitchratings.com/research/banks/bank-rating-criteria-28-02-2020, see page 41.

https://www.moodys.com/researchandratings/research-type/methodology/rating-methodologies/003006001/003006001|005001000/-/0/0/-/0/-/-/-/-1/-/-/-/en/global/pdf/-/rra: “Banks Methodology” of 2019, see page 85.

External assets are holdings of cash in currencies other than euro, holdings of securities issued by nonresidents of the euro area, loans to nonresidents of the euro area (including banks), and gold and receivables from the IMF (including special drawing rights (SDRs). They represent claims on nonresidents of the euro area (ECB Manual of MFI balance sheet statistics).

Barakova, I, M. Birn, A. v. Hafften, M. Kutlukaya, C. Martin, D. Ruffino, S. W. Schmitz, V. Seidl, K. Steiner, T. Teramura, O. Toader (2019) Survey on the interaction of regulatory instruments: results and analysis”, BCBS Working Paper 35, https://www.bis.org/bcbs/publ/wp35.pdf. Diner, V., F. Vallascas (2016) Do banks issue equity when they are poorly capitalized? Journal of Financial and Quantitative Analysis 51 (5), 1575-1609.

Eidenberger, J., S. W. Schmitz, K. Steiner (2014) The Priorities of Deleveraging in the euro area and Austria and its implications for CESEE; Financial Stability Report 27, https://www.oenb.at/dam/jcr:83caf122-96cf-41aa-a5ed-7a844ab4988d/fsr_27_special_topics_01.pdf.

For the structural buffers, justified refers to substantial reductions of structural systemic risk. “In contrast, the Countercyclical Capital Buffer (CCyB) rate fluctuates. Its level varies between 0% and 2.5% of RWA, depending on how the relevant authority assesses the system-wide risk at any point in time within the credit cycle.” https://www.bis.org/fsi/fsibriefs6.pdf, see page 2.

BCBS: Basel III: A global regulatory framework for more resilient banks and banking systems, December 2010, P54f; BCBS Newsletter October 2019: https://www.bis.org/publ/bcbs_nl22.htm; June 2020 Basel Committee meets; discusses impact of Covid-19; reiterates guidance on buffers

https://www.bankingsupervision.europa.eu/press/pr/date/2020/html/ssm.pr200327~d4d8f81a53.en.html

https://www.bankingsupervision.europa.eu/press/pr/date/2020/html/ssm.pr200312~43351ac3ac.en.html

VoxEU, Manuel A. Muñoz (2020).

ESRB System-wide restraints on dividend payments, share buybacks and other pay-outs, June 2020.

BCBS FSI Briefs, No 6 Banks’ dividends in Covid-19 times, May 2020.

IMF, Special Series on COVID-19: Restriction of Banks’ Capital Distribution During the COVID-19 Pandemic (Dividends, Share Buybacks, and Bonuses), July 2020.

E.g. in Brazil, the central bank restricted all discretionary capital pay-outs when reducing the CCB for one year with a step-wise re-phase-in of the full buffer in the subsequent year. https://www.gov.br/economia/pt-br/centrais-de-conteudo/publicacoes/publicacoes-em-outros-idiomas/covid-19/brazil2019s-policy-responses-to-covid-19